For the majority of UK businesses, the most important date to circle in your calendar is your VAT payment due date. It's surprisingly straightforward: your payment must reach HMRC by one month and seven days after the end of your accounting period.

Getting this right is the cornerstone of good VAT management. It’s not just about ticking a box; it’s about avoiding immediate penalties and keeping your business on the right side of the taxman.

Your Guide to UK VAT Payment Due Dates

Knowing your VAT payment dates is crucial for managing your cash flow and staying compliant. Let's break down that "one month and seven days" rule with a simple example. If your VAT period finishes on 31st March, your deadline to file the return and make the payment is 7th May.

This isn't just an arbitrary timeline; it's a structured system set by HM Revenue and Customs (HMRC) that plays a part in the government's own financial planning. You can get a sense of the scale of this by looking at HMRC's annual reports.

Key Takeaway: Filing your return isn't the finish line. The deadline for submitting your VAT return and ensuring the payment is in HMRC’s bank account is exactly the same. The money has to have cleared by the due date.

To help you visualise this, here’s a quick-reference table outlining the standard quarterly VAT periods and their deadlines.

Standard UK Quarterly VAT Periods and Deadlines

Most UK businesses fall into a standard quarterly cycle. The table below shows the most common set of VAT periods and the corresponding deadlines you'll need to meet.

| VAT Period End Date | VAT Return Submission Deadline | VAT Payment Due Date |

|---|---|---|

| 31 March | 7 May | 7 May |

| 30 June | 7 August | 7 August |

| 30 September | 7 November | 7 November |

| 31 December | 7 February | 7 February |

Think of this table as your reliable guide. While other quarterly cycles exist, this one is the most typical, so it’s a great starting point for keeping your VAT affairs in order.

Finding Your Specific VAT Accounting Period

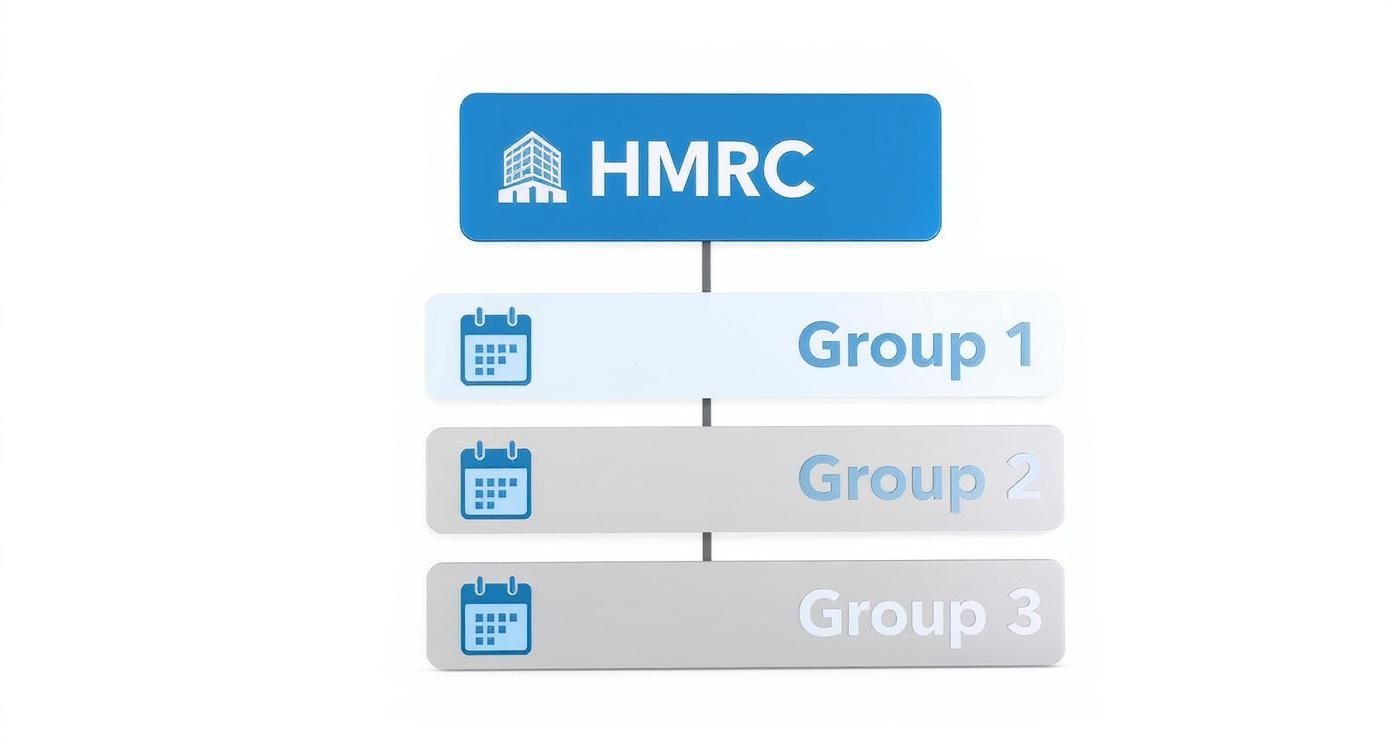

Ever wondered why your VAT deadline is different from the business next door? It’s not random. HMRC doesn’t use a one-size-fits-all calendar. Instead, they assign your business to a "stagger group," which is just a fancy term for a specific tax timetable that sets your quarterly cycle.

This system is actually pretty clever. By staggering the deadlines, HMRC spreads out the workload of processing millions of VAT returns throughout the year, preventing a massive administrative jam. Figuring out which group you're in is the first and most important step to pinpointing your exact VAT payment due dates.

Most businesses that file quarterly will land in one of three main stagger groups.

The Three Main Stagger Groups

Think of these groups like different train timetables, all heading to the same destination: VAT compliance. HMRC puts your business on a specific track, and you just need to follow its schedule.

-

Group 1 (Stagger 1): Your accounting periods wrap up at the end of March, June, September, and December. This is often what people think of as the 'standard' tax quarter.

-

Group 2 (Stagger 2): Your periods end on the last day of April, July, October, and January.

-

Group 3 (Stagger 3): Your quarters finish at the end of May, August, November, and February.

Your assigned group determines the end date for your VAT accounting period. From that date, the usual "one month and seven days" rule kicks in to give you your final deadline for both filing the return and making the payment. So, if you're in Group 2 and your period ends on 31st July, your VAT needs to be paid and filed by 7th September.

The easiest way to confirm your accounting period is to check your VAT registration certificate. It’s also clearly stated right when you log in to your HMRC online VAT account. These are your most reliable sources.

Once you know which stagger group you belong to, you can map out your deadlines for the entire year. This simple bit of knowledge removes all the guesswork and lets you manage your tax calendar with confidence, making sure you’re always one step ahead.

How Different VAT Schemes Affect Your Deadlines

While the standard quarterly routine is what most businesses know, it's far from your only option for managing VAT. HMRC has several schemes that can change your payment schedule and, just as importantly, how you calculate what you owe. Getting this right can make a world of difference to your cash flow and how you prepare for your VAT payment dates due.

Some schemes stick to the usual quarterly deadline but completely change the maths behind your VAT return. This can have a huge impact on the amount you actually hand over to HMRC each period.

Schemes That Change Your Calculation Method

For many small businesses, simplifying the paperwork is a top priority. Two schemes, in particular, are brilliant for this.

-

Cash Accounting Scheme: This is a real game-changer for managing cash flow. Instead of paying VAT based on invoices you've sent out, you only account for it on the money that has physically landed in your bank account. It means you're never paying tax on cash you haven't received yet. To see if it's right for you, you can learn more about the benefits of the VAT Cash Accounting Scheme in our guide.

-

Flat Rate Scheme: If you're after pure simplicity, this is it. The scheme allows you to pay a fixed percentage of your turnover to HMRC. You'll still charge your customers the correct VAT rate, but the calculation for your return becomes much, much simpler, saving you a heap of administrative time.

The infographic below shows how HMRC assigns different "stagger groups" to spread out the quarterly deadlines.

Even though these two schemes follow the standard quarterly filing dates, the way they let you work out your bill provides some much-needed breathing room for your finances.

The Annual Accounting Scheme

If you want to break away from the quarterly cycle entirely, the Annual Accounting Scheme is the biggest shift you can make. It’s designed for businesses with a VAT taxable turnover of £1.35 million or less.

Instead of four big quarterly payments, you make nine smaller, more manageable interim payments throughout the year. Then, at the end of the year, you file a single VAT return and make one final payment to clear your balance (or claim a refund if you've overpaid).

This approach turns a frantic quarterly task into a predictable monthly outgoing. The final VAT payment due date for this scheme is a full two months after your year-end, giving you plenty of time to get your books in order and settle up.

A Step-by-Step Guide to Paying Your VAT Bill

Knowing your VAT payment due date is half the battle; the other half is making sure the payment itself goes through smoothly. It's surprisingly easy for a simple mistake to cause delays, which can land you with a penalty even if you sent the money on time. Let's walk through how to get it right.

The single most important detail for any VAT payment is your 9-digit VAT number. You absolutely must use this as the payment reference. If you don't, HMRC has no way of knowing the money is from you, leading to a major headache and compliance problems down the line.

Choosing Your Payment Method

Think of payment methods in terms of how long they take to clear. Some are instant, others take a few days. This processing time is key to meeting your deadline, so planning ahead is always your best bet.

Here are the most common ways to pay your VAT bill:

-

Direct Debit: This is the easiest option by far. Once you’ve set it up, HMRC automatically takes the payment from your bank account. The best part? The collection usually happens 3 working days after your filing deadline, giving you a bit of breathing room. Just be sure to set it up well in advance.

-

Online or Telephone Banking (Faster Payments): This is how most businesses pay. Money sent via Faster Payments usually lands in HMRC's account the same day, though it can sometimes take a couple of hours. To be safe, always send the payment well before the end of the day on your deadline.

-

CHAPS, BACS, or Card Payment: Be careful with these. BACS can take up to three working days to clear, which makes it a risky choice if you're cutting it fine. You can also pay with a corporate credit or debit card on HMRC’s website, but watch out for potential processing fees.

Crucial Tip: Whichever method you use, log into your online VAT account a few days later. Double-check that the payment has been received and credited to your account. This quick check gives you complete peace of mind.

For a full breakdown of the entire process, from preparing your figures to hitting 'submit', have a look at our detailed guide on how to submit VAT returns.

The Real Cost of Missing a VAT Deadline

https://www.youtube.com/embed/RJYr4JVlVRQ

Missing your VAT payment dates due can feel like a minor admin slip, but the financial hit can be far more serious than many business owners expect. HMRC has a very clear system for penalising late submissions and payments, and those costs can quickly start to squeeze your cash flow.

It’s not just about the original VAT amount; it's the extra charges that get piled on top. These penalties are designed to be a real deterrent, not just a slap on the wrist, encouraging businesses to keep up. After all, timely VAT payments are crucial for government finances. This system allows HMRC to forecast its revenue—for 2025/26, VAT is expected to bring in a staggering £180.4 billion. You can see how this fits into the wider UK tax landscape on RSM UK.

How the Penalty System Works

HMRC has moved to a penalty points system for late filings. The easiest way to think about it is like getting points on your driving licence—each time you miss a deadline, you get a point on your record. Once you hit a certain total, you get a fine.

- Penalty Points: You get one point for every late VAT return.

- Penalty Threshold: If you file quarterly, the threshold is 4 points.

- Financial Penalty: As soon as you hit that threshold, you’ll be fined £200.

- Further Penalties: You'll get another £200 fine for every subsequent late filing while you're still at the penalty threshold.

This system is automated and pretty unforgiving. The points don’t just disappear; they only expire after you’ve demonstrated a period of consistent, on-time filing. We break this down even further in our guide to understanding VAT late filing penalties.

Interest on Late Payments

On top of the points for filing late, HMRC charges interest on any unpaid VAT. This starts clocking up the day after your deadline and doesn't stop until you've paid in full. The rate is set at the Bank of England base rate plus 2.5%.

This is where things can really escalate. The longer you leave it, the bigger the bill gets. A small, manageable VAT liability can quickly balloon when daily interest is being added, turning a simple tax obligation into a genuine financial headache for your business. It’s a powerful incentive to keep your VAT affairs in order.

Getting Ahead of Your VAT Deadlines

Turning VAT management from a last-minute panic into a smooth, routine part of your business is entirely possible. The key is to stop reacting to deadlines and start proactively managing them.

A few good habits can make all the difference. Start by setting up calendar reminders at least a week before your VAT payment dates due. This gives you a decent buffer to get everything in order without the stress. If you're looking to manage all your financial tasks in one place, guides like the 12 Best Planning Apps can point you towards some seriously helpful digital tools.

Good accounting software is also a game-changer. It will track your deadlines for you and pull the figures together automatically, which cuts out the manual work and significantly reduces the chance of making a costly error.

Make Payments Effortless and Plan for the Unexpected

For a truly "set-it-and-forget-it" approach, setting up a Direct Debit with HMRC is the simplest way to guarantee you always pay on time. The payment is taken automatically, usually three working days after your filing deadline, which can even give you a small cash flow buffer.

Even the best-laid plans can go awry. If you think you're going to struggle to pay your VAT bill, the worst thing you can do is ignore it. Contact HMRC as soon as you can. They may be able to set you up with a 'Time to Pay' plan, letting you spread the cost and avoid penalties.

With 2.73 million VAT-registered businesses in the UK as of March 2025, staying on top of compliance is a non-negotiable. By managing your VAT proactively, you can ensure you’re doing your part for the £170 billion in annual VAT revenue without the headache. You can discover more about these VAT statistics directly on the government's official page.

A Few Common VAT Payment Questions

When it comes to the nitty-gritty of paying your VAT bill, a few practical questions almost always crop up. Getting these sorted will help you stay on top of your obligations and avoid any nasty surprises down the line.

What if the Deadline Falls on a Weekend or Bank Holiday?

This is a classic stumbling block. If your payment deadline lands on a weekend or a bank holiday, the rule is simple: the money must be in HMRC's bank account by the last working day before that date.

It’s a common misconception that you just need to send it on the day. The key is when the payment clears. So, if your deadline is a Sunday, you need to make sure HMRC has received the funds by Friday at the latest.

Can I Get an Extension on My VAT Payment?

Honestly, HMRC doesn't really do extensions. However, if you know you’re going to struggle to pay on time, the absolute worst thing you can do is ignore it.

Get in touch with HMRC as soon as you foresee a problem—well before the deadline hits. You might be able to set up a ‘Time to Pay’ arrangement, which lets you pay what you owe in manageable instalments.

Reaching out to HMRC proactively is your best move. Burying your head in the sand will just rack up penalties and interest. A quick phone call to explain your situation can often lead to a workable solution and shows you're taking your responsibilities seriously.

How Do I Know HMRC Has Received My Payment?

The easiest and most reliable way to check is by logging into your online VAT account on the government gateway. Depending on your payment method, it might take a couple of business days to show up, but you'll see it logged there once it's processed. This is your official confirmation and peace of mind.

Getting your head around VAT can feel like a full-time job in itself. Stewart Accounting Services offers expert, practical advice to handle all your VAT responsibilities, making sure you hit every deadline without the stress. Let us manage your VAT returns so you can get back to running your business.