So, you've paid VAT on business expenses and you want to get it back. It sounds straightforward, and it can be, but first, we need to cover the ground rules. The entire process hinges on one key concept: reclaiming what's known as 'input tax'. This is simply the VAT you've paid on goods and services for your business.

Who Can Claim VAT Back in the UK?

Before you can even think about getting a penny back from HMRC, your business needs to tick two fundamental boxes. Firstly, you must be registered for VAT. Secondly, you must be selling—or at least have the intention of selling—'taxable supplies'. These are the goods or services that have VAT applied to them.

Registration becomes a legal requirement once your VAT taxable turnover hits the £90,000 threshold within any rolling 12-month period. However, many businesses find it beneficial to register voluntarily long before they reach that figure. If you're teetering on the edge or just unsure, it's worth taking a look at our detailed guide on the specific requirements for VAT registration.

To help clarify the core eligibility requirements, here’s a quick checklist of what HMRC is looking for.

VAT Reclaim Eligibility Checklist

| Eligibility Criteria | Requirement Details | Why It Matters |

|---|---|---|

| VAT Registration | Your business must have a valid UK VAT registration number. | Without this, you are outside the VAT system and cannot reclaim any input tax. |

| Business Purpose | The goods or services must be for legitimate business use. | Personal expenses are not eligible. HMRC is very strict on this point. |

| Making Taxable Supplies | You must sell goods/services that are standard, reduced, or zero-rated. | This is the foundation of your right to reclaim VAT. |

| Valid VAT Invoice | You need a proper VAT invoice from your supplier for the purchase. | This is your primary evidence. No valid invoice means no reclaim. |

Meeting these conditions is the first and most important step in the process. If you can’t tick all these boxes, any attempt to reclaim VAT will be rejected.

Understanding Taxable Supplies

Not all sales are created equal in the eyes of HMRC, and this directly affects how much VAT you can get back. The type of goods or services your business provides is crucial.

- Standard-Rated Supplies: These are most goods and services, which are taxed at the standard 20% rate. If this is what you sell, you can generally reclaim the VAT on your business costs.

- Reduced-Rated Supplies: Some items, like domestic fuel or children’s car seats, are taxed at a lower 5% rate. You can still reclaim input tax on costs related to these sales.

- Zero-Rated Supplies: This is a key one. These are taxable supplies, but the VAT rate is 0%. Think of most food, books, and children's clothing. Because they are still technically 'taxable', you can reclaim all the VAT on your related business expenses.

The Critical Difference with Exempt Supplies

This is a common pitfall that catches many businesses out. Certain goods and services, such as insurance, finance, and some types of education, are VAT exempt. This means they fall completely outside the scope of the VAT system.

If your business only sells VAT-exempt items, you cannot register for VAT. As a result, you cannot claim back any VAT on your business purchases. This is a hard-and-fast rule.

The distinction between zero-rated and exempt is absolutely vital. With zero-rated items, you're in the VAT club—you just charge your customers 0%. This means you still get to reclaim the VAT you spend. With exempt items, you're out of the club entirely, and you can’t reclaim a thing.

Life gets a bit more complicated for businesses that sell a mix of both taxable and exempt items. These 'partially exempt' businesses need to work out a specific proportion of the VAT they can reclaim. Getting this right is the bedrock of a solid VAT reclaim strategy and keeps you on the right side of HMRC.

Gathering Your Essential VAT Records

When it comes to reclaiming VAT, your success is completely tied to the quality of your records. HMRC doesn't work on guesswork or estimates; they need to see clear, verifiable proof for every single penny of input tax you're asking for. Without the right paperwork, a claim can be dead in the water before you've even started.

The absolute bedrock of any VAT reclaim is the valid VAT invoice. This isn't just a simple receipt from a corner shop; it’s a specific document that has to include certain details to be considered legitimate by the taxman. Think of it as your golden ticket for getting that money back.

Trying to make a claim without one is like trying to board a plane without a passport—it’s just not going to happen. You have to be meticulous about checking every invoice you use.

What Makes a VAT Invoice Valid

A proper VAT invoice is the undeniable proof HMRC needs for your claim. It must clearly lay out several key details that confirm a legitimate transaction took place and that VAT was charged correctly. For any purchase over £250, anything less than a full, valid invoice is practically guaranteed to be rejected if you face an inspection.

Here’s what HMRC expects to see on a standard VAT invoice:

- A unique, sequential invoice number.

- The seller’s name, address, and their VAT registration number.

- The time of supply (often called the tax point).

- Your own business name and address.

- A clear description of what you bought (goods or services).

- The VAT rate applied to each item.

- The total amount before VAT, and the total amount of VAT charged.

It's your responsibility to make sure the invoices you get from suppliers have all this information. You can check out a guide to tax-compliant invoices to get a feel for the core principles, even though it's not UK-specific.

Handling Different Types of Proof

Of course, not every business purchase results in a full-blown VAT invoice, and HMRC knows this. For smaller purchases—anything under £250—you can usually use a simplified invoice. These are less detailed but still need to show the seller’s name, address, VAT number, the date, and what you bought.

A classic mistake I see all the time is businesses trying to claim VAT using a pro-forma invoice or an order confirmation. These documents are not valid for a VAT reclaim. They only show an intention to make a sale, not that one has actually happened. You must always wait for the final, official VAT invoice.

Invoices are just one part of the puzzle. Keeping good digital records isn't just a 'nice to have' anymore; it's a legal requirement. If you feel your system could be better, getting to grips with VAT digital record keeping is a smart move. This also covers crucial documents for more complex situations, like import paperwork for Postponed VAT Accounting or self-billing agreements.

At the end of the day, being organised is your best defence against any query from HMRC.

Submitting Your VAT Return to Reclaim Tax

With all your records organised, you’re ready to complete and submit your VAT return. Think of this as the official conversation you have with HMRC, where you lay out how much VAT you’ve collected and, crucially, how much you need to claim back on your business expenses. It all boils down to a straightforward calculation.

The most important number for your reclaim is in Box 4 of the VAT return, which is labelled "VAT reclaimed in this period on purchases and other inputs". This is where you'll put the grand total of all the input tax you’ve meticulously calculated from your invoices and receipts. This figure is then set against the VAT you’ve charged your customers, which you record in Box 1.

The final result tells you where you stand with HMRC for that quarter:

- If Box 1 (VAT on sales) is bigger than Box 4 (VAT on purchases): You’ll need to pay HMRC the difference.

- If Box 4 is bigger than Box 1: This is great news! You're in a 'repayment position', meaning HMRC owes you a refund.

This is the moment all that diligent record-keeping really pays off, directly boosting your business's cash flow. For a more detailed walkthrough of the submission process itself, our guide on how to submit VAT returns breaks down every step.

When You Are Due a Repayment

It’s actually quite common for a business to be in a repayment position. This often happens after you’ve made a big investment, like buying new equipment or machinery, or if a lot of your sales happen to be zero-rated. For example, a local bakery might charge 0% VAT on the bread it sells but can still reclaim the 20% VAT it paid for its new commercial ovens.

Once you’ve submitted a return showing a repayment is due, HMRC usually moves pretty fast. Their target is to get the money into your bank account within 10 working days of receiving your online return, as long as your bank details are up to date.

Don’t panic if your very first VAT reclaim takes a bit longer to process. It’s standard practice for first-time claims, especially larger ones, to go through extra checks. This is just a routine anti-fraud measure to verify your business and its expenses.

Getting your claim right is not just good for your business; it helps the whole system run smoothly. The Office for Budget Responsibility reported a 'VAT gap' of 4.9 percent in 2022-23 – the difference between what HMRC should collect and what it actually does. This gap is partly caused by simple errors, so by filing accurately, you're doing your bit. You can read more about VAT's role in government receipts and why accurate reporting matters.

Navigating Potential HMRC Queries

While most repayments go through without a hitch, some things can make HMRC take a closer look. Knowing what might trigger a query helps you stay prepared and avoid any unnecessary hold-ups.

One of the most common red flags is an unusually large repayment claim. For instance, if you normally reclaim around £1,000 each quarter but suddenly file for £15,000, HMRC will almost certainly want to know why there's such a big jump.

Other things that might prompt a question include:

- A sudden change in the nature of your business activity.

- Figures that seem inconsistent with your past returns.

- Claims that involve tricky areas like partial exemption or reverse charge rules.

If HMRC does decide to review your return, they'll get in touch to ask for more information. This usually means sending them copies of your biggest purchase invoices to back up your claim. The best way to handle this is to respond quickly with clear, well-organised documents. This almost always resolves the query and gets your repayment back on track.

Handling Complex VAT Reclaim Scenarios

https://www.youtube.com/embed/QNVDcwkxPh4

While your regular VAT return might feel like a straightforward cycle of adding up what you've paid and what you've charged, business rarely sticks to a neat script. Things get complicated.

You'll almost certainly run into situations that don't fit the standard mould, from customers who don't pay to correcting a mistake made months ago. Knowing how to handle these moments is crucial for keeping your cash flow healthy and making sure you get back every penny you're entitled to.

Reclaiming VAT on Bad Debts

It’s one of the most frustrating parts of running a business: you make a sale, you pay the VAT over to HMRC as required, and then your customer simply… doesn't pay you. You're left covering the VAT on money you never received.

The good news is you can claim this back using Bad Debt Relief. The key is patience. You can't make a claim immediately. The debt must be at least six months old from the date the payment was due, and you have to have formally written it off in your business accounts.

Let's say you invoiced a client for £1,000 plus £200 VAT on 1st March, with payment due by the end of that month. If by 1st October (six months after the due date) the invoice remains unpaid and you've accepted it's a lost cause, you can reclaim that £200 VAT on your next return. It's a vital mechanism to ensure you're not penalised for someone else's failure to pay.

Navigating Imports with Postponed VAT Accounting

Bringing goods into the UK used to be a real drain on cash. Businesses had to pay import VAT upfront at the border and then wait to reclaim it on their next VAT return, creating a significant gap in their finances.

Thankfully, Postponed VAT Accounting (PVA) has completely changed the game. This system allows you to declare and recover import VAT on the very same VAT return.

Instead of a physical payment, you simply account for the import VAT on your return. It gets declared as output tax and simultaneously reclaimed as input tax. The net effect on your VAT bill is zero. It's a huge relief for any business with an international supply chain, as the cash for import VAT never actually leaves your bank account.

Correcting Errors on Past Returns

We’re all human, and mistakes are bound to happen. Maybe an invoice was missed, or a number was typed in wrong. Whatever the reason, HMRC has a defined process for putting things right. The method you need to follow depends entirely on the size of the error.

-

For smaller errors: If the net value of the mistake (the total VAT you underpaid minus the VAT you overpaid) is under £10,000, you can simply correct it on your next VAT return. You just add the amount to the relevant box – Box 1 for sales VAT or Box 4 for purchase VAT.

-

For larger or deliberate errors: This is where you need to be more formal.

If the net error is over £10,000, or if you made the error intentionally, you can't just quietly adjust your next return. You must officially inform HMRC by filling out form VAT652. When it comes to significant corrections, being proactive and transparent is always the right call.

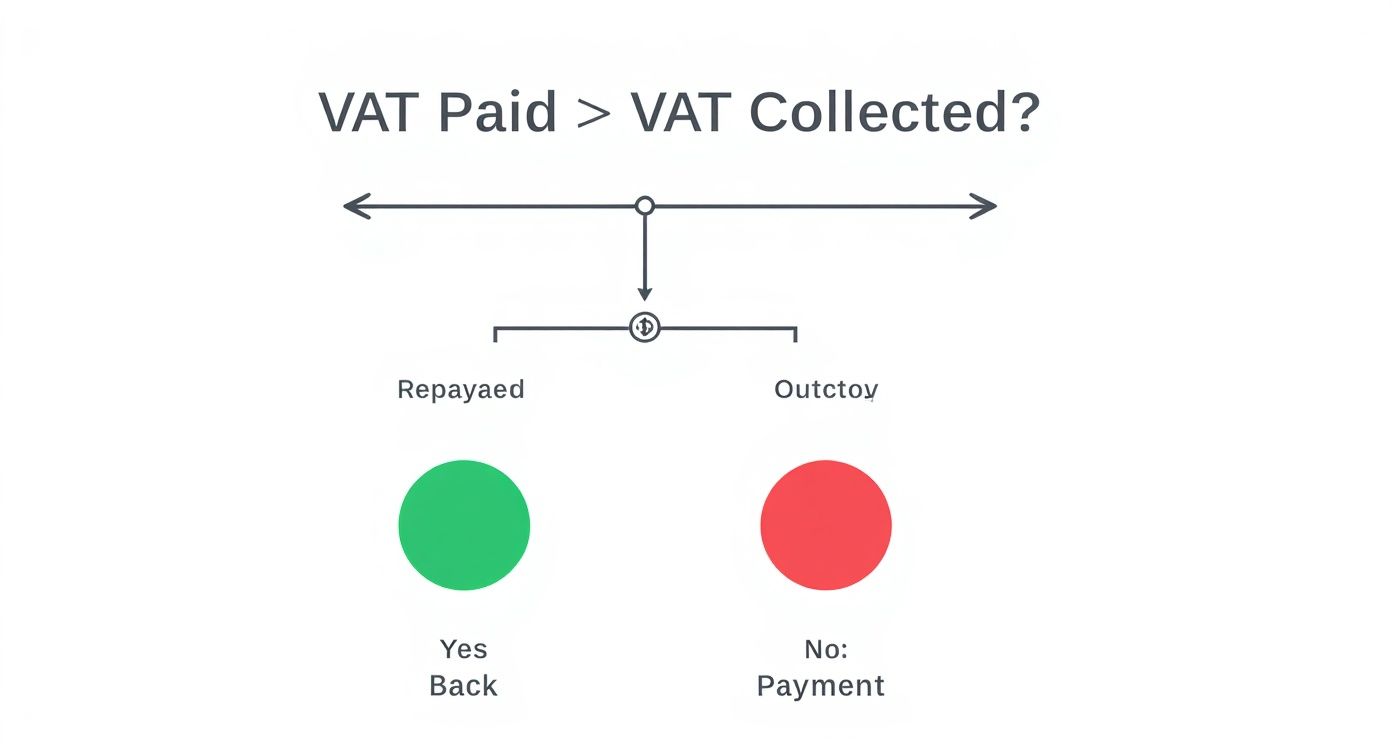

This flowchart illustrates the fundamental principle behind any VAT return.

When the VAT you've paid on your costs (input tax) is more than the VAT you've collected from your customers (output tax), you get a refund. Dealing correctly with bad debts, imports, and errors ensures your input tax figure is accurate, giving you the best chance of reclaiming what you're owed.

Navigating these different reclaim scenarios requires knowing which process to use and when. The table below breaks down the methods for these common situations.

VAT Reclaim Methods for Different Scenarios

| Reclaim Scenario | Method | Key Requirement |

|---|---|---|

| Standard Business Purchases | Include in regular VAT return (Box 4) | Must hold a valid VAT invoice and be a legitimate business expense. |

| Bad Debt Relief | Add VAT amount to Box 4 of the return | Debt must be 6+ months past its due date and written off in accounts. |

| Imported Goods | Use Postponed VAT Accounting (PVA) | Account for VAT on the same return (as both input and output tax). |

| Error Corrections (under £10k) | Adjust Box 1 or Box 4 on the next VAT return | The net impact of the error must be below the £10,000 threshold. |

| Error Corrections (over £10k) | Submit form VAT652 to HMRC | Must formally notify HMRC; cannot be adjusted on a standard return. |

Understanding which path to take is essential for accurate VAT compliance and maximising your refunds. Each scenario has specific rules that, if not followed, could lead to delays or rejected claims.

Common VAT Reclaim Mistakes to Avoid

Navigating the rules to claim VAT back can be tricky, and even the most organised businesses trip up now and then. Getting a handle on the common pitfalls is the best way to keep your claims accurate and avoid rejections, penalties, or stressful letters from HMRC.

One of the most frequent mistakes we see is around expenses that have a mix of business and personal use. It’s an easy one to get wrong, but crucial for staying compliant.

Apportioning VAT for Mixed-Use Expenses

Let's face it, many business costs aren't black and white. Think about your mobile phone contract or the fuel for a company car that you also use for personal trips. You can't just claim 100% of the VAT on these expenses; you have to work out a fair and reasonable split.

For instance, if your phone is used 70% for business calls and 30% for personal chats, you can only reclaim 70% of the VAT on the bill. The key is to have records that justify your calculation, like call logs or a detailed mileage log for a vehicle. Simply plucking a percentage out of thin air is a major red flag for HMRC and won't stand up to scrutiny.

Another common slip-up is trying to reclaim VAT on things that are completely outside the system. This often happens from a simple misunderstanding of the rules.

A classic error we see is businesses trying to claim VAT on entertaining UK clients. While it feels like a genuine business cost, HMRC specifically 'blocks' this, meaning the input tax is not recoverable.

Trying to Claim VAT on Exempt Items

As we touched on earlier, some goods and services are VAT-exempt. This category includes things like insurance, postage stamps from the Royal Mail, and most financial services. Since no VAT was charged on them in the first place, there’s simply nothing for you to claim back.

Always double-check your supplier invoices. If an item is marked as "E" (exempt) or shows no VAT amount, you can't include it in your VAT return's Box 4 calculation. It’s a simple check that can save a lot of headaches later on.

Missing the Four-Year Time Limit

This one can be painful. There’s a strict time limit for reclaiming input tax, often called the "four-year cap". You generally have four years from the end of the VAT accounting period in which the expense occurred to make your claim.

Forgetting about an old invoice for a big purchase is a costly lesson. Imagine a business bought a new server for £5,000 + £1,000 VAT back in June 2021. They must claim that £1,000 back by the end of their VAT period that covers June 2025. Once that window slams shut, the chance to get that VAT back is gone for good. A regular review of old records can help you spot these forgotten claims before it's too late.

Frequently Asked Questions About VAT Reclaims

It’s completely normal to have questions when you’re getting to grips with VAT. It's a complex area, and getting your claims right is crucial. Here are some plain-English answers to the questions we hear most often from business owners.

Can I Claim VAT on Pre-Registration Expenses?

Yes, you can – and you’d be surprised how many new businesses miss this. It’s a great way to recover some of your initial start-up costs. HMRC has specific rules you need to follow, though.

Let's break them down:

- Goods: You can go back four years from your registration date to reclaim VAT on goods, but there's a catch. You must still have them on hand when you register. This typically covers things like office furniture, computer equipment, or leftover stock.

- Services: The window for services is much shorter – just six months before your registration date. This could include things like accountancy fees or marketing consultations you paid for while setting up.

The golden rule for both is that the expense must be directly for your business, and you absolutely must have a proper VAT invoice. Without that paperwork, you can't make a claim.

What Happens If HMRC Disputes a Claim?

First off, don't panic. If HMRC spots something unusual or has a question about your VAT return, their first step is usually just to get in touch and ask for more information. It could be something as simple as wanting to see a specific invoice for a large purchase.

Your best bet is to respond quickly and give them exactly what they’ve asked for. In our experience, most queries are cleared up right away with clear communication and the right documentation.

But what if they formally reject part of your claim? It's not necessarily the end of the line. You have the right to appeal. The first step is an internal review with HMRC, and if you still disagree, you can take your case to an independent tax tribunal. This is where your diligent record-keeping really pays off – it’s your best defence.

Can I Claim VAT Back If I Am Not Registered?

For a typical UK business, the answer is a straightforward no. Claiming back VAT (your input tax) is a benefit reserved for businesses that are registered for VAT and are charging it to their own customers (your output tax). The whole system is designed to work as a chain.

There are a handful of very specific exceptions, like the DIY House Builders Scheme, but these are niche cases and won't apply to the vast majority of trading businesses. For almost everyone, VAT registration is the non-negotiable key to reclaiming any VAT.

Trying to figure out everything from pre-registration costs to what to do if HMRC queries a claim can be a real headache. At Stewart Accounting Services, we take that stress away. We’ll make sure your claims are not only compliant but also maximised, so you get back every penny you're entitled to.

Let us handle the VAT complexities so you can get back to running your business. Contact us today for expert VAT assistance.