Fully Qualified Chartered Accountants, Bookkeepers, Tax and Business Development Experts.

Enabling ambitious business owners achieve their personal and business goals

Giving you the three freedoms; more time, more money and more mind (less stress !!!!!!)

Chartered accountants Stirling: Stewart Accounting Services, Chartered Accountants, is a CA firm with its main office in Alloa, Clackmannanshire. We also have offices in Falkirk and Stirling. We provide accounting, taxation, payroll, bookkeeping, business growth services to small and medium sized businesses across Central Scotland and beyond. Therefore, we currently have over 200 clients across a variety of business sectors. Ranging from tax return only clients through to limited companies turning over multi £m. Furthermore, we provide tailored services to meet the specific requirements of each client. We deal with clients remotely across the UK as well as clients across the central belt of Scotland.

We give you more time 3 ways;

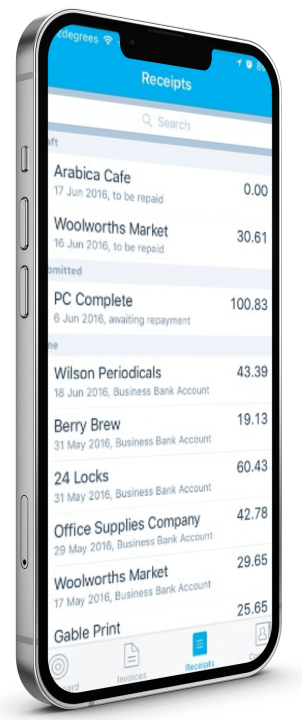

1. Implementing Xero and supporting apps so you can do the bookkeeping more efficiently yourself.

2. Taking the bookkeeping off your hands leaving us to deal with it all.

3. Take the full finance function off your hands leaving you time to concentrate on the things you want

We give you more money 3 ways;

1. Helping you reduce costs

2. Helping you improve income

3. Helping you improve cashflow

We take stress away 3 ways;

1. Dealing with all the compliance and deadlines so you don’t need to worry about them.

2. Putting in place a strategy so you know where you are heading in the short term.

3. Putting in place a longer strategy so you can exit the business on your terms.

Your year end company accounts are an important part of your overall accounting and bookkeeping function. Stewart Accounting Services can assist with the preparation of your year end annual accounts.

Stewart Accounting Services can provide which are tailored to suit your own business needs. All businesses are required to keep accurate business records. Good bookkeeping procedures and practices have many benefits.

The UK has one of the most complicated tax systems in the world. There are various deadlines and obligations that taxpayers should be aware off.

It is relatively easy to set up and start to trade as a sole trader. You complete a form and notify HM Revenue and Customs that you are operating as a sole trader (form CWF1).

A partnership is similar in business structure to a sole trader. The main difference is that whereas a sole trader is run by one person a partnership is run by two or more people.

A Limited Company is the most complex of the common business structures but it does offer a number of benefits that operating as a sole trader or partnership doesn’t.

Stewart Accounting Services assisting you as a contractor or freelancer to fulfil your accounting and tax requirement. To be able to trade as a contractor through your limited company you need to…

If you receive rental income that exceeds your expenses then you are obliged to declare this income on your self assessment tax return.Areas to consider with respect to properties include the following:

I approached Stewart Accounting Services because I had recently moved and needed a new Accountant and wanted to stay local. Stewart Accounting Services helped me by taking everything out of my hand and preparing my accounts. The result was I had more time to work and not stress about whether I was doing it correctly or not. One thing I liked was their help and assistance with everything, any call or email or question, they had the time to deal with. I would definitely recommend Stewart Accounting Services to others.

SW, Sole Trader precognition agent