At its heart, the whole VAT system boils down to two simple ideas: output VAT and input VAT. Think of output VAT as the tax you collect for the government when you sell something, and input VAT as the tax you pay on things you buy for your business.

The magic happens when you subtract one from the other. You only ever send HMRC the difference, which is why it’s called a tax on the 'value added' by your business.

Understanding VAT: The Core Concepts for Your Business

To get your head around how Value Added Tax really works, picture it as a two-way street. Money comes into your business through sales, and money goes out through your expenses. VAT is part of both transactions, but it works in opposite directions.

Let’s make this real with a quick example. Imagine you run a small bakery.

- Output VAT (The Tax You Collect): You sell a beautiful celebration cake to a customer. The total price is £12, which includes £2 of VAT (assuming the standard 20% rate). You've essentially collected that £2 on behalf of HMRC. That's your output VAT.

- Input VAT (The Tax You Pay): Now, think about what it took to make that cake. You bought flour, sugar, and eggs from your supplier for £6, and that price included £1 of VAT. This £1 is your input VAT – the tax you paid on a genuine business purchase.

Here's the crucial bit: you don’t just send that entire £2 you collected straight to HMRC. You get to deduct the £1 you already paid out.

Your VAT bill is simply your total Output VAT minus your total Input VAT. For our bakery, that's £2 – £1 = £1 owed to HMRC.

This clever system ensures tax is only ever paid on the actual value your business adds at each stage. The core idea of output and input VAT has been the bedrock of the UK system since it was introduced way back on 1 January 1973.

To give you a quick, easy reference, here’s a simple table breaking down the key differences.

Output VAT vs Input VAT at a Glance

| Concept | Output VAT | Input VAT |

|---|---|---|

| What is it? | The VAT you charge and collect on your sales. | The VAT you pay on your business purchases and expenses. |

| Who is involved? | You and your customer. | You and your supplier. |

| Direction of money? | You receive it from customers. | You pay it to suppliers. |

| Impact on your VAT bill? | Increases the amount you owe to HMRC. | Decreases the amount you owe to HMRC. |

This table helps visualise the two sides of the VAT coin, making it easier to track where your money is going.

Why This Distinction Matters

Getting this right is about more than just ticking a box on your accounting software; it has a direct impact on your cash flow. When you diligently track all your input VAT, you’re actively reducing the tax bill you have to pay. It effectively lowers the real cost of your business supplies and overheads.

For a deeper dive into the fundamentals, check out our guide on what every business needs to know about Value Added Tax. Nailing this foundational knowledge is the first real step toward managing your finances with confidence and staying compliant.

How to Calculate and Record Your VAT Correctly

Alright, let's move from theory to practice. Understanding the difference between output and input VAT is one thing, but knowing how to handle it in your daily finances is what really matters. If you get the calculations and bookkeeping right from day one, you’ll save yourself a world of pain and keep HMRC happy.

To make this crystal clear, we'll walk through two very different business scenarios: a service-based graphic designer and a product-based online shop.

Calculating VAT for a Service Business

Let's say you're a freelance graphic designer. You've just wrapped up a logo design for a client and it's time to get paid.

- Work out your net fee: The price you agreed for the work was £1,000. This is your net figure, before any tax.

- Add the output VAT: With the standard UK VAT rate at 20%, you need to calculate 20% of £1,000. That comes to £200.

- Issue the final invoice: The total amount on the invoice you send to your client is £1,200 (£1,000 for your work + £200 in VAT).

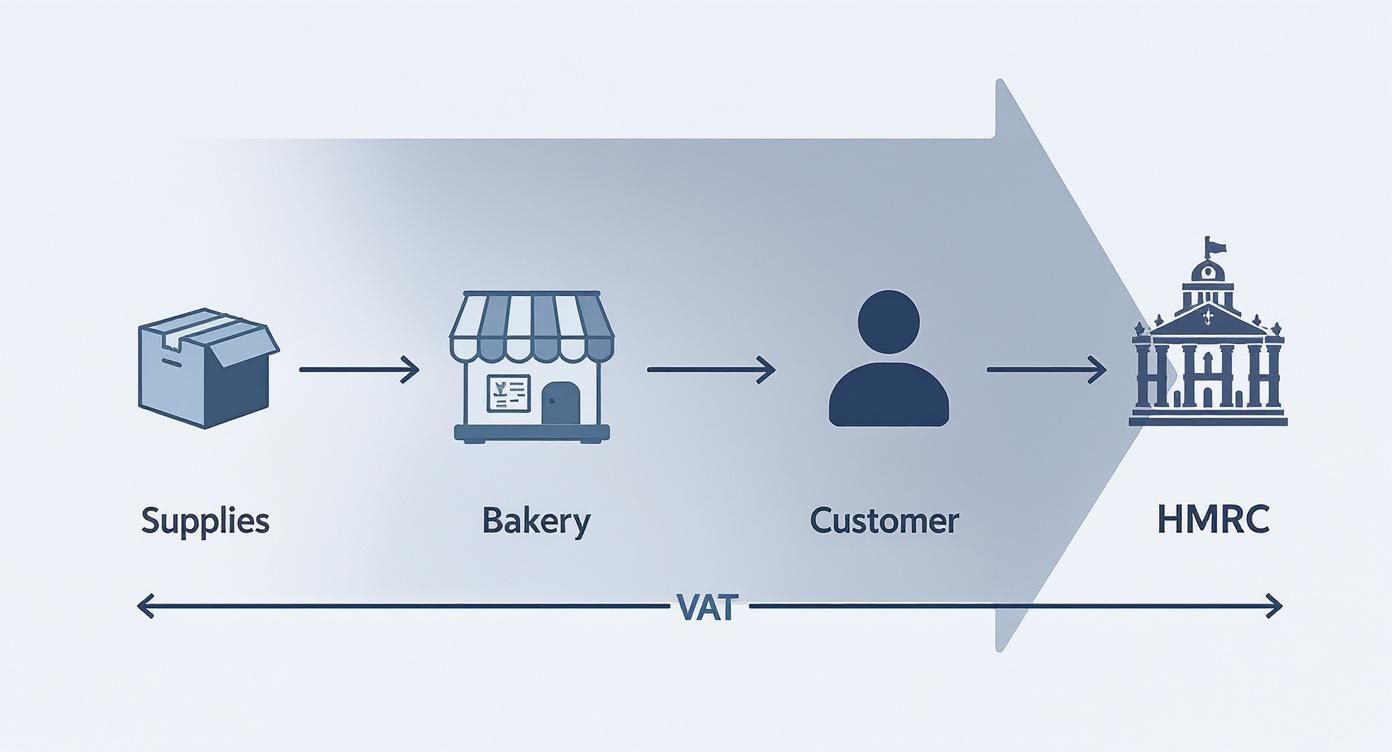

This infographic gives you a great visual of how the VAT you collect and pay cycles through the system.

As you can see, your business essentially acts as a temporary holding point. You gather the output VAT from your customers and reclaim the input VAT from your suppliers, then you simply pay the difference to the tax man.

Calculating VAT for a Product Business

Now for our online shop that sells handmade crafts. You’ve got a product you sell for £50 (before VAT).

- Output VAT on the Sale: You'll add 20% VAT (£10) to the price. The customer pays a final price of £60.

- Input VAT on Materials: To create that craft, you spent £24 on materials, and that price included £4 of input VAT.

- The Net VAT Calculation: In this one transaction, you've collected £10 in output VAT but already paid £4 in input VAT. The amount you actually owe HMRC is the difference: £10 – £4 = £6.

If you want to dive deeper into more complex examples, our guide on how to https://stewartaccounting.co.uk/calculate-vat/ has you covered.

Recording VAT in Your Accounts

Good bookkeeping is the bedrock of accurate VAT returns. While most accounting software does the heavy lifting, it’s vital you understand what’s happening behind the scenes. Every time there’s a VAT transaction, it gets logged in a specific ledger account, usually called the VAT Control Account.

Think of it like this: When you send a sales invoice and collect output VAT, you credit the VAT Control Account. When you log a purchase and pay input VAT, you debit it. The closing balance on this account tells you exactly what you owe HMRC, or what they owe you.

Keeping these records straight isn't optional. For those who rely on specific accounting platforms, working with a QuickBooks Virtual Assistant can be a game-changer. They ensure every transaction is correctly coded and reconciled, making your VAT return process feel almost effortless.

Connecting Your Records to Your HMRC VAT Return

So, you’ve been carefully tracking all your output and input VAT. Now what? The final piece of the puzzle is pulling those numbers together and putting them in the right places on your HMRC VAT Return.

Think of it this way: your bookkeeping is the day-to-day story of your business, and the VAT return is the summary you send to the tax man. It’s not as daunting as it looks; the form is just a logical reflection of the records you’ve already been keeping. Good record-keeping isn't just a 'nice-to-have'—it's the bedrock of a stress-free VAT submission. For a deeper dive into what that looks like, check out our guide on VAT digital record keeping.

Where Your Numbers Go on the Return

The standard VAT return has nine boxes, but when you're working out what you owe HMRC (or what they owe you), a few key boxes do all the heavy lifting. Let's break down where your output and input VAT figures actually go.

At its core, the VAT return is a straightforward calculation that brings your sales and purchase VAT together to find the difference.

Here is a simple table to explain the most important boxes on your return and what they mean for your business.

Key Boxes on Your VAT Return Explained

| Box Number | Box Title | What Goes Here (Output or Input VAT) |

|---|---|---|

| Box 1 | VAT due on sales | This is the home for your total Output VAT. It’s the sum of all the VAT you’ve charged your customers during the period. |

| Box 4 | VAT reclaimed on purchases | Your total Input VAT goes in here. This represents all the VAT you’ve paid on eligible business purchases and expenses. |

| Box 5 | Net VAT to pay or reclaim | This is the crucial one. It’s the difference between Box 1 and Box 4. It shows the final amount you either owe HMRC or can reclaim. |

As you can see, the final calculation is beautifully simple: you subtract the figure in Box 4 from the figure in Box 1.

The result of that sum is what you enter into Box 5. If Box 1 is bigger than Box 4, the number in Box 5 is what you owe HMRC. If Box 4 is bigger, congratulations – you’re due a refund.

This simple subtraction is the engine of the entire VAT system, making sure you only pay tax on the value your business has added. It’s a powerful system; total VAT receipts hit a massive £173.4 billion in 2023-24, showing just how vital accurate reporting from the UK's 2.1 million registered traders is. If you’re interested in the bigger picture, you can explore how government revenues have changed over time on ifs.org.uk.

Navigating Tricky VAT Scenarios and Rules

https://www.youtube.com/embed/I1HRoezBxEE

While the basic idea of collecting output VAT and reclaiming input VAT seems straightforward, real-world business isn't always so neat. You'll inevitably run into situations that complicate your VAT accounting, and knowing how to handle them is key to staying on HMRC's good side and protecting your cash flow.

Let's walk through three of the most common tricky scenarios we see small and medium-sized businesses grappling with.

Partial Exemption When You Sell a Mix of Goods

So, what happens if your business sells a mix of standard-rated items (which have VAT) and exempt items (which don't)? This is more common than you might think. A good example is a dental practice that also sells standard-rated electric toothbrushes, or a property developer selling new zero-rated homes alongside exempt commercial lets.

This is where the concept of partial exemption kicks in. The rule is simple: you can only reclaim input VAT on costs that directly relate to your taxable sales (that's anything standard, reduced, or zero-rated). This means you can't claim back all of it. You have to figure out a fair and reasonable way to split your input VAT between your taxable and exempt activities.

Imagine a marketing agency spends £1,200 (including £200 input VAT) on a new laptop. They need to work out how much of that laptop's time is spent generating taxable sales versus exempt sales. If it’s used 80% for taxable work, they can only reclaim 80% of the input VAT, which comes to £160.

Bad Debt Relief for Unpaid Invoices

Few things are more frustrating for a business owner than a customer who just doesn't pay. It gets even worse when you realise you’ve already declared the output VAT on their invoice to HMRC and paid it over on a previous return.

Thankfully, HMRC doesn't expect you to be left out of pocket. You can use a mechanism called Bad Debt Relief to reclaim the output VAT you paid.

To qualify for this relief, you have to meet a few conditions:

- The debt must be more than six months overdue from the payment due date.

- You must have already accounted for and paid the output VAT to HMRC.

- The debt must be formally written off in your business accounts.

Once you’ve ticked those boxes, you can add the value of the unpaid VAT to Box 4 of your next VAT return, essentially getting it back as if it were input VAT.

By claiming Bad Debt Relief, you are essentially correcting your previous VAT payment to HMRC, ensuring you only pay tax on the money you have actually received from customers. This is a vital mechanism for protecting your business from the financial impact of non-paying clients.

The Reverse Charge for Overseas Services

The reverse charge often causes a bit of head-scratching, but it’s a crucial rule to get right if you buy services from suppliers based outside the UK. Think of things like advertising from a US-based social media giant or software subscriptions from an Irish tech firm.

Normally, the supplier charges you VAT. With the reverse charge, that responsibility flips entirely. You, the customer, become responsible for accounting for both the output and input VAT on the purchase.

Here’s how it works in practice:

- You get an invoice from an overseas supplier for, let's say, £1,000. It won't have any VAT on it.

- On your VAT return, you have to play the part of both the supplier and the customer.

- You declare £200 of output VAT in Box 1 (as if you'd supplied the service to yourself).

- You then reclaim that exact same £200 as input VAT in Box 4.

The net effect on your VAT bill is zero—no cash actually changes hands with HMRC. It's really just an accounting exercise to make sure tax is correctly recorded in the right country. VAT rules and rates have certainly changed over the years; the standard rate hit its highest ever level of 20% on January 4th, 2011, and it's stayed there ever since. If you're curious about how rates have shifted over time, you can explore the history of VAT rates in the UK on en.wikipedia.org.

An Actionable VAT Management Checklist for SMEs

Getting a grip on your output and input VAT isn't about memorising the entire tax code; it's about building good habits. When you turn complicated rules into simple, repeatable steps, you protect your cash flow, stay on the right side of HMRC, and frankly, sleep better at night. Here’s a practical checklist to help you stay in control.

Establish a Solid Digital Foundation

The days of stuffing receipts into a shoebox are well and truly over, especially with Making Tax Digital now in full swing. The very first thing to do is get your digital house in order.

- Embrace Accounting Software: A cloud-based platform like Xero or QuickBooks is a game-changer. These tools are designed to automatically categorise your output and input VAT, which makes pulling together your return almost effortless and drastically cuts down on human error.

- Keep Meticulous Digital Records: Make it a rule to get and save a proper VAT invoice for every single business purchase. To reclaim your input VAT, you need the official proof – that means an invoice showing the supplier's VAT number, the date, and a clear breakdown of the VAT you paid. A quick photo on your phone uploaded straight to your software often does the trick.

Build Consistent Routines

Consistency is your best friend when it comes to avoiding last-minute panic and costly mistakes. A few simple routines can turn VAT from a dreaded quarterly chore into a manageable background task.

Pop reminders in your calendar for your key VAT deadlines, like the submission and payment dates. It’s a tiny action that helps you sidestep the automatic penalties for being late.

Regular reconciliation of your VAT account is non-negotiable. Set aside an hour or so each month to check that the numbers in your accounting software line up perfectly with your bank statements and invoices. Catching a discrepancy early is far easier than unravelling a huge mess three months down the line.

Know When to Call for Backup

Even with the best systems in place, VAT can get tricky. Knowing when you need to bring in a professional isn't a sign of failure – it's the mark of a smart business owner.

It's probably time to seek expert advice if you find yourself in any of these situations:

- Complex Transactions: You’re suddenly dealing with things like partial exemption, international services (hello, reverse charge), or significant property deals.

- Rapid Growth: Your business is taking off, and the sheer volume of transactions is becoming a headache to manage accurately on your own.

- Persistent Errors: You keep finding yourself making corrections or just feel a nagging uncertainty about the figures you're submitting on your VAT return.

These are all red flags that it’s time to get an expert involved. An accountant won't just keep you compliant; they can often spot opportunities to optimise your VAT position, potentially saving you a good deal of money. By following this checklist, you'll build a solid process for managing your output and input VAT with confidence.

Common VAT Questions from Business Owners

Once you get your head around the basics of output and input VAT, the real-world questions start popping up. It's one thing to understand the theory, but quite another to apply it to the day-to-day running of your business. Here, we'll tackle some of the most frequent questions we get from business owners, giving you practical answers to help you handle VAT confidently.

What Happens If My Input VAT Is Higher Than My Output VAT?

First off, don't panic. This is a very common situation. If your input VAT (the VAT you’ve paid out) is greater than your output VAT (the VAT you’ve collected) for a particular quarter, it simply means HMRC owes you a refund.

This usually happens for a few straightforward reasons:

- A major business purchase: Maybe you've just invested in a new van, a pricey piece of machinery, or a complete office refit. The VAT on these big-ticket items can easily push your input tax figure up.

- A slow sales period: If sales take a dip but your regular business costs stay the same, your input VAT can quickly overtake your output VAT.

- Making zero-rated sales: If you sell zero-rated items (like children's clothing or most food), you charge your customers 0% VAT. But you can still reclaim all the VAT on your business costs, which often leads to a repayment.

When you file your VAT return, you'll see a negative figure in Box 5. This tells HMRC they need to send you money. The repayment is typically made directly to your business bank account, usually within 30 days, as long as your return is accurate and they don't have any queries.

Can I Reclaim VAT on Every Business Expense?

This is a great question, and the answer is a firm no. The golden rule is that to reclaim input VAT, the expense must be ‘wholly and exclusively for business purposes.’ Most of your day-to-day costs will pass this test, but there are some notorious exceptions and grey areas you need to know about.

Client entertainment is the classic example. Taking a client out for lunch to seal a deal is considered entertainment, and HMRC is very clear that you cannot reclaim the VAT on that bill.

A few other common sticking points include:

- Car Fuel: The rules for fuel are quite specific, particularly if a vehicle is used for both business and private trips. You either reclaim all the VAT and pay a 'fuel scale charge' to account for the private use, or you only reclaim VAT on the fuel used for business mileage, which means keeping detailed records.

- Mixed-Use Items: Think about your mobile phone contract. If you use it for both business and personal calls, you can't claim back 100% of the VAT. You need to make a fair and reasonable calculation of the business portion and only reclaim that part.

The ‘wholly and exclusively’ principle is your guiding light for input VAT. Before you claim, always ask yourself: is this purchase 100% for my business? If there’s any personal benefit, you probably can't reclaim all of the VAT.

How Long Do I Really Need to Keep My VAT Records?

HMRC is very clear on this: you are legally required to keep all your VAT records for at least six years. This isn't just a recommendation; failing to keep adequate records can lead to some hefty penalties if you ever face an inspection.

And by 'records', they mean everything that backs up the numbers on your VAT returns. This includes:

- All sales and purchase invoices

- Credit notes issued or received

- A summary of your VAT for each period (often called a VAT account)

- Proof of exports or goods moved to the EU

With a six-year retention period, relying on a shoebox full of receipts just isn't practical. This is where good digital record-keeping becomes a lifesaver. Using cloud accounting software keeps your records safe, organised, and ready to go if HMRC ever needs to see them.

Juggling the ins and outs of output and input VAT can easily feel like a full-time job in itself. If you’d rather be focusing on growing your business, the team at Stewart Accounting Services is ready to step in. Visit us at stewartaccounting.co.uk and find out how we can lift the weight of VAT compliance off your shoulders.