Dipping your toe into the world of landlord taxes can feel like wading into a sea of jargon. Let's cut through the noise right away.

The most important thing to understand about property rental income tax is that it's not some strange, separate tax. It’s simply income tax, but for the money you make from your rental property. Crucially, you’re only taxed on the profit you make, not the total rent you pull in each month.

Your First Look at Property Rental Income Tax

When you start renting out a property, you've effectively launched a small business. And just like any other business, the income it generates is taxable. For tax purposes, HMRC views the profit from your property in much the same way as it views the salary you might earn from your day job.

This simple idea is the bedrock of managing your landlord finances. It means every legitimate pound you spend on keeping your rental running has the potential to lower your final tax bill.

It's All About Profit, Not Revenue

Let's use a quick example. Say you collect £12,000 in rent over the course of a tax year. You won't be paying tax on that full amount.

First, you get to subtract all your allowable expenses – think letting agent fees, landlord insurance, or the cost of a plumber to fix a leaky tap. If those expenses add up to £4,000, your taxable profit is just £8,000. That's the figure HMRC is interested in.

This distinction is massive because it puts you in the driver's seat. The more diligent you are about tracking your expenses, the more accurately you can calculate your profit, ensuring you don't pay a penny more in tax than you need to.

Key Takeaway: Managing your rental income tax properly begins with a simple mental switch. Your job isn't just collecting rent; it's about meticulously logging every single associated cost to work out your true taxable profit.

Nailing this from the start keeps you fully compliant and makes the whole process far less intimidating.

Why Does This Matter to You?

Getting this core concept right from day one gives you a clear road map. Instead of dreading the self-assessment deadline, you can approach it as just another part of running your property business. A solid understanding helps you:

- Plan Your Finances: When you know you're taxed on profit, you can manage your cash flow and forecast your financial position much more effectively.

- Maximise Your Returns: By carefully tracking every allowable expense, you legally reduce your tax liability, which means more of your hard-earned cash stays in your pocket.

- Avoid Common Mistakes: So many new landlords end up overpaying tax simply because they don’t realise the full range of expenses they’re entitled to claim.

This guide will build on this foundation. We'll walk you through exactly how to calculate your profit, what you can (and can't) claim as an expense, and how to file your tax return with confidence.

How to Calculate Your Taxable Rental Profit

Alright, let's get down to the brass tacks. Figuring out your taxable profit is much less intimidating than it sounds. At its heart, it’s a simple piece of arithmetic that forms the bedrock of your entire property rental income tax calculation.

You start with the total amount of rent you've collected over the year and then subtract all the legitimate running costs. What’s left is your profit.

The Core Formula:

Total Annual Rent – Total Allowable Expenses = Taxable Profit

This final number is what HMRC is interested in. It’s the figure they’ll use to work out how much tax you owe, so getting both sides of this equation right is absolutely crucial.

Step 1: Nailing Down Your Total Annual Rental Income

First things first, you need to add up every single penny your property has brought in during the tax year (which runs from 6th April to 5th April). This is more than just the basic monthly rent you see hitting your bank account.

Your total rental income can include a variety of other payments, and it's vital to capture everything to stay on the right side of HMRC.

Typically, your income will come from:

- Monthly Rent Payments: The standard, predictable rent your tenants pay you under their tenancy agreement.

- Non-Refundable Deposits: Any part of a security deposit you've held back to cover things like damage or unpaid rent.

- Additional Fees: Charges for services you provide, like cleaning, gardening, or even utilities if you bill them separately.

- Associated Income: Money tenants pay you for using furniture or other amenities that come with the property.

Imagine you rent out a flat for £1,000 a month but also charge an extra £50 a month for a gardening service. For tax purposes, your total monthly income isn't £1,000, it's £1,050. Over a year, that adds up to £12,600, not the £12,000 you might initially think of.

Step 2: Subtracting Your Allowable Expenses

Once you've got your total income figure, the next job is to subtract your allowable expenses. These are essentially the costs you’ve had to pay out "wholly and exclusively" to rent out your property.

Think of it this way: if you had to spend money to keep your rental business running and the property in a safe, liveable state, it's very likely a deductible expense. This is where good, thorough record-keeping really starts to pay for itself.

These deductions shrink your taxable profit, which, in turn, reduces your final tax bill. We'll dive into the specifics of what you can claim in the next section, but common examples include:

- Letting agent and management fees

- Landlord insurance premiums

- The cost of necessary repairs and maintenance

- Accountancy fees for getting your rental accounts in order

When you subtract these costs from your total income, you're left with the true profit you’ve made.

A Practical Example of Calculating Profit

Let's walk through a simple, real-world scenario to see how this works in practice. We'll use the example of Sarah, a landlord based in Stirling.

-

Calculate Total Income: Sarah lets her flat for £900 per month. Across the 12-month tax year, her total rental income comes to £10,800.

-

Tally Allowable Expenses: Throughout the year, Sarah kept meticulous records of her outgoings:

- Letting Agent Fees: £1,296 (at 12% of her annual rent)

- Gas Safety Certificate: £80

- Emergency Plumber Call-Out: £250

- Landlord Insurance: £220

- Her total allowable expenses for the year are £1,846.

-

Determine Taxable Profit: Now, she simply plugs her numbers into the formula:

- £10,800 (Total Income) – £1,846 (Total Expenses) = £8,954 (Taxable Profit)

It's this £8,954 figure that Sarah will declare on her Self Assessment tax return. She isn’t taxed on the full £10,800 she received, only on the profit she actually made after covering the necessary costs of being a landlord.

Finding Every Allowable Expense You Can Claim

When it comes to your property rental income tax bill, understanding your allowable expenses is the single most powerful tool you have. Think of it this way: your rental income is your starting point, but every pound you genuinely spend to keep your property business running directly shrinks your taxable profit. This ensures you only pay tax on what you actually earn.

HMRC’s golden rule is that any expense must be “wholly and exclusively” for the purpose of renting out your property. This simply means the costs have to be for the business, not for your personal benefit. For most landlords with one or two properties, this is pretty clear-cut, but it’s a vital principle to always keep in the back of your mind.

The Crucial Difference: Repairs vs Improvements

One of the biggest tripwires for landlords is telling the difference between a repair and an improvement. Getting this wrong can mean claiming for something you shouldn’t, so it’s absolutely essential to nail the distinction.

A repair is what you spend to restore something to its original condition. Good news – this is an allowable expense. For example, if a tenant reports a broken window and you pay to have the glass replaced with a modern, like-for-like equivalent, that’s a repair. You’re just putting things back to how they were.

An improvement, on the other hand, is any cost that enhances the property beyond its original state. This is treated as capital expenditure and is not deductible from your rental income. If you decide to replace that same small window with grand French doors, you’re not just repairing it – you're adding significant value and improving the property.

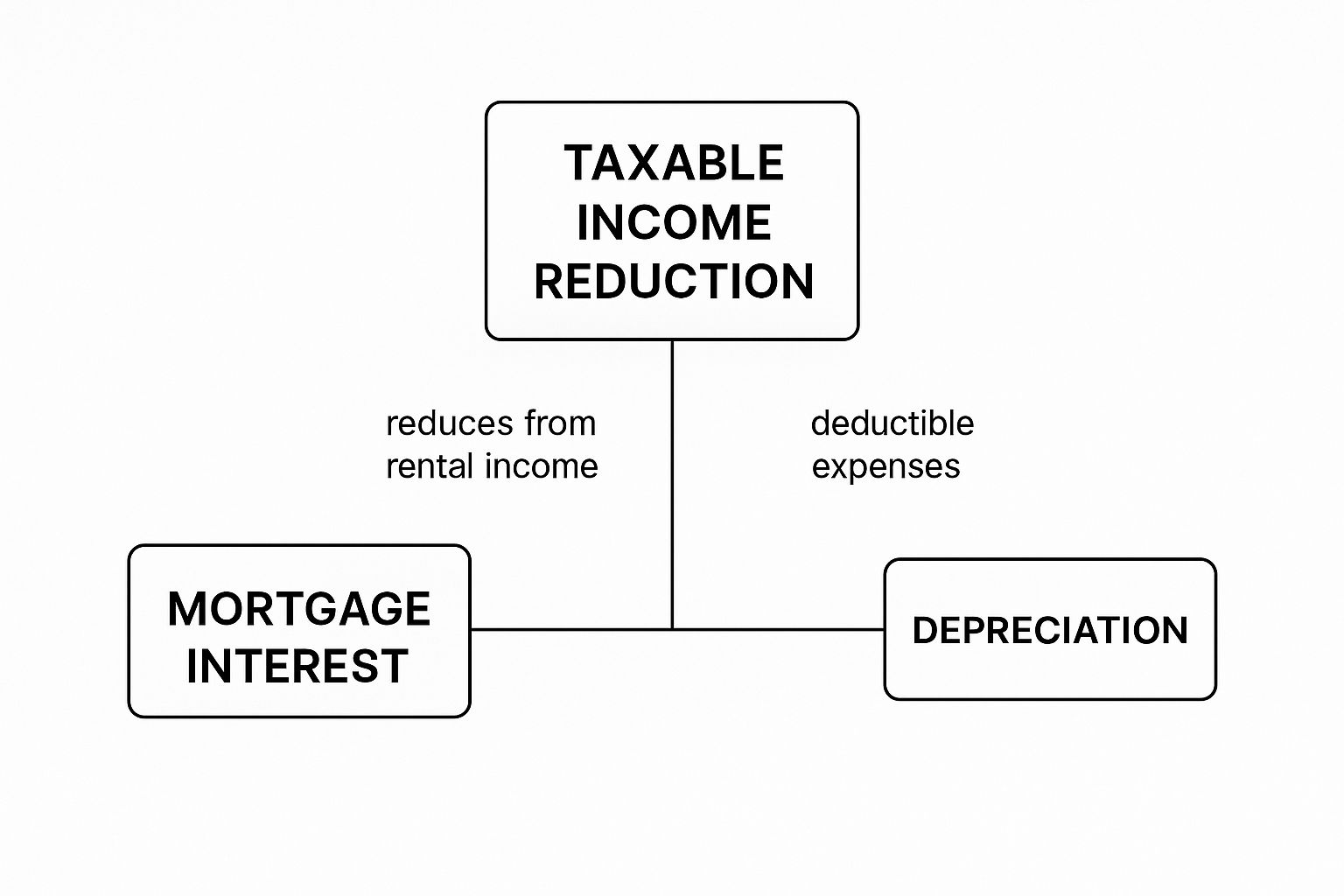

This image breaks down the three main types of expenses that help lower the amount of profit you pay tax on.

As you can see, costs like mortgage interest and general maintenance play a direct role in reducing your taxable income, showing just how important they are in your calculations.

To make this distinction crystal clear, here’s a quick-reference table to help you categorise your spending correctly.

Comparing Allowable Repairs vs Capital Improvements

| Expense Category | Allowable Expense (Deductible) | Capital Improvement (Not Deductible) |

|---|---|---|

| Windows & Doors | Replacing a broken window pane with the same type of glass. | Upgrading single-glazed windows to double-glazing. |

| Kitchen | Repairing a faulty oven thermostat. | Installing a brand-new, modern fitted kitchen. |

| Flooring | Replacing a torn or damaged section of carpet. | Replacing carpets with expensive hardwood flooring. |

| Plumbing | Fixing a leaking tap or a burst pipe. | Adding a new en-suite bathroom to a bedroom. |

| Roofing | Replacing a few broken tiles after a storm. | Re-roofing the entire property with a different material. |

Thinking in these terms helps you confidently decide what to include on your tax return and what to leave out.

Common Categories of Allowable Expenses

While every property has its unique quirks, most allowable expenses fall into a few predictable buckets. Keeping detailed records under these headings will make filling out your Self Assessment tax return a whole lot less painful. For a really deep dive into what you can claim, check out this guide on rental property tax deductions.

Here are some of the key deductible areas to track:

- Property Maintenance and Repairs: This is your bread and butter. It covers everything from fixing a dripping tap and getting the boiler serviced to a full repaint between tenancies to keep the property looking fresh.

- Professional Fees: You can claim for your letting agent’s management fees, what you pay your accountant to handle your rental accounts, and legal fees for things like drafting a tenancy agreement.

- Landlord Insurance: The premiums you pay for buildings, contents, and public liability insurance are all fully deductible.

- Running Costs: This covers things like council tax and utility bills (gas, electricity, water) that you have to pay for during void periods when the property is empty between tenants.

Top Tip: Don't forget you can also claim for expenses you paid out before your first tenant even moved in. Things like advertising the property or running credit checks are known as pre-letting expenses and can be deducted from your first year's rental income.

Navigating Mortgage Interest Tax Relief

One of the biggest changes for landlords in recent years has been the rules around mortgage interest. You can no longer just subtract your mortgage interest payments from your rental income to lower your profit.

Instead, you now get a tax credit. After you’ve worked out your total tax bill, you can claim a 20% tax credit based on your annual mortgage interest payments. This change means higher-rate taxpayers don't get as much relief as they used to. For a more detailed look at what's allowed, you can explore our in-depth article about https://stewartaccounting.co.uk/rental-property-tax-deductions/.

Let’s run through a quick example. Imagine you're a higher-rate (40%) taxpayer and your mortgage interest for the year is £5,000:

- Under the old rules, you could have deducted the full £5,000 from your income. This would have saved you £2,000 in tax (£5,000 x 40%).

- Under the new rules, you get a tax credit of £1,000 (£5,000 x 20%).

This shift has had a huge impact on profitability for many landlords, which makes it more crucial than ever to claim every single other allowable expense you possibly can. In today's rental market, meticulous record-keeping isn't just good practice—it's a financial necessity.

How Tax Bands and Rates Affect Your Rental Profit

Working out your taxable profit is a massive step, but it’s only half the story. The next piece of the puzzle is figuring out how that profit is actually taxed. The UK tax system doesn't look at your rental income in a vacuum; it’s added to your other earnings, like your salary, to give one total figure for your annual income.

This combined income is the number that matters. It dictates which income tax band you fall into and, ultimately, what percentage of your rental profit you’ll hand over to HMRC. For most landlords, this means stacking their rental profit right on top of their salary from their day job.

This is where things can get tricky. A healthy rental profit is obviously the goal, but it can easily nudge your total income into a higher tax bracket. If you're not prepared, you could be facing a much bigger tax bill than you bargained for.

Understanding The UK Income Tax Bands

The UK has a progressive tax system, which is just a fancy way of saying the more you earn, the higher your tax rate gets. For the 2024/25 tax year in England, Wales, and Northern Ireland, the system is quite straightforward:

- You pay 0% on your first £12,570 (this is your tax-free Personal Allowance).

- You pay 20% on income between £12,571 and £50,270 (the Basic Rate).

- You pay 40% between £50,271 and £125,140 (the Higher Rate).

- Anything over £125,140 is taxed at 45% (the Additional Rate).

A Quick Note for Scottish Landlords: Remember, Scotland plays by its own rules. It has a different set of income tax bands and rates, including Starter, Basic, Intermediate, Higher, and Top rates. If you live in Scotland, your rental profits will be taxed based on these Scottish rates, not the ones for the rest of the UK.

For a full breakdown of the figures, it’s always best to check the latest information. You can find out more on our deep dive into the current income tax bands and allowances.

How Rental Profit Can Tip You Into a Higher Tax Band

Let's walk through a real-world example to see this in action. We'll call our landlord David, a marketing manager in Manchester who also rents out a small terraced house.

- David's Salary: He earns £45,000 a year from his job.

- Rental Profit: After tallying up his income and deducting all his allowable expenses, his taxable rental profit for the year comes to £8,000.

- Total Taxable Income: We simply add the two together: £45,000 + £8,000 = £53,000.

Now, let's see how HMRC views David's income:

- His £45,000 salary has already used up his Personal Allowance and sits comfortably in the 20% Basic Rate band.

- The £8,000 rental profit is then added on top of that.

- The first £5,270 of this rental profit is taxed at the Basic Rate of 20%. This brings his total income up to the £50,270 threshold.

- But here’s the kicker: the remaining £2,730 of his rental profit has pushed him over the line into the Higher Rate band. That portion is taxed at 40%.

Without his rental property, David would be a Basic Rate taxpayer, plain and simple. But because his rental income is stacked on top of his salary, a good chunk of it ends up being taxed at double the rate. This is exactly why you have to look at the bigger picture and consider all your income sources when working out your landlord tax obligations.

A Landlord's Guide to the Self Assessment Tax Return

Once you’ve worked out your profit, the next step is to officially declare it to HMRC. This happens through the Self Assessment tax return, which is just the formal system for reporting any income that isn't taxed automatically through a regular job. It might sound a bit daunting, but it's really just a process you need to get the hang of.

The first, and most critical, step is getting registered. If you've started to receive rental income, you absolutely must register for Self Assessment with HMRC by 5th October of the tax year after you started letting your property. Don't let this one slip by – missing this initial deadline can trigger penalties right from the start.

Navigating the Key Forms and Deadlines

When it's time to fill out your tax return, you'll be dealing with the main SA100 form. But for your rental income, there's a special add-on: the SA105 ‘UK Property’ pages. This is the section where you'll put down your total rent received and then list all your allowable expenses to calculate your final taxable profit.

Knowing your deadlines is non-negotiable if you want to avoid fines. There are two dates you need to burn into your calendar:

- 31st October: This is your last day to file if you’re submitting a paper tax return.

- 31st January: The big one. This is the deadline for filing your tax return online and for paying any tax you owe.

Almost everyone files online these days. It gives you more time, and you get an instant confirmation that HMRC has received everything. If you miss that 31st January deadline, you’ll be hit with an immediate £100 penalty, and it only gets worse the longer you leave it.

Important Reminder: The law requires you to keep meticulous financial records for your property. This means holding onto all receipts, invoices, and bank statements for at least five years after the 31st January submission deadline for that tax year.

Why Accurate Reporting is So Important

HMRC is paying closer attention than ever to the rental sector. It's no secret that undeclared rental income is a major focus for them. A 2020 analysis suggested that tax evasion by landlords could be costing the UK Treasury as much as £1.73 billion a year. You can read the full breakdown of this landlord tax compliance analysis on TaxWatchUK.org. That number alone explains why they’re so vigilant.

Put simply, honest and accurate reporting isn't just about sidestepping penalties – it's a legal duty.

A Practical Checklist for Filing

To keep things as smooth and stress-free as possible, run through this simple checklist when you're getting ready to file. The system can feel a little tricky, so if you'd prefer an expert to handle it for you, feel free to get some professional help with self-assessment tax returns.

- Register on Time: If you're a new landlord, make sure you've registered for Self Assessment before the 5th October deadline.

- Gather All Your Records: Get everything together in one place – income statements, receipts for every expense, mortgage interest statements, the lot.

- Complete the SA105: Carefully fill out the UK Property pages with your summarised income and expense figures.

- Double-Check Your Numbers: Before you hit submit, go over every single entry. A simple typo can create a real headache down the line.

- Submit Before the Deadline: Don’t leave it until the last minute. File well before 31st January to avoid any last-minute stress or technical glitches.

- Pay Your Tax Bill: Make sure any tax you owe is paid by the 31st January deadline to officially wrap up your obligations for the year.

A Look at the UK Rental Market

Before diving into the nitty-gritty of tax calculations, it’s worth taking a step back to look at the bigger picture. Managing your property rental income tax isn't just about your own spreadsheets; you're operating within the massive, ever-changing UK rental market. Seeing these wider trends helps you gauge how your own property is performing and make smarter decisions for the future.

Think of your rental property as a business competing in a dynamic marketplace. Things like tenant demand, how many other landlords are out there, and average rental prices all shape the environment you're in. Keeping an eye on these national trends gives you vital context, helping you shift from being a reactive landlord to a proactive investor.

The Rising Tide of Rental Income

The UK rental sector has seen some serious growth over the last few years. This isn't just a hunch; the official data shows a huge jump in what landlords are earning collectively.

Government statistics paint a clear picture. Between the 2019-20 and 2023-24 tax years, the total income from UK property rentals surged by a staggering £8.02 billion — that's a 17% increase. This was driven by more people becoming landlords and the average income per landlord going up. In fact, over that same time, the average income for a typical landlord rose by £2,500, or 15%. You can dig into these numbers yourself in the latest property rental income statistics from GOV.UK.

By the 2023-2024 tax year, the average income per landlord had climbed to £19,400, the highest it’s been in the last five years.

What Does This All Mean for You?

These aren't just interesting stats to glance over. They provide a powerful measuring stick for your own rental business.

Strategic Insight: Knowing the national average rental income helps you see where you stand. Are you keeping up with the market, outperforming it, or maybe lagging a bit behind? This insight can guide your thinking on everything from rent reviews and property upgrades to your next investment.

This clear upward trend confirms just how strong demand is in the rental market right now. But it also explains why HMRC is paying closer attention to landlords declaring their income correctly. When the total rental income pot grows by billions, so does the potential tax owed.

Taking this wider view helps you see your rental not just as a single property, but as an asset in a much bigger financial ecosystem. When you understand these market forces, you're in a much better position to plan for your tax obligations and secure the long-term health of your investment. It’s the final piece of the puzzle, connecting your day-to-day tasks with the wider economic reality.

Got Questions? We’ve Got Answers

When you're a landlord, the theory of tax is one thing, but dealing with real-world situations is another. It’s natural to have questions pop up, from what to do when a big repair bill wipes out your profit for the year, to whether it’s finally time to call in a professional.

Let’s tackle some of the most common queries we hear from landlords every day.

What If My Expenses Are More Than My Rent This Year?

It happens. A new boiler, a roof repair, or a void period can easily push your expenses past your rental income for the tax year. When this occurs, you've made a rental loss. The immediate upside? You won't owe any tax on your property income for that year.

But don't just ignore it. You absolutely must declare this loss on your Self Assessment tax return. Why? Because by officially logging it with HMRC, you can carry that loss forward. This means you can use it to reduce the taxable profit from the same rental business in a future year. It’s a crucial step that can save you a surprising amount of tax down the line.

Should I Bother With the Property Allowance?

HMRC offers a £1,000 tax-free Property Allowance to simplify things for landlords with very low income or expenses. If your total gross rental income for the year is less than £1,000, you don't even have to declare it. Simple.

If your income is over £1,000, you have a decision to make. You can either:

- Add up all your actual, allowable expenses and deduct them from your income as usual.

- Or, you can simply deduct the flat £1,000 Property Allowance from your income instead.

This allowance is really only for landlords with minimal running costs—far less than £1,000. It saves on paperwork, but you can’t claim both. You have to run the numbers and see which option leaves you better off.

Think about it: if your gross rent is £7,000 and your actual expenses hit £2,500, claiming those expenses is a no-brainer. Your taxable profit would be £4,500. If you used the allowance instead, your taxable profit would be a much higher £6,000.

Does Setting Up a Limited Company Change How I’m Taxed?

Yes, massively. When you hold property through a limited company, the entire tax game changes. The company itself pays Corporation Tax on the profits, not you personally. The biggest single advantage is that all mortgage interest counts as a fully deductible business expense, sidestepping the restrictive tax credit system that individual landlords face.

Of course, you’ll be taxed personally when you take money out of the company as a salary or dividends, each with its own rules and allowances. It’s a route many higher-rate taxpayers and portfolio landlords explore, but be prepared for more paperwork, formal accounts, and higher accountancy fees.

Do I Really Need to Hire an Accountant?

There's no law that says you do. Plenty of landlords with a single, straightforward property manage their own tax returns perfectly well. However, if your situation is more complex, you're not confident you're claiming everything you're entitled to, or you simply want the reassurance that everything is done right, an accountant can be worth their weight in gold.

A good property accountant often saves you more in tax than they charge in fees. Plus, their fee is an allowable expense! They'll make sure you're compliant, efficient, and not paying a penny more in tax than you legally have to.

Getting your rental tax right is fundamental to running a successful and profitable property business. At Stewart Accounting Services, we specialise in taking the stress out of property tax for landlords, from filing your Self Assessment to providing strategic advice. Contact us today to ensure your finances are in expert hands.