Submitting your company accounts in the UK means getting your financial statements in order and sending them off to two different government bodies: Companies House and HMRC. This isn't just a bit of admin; it's a legal requirement for every limited company, keeping things transparent and making sure you're paying the right amount of tax.

Your First Steps in Filing Company Accounts

Tackling your annual accounts for the first time can feel like a huge task. The best way to approach it is to see it as more than just a box-ticking exercise. It's a proper financial health check for your business, giving you a clear, official picture of how you've performed over the last 12 months.

Essentially, you have two separate but related jobs to do. First, you need to send a set of statutory accounts to Companies House, where they'll be placed on the public record. Then, you'll file a Company Tax Return (the CT600 form) with HMRC, which includes a copy of those same accounts, so they can work out your Corporation Tax bill.

Key Documents You Will Need

Before you even think about hitting 'submit', you need to have the right paperwork ready. These documents are the building blocks of your year-end filing, and they tell the financial story of your business.

You'll definitely need:

- A Balance Sheet: This is a snapshot in time. It shows exactly what your company owns (its assets) and what it owes (its liabilities) on the final day of your financial year.

- A Profit and Loss (P&L) Account: This report covers the full financial year, detailing all your sales, costs, and expenses. It shows the bottom line—whether you've made a profit or a loss.

A question I hear all the time from new directors is: "Should I do this myself or pay someone?" You absolutely can file your own accounts, but a good accountant will spot things you might miss and keep you clear of common mistakes. If you're on the fence, check out our guide on whether you need an accountant or can file company accounts yourself.

Getting these documents spot-on is critical. Simple mistakes or missed deadlines trigger automatic penalties that start small but can grow quickly. Even worse, getting your figures wrong could attract unwanted attention from HMRC. The secret to a smooth year-end is good record-keeping from day one.

Preparing Your Financial Statements for Submission

Before you even think about hitting 'submit', you need to be confident that the story your accounts tell is both accurate and complete. This stage is all about gathering your financial records from the past year and translating them into the official documents required by law.

Think of it as building a case. Every invoice, receipt, and bank statement is a crucial piece of evidence.

Your main job here is to put together two key statements. First up is the profit and loss (P&L) account, which is essentially a report card on your company's performance over its financial year. It meticulously lists your income, subtracts all your costs, and lands on your final profit or loss.

The second is the balance sheet. This document gives a snapshot of your company’s financial health on the very last day of your accounting period. It neatly lists what your company owns (assets) against what it owes (liabilities), making sure both sides of the equation balance out. For a much deeper dive, check out our guide on what your year-end limited company accounts need to include.

Assembling Your Core Financial Records

The accuracy of your final accounts hangs entirely on the quality of the information you feed into them. If your records are disorganised or incomplete, you're paving the way for errors and potential compliance headaches down the line.

To get started, you'll need to pull together a few essentials:

- All Company Bank Statements: Every single transaction needs to be accounted for so your books are properly reconciled.

- Sales Invoices: You need a complete record of everything you've sold during the year.

- Purchase Invoices and Receipts: This is your proof for every business expense you want to claim, from software subscriptions to office supplies.

- Payroll Records: All the details of salaries paid, PAYE, and National Insurance contributions.

Having all this organised from the get-go makes a world of difference. Using cloud accounting software like Xero can turn what feels like a chaotic pile of paperwork into a clear, auditable trail.

A Major Shift in Reporting Requirements

In the past, smaller companies had a bit of an advantage. They could file simplified or 'filleted' accounts with Companies House, which meant they could keep sensitive details like turnover private. That’s all changing.

The process of submitting company accounts is undergoing a huge shake-up. Thanks to the new Economic Crime and Corporate Transparency Act, all UK limited companies, no matter their size, will soon have to file a full profit and loss account. This change means your company's turnover and detailed costs will become public information. The goal is to boost transparency and help fight financial crime.

This is a significant departure from how things have been done for years. For countless small business owners, it'll be the first time their full financial performance is on display for competitors, clients, and the general public to see. Getting ready for this new level of transparency is now a non-negotiable part of your annual accounting routine.

Adapting to this new standard isn't optional—it's essential for staying compliant and avoiding penalties. Understanding these changes now means you can prepare accounts that meet all the current legal standards, protecting your business for the future.

How to Classify Your Company Size

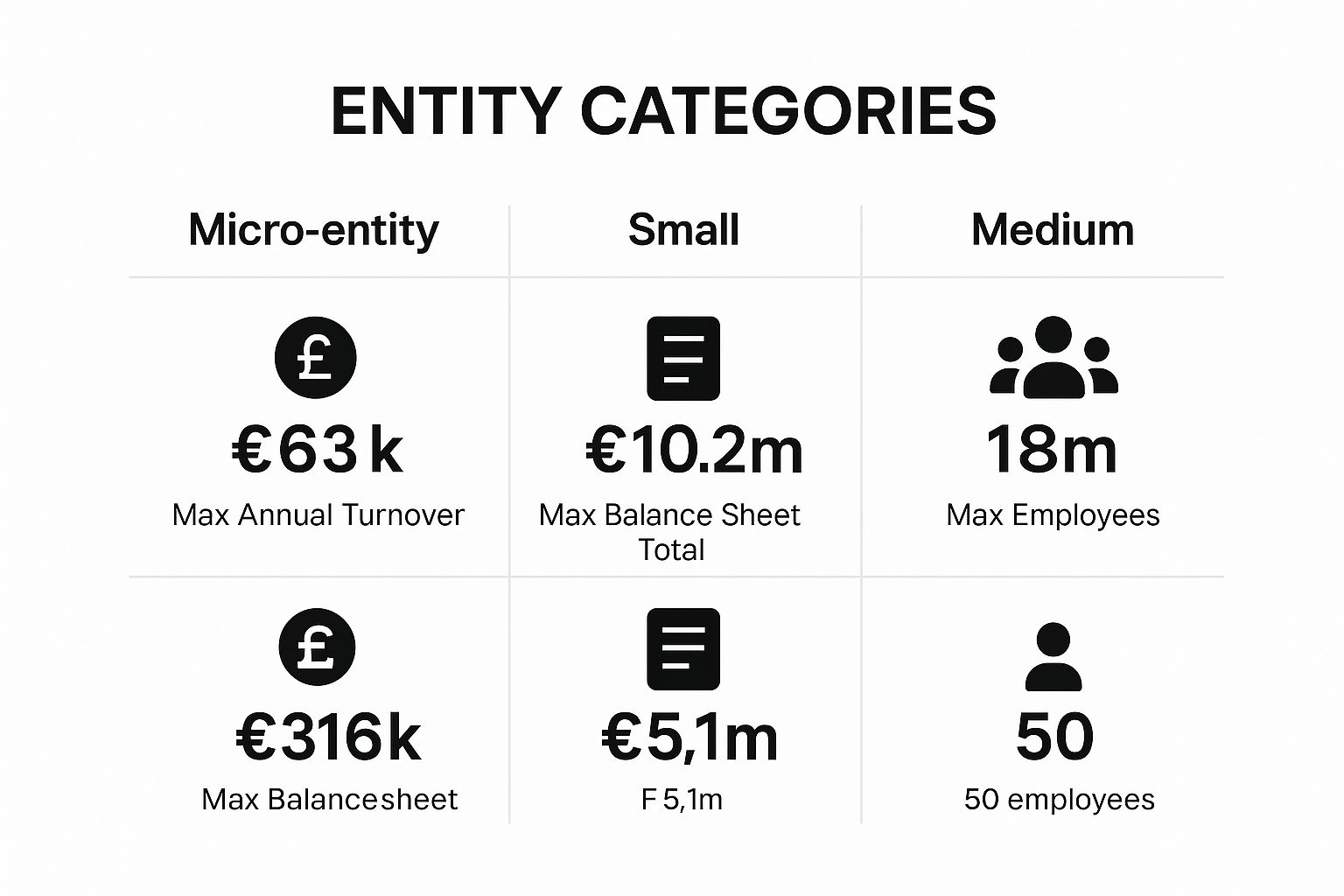

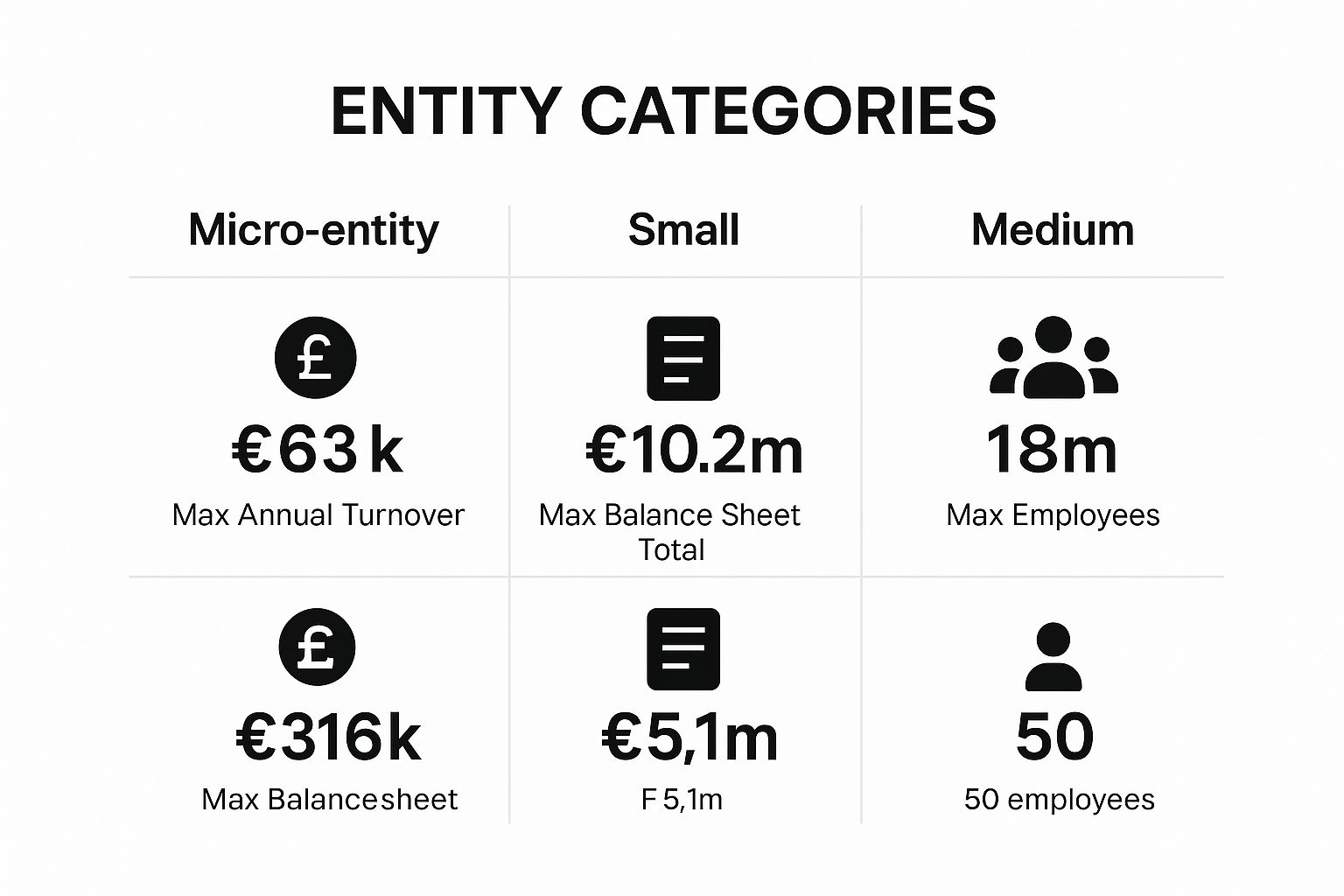

Before you even think about preparing your year-end accounts, you need to know where your company fits in. The amount of detail you'll need to provide depends entirely on whether you're classed as a 'micro', 'small', or 'medium-sized' company.

Getting this right is your first big win. It determines the accounting rules you can follow and, crucially, whether you can file a much simpler set of accounts.

Your company's size isn't just a label; it's a legal classification based on cold, hard numbers. To fall into a certain category, your business has to meet at least two out of three criteria: turnover, balance sheet total (the value of everything it owns), and the average number of employees.

Understanding the Key Thresholds

The government lays out clear financial boundaries for each company size. It’s vital to keep an eye on these, as they're occasionally updated to account for things like inflation – and a recent change is about to have a big impact.

To ease the admin burden on businesses, the UK government has announced it's increasing these thresholds. From April 2025, a micro-entity will be defined as a company with a turnover of no more than £632,000, a balance sheet under £316,000, and an average of 10 or fewer employees. These updates apply to both limited companies and LLPs, which is good news for a lot of smaller businesses. You can read the full details of these legislative changes to see exactly how they might affect you.

This infographic gives you a clear at-a-glance view of the updated thresholds for all three company sizes.

As you can see, there’s a big jump in the numbers as you move up from a micro-entity to a small company, and again to a medium-sized one.

Here’s the important bit: Your company must meet at least two of the three criteria for a particular category for two years in a row to be officially classified as such. This stops businesses from flipping between categories year after year because of a small dip or a single good year.

Nailing down your company's size is the foundational step. It sets the stage for everything that follows and can genuinely save you a ton of time and stress.

How This Affects Your Filing Process

Once you know where you stand, you'll know what kind of accounts to prepare. For instance, a business that qualifies as a micro-entity can get away with filing very simple accounts, whereas a medium-sized company has to jump through a lot more hoops with much more detailed disclosures.

This screenshot from the official GOV.UK guidance shows the different flavours of accounts you can file.

As you can see, options like 'abridged accounts' or 'micro-entity accounts' are only on the table if you meet the size criteria and get shareholder approval. This page is the best place to double-check your exact obligations before you start pulling any numbers together.

Getting Your Accounts Filed with Companies House and HMRC

https://www.youtube.com/embed/lkzMp_N7o44

You’ve done the hard work of getting your financial statements prepared and approved. Now for the final step: sending them off to the two government bodies that need them, Companies House and HMRC.

It’s a common point of confusion, but yes, you do have to file with both. Think of them as two separate submissions with their own portals and reasons for needing your data. Getting a handle on how to approach each one will make the whole process much smoother.

Submitting Your Annual Accounts to Companies House

I usually recommend tackling Companies House first. Their job is to keep the public record of UK limited companies up to date, and your annual accounts are a crucial piece of that puzzle.

For years, the go-to method was the Companies House WebFiling service. It’s their own online portal, and it gets the job done. You’ll just need your company’s 6-character authentication code, which would have been posted to your registered office when you first set up the company.

These days, though, most business owners I work with file directly through their accounting software. Platforms like Xero or QuickBooks are built to talk directly to government systems. This is a far better approach because it pulls the figures straight from your bookkeeping records, which dramatically cuts the risk of typos or other manual errors when you're re-keying data.

My golden rule: never assume the filing was successful. Whether you use the government portal or your own software, always wait for that submission confirmation. I tell all my clients to screenshot it or download the PDF and save it somewhere safe. It's your concrete proof that you've done what you needed to do.

Don't forget that filing deadlines can shift based on your company's situation. To make sure you’re on the right track, our guide on Companies House filing deadlines lays out all the key dates.

Filing Your Company Tax Return with HMRC

With Companies House sorted, it's time for HMRC. This submission is all about Corporation Tax. Alongside your accounts, you must also file a Company Tax Return (form CT600). This is the document that officially declares your company’s profit or loss for the year and calculates the tax bill.

Your filing options here will look familiar. You can either use HMRC’s own free online service to upload your CT600 and accounts, or you can do it through commercial accounting software.

It’s worth pausing to understand why you're sending the exact same accounts to two different places. Companies House needs them for public transparency, while HMRC needs them to check that your Corporation Tax calculation is correct and based on accurate figures.

Comparing Filing Options: Software vs Government Gateway

Choosing how to file can feel like a big decision, but it really comes down to what works best for your business. Here’s a quick breakdown to help you compare the two main routes.

| Filing Method | Best For | Key Advantage | Potential Drawback |

|---|---|---|---|

| Accounting Software | Businesses using digital bookkeeping (e.g., Xero, QuickBooks). | Pulls data directly, reducing errors. Often allows joint filing. | Requires a paid software subscription. |

| Government Gateway | Micro-entities or those with very simple accounts filing manually. | Completely free to use. | Clunky interface; requires manual data entry, risking errors. |

Ultimately, if you're already using accounting software, filing through it is almost always the smarter, safer, and faster option.

The real game-changer with modern software is the joint filing feature. Many packages now let you submit to both Companies House and HMRC in a single, streamlined process. This is fantastic for efficiency – it guarantees the figures sent to both are identical and basically halves your admin time. If your software has this function, I’d highly recommend using it.

Common Filing Mistakes and How to Avoid Them

Learning how to submit company accounts is one thing, but knowing the common tripwires is what really saves you headaches down the line. A simple admin error can quickly snowball into a rejected filing, an automatic penalty, or even a formal investigation. The good news? Most of these mistakes are entirely avoidable with a bit of care and preparation.

One of the most frequent slip-ups I see is a basic calculation error. It could be a simple typo when keying in figures or a miscalculation in the final profit and loss statement. Using proper accounting software like Xero massively reduces this risk, as it handles the number-crunching for you based on the data you’ve already entered.

Another classic pitfall is sending accounts off without the proper director approvals. Before anything goes to Companies House, your accounts must be formally approved by the board and signed on the balance sheet by at least one director. Forgetting this step is a surefire way to get an immediate rejection.

The Danger of Incomplete Information

Submitting accounts with missing or inconsistent information is a guaranteed way to have them bounced straight back. This usually happens when directors are rushing to meet a deadline or don't have a clear checklist of what’s needed.

Here are a few classic examples of incomplete filings I've had to fix over the years:

- Missing director's report: Even for small companies, certain notes and disclosures are mandatory. You can't just skip them.

- Forgetting the balance sheet date: The accounts must clearly state the financial year-end date they cover. It seems obvious, but it gets missed.

- Incorrect company number: A single wrong digit here and the whole submission fails verification.

Accurate, complete accounts aren't just a box-ticking exercise. They're a fundamental part of running a responsible business. Getting this wrong can have serious consequences and reflects poorly on your company's stability and governance.

The wider economic climate really brings home why diligent reporting is so critical. For instance, in the financial year ending 2025, total company insolvencies jumped by 8.6% to 39,841. Interestingly, while insolvent liquidations saw a slight dip, members' voluntary liquidations (solvent companies closing down) rose by a huge 35.4%. These figures, which you can explore further in the government's official statistics on UK company insolvency trends, highlight a shifting landscape. They're a stark reminder of why maintaining meticulous records is essential to protecting your company's future.

Miscalculating Your Filing Deadlines

Finally, getting your filing deadline wrong is an expensive and completely avoidable mistake. The deadlines are rigid, and the penalty system is automated—it kicks in the moment you miss the date, no exceptions.

What often catches new directors out is that the deadline for your first set of accounts is different from all subsequent years.

Always, always double-check your specific deadline on the Companies House service. Don't just assume. Set multiple calendar reminders well in advance to give yourself a comfortable buffer. Leaving it to the last minute is just a recipe for stress and silly errors. By steering clear of these common pitfalls, you can ensure a smooth, penalty-free submission every time.

Got Questions About Filing Your Accounts? We've Got Answers

Even with the best preparation, a few questions always crop up when it's time to file your company accounts. It’s completely normal. Let's walk through some of the most common queries we hear from directors to clear up any confusion and help you file with confidence.

What Happens If I Miss the Filing Deadline?

This is one you really want to avoid. The moment you miss your deadline, Companies House issues an automatic, non-negotiable penalty. For a private limited company, that starts at £150 if you’re just one month late. If it happens again the next year, that penalty doubles.

The fines escalate quickly the longer you leave it:

- 1 to 3 months late: The penalty jumps to £375.

- 3 to 6 months late: Now you're looking at £750.

- More than 6 months late: The fine hits a hefty £1,500.

And that's just Companies House. HMRC will also issue its own penalties for a late Company Tax Return, starting at £100. It’s an expensive mistake and one that is easily sidestepped with a bit of forward planning.

Can I Change My Company's Year-End Date?

Yes, you can, but it’s not a free-for-all. The official term for your year-end is the 'accounting reference date' (ARD), and the rules for changing it are strict. You can shorten your accounting period as many times as you like, but you can typically only lengthen it once every five years.

Lengthening your year-end might be useful for aligning with a new parent company or for other strategic reasons. What you can't do is use it as a get-out-of-jail-free card to dodge an impending filing deadline. Any change must be formally submitted to Companies House before your current filing deadline arrives.

One of the biggest misconceptions we see is directors thinking they can move their year-end date whenever they want. That "once in five years" rule for extensions catches a lot of people by surprise. It's there specifically to stop companies from endlessly pushing back their reporting.

What Is an Authentication Code and Why Do I Need It?

Think of your Companies House authentication code as your company's digital signature. It's a unique 6-character alphanumeric code that proves you have the authority to file information online.

You’ll need this code for almost everything, from submitting your annual accounts and confirmation statement to updating your director's details. When your company was first set up, this code was posted to your registered office address. If you've misplaced it, you can request a new one from the Companies House website, but remember it will be sent by post to your registered office, which can take a few days to arrive.

Do I Have to File Even If My Company Is Dormant?

Yes, you absolutely do. A dormant company is one that has had no 'significant accounting transactions' during the financial year. While that means you're not actively trading, it doesn't get you off the hook for filing. You still have to submit a confirmation statement and a set of dormant company accounts to Companies House.

The good news is that the paperwork is much simpler—there's no profit and loss account to deal with. The bad news? The penalties for failing to file are exactly the same as for an active company. This is a really common and costly oversight, especially for entrepreneurs who've registered a company but haven't started trading yet.

Figuring out how to submit company accounts can feel like navigating a maze, but you don’t have to go it alone. Stewart Accounting Services specialises in taking the stress out of compliance for limited companies, ensuring your accounts are accurate, timely, and right the first time. Let us handle the details so you can focus on growing your business.