A CIS deduction is simply an advance payment that goes towards a subcontractor's tax and National Insurance bill.

Think of it as being similar to the PAYE system for employees. It's not a separate tax, but a way for HMRC to collect tax contributions directly from contractors throughout the year, rather than waiting for the subcontractor's end-of-year tax return.

How Does the Construction Industry Scheme Actually Work?

If you're dealing with CIS, you've stepped into a system designed specifically for the UK construction industry. It might seem a bit complicated at first, but its core purpose is quite straightforward: to ensure tax is paid correctly and on time in a sector known for its high number of self-employed workers.

The scheme requires contractors to hold back a portion of the payment due to their subcontractors. This withheld money—the CIS deduction—is then sent straight to HMRC.

This whole system has been around since the 1970s and was created to tackle tax evasion in the industry. It covers most construction work you can think of, from preparing a site and building to decorating and demolition. By getting contractors to make these deductions at the point of payment, HMRC secures tax revenue and levels the playing field.

Contractors and Subcontractors: Understanding Your Role

To really get to grips with CIS deductions, you need to be clear on the two main roles involved. The entire scheme hinges on the relationship between the contractor and the subcontractor.

- The Contractor: This is the business that pays subcontractors to carry out construction work. Their main job under CIS is to check the subcontractor's status with HMRC, make the correct deduction from their invoice, and pay that money over to HMRC.

- The Subcontractor: This is the business or individual doing the construction work. They get paid by the contractor, but with the CIS deduction already taken off the total.

A good way to think about it is that the contractor acts as a kind of collection agent for HMRC. They handle the deduction part, making the tax collection process much smoother for the government.

Key Takeaway: A CIS deduction is money a contractor withholds from a subcontractor's payment. This is then paid to HMRC as an advance on the subcontractor’s annual tax and National Insurance bill.

This system of paying tax upfront has a real impact on cash flow and how you file your annual tax returns, which we’ll dive into later. Understanding these two roles is the first and most important step in managing your CIS obligations correctly. For a more detailed breakdown, have a look at our complete guide on the Construction Industry Scheme.

How CIS Deduction Rates Actually Work

So, you understand the basic idea behind CIS deductions. Now, let's get into the nitty-gritty of the numbers. The deduction rate isn't a single, fixed figure; it all comes down to the subcontractor's registration status with HMRC. For the contractor, getting this right is non-negotiable.

Think of it like a traffic light for payments. Each colour signals a different status and tells the contractor exactly how much to deduct from the subcontractor's invoice. Using the wrong rate can cause a pile-up of problems, from payment delays and incorrect tax filings to unwanted attention from HMRC.

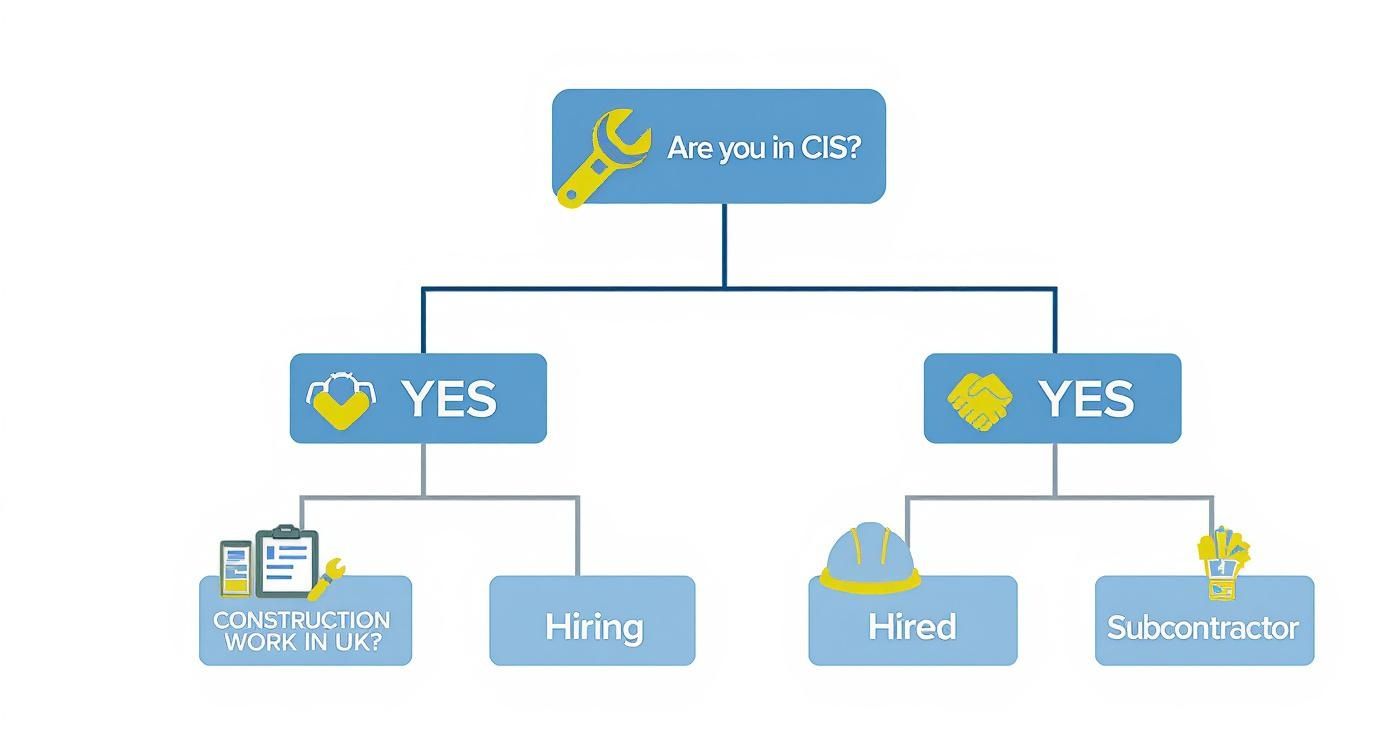

The first step is always knowing which side of the transaction you're on.

This simple chart cuts through the confusion, helping you figure out your role and responsibilities from the get-go.

The Three CIS Deduction Rates

There are three possible rates a contractor will use when paying a subbie. Before a single penny changes hands, the contractor must verify the subcontractor with HMRC. This quick online check confirms which of the following rates to apply.

- Gross Payment Status (0% Deduction): This is the gold standard for subcontractors. If they meet HMRC's strict criteria, they can achieve gross payment status. It means the contractor pays their invoice in full, with no CIS deductions taken off. The benefit? A massive boost to cash flow.

- Standard Rate (20% Deduction): This is the most common scenario. It applies to subcontractors who are properly registered for CIS but don't have gross payment status. The contractor simply deducts 20% from the labour part of the invoice.

- Higher Rate (30% Deduction): This is the penalty rate. It’s used when a subcontractor isn't registered for CIS, or if HMRC can't verify their details for some reason. In this case, the contractor has to deduct a hefty 30% from the labour costs.

A Practical Example of CIS Deduction

Let’s walk through a real-world example to see how this works on an actual invoice. The most important thing to remember is that CIS deductions are only ever taken from the cost of labour, never from materials.

Meet Dave, a plasterer who is registered for CIS at the standard rate. He's just finished a job and sends his invoice to the main contractor.

Invoice Breakdown:

- Total Labour Cost: £1,000

- Cost of Materials (plaster, beads, etc.): £400

- Total Invoice Value: £1,400

The contractor does their due diligence and verifies Dave, confirming he’s on the standard 20% rate. The calculation is then applied only to the labour.

Calculation:

- £1,000 (Labour) x 20% = £200 CIS Deduction

The contractor pays Dave £1,200 (£1,400 total invoice minus the £200 deduction). That £200 is then paid over to HMRC. Dave also gets a payment and deduction statement from the contractor, which is a crucial piece of paper he'll need for his tax return.

Qualifying for Gross Payment Status

For any subcontractor, getting 'paid gross' is the goal. Being paid 100% of your invoice value without deductions is a game-changer for managing cash flow. But HMRC doesn't just hand this status out; you have to earn it by passing three key tests.

- The Business Test: You must prove you’re running a construction business in the UK, and that your business has its own bank account.

- The Turnover Test: Your annual turnover from construction work must hit a certain threshold. For a sole trader, this is currently £30,000.

- The Compliance Test: You need a solid track record with HMRC. This means you’ve filed your tax returns and paid your tax and National Insurance on time.

Achieving this status is a huge plus. Our guide offers more detail on CIS qualifying for gross payment status, laying out a clear path for subcontractors who want to take control of their finances.

Managing Your CIS Responsibilities

Getting to grips with the Construction Industry Scheme doesn't have to be a major headache. The key is understanding what you need to do, whether you're the contractor paying the bills or the subcontractor getting the work done. Once you know your role, you can set up a simple monthly routine to keep HMRC happy and your cash flow healthy.

Think of it like this: a contractor's job is all about checking, deducting, and reporting. A subcontractor, on the other hand, is focused on keeping good records so they can claim back every penny they're owed.

Let's walk through the essential tasks for both sides of the coin.

The Contractor's Monthly Playbook

If you're a contractor, consistency is your best friend. A solid monthly process is the only way to manage CIS properly and avoid those dreaded penalties from HMRC. Your best bet is to treat it like a checklist you tick off every single month.

Here’s what that routine looks like in practice:

- Verify New Subbies: Before you pay a new subcontractor for the first time, you must verify them with HMRC. It’s a quick online check that tells you exactly which rate to use for deductions – 0%, 20%, or 30%.

- Calculate and Deduct: For every payment you make, you need to apply the correct CIS deduction to the labour part of the invoice. Crucially, you never deduct from the cost of materials.

- File Your Monthly Return (CIS300): By the 19th of each month, you must send a return to HMRC detailing all the payments you've made to your subcontractors in the previous tax month.

- Pay HMRC: Any money you've deducted has to be paid over to HMRC. The deadline is the 22nd of the month (or the 19th if you’re old-school and paying by post).

- Issue Deduction Statements: You must give each subcontractor a statement showing their payments and the amount you've deducted. This needs to be done within 14 days of the end of the tax month.

The CIS is a huge part of the UK construction sector's finances, making sure tax is collected efficiently right at the source. It cuts down on non-compliance and keeps things transparent. If you need the official government line on the scheme, you can find more information about what the construction industry scheme is on GOV.UK.

The Subcontractor's Guide to Reclaiming Your Money

As a subcontractor, your main goal is simple: make sure you get credit for all the tax that’s been taken off your invoices. This isn't lost money. Think of it as an advance payment towards your end-of-year tax and National Insurance bill.

When you file your Self Assessment tax return at the end of the tax year, you add up all the CIS deductions from your statements. This total is then knocked off your final tax bill.

For many subcontractors, this means a tax refund is heading their way, especially if the deductions taken were more than the tax they actually owed. It’s a very welcome outcome, but it only happens if your paperwork is spot on.

To make sure you're on the right track, this monthly checklist helps clarify who does what.

Monthly CIS Compliance Checklist

| Task | Contractor Responsibility | Subcontractor Responsibility |

|---|---|---|

| Verification | Verify any new subcontractor with HMRC before their first payment. | Provide accurate details (UTR number, name) for verification. |

| Invoicing | Receive and process invoices, ensuring labour and materials are separate. | Send clear invoices that split out labour and material costs. |

| Deductions & Payments | Calculate and withhold the correct CIS deduction from labour payments. | Receive payment with deduction applied. |

| Reporting to HMRC | File the CIS300 monthly return by the 19th of the month. | N/A (your details are included on the contractor's return). |

| Statements | Issue a payment and deduction statement by the 14th of the following month. | Receive, check, and safely file all deduction statements. |

| Record Keeping | Keep detailed records of all payments, deductions, and returns filed. | Keep all invoices and deduction statements as proof of tax paid. |

This checklist shows how the responsibilities are divided, highlighting the importance of clear communication and diligent record-keeping for both parties to stay compliant.

Essential Bookkeeping for a Smooth Tax Season

Whether you're a contractor or a subbie, good records are your best defence. They are the proof that backs up your returns and ensures you pay the right amount of tax – and not a penny more.

Here’s what you absolutely must keep on top of:

- All Invoices: Keep a copy of every single invoice you send or receive. Make sure they clearly show the split between labour and materials.

- Payment and Deduction Statements: If you're a subcontractor, these are like gold dust. They are the official proof of the tax you've already paid. Keep them safe!

- Business Expenses: Track everything you spend on your business – from tools and materials to fuel for the van and your insurance. These expenses reduce your profit, which in turn lowers your final tax bill.

- Bank Statements: Having a separate business bank account isn't just a good idea; it makes it infinitely easier to trace all your income and spending.

Keeping these records organised, ideally with accounting software like Xero, turns the annual tax return from a nightmare into a straightforward admin task. It means contractors can justify their figures to HMRC, and subcontractors can claim back every penny they are owed.

Common CIS Mistakes and How to Avoid Them

It doesn’t matter if you’re a seasoned contractor or a subcontractor who knows their trade inside and out; the Construction Industry Scheme has tripwires that can catch anyone off guard. The system itself isn't massively complicated, but a simple slip-up can quickly snowball into HMRC penalties, serious cash flow headaches, and a whole lot of unwanted stress.

The key is knowing where the common pitfalls lie. A tiny mistake on a single invoice or a deadline missed by a day might not seem like a big deal at the time, but the consequences can really stack up. The good news is that most of these errors are completely avoidable once you know what to look for.

Let's walk through the mistakes we see most often and, more importantly, the practical steps you can take to make sure you don't make them.

Failing to Verify a Subcontractor

This is the big one. As a contractor, you are legally required to verify every new subcontractor with HMRC before you pay them for the first time. It's a fundamental step, and skipping it has an immediate and painful financial impact.

If you fail to verify, you have no choice but to deduct tax at the highest rate of 30%. Imagine the problem this causes if your subcontractor is actually registered for the standard 20% rate or, even worse, has gross payment status. You’ve taken far too much money, creating a massive cash flow issue for them and a bureaucratic nightmare for you to unravel.

How to Avoid It: Make verification a non-negotiable part of your onboarding process for every single subcontractor. Before they even step on site, get their UTR number and run it through the HMRC portal. It’s a five-minute job that will save you from a world of trouble.

Applying Deductions to Materials

This is another incredibly common—and costly—mistake. The CIS deduction should only be applied to the cost of labour. It should never be applied to the full invoice value if it includes materials.

When you mistakenly deduct from material costs, you’re holding back money that the subcontractor needs to cover their expenses for the job. Not only is it incorrect, but it’s a sure-fire way to damage a good working relationship.

Crucial Reminder: Always insist that your subcontractors provide invoices with a clear, itemised breakdown between their labour and materials. If you get an invoice that lumps it all together, don't pay it. Send it back and politely ask for a corrected version.

This one simple habit protects both you and your subbie.

Missing Key Monthly Deadlines

The CIS runs on a strict monthly timetable, and HMRC is not known for its flexibility on deadlines. Missing them triggers automatic penalties that start at £100 and can quickly spiral into thousands if the problem persists.

You have two critical dates to burn into your calendar each month:

- The 19th: Your CIS300 monthly return, which lists all payments made to subcontractors, must be filed by this date.

- The 22nd: The payment for all the tax you've deducted must clear into HMRC's account by this date (or the 19th if you’re paying by post).

Late filing penalties are an expensive and entirely avoidable drain on your profits. Getting this right is just good business.

How to Avoid It: Put reminders in your calendar, but better still, use modern accounting software. Most packages have CIS features that can automate the filings and payments for you, making it almost impossible to miss a deadline. A simple monthly checklist works wonders, too.

Getting Expert Help with CIS

Let's be honest, trying to keep up with the Construction Industry Scheme can feel like a full-time job. Juggling subcontractor verifications, calculating the right deductions, and filing monthly returns is a huge administrative headache. It’s easy to feel overwhelmed, but this is exactly where getting the right support can turn a major source of stress into a smooth, straightforward process.

Handing over the CIS burden to a team like Stewart Accounting Services means you can finally get that weight off your shoulders. Instead of losing your evenings to paperwork or worrying you’ve missed a deadline, you can get back to what you’re actually good at—running your business and keeping your clients happy.

How We Support Contractors

For contractors, the stakes are high. A simple mistake or a late filing can lead to hefty HMRC penalties, starting at £100 and quickly climbing. Our CIS service is designed to take that risk completely off the table, keeping your business compliant and your mind at ease.

We take care of the entire monthly cycle for you:

- Verifying Subcontractors: We’ll handle the verification for every new subcontractor you hire, making sure the correct deduction rate is used from the very first payment.

- Filing Monthly Returns (CIS300): Your CIS monthly returns will be prepared and filed accurately and on time, every single month. No exceptions.

- Issuing Statements: We’ll provide clear, professional payment and deduction statements to all your subcontractors, which helps maintain good relationships and gives them the paperwork they need.

- Paying HMRC: We make sure the tax you’ve deducted is paid to HMRC on schedule, protecting you from any late payment fines.

This isn’t just about ticking boxes. It’s about freeing up your time and energy to focus on growing your business. Getting CIS right is a massive part of good financial management, and we can guide you through the wider world of how accountants help contractors in the UK to avoid tax traps.

Getting Subcontractors Their Money Back

If you’re a subcontractor, you know that every CIS deduction is your hard-earned cash sitting with HMRC. Getting it back isn't just a nice-to-have; it’s a crucial part of your annual cash flow. Our job is simple: make sure you get back every penny you’re entitled to.

We dig deep into your income, expenses, and CIS statements to build a solid Self Assessment tax return. Our aim is to maximise your refund by finding every allowable expense you might have missed.

We look at everything—tools, materials, van running costs, insurance, and more. For most of our subcontractor clients, the tax refund we secure for them is far more than our fee, making it a smart investment. We cut through the confusion of the year-end tax return and help turn those CIS deductions into a welcome cash boost for your business.

Ready to Make CIS Simple?

Whether you're a contractor bogged down by the monthly grind or a subcontractor who wants to be certain you're getting the biggest possible tax refund, we're here to help. Stewart Accounting Services provides the expertise and clarity you need to handle CIS without the hassle.

Don’t let CIS admin slow you down. Contact our team today for a friendly, no-obligation chat about what you need. Let us show you how we can save you time, eliminate stress, and put more money back in your pocket.

Your CIS Questions Answered

Even when you think you've got the hang of it, the Construction Industry Scheme has a knack for throwing up tricky, real-world questions. What happens if a contractor gets a deduction wrong? Can you get off the scheme entirely? It’s these ‘what-if’ scenarios that cause the most headaches when you're trying to get on with the job.

We've pulled together the most common questions we hear day-in, day-out from both contractors and subcontractors. Think of this as your go-to problem-solver for those fiddly details.

What Happens If a Contractor Deducts the Wrong Amount?

Mistakes happen. But with CIS, they need sorting out quickly. If a contractor realises they've taken the wrong amount of tax from a subcontractor, the fix needs to happen on the next monthly return (the CIS300).

Let's paint a picture. A contractor hires a new subbie but forgets to verify them, so they default to the higher 30% deduction rate just to be safe. A week later, they discover the subcontractor is actually registered for the standard 20% rate. They've taken too much tax.

To put it right, the contractor simply adjusts the figures on their next CIS return. This ensures their own payment to HMRC is correct. The crucial thing to remember is that the contractor cannot just refund the difference to the subcontractor. The subcontractor has to wait until they file their Self Assessment tax return to claim that overpaid tax back from HMRC. As you can imagine, this makes getting it right the first time key to keeping your subbies happy.

Can I Apply for Gross Payment Status Straight Away?

Getting gross payment status (GPS) is the goal for most subcontractors. It means you get paid 100% of your invoice, with no deductions at all. It’s a massive boost for cash flow. But you can't just apply for it the day you register for CIS. HMRC needs to see that you're reliable first.

To get the green light, you have to pass three specific tests:

- The Business Test: You must be running a construction business in the UK and channelling your payments through a business bank account.

- The Turnover Test: Your annual turnover from construction (not including VAT or the cost of materials) needs to hit at least £30,000 for a sole trader. For partnerships, it's £30,000 for each partner (or a minimum of £100,000 for the partnership). For limited companies, it's £30,000 per director (or a minimum of £100,000 for the company).

- The Compliance Test: This is the big one. You need a spotless record of paying your tax and National Insurance on time and filing every return you're supposed to.

This means any new business has to put in the time, hit that turnover target, and prove to HMRC they can be trusted before a GPS application stands a chance.

Are There Any Construction Activities Exempt from CIS?

Yes, but the list is short and very specific. If a job even smells like 'construction', it’s almost certainly covered by the scheme. The main exceptions are for certain professional services, even if they're carried out on a building site.

Work that generally sits outside of CIS includes:

- Architecture and Surveying: The professional work of architects and surveyors isn't classed as a construction operation.

- Scaffolding Hire (with no labour): Just hiring out the scaffolding kit is fine. The moment you supply labour to put it up, you're back in CIS territory.

- Carpet Fitting: This is one of the few trades specifically excluded from the scheme.

- Delivery of Materials: Simply dropping off materials at a site isn't a CIS-related activity.

- Ancillary work, like running a site canteen or providing on-site security.

One critical point: If you have a contract that includes a mix of CIS and non-CIS work, the entire payment for that contract falls under the scheme. You can't split it out, so it’s vital to know exactly where your services stand.

What If My Business Stops Doing Construction Work?

If you pivot your business and no longer work as a contractor or subcontractor in the construction industry, you need to tell HMRC. You can ask them to mark your CIS scheme as 'inactive', which lets them know you won't be filing any more monthly returns.

This is an absolutely essential step for contractors. If you just stop filing without officially deactivating your scheme, HMRC will assume you're simply failing to comply. The late filing penalties will start rolling in automatically, beginning at £100 for every missed return.

For subcontractors, there isn't really a formal 'de-registration' process. But if you hold gross payment status, you should definitely let HMRC know about your change of circumstances. You'll no longer meet the business and turnover tests, and keeping HMRC in the loop is always the smartest move.

Getting your head around CIS is one thing; feeling truly confident about it is another. It’s the key to running a smooth and profitable construction business. If you're tired of the paperwork chase and want to be certain you're compliant and efficient, let Stewart Accounting Services take the strain. We can manage your CIS returns, handle all your subcontractor verifications, and make sure you reclaim every penny you're owed.