If you’ve ever worked in or around the UK construction industry, you've probably heard of the CIS scheme. But what exactly is it?

Think of it like the PAYE system used for employees, but tailored specifically for construction. The Construction Industry Scheme (CIS) is basically a way for HMRC to collect tax from subcontractors throughout the year, rather than waiting for a single, large payment when they file their tax return.

So, What's the Point of the CIS Scheme?

At its heart, the scheme is all about managing cash flow and making sure everyone pays their fair share of tax. It requires contractors to hold back a portion of the money they pay to their subcontractors and send it directly to HMRC.

This process helps subcontractors stay on top of their tax and National Insurance contributions, preventing a shock bill at the end of the tax year. For HMRC, it's a vital tool to reduce tax evasion in an industry with a high number of self-employed workers.

The whole system hinges on the relationship between two main groups: contractors and subcontractors. Let's quickly break down who's who.

Here’s a simple table to show who does what in the CIS scheme.

CIS Scheme Roles at a Glance

| Participant | Primary Role |

|---|---|

| Contractor | The business that hires and pays for construction work. They are responsible for registering for CIS, verifying subcontractors, and making the tax deductions. |

| Subcontractor | The individual or business carrying out the work. They should also register to ensure deductions are made at the correct rate. |

This table gives a bird's-eye view, but the key takeaway is that the contractor handles the admin.

The core idea is simple: contractors deduct money from a subcontractor's invoice and pay that deduction straight to HM Revenue & Customs (HMRC). This acts as an advance payment towards the subcontractor's final tax bill.

For subcontractors, registering is a no-brainer. If you don't, contractors are legally required to deduct tax at a much higher, non-registered rate. Getting set up correctly is a fundamental part of staying compliant and financially healthy in the UK construction industry.

Who Actually Needs to Register for CIS?

Figuring out if the Construction Industry Scheme applies to you can feel a bit like navigating a maze, especially because its net is cast wider than most people think. It really boils down to two key roles: contractors and subcontractors. The first, and most important, step is working out which hat you wear.

Are You a Contractor or a Subcontractor?

It's fairly straightforward if you're a contractor. You're a contractor if you run a construction business and pay others—whether that’s another company or a sole trader—to do construction work for you. It doesn't matter if you're a massive firm or just a one-man band needing an extra pair of hands for a big job; if you pay for construction work, you must register.

For subcontractors—the people actually carrying out the work—the situation is a little different. If you're a self-employed plumber, electrician, or run a small building firm and get paid by a contractor, registering for CIS is technically your choice. But I’ll be honest, it's a choice you'll want to make. If you don't register, the contractor has to deduct a massive 30% from your payments instead of the usual 20%. It’s a huge hit to your cash flow. We dive deeper into this in our guide on the definition of a building sub-contractor.

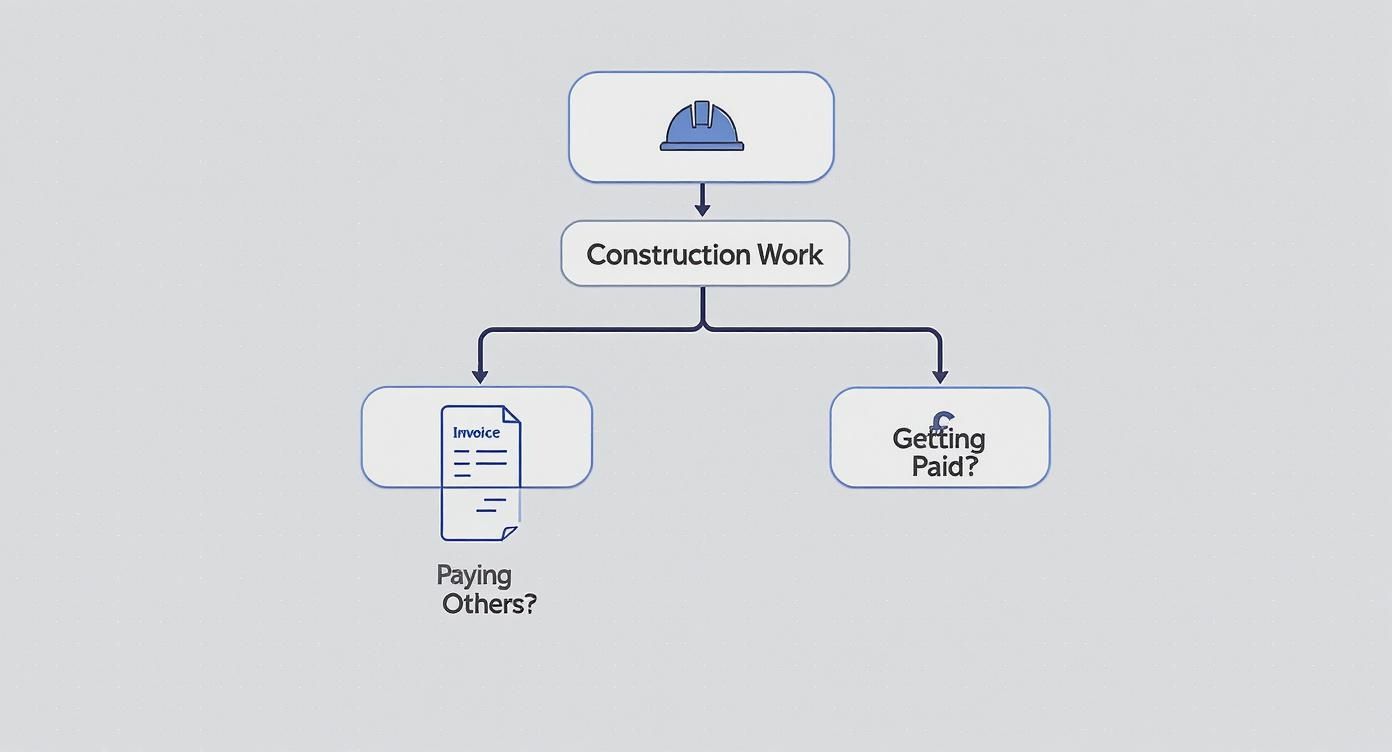

This handy decision tree can help you picture where you fit in.

Ultimately, it all comes down to the flow of money. Are you paying out for construction services, or are you the one getting paid for them? That single question determines your primary responsibilities under CIS.

Don't Forget About 'Deemed Contractors'

This is where things get interesting and where many businesses get caught out. There’s a special category called deemed contractors. These are businesses that don’t actually work in construction but spend a lot of money on it.

This isn't just for building firms. We're talking about property developers, housing associations, and even local councils. If their spending on construction projects gets high enough, HMRC considers them contractors.

So, what's the magic number? A business becomes a deemed contractor if its construction spending tops £3 million over any 12-month period. Once you cross that line, you have to register for CIS and start deducting tax from the payments you make to your subcontractors. It's a rule with serious teeth, and ignoring it can lead to some painful penalties.

How CIS Deductions Actually Work on an Invoice

It’s one thing to talk about the CIS scheme in theory, but what really matters is seeing how it impacts your cash flow on a real job. The amount a contractor takes from a subcontractor's payment isn't just a random figure; it's set by HMRC and depends entirely on the subcontractor's registration status.

Before paying a single penny, a contractor must verify every subcontractor with HMRC. It's not just good practice—it's a legal requirement. This verification step is what tells the contractor which deduction rate to use.

The Three CIS Deduction Rates

The rate applied can have a massive impact on a subcontractor's immediate income. There are three distinct tiers, each tied to a specific status within the scheme.

Let's break down exactly what each status means and how much tax gets held back.

CIS Tax Deduction Rates Explained

| Subcontractor Status | Deduction Rate | Who It Applies To |

|---|---|---|

| Gross Payment Status | 0% | Subcontractors who have met HMRC's strict turnover, tax, and business tests. They receive their payments in full. |

| Standard Rate | 20% | The most common rate. It applies to subcontractors who are properly registered for CIS but don't qualify for gross status. |

| Higher Rate | 30% | A penalty rate for unverified or unregistered subcontractors. It's a powerful incentive to get registered correctly. |

As you can see, getting registered and maintaining a good compliance record with HMRC can make a huge difference to your take-home pay on every single invoice.

The single most important rule to remember is that CIS deductions apply only to the labour portion of an invoice. Costs for materials, VAT, or plant hire are always excluded from the calculation.

So, how does this work in practice? Imagine a subcontractor invoices for £1,000 of labour and £200 for materials. If they're registered at the standard rate, the contractor will deduct £200 (20% of the £1,000 labour cost). The £200 for materials is paid in full, with no deductions. You can find more detail on this crucial distinction from the FCSA.

Getting your invoices right is absolutely vital for staying compliant and keeping your business relationships strong. For some practical templates, take a look at our invoice examples for contractors. When you separate labour from materials correctly, you ensure the right amount is deducted, which keeps you, your subcontractors, and HMRC happy.

Keeping on Top of Your CIS Duties

Getting to grips with the Construction Industry Scheme is the first step, but staying compliant month in, month out is where the real work begins. Both contractors and subcontractors have their own set of responsibilities, and letting them slide can attract unwanted attention and penalties from HMRC. Staying on top of CIS is a crucial part of your company's broader risk and compliance strategies, especially in construction.

For contractors, most of the administrative heavy lifting falls to you. Think of it as a monthly checklist of must-do tasks that protect both your business and the people you hire.

A Contractor's Monthly Checklist

From the moment you bring a subcontractor on board, a strict monthly cycle of duties kicks in. Getting your process right from the start is the secret to avoiding headaches later on.

-

Verify Your Subbies: Before you pay a new subcontractor a single penny, you must verify them with HMRC. This confirms their registration status and tells you which deduction rate to use: 0%, 20%, or 30%.

-

Get the Sums Right: You're responsible for calculating the correct deduction. Remember, this is only applied to the cost of labour on their invoice, not materials or VAT.

-

File Your Monthly Return: A CIS return detailing every payment made to your subcontractors in the previous tax month must be sent to HMRC by the 19th of each month. No excuses.

-

Issue Payment Statements: You have to give each subcontractor a written statement showing the payments you've made and the tax you've deducted. This needs to be done within 14 days of the end of the tax month.

A Subcontractor's Role in the Process

While contractors do the deducting, subcontractors have a vital role to play in making sure the system works smoothly and they don't end up overpaying tax.

As a subcontractor, your main job is to make sure you're taxed correctly from the get-go and that you can easily claim back any overpaid tax when the year is up.

The single most important thing you can do is register for the scheme. This is what helps you avoid the default, higher-rate deduction of 30%.

You also need to be meticulous about keeping every single payment statement you receive from contractors. These aren't just bits of paper; they are your proof. When you file your annual Self Assessment tax return, you'll use these statements to show HMRC how much tax has already been taken. This amount is then set against your final income tax and National Insurance bill, often resulting in a welcome tax refund.

How to Achieve Gross Payment Status

For subcontractors in the construction game, getting gross payment status is the gold standard. It’s the difference between seeing a chunk of your invoice held back and getting paid in full, every single time. No CIS deductions.

Think of it as HMRC giving you a nod of approval. They're essentially saying they trust you to handle your own tax affairs. Achieving this status can be a total game-changer for your cash flow, putting you firmly in control of your finances. But as you can imagine, HMRC doesn't just hand this out to everyone.

The Three Tests for Gross Status

To get the green light, you need to prove your reliability by passing three key tests. You'll have to satisfy all of them, so it pays to know what HMRC is looking for.

-

The Business Test: First off, you need to show you’re a legitimate construction business. This means your work is genuinely in construction and you’re running your operations properly, primarily through a business bank account.

-

The Turnover Test: Your annual turnover from construction work must hit a certain threshold. The exact figure depends on whether you're a sole trader, a partnership, or a limited company, but it needs to be substantial enough to show you're a serious player.

-

The Compliance Test: This one is absolutely crucial. HMRC will put your tax history under a microscope. They'll expect to see a perfect record of submitting returns and paying your tax and National Insurance on time over the past 12 months.

Passing these hurdles tells HMRC you're a stable, well-managed business that can be trusted to meet its tax obligations without needing the CIS safety net.

Getting everything in order requires careful, consistent bookkeeping and staying on top of every tax deadline. For a deeper dive into the specifics, check out our guide on qualifying for gross payment status. It’s a major milestone that can really set your business up for growth.

Got CIS Questions? We've Got Answers

Once you get your head around the basics of CIS, the real-world questions start popping up. It's one thing to know the rules, but another to apply them day-to-day. Let's walk through a few of the most common queries we hear from contractors and subcontractors.

What Kind of Construction Work Falls Under CIS?

The scheme casts a pretty wide net, covering most jobs you'd picture on a building site. Honestly, it’s often simpler to think about what isn't covered rather than what is.

As a rule of thumb, CIS applies to any work on a building, a temporary structure, or a civil engineering project. This includes the obvious stuff like:

- Getting the ground ready: Think demolition, laying foundations, and creating access routes.

- The main build: From putting up walls to repairs, painting and decorating, and full-scale refurbishments.

- System installations: This covers fitting essentials like heating, lighting, power, water, and ventilation.

But, it's not all-encompassing. A few professional services are specifically left out. For instance, you don't have to worry about CIS for payments related to scaffolding hire (as long as no labour is included), architectural or surveying work, or for the simple delivery of materials to a site.

How Do I Get My Overpaid CIS Tax Back?

For many subcontractors, getting a tax rebate is one of the best parts of the year – and CIS is often the reason. The best way to think about those 20% or 30% deductions is as pre-payments towards your final tax and National Insurance bill. HMRC is essentially holding that money for you.

When it's time to file your annual Self Assessment tax return, you'll tell HMRC about your total income for the year, and crucially, you'll also declare the total amount of CIS deductions that were taken from your pay.

HMRC then works out what you actually owe. If the total CIS you've already paid is more than your final tax bill, you get the rest back as a refund. This is exactly why holding onto every single payment statement is so important!

What Happens if a Contractor Can't Verify Me?

This is a big one, and it really highlights why getting registered is a non-negotiable. If a contractor can't find you in HMRC's system to verify your status, they have no choice in what happens next. By law, they must take deductions at the highest rate, which is 30%.

This isn't the contractor being difficult; it's a mandatory default rate set by HMRC to prevent tax from going missing from unregistered workers. It's a powerful nudge to make sure every subcontractor registers properly and keeps their details with HMRC completely up-to-date. A few minutes of admin can prevent a huge chunk of your earnings from being held back.

Juggling CIS rules and making sure every deduction and return is spot-on can be a real headache. Stewart Accounting Services takes the weight off your shoulders by handling all things CIS, from monthly filings to chasing your year-end tax refund. This frees you up to focus on what you do best. See how we can make your life easier at Stewart Accounting Services.