When you're a sole trader, the goal is to pay tax on your actual profit, not just your total income. That's where tax allowances come in. In simple terms, they are HMRC’s way of letting you earn a certain amount of money before you have to start paying tax on it.

Think of the Personal Allowance – the amount everyone can earn tax-free – and the Trading Allowance, a handy £1,000 exemption specifically for small business income. Getting to grips with these is the first, and most important, step to taking control of your finances and legally reducing your tax bill.

Unpacking Your Financial Toolkit

Picture your annual business turnover as a big pile of cash on the table. Before HMRC takes its slice, you're allowed to set aside a portion of that pile that is completely tax-free. These are your allowances.

Their job is to shrink the pile of money that's actually taxable. The smaller that taxable pile is, the less tax you pay. It's that simple. By using your allowances correctly, you make sure your tax bill is a fair reflection of your business's real profit, not just the money that came through the door.

The Two Core Allowances

For any sole trader, everything starts with two key allowances. They are the foundation of smart tax planning and offer support whether you're just starting out or well-established.

-

The Personal Allowance: This is the big one. It's the amount of income you can earn in a tax year without paying a penny of Income Tax. It isn't just for sole traders—nearly everyone working in the UK gets it.

-

The Trading Allowance: This is a £1,000 tax-free allowance specifically for income from self-employment or casual work. It's a fantastic simplification if your business expenses are very low.

A common mistake is seeing tax as a fixed cost you just have to swallow. The truth is, it's manageable. Understanding your allowances turns you from a passive taxpayer into someone who actively and smartly manages their own business finances.

Why Understanding Allowances Matters

Knowing how these allowances work is what separates a savvy business owner from one who leaves money on the table. The standard Personal Allowance, for example, is currently £12,570. It's a significant figure, especially when you consider it was just £6,475 back in 2010. This tax-free buffer has a direct and immediate impact on your final tax bill.

Ultimately, figuring out which allowances to claim—and when—is the difference between paying your fair share and overpaying. While this guide sticks to sole trader allowances, the principles of tax efficiency apply everywhere. You can see similar concepts in action in specialised areas like these real estate investment tax strategies.

To get a clearer picture, let's break down the main allowances you'll encounter.

Key Sole Trader Tax Allowances at a Glance

This table provides a quick summary of the primary tax-free allowances available to you as a sole trader in the UK. Think of it as your cheat sheet for understanding the tools at your disposal.

| Allowance Type | Current Threshold | Primary Benefit |

|---|---|---|

| Personal Allowance | £12,570 | A universal tax-free income threshold for everyone. |

| Trading Allowance | £1,000 | A tax exemption for small trading income, simplifying tax returns. |

| Marriage Allowance | £1,260 | Allows transferring a portion of your Personal Allowance to your spouse. |

| Blind Person's Allowance | £2,870 | An extra tax-free allowance for those who are registered blind. |

These figures represent the core opportunities to reduce your taxable income before even considering your day-to-day business expenses.

How the Personal Allowance Works for You

Of all the tax allowances available to a sole trader, the Personal Allowance is arguably the most important one to understand. Think of it as a head start from HMRC—it’s the amount of money you can earn each year before you have to pay a single penny of Income Tax.

This isn’t just for the self-employed; pretty much every UK taxpayer gets it. For the current tax year, the Personal Allowance is set at £12,570. So, whether that income comes from your business profits, a part-time job, or a mix of sources, the first £12,570 is completely tax-free.

Because it automatically reduces the profit you pay tax on, it's a foundational part of managing your finances as a sole trader. You don’t need to do anything to claim it, but knowing how it works is vital for good financial planning.

Putting the Personal Allowance into Practice

Let's see how this plays out in the real world. Imagine you're a freelance graphic designer, and after you've tallied up your invoices and subtracted all your allowable business expenses, you're left with a profit of £35,000 for the year.

Now, you won't be taxed on that full amount. HMRC applies your Personal Allowance first.

Here’s the simple maths:

- Total Profit: £35,000

- Less Personal Allowance: – £12,570

- Taxable Profit: = £22,430

You only have to work out the Income Tax on £22,430. That first chunk of your earnings, the £12,570, is yours, free and clear. It’s a straightforward calculation, but it’s at the very heart of your Self Assessment tax return and makes a big difference to your final bill.

The High-Income Tapering Rule

While the Personal Allowance is a fantastic benefit, it doesn't stick around for everyone, particularly high earners. There's a catch you need to be aware of if your business really takes off.

Once your total income (what HMRC calls your ‘adjusted net income’) creeps over £100,000, your Personal Allowance starts to shrink. The rule is simple but brutal: for every £2 you earn over the £100,000 threshold, you lose £1 of your allowance.

By the time your income hits £125,140, your entire £12,570 Personal Allowance has completely vanished. This creates a painful spike in your effective tax rate in this income bracket, often called the '60% tax trap', because you’re paying the higher rate of tax on your earnings and losing a tax-free allowance at the same time.

This tapering effect is something every successful sole trader needs to keep a close eye on as their business grows. Understanding the potential for the loss of your personal allowance at the £100k ceiling is key to avoiding a nasty surprise from the taxman. With some careful forward-planning, things like making pension contributions can help manage your income level and protect this valuable allowance.

Choosing the £1000 Trading Allowance

If you're a sole trader with fairly low business costs, HMRC has a rather neat shortcut for you called the Trading Allowance. Think of it as a £1,000 tax-free pass on your income from self-employment.

Put simply, you can earn your first grand from your hustle without paying a penny of tax on it. If that's your only self-employed income, you don't even need to declare it. It’s one of the most straightforward sole trader tax allowances out there, designed to make life a bit easier, especially if you're just starting out.

But here’s the crucial part: you have a choice to make. You can either claim this flat £1,000 allowance, or you can deduct your actual, itemised business expenses. You can't have both. Your decision boils down to one simple question: are your total business costs for the year more or less than £1,000?

Making the Right Financial Choice

Figuring out which path to take just needs a quick bit of maths. If your running costs are minimal, the trading allowance is almost always the winner. It saves you the hassle of tracking every single receipt and small purchase.

On the other hand, if your expenses are higher, claiming them individually will give you a bigger deduction from your profits, which naturally means a lower tax bill.

Let’s walk through a couple of real-world examples to see how this plays out.

-

Scenario 1: The Freelance Writer

A writer earns £8,000 during the tax year. Their actual business costs—things like software subscriptions, a new keyboard, and some online courses—add up to £450. In this case, claiming the £1,000 trading allowance is a no-brainer. It lets them deduct a much larger figure than their actual expenses, reducing their taxable profit far more effectively. -

Scenario 2: The Tradesperson

A self-employed plumber brings in £25,000. Their expenses for materials, van fuel, insurance, and tools for the year come to a hefty £4,200. Here, claiming the actual £4,200 in expenses is clearly the better move. It provides a much bigger tax reduction than the fixed £1,000 allowance ever could.

The trading allowance is all about convenience. It’s perfect for simplifying your tax return when your costs are low. The moment your genuine business expenses climb past the £1,000 mark, however, it stops making financial sense. Always run the numbers before making a final decision.

This allowance is especially handy if you have a few small side gigs. If you want to get a better handle on managing your tax obligations when you have additional income streams, our guide can help clear things up.

Ultimately, the choice is yours to make every single tax year. My advice? Keep a rough running total of your expenses. If it looks like they're going to stay well under £1,000, embrace the simplicity of the allowance. If they start creeping up, switch over to claiming your actual costs to make sure you’re not paying more tax than you need to.

Claiming Your Allowable Business Expenses

So, what happens if your business running costs are more than £1,000 a year? In that case, forget the trading allowance. It's time to start claiming for your actual business expenses. For most growing businesses, this is the best way to shrink your taxable profit, but you need to get to grips with one of HMRC’s golden rules.

The rule is simple: to be a deductible expense, the cost must be “wholly and exclusively” for your business. It’s just a formal way of saying you can only claim for things you bought purely for your trade. Got a mobile phone you use for both work and personal calls? You can only claim the business portion of the bill. It’s all about separating business from personal life.

What Counts as an Allowable Expense?

You’d be surprised at how many of your day-to-day running costs fall into this category. The key is to keep meticulous records. Every receipt you save for a legitimate business cost directly lowers the amount of profit you’ll pay tax on.

Some of the most common categories include:

- Office Costs: Think of the essentials like stationery, business phone bills, and any software subscriptions you rely on (like accounting software or industry-specific apps).

- Travel Costs: You can claim for fuel, train tickets, parking, and even hotel stays for business trips. Just remember, your daily commute to your usual workplace doesn’t count.

- Stock and Materials: This is a big one for many. It covers the raw materials you use to create products or the goods you buy to sell on to customers.

- Marketing and Advertising: The costs of running your website, placing adverts online, or even printing promotional flyers are all allowable.

- Insurance: Any business insurance, like public liability or professional indemnity cover, is a fully deductible expense.

This list is really just the tip of the iceberg. To get a much clearer picture, we've put together a comprehensive guide on the full sole trader expenses list.

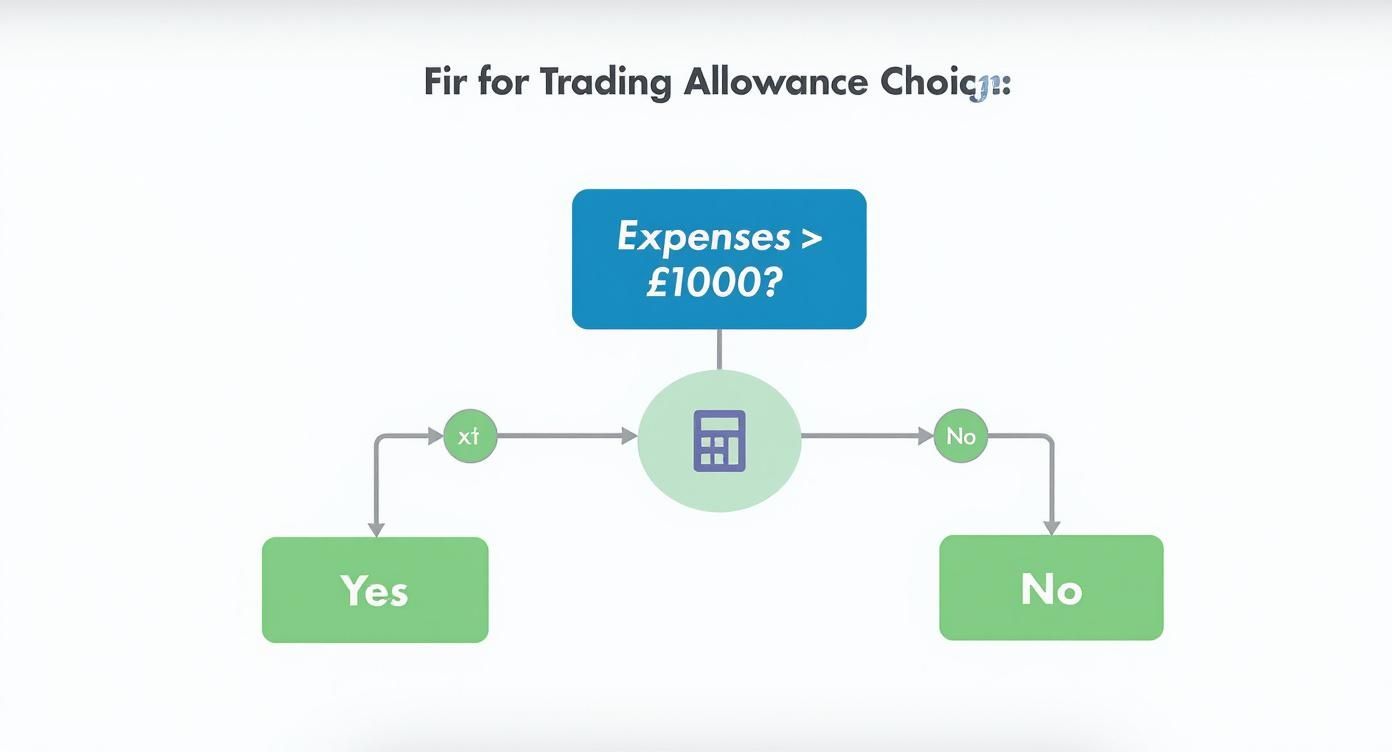

It’s worth remembering that you have to make a choice between the trading allowance and claiming expenses each year. This infographic gives you a straightforward way to see which path makes the most sense for you.

As you can see, the decision really boils down to one simple question: do your total annual business costs come to more than £1,000? If yes, it's time to start itemising.

Trading Allowance vs Claiming Expenses: Which Should You Choose?

This is a decision every sole trader faces. To make it clearer, let’s break down a few common scenarios.

| Scenario | Claim Trading Allowance (£1,000) | Claim Actual Expenses | Recommendation |

|---|---|---|---|

| New part-time freelancer | Income: £800, Expenses: £150 | Income: £800, Expenses: £150 | Use the trading allowance. It's simple and offers a bigger deduction. |

| Established graphic designer | Income: £35,000, Expenses: £4,500 | Income: £35,000, Expenses: £4,500 | Claim actual expenses. Your costs are well over £1,000. |

| Side hustle selling crafts | Income: £2,000, Expenses: £950 | Income: £2,000, Expenses: £950 | Stick with the trading allowance. It provides a slightly larger £1,000 deduction. |

| Consultant with high travel costs | Income: £50,000, Expenses: £8,000 | Income: £50,000, Expenses: £8,000 | Definitely claim actual expenses to maximise your tax relief. |

Ultimately, it’s a numbers game. Whichever route gives you the biggest deduction from your income is the one you should take for that tax year.

Navigating Home Office Expenses

Working from home brings its own set of rules, and this is where many sole traders get confused. You can’t just claim your entire mortgage or rent payment, but you absolutely can claim a fair proportion of your household bills.

The trick is to calculate the business use of your home. A common-sense method is to work out what percentage of your home is used as your office, and for how long. For example, if you live in a four-room house and use one room only as your office, you could make a reasonable claim for 25% of your utility bills.

HMRC also offers a simplified 'flat rate' for home working expenses. This allows you to claim a set monthly amount based on the hours you work from home, which can save a lot of complex calculations if your usage is straightforward.

There's no single "right" answer here. Choosing the best method depends on your situation, but both are perfectly valid ways to account for what is often one of the most significant sole trader tax allowances.

The Impact on Your Bottom Line

Getting into the habit of tracking and claiming every allowable expense is one of the smartest things you can do for your business's financial health. It ensures your tax bill is a true reflection of your profitability. In a tough economic climate, making the most of these deductions is more important than ever. In fact, research from the Institute for Fiscal Studies showed that between 2007-08 and 2011-12, real mean profits for the self-employed fell by a staggering 23%.

This makes every single pound you save through accurate expense claims incredibly valuable. By keeping organised records and having a solid grasp of the "wholly and exclusively" rule, you put yourself in control of your tax affairs and, most importantly, keep more of your hard-earned money in your business.

Understanding Capital Allowances for Business Assets

So far, we've been talking about the everyday running costs of your business. But what about the bigger, more significant purchases? I’m talking about the items built to last for years—a new van, a powerful laptop, or that specialised piece of machinery you’ve had your eye on.

These aren’t treated like regular expenses. Instead, you claim their cost against your profit using something called Capital Allowances.

Think of it this way: printer paper is an everyday expense that gets used up quickly. The printer itself, however, is a major asset that will hopefully serve you for several years. Capital Allowances are simply HMRC's system for letting you account for the cost of these long-term investments, which in turn lowers your taxable profit.

For most sole traders, the most useful type of capital allowance you'll come across is the Annual Investment Allowance (AIA). It's a fantastic tool that lets you deduct the full value of an eligible asset from your profits in the same year you buy it.

How the Annual Investment Allowance Works

In essence, the AIA allows you to 'write off' the entire cost of a major business purchase right away. This gives you a significant and immediate tax reduction, making it much easier to invest in the kit you need to push your business forward.

Let's run through a quick example. Imagine you're a freelance videographer, and you splash out on a new camera rig and lighting setup for £5,000. You wouldn't claim this as a standard expense; you'd use your AIA.

Here’s how that plays out:

- You claim the full £5,000 as a capital allowance.

- This amount is subtracted directly from your profits before any tax is worked out.

- Just like that, your taxable profit is £5,000 lower, which means a smaller tax bill for the year.

This is really the government’s way of encouraging small businesses to invest in themselves. By giving you immediate tax relief, it makes those essential asset purchases more manageable and helps boost your business's productivity.

This whole process is closely linked to the accounting concept of depreciation. If you want to get a better handle on how the value of assets is spread out over time for tax purposes, this guide on What Is Depreciation in Accounting Explained is a great resource.

While the AIA offers a super-fast way to claim, the basic principle is all about accounting for an asset's declining value. Making smart use of these sole trader tax allowances is a cornerstone of good financial management.

Common Questions About Sole Trader Tax Allowances

When you're wading into the world of sole trader tax allowances, it’s natural for a few tricky questions to pop up, especially around how the different rules fit together. We get these all the time from business owners, so we’ve put together some clear, straightforward answers to help you feel more confident.

Getting these details right isn't just about ticking boxes; it's about managing your finances smartly and making sure your tax return is spot-on. Let's clear up the confusion so you can get back to what you do best—running your business.

Can I Use the Personal Allowance and Trading Allowance Together?

Yes, you absolutely can. This is a big one that a lot of new sole traders overlook. The Personal Allowance and the Trading Allowance are two completely separate tools built for different jobs, and you can definitely use both in the same tax year.

Here’s an easy way to think about it: your Personal Allowance of £12,570 is your general tax-free threshold for all your income, no matter where it comes from. The £1,000 Trading Allowance, however, is a specific relief just for your self-employment income, which you can choose to use instead of claiming a detailed list of business expenses.

So, the two work hand-in-hand. You can use the Trading Allowance against your turnover first, and then the Personal Allowance is applied to whatever profit is left. For example, if your turnover is £10,000 and you opt for the Trading Allowance, your taxable profit instantly drops to £9,000. Your Personal Allowance then gets to work on that £9,000, reducing it even further.

What Should I Do If My Business Expenses Exceed £1,000?

This one’s a no-brainer. If your total allowable business expenses add up to more than £1,000, you should always claim the actual costs instead of taking the Trading Allowance. By totting up every single valid expense, you’ll secure a much bigger deduction from your profits, which means less tax to pay.

Choosing the Trading Allowance when your expenses are higher is like turning down free money. It’s a convenient shortcut, for sure, but it only makes financial sense when your costs are genuinely low. Always do a quick tally of your expenses before you decide.

Let's say your turnover is £20,000 and you've spent £2,500 on legitimate business costs. Claiming those specific expenses brings your taxable profit down to £17,500. If you used the Trading Allowance instead, your profit would only be reduced to £19,000, leaving you with a bigger tax bill.

Do I Need to Keep Records If I Use the Trading Allowance?

This is a common and dangerous misconception. While the Trading Allowance frees you from tracking every last business expense, it does not let you off the hook for keeping accurate records of your business income. That’s a legal requirement.

You must have a clear and organised trail of all your sales and turnover. HMRC can ask to see proof of your earnings at any point, and solid record-keeping is just a fundamental part of running a business in the UK.

You still need to keep track of:

- All sales invoices you’ve sent out.

- Records of payments you’ve received, with dates and amounts.

- Bank statements that show your business income.

Remember, if your total turnover is over £1,000, you have to declare it on a Self Assessment tax return, even if the Trading Allowance brings your taxable profit down to zero.

Figuring out the ins and outs of sole trader tax allowances can feel like a puzzle, but you don't have to solve it alone. At Stewart Accounting Services, our expert team can handle your Self Assessment tax return, make sure you claim every penny you're entitled to, and give you clear advice that saves you time, money, and stress. Get in touch with us to see how we can support your business.