How to Prepare Your Business for the 2023 Cost Landscape

It’s not news that businesses face a constantly changing landscape. As we look ahead to 2023, it’s essential for business owners to prepare for the challenges they may face. From rising wages to inflation. There are many factors at play when it comes to managing costs in a year as unpredictable as 2023. Let’s take a look at what business owners need to know about the cost landscape in 2023 and how to prepare for it.

The future is always hard to predict. One thing we do know is that the cost of running a business will be higher in 2023 than it is today. This means that your business will have to make certain adjustments if you want to remain profitable and competitive. One of the biggest changes we’ll see is an increase in wages. With unemployment rates still low, employers will have to offer higher wages in order to attract and retain top talent. In addition, inflation will likely be on the rise due to increased demand for goods and services. All of this means that your business must prepare for changes in the cost landscape if you want to survive and thrive.

Strategies for Managing Business Costs

In order to stay afloat, businesses must adjust their strategies accordingly. This means developing new ways of managing costs effectively. The first step is pricing adjustments. You should assess prices regularly and make sure you’re keeping up with market demands while still remaining profitable. Additionally, businesses should cut back on unnecessary spending wherever possible. This could include things like travel expenses or office supplies that aren’t necessary. Lastly, financial planning can help businesses stay ahead of potential issues before they become problems. Having an accurate budget and forecasting reports can help business owners anticipate any potential issues and make necessary adjustments ahead of time.

Business Costs Increasing

In a perfect business world, business costs would remain the same. Unfortunately, in 2023 this isn’t the case. Business costs are no doubt on the rise, squeezing expenditure and lowering profit margins. Business owners still have to take steps to stay afloat and make a success of their business. From taking advice from advisors to reassessing business practices, entrepreneurs need to be on top of their game. This is if they want their business to succeed despite these higher business costs. It’s no easy task but one that increases pressure and responsibility in order to keep business functions running smoothly.

The National Living Wage and Minimum Wage Increase

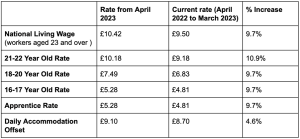

The National Living Wage and Minimum Wage have both been on the rise in recent years. Bringing a much-needed boost to employees but costing businesses an increase in payroll costs. Companies have had to adjust their pricing structures and put other cost-saving measures in place to offset these extra expenses. The National Living Wage and Minimum Wage serve an important purpose. Allowing workers to make a living wage, but it’s not without its challenges for employers. Meeting everyone’s needs with the rising personnel costs is no mean feat. Only with planning and creative solutions, it can be done. The new NLW and NMW rates from 1 April 2023 will be:

Inflation Reaching Unprecedented Levels

Inflation has been reaching unprecedented levels lately and although it has its perks, it’s not all sunshine and rainbows. With inflation comes a rise in prices for essentials such as food and other materials. Meaning that the cost of living increases despite wages staying relatively the same. This can be incredibly difficult to manage, particularly during challenging economic times like right now. Considering inflation when budgeting is crucial if you’re trying to build up savings or stay afloat financially!

The Evolving Business Landscape

The business landscape is ever-evolving and companies have to keep up. In order to remain profitable, many companies get forced to make hard decisions when it comes to their budgeting. Such as finding ways of cutting back on spending or raising prices on products and services. Although profit margins increase when prices go up. Careful consideration needs to be given in order for businesses to retain their customer base. Who likely support their profit in the first place. It’s a delicate balance that requires careful manoeuvring from corporate executives. It can become even more difficult when customers expect a certain level of quality provided for a certain price. Finding the right combination of budget consciousness and profit maintenance can be difficult. However, not impossible.

Having Proper Financial Planning

Proper financial planning is essential for business owners who are looking to stay productive and successful. Being able to effectively manage business costs can make a dramatic difference in the long-term success of a business. Especially when unexpected expenses or changes arise. By taking time to go over business finances consistently, business owners can find areas where cost reduction is possible. Allowing the ability to plan ahead so they’re not taken by surprise. With proper financial planning, business owners have the power to turn business costs into opportunities for success.

In Conclusion:

Businesses today exist in an ever-changing landscape. So it’s essential that business owners stay ahead of the game by preparing for potential challenges down the road. In particular, business owners should pay close attention to the cost landscape in 2023. From rising wages to inflation, there are many factors at play when it comes to managing costs effectively. Especially in a year as unpredictable as 2023. By making pricing adjustments where appropriate, cutting back on unnecessary spending where possible and engaging in good financial planning practices now. Business owners can ensure their success well into the future.

If you would like to go over business growth and planning with a specialist then get in touch with us.