Think of your business like a car. You've got the engine, the chassis, the whole vehicle – that's your company. But what keeps it running on the road every day? The fuel in the tank. That fuel is your working capital.

In simple terms, working capital is the ready money your business has to cover its immediate, day-to-day running costs. It's the lifeblood that keeps the engine turning.

Getting a Grip on Your Business's Fuel Gauge

So, what is working capital really telling you? It's a quick, real-time snapshot of your company’s financial health. You calculate it by looking at your current assets (what you own that can be quickly turned into cash) and subtracting your current liabilities (what you owe in the short term).

This simple sum reveals a lot about how efficiently your business is running and whether you can comfortably meet your financial obligations as they fall due.

It’s the financial breathing room every business owner needs. With healthy working capital, you can confidently:

- Pay your staff and suppliers without breaking a sweat.

- Buy the stock you need to keep your customers happy.

- Handle those unexpected bills that always seem to pop up.

Getting this balance right isn't just a box-ticking exercise for your accountant; it's a fundamental part of your strategy for survival and growth. Poor management can leave a business dangerously exposed. In fact, a recent PwC study found that UK businesses are holding around £1.3 trillion in excess working capital—a staggering amount of cash tied up that could be put to better use.

Working Capital at a Glance

The building blocks of working capital are found right there in your financial statements. Understanding them is the first step, especially when you're learning how to read financial statements.

Here's a straightforward breakdown of the components.

| Component Type | Definition | Examples for a UK Business |

|---|---|---|

| Current Assets | Resources you own that can be converted into cash within one year. | Cash in the bank, outstanding customer invoices (accounts receivable), stock (inventory). |

| Current Liabilities | Debts and obligations that you need to pay off within one year. | Supplier invoices (accounts payable), short-term loans, VAT and payroll taxes due. |

Essentially, the table shows the two sides of the working capital coin: the cash you have or are about to receive, versus the bills you need to pay soon. The difference between the two is your operational cushion.

Breaking Down the Working Capital Formula

To get a real feel for what working capital is, we need to look at its simple but powerful formula. Think of this calculation as the heartbeat of your business’s short-term financial health, giving you a crystal-clear snapshot of your liquidity.

The formula itself is straightforward: Current Assets – Current Liabilities = Working Capital.

But what do these terms actually mean for your business day-to-day? Let’s break them down.

Unpacking Current Assets

Current Assets are essentially all the resources your business has that can be turned into cash within the next 12 months. This is your readily available financial firepower.

Typically, this includes things like:

- Cash: The most obvious one – money sitting in your bank account, ready to go.

- Accounts Receivable: This is all the money your customers owe you for invoices you've sent out but haven't been paid for yet.

- Inventory: The value of all your stock, whether it's raw materials or finished products waiting to be sold. For a local coffee shop, this would be their coffee beans, milk, and pastries. Getting this right is crucial, as it directly affects your cost of goods sold calculation.

Demystifying Current Liabilities

On the other side of the coin, you have your Current Liabilities. These are all your financial commitments and debts that need to be paid within the next 12 months.

Working capital represents the short-term financial pulse of your company. It’s not just an accounting metric; it’s a direct indicator of your ability to operate smoothly day-to-day without financial strain.

Common examples of current liabilities include:

- Accounts Payable: The money you owe to your suppliers for goods and services you've already received.

- Short-Term Loans: Any business loans or portions of larger loans that are due for repayment within the year.

- Accrued Expenses: These are the costs you've built up but haven't paid yet, such as staff wages or upcoming tax bills.

By subtracting what you owe in the short term from what you own, you get a clear, immediate picture of where your business stands financially. This isn't just theory; it's a practical measure of your ability to keep the lights on and the business running.

Here is the rewritten section, crafted to sound natural and human-written.

Why Working Capital Is So Crucial for Your Business

It's one thing to know the formula, but it’s another thing entirely to grasp why working capital is the absolute lifeblood of your business. Forget seeing it as just another accounting metric; think of it as your company's short-term financial fitness.

Healthy working capital is what keeps the lights on and the day-to-day operations humming along. It’s your buffer against nasty surprises and your ticket to grabbing opportunities when they pop up.

Even a profitable business—one that looks great on paper—can quickly run into serious trouble without enough working capital. Suddenly, paying your staff, covering supplier bills, and making rent becomes a high-wire act. This is the difference between running your business with confidence and constantly scrambling to find cash. Let it slide, and you’ll miss out on growth or, worse, face the risk of going under.

The Three Pillars of a Healthy Business

When you get working capital management right, you’re not just crunching numbers. You’re building a solid foundation for your business based on three key pillars:

- Keeps the Engine Running: It’s the cash you need, right now, to buy stock, run payroll, and cover all those daily expenses. It ensures the business doesn’t grind to a halt.

- Provides a Financial Safety Net: Think of it like a personal emergency fund. If an unexpected bill lands on your desk or sales take a sudden hit, this cushion means you can handle it without panicking or taking out a high-interest loan.

- Fuels Your Agility and Growth: A healthy cash position gives you freedom. You can decide to invest in new equipment, jump on a marketing opportunity, or hire that perfect candidate without being held back by an empty bank account.

In simple terms, working capital is the fuel for your operational engine. It’s not just about staying afloat. It's about having the flexibility to make smart, strategic moves that will grow your business for years to come.

Getting a firm handle on this concept helps you build a more resilient company—one that can ride out the tough times and make the most of the good ones. It turns your financial reports from a backwards-looking history lesson into a powerful tool for shaping your future.

Positive Versus Negative Working Capital Explained

When you calculate your working capital, the number you get tells a story about your business’s immediate financial health. It can be positive or negative, and knowing what each one means is vital for making smart decisions.

A positive working capital figure is what most businesses aim for. It simply means your current assets are greater than your current liabilities. Think of it as having more than enough cash and near-cash assets on hand to cover all your bills due in the next year. This position gives you a crucial financial cushion, offering the flexibility to handle unexpected expenses or seize new growth opportunities without a second thought.

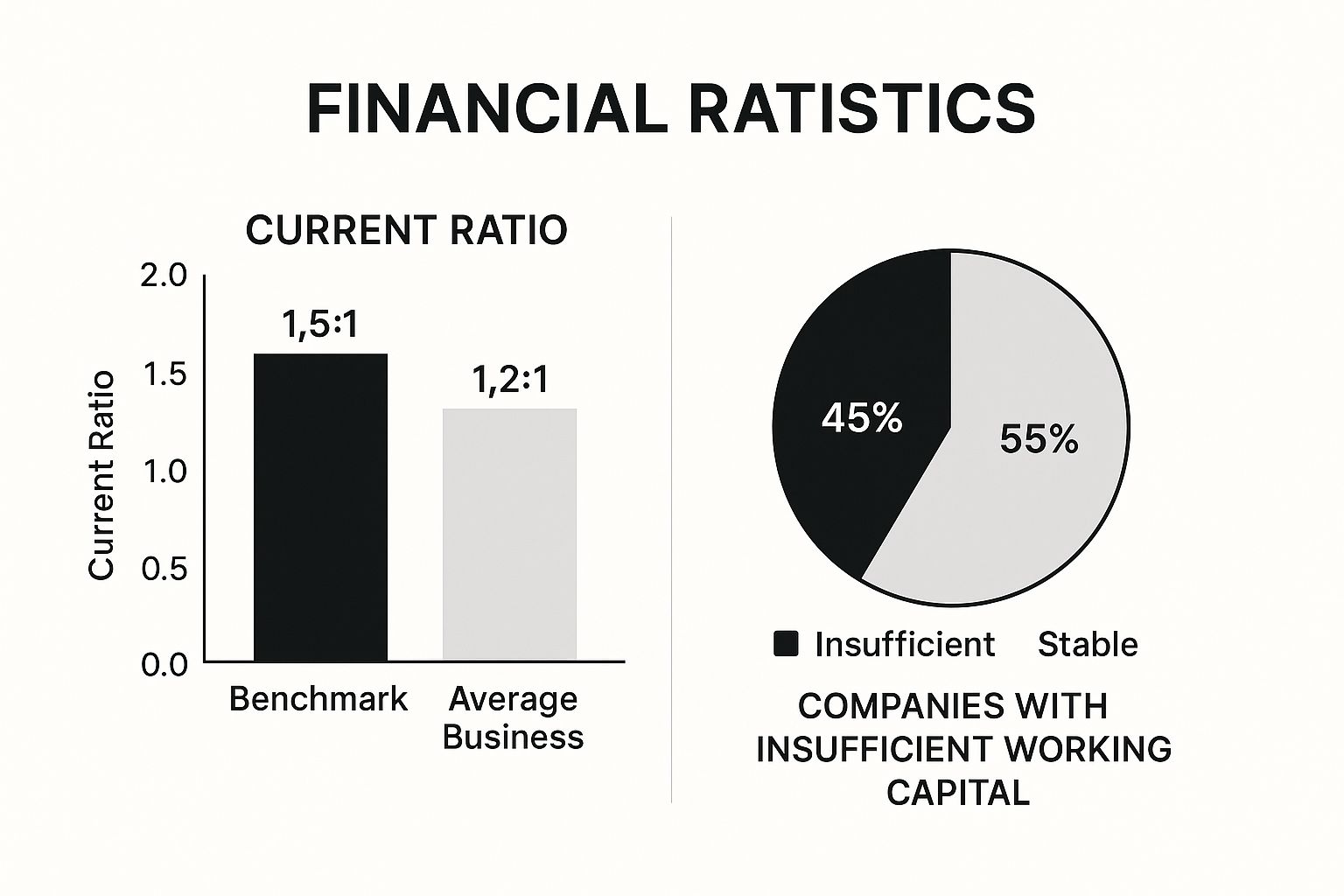

The infographic below paints a picture of the current state of play, showing how many companies are operating with insufficient working capital.

This data really brings home a common challenge: a significant number of businesses are running without the adequate financial buffer they need to feel secure.

When Negative Can Be a Positive

On the other side of the coin, negative working capital means your current liabilities are greater than your current assets. For many small and medium-sized businesses, this is a serious red flag. It can signal looming cash flow problems and suggest you might struggle to pay your bills on time.

But—and this is a big but—a negative figure isn't always a sign of impending doom. For some businesses, it's actually a sign of incredible efficiency.

Negative working capital can be a strategic advantage for businesses with rapid inventory turnover and favourable payment terms, effectively using supplier credit to fund operations.

Take a large UK supermarket chain, for example. They get paid instantly by customers at the checkout, but they often pay their suppliers on 30, 60, or even 90-day terms. This creates a powerful cash flow cycle. The supermarket can use the money from sales to fund its day-to-day operations long before its supplier invoices are due.

Here's a quick comparison to help break it down:

Comparing Positive and Negative Working Capital

| Characteristic | Positive Working Capital | Negative Working Capital |

|---|---|---|

| Financial Health | Generally indicates a healthy, liquid business. | Often a red flag, but can signal high efficiency. |

| Operational Flexibility | High. Can easily cover short-term debts and invest. | Low. May struggle with unexpected costs. |

| Reliance on Debt | Less reliant on short-term financing. | May rely heavily on credit from suppliers or lenders. |

| Common Industries | Manufacturing, consulting, seasonal businesses. | Retail, restaurants, online subscription services. |

In the supermarket's case, negative working capital is a feature of a well-oiled, cash-generating business model, not a flaw. The key is to understand what the number means for your specific industry and business model.

Practical Ways to Improve Your Working Capital

Knowing your working capital number is one thing; actively improving it is where the real magic happens for your business. Making a few small, consistent tweaks can free up cash, dial down the financial stress, and open up new doors for growth.

Think of it as fine-tuning your business's financial engine. The aim is to get cash flowing in faster, manage what's going out more thoughtfully, and make sure your resources are always working for you.

Here are some straightforward strategies you can start using today, broken down into three core areas.

Speed Up Your In-Coming Cash

Getting paid quicker is the most direct route to a healthier working capital position. Every day an invoice goes unpaid, it's draining your cash reserves.

- Invoice Immediately and Clearly: Don't let invoicing pile up until the end of the month. Send them the moment the job is done. Make sure your invoices are easy to understand, with crystal-clear payment terms and instructions.

- Offer a Nudge for Early Payment: A small discount, maybe 1-2% for paying within 10 days, can be a powerful incentive for clients to pay you first. That small hit might be well worth the improved cash flow.

- Put Reminders on Autopilot: Accounting software can be a lifesaver here. Set up polite, automated reminders for invoices that are due soon or already overdue. It saves you time and sidesteps those awkward phone calls.

Getting your invoicing and collections sorted is the low-hanging fruit of working capital management. When you get paid faster, you have more cash on hand for everything else.

These are foundational steps for any business owner. For a more detailed look, we have a whole guide on practical ways to improve cash flow.

Get a Handle on Your Out-Going Cash

While getting money in the door is crucial, you also need to be smart about what you're paying out. This isn't about dodging bills, but about managing the timing to keep cash in your business for as long as possible.

Talk to your suppliers. If you’ve built a solid relationship, there's no harm in asking to extend your payment terms from the standard 30 days to 45 or even 60. That simple change can give your cash reserves some much-needed breathing room.

Make Your Stock Work Smarter

Inventory sitting on a shelf is essentially cash you can't use. It’s a classic trap for many businesses, tying up a huge chunk of working capital that could be used elsewhere.

Take a regular, hard look at what's selling and what's not. If you have stock gathering dust, consider a sale or a discount to shift it and turn it back into cash. You could also explore a "just-in-time" approach, ordering stock only as you need it. This stops you from locking up capital in products that aren't moving.

Got Questions About Working Capital? We’ve Got Answers.

As you start wrapping your head around working capital, it’s natural for a few questions to surface. Getting these sorted is how you turn abstract financial theory into a practical tool that helps you make smarter decisions every day.

Let’s tackle some of the most common ones we hear from business owners.

What Does a “Good” Working Capital Ratio Look Like?

A healthy working capital ratio usually sits somewhere between 1.5 and 2.0. Think of it this way: for every £1.00 you owe in the short term, you have £1.50 to £2.00 ready to cover it. That’s a comfortable buffer.

But be careful—a ratio that’s too high isn't always a good thing. It might mean you've got too much cash just sitting there, not being invested back into the business. The "perfect" number really depends on your industry, so it's always a good idea to see how you stack up against your peers.

Can a Profitable Business Go Bust from Bad Working Capital?

Yes, and it happens more often than you’d think. This is the classic trap of being "profitable on paper" but having no cash in the bank. You might be making plenty of sales, but if all your money is locked up in unpaid invoices or stock gathering dust, you can’t pay your own bills.

When your suppliers, staff, or the tax man come knocking, profits won’t help you if the cash isn’t there. This is precisely why keeping a close eye on working capital is non-negotiable for survival.

How Often Should I Be Checking My Working Capital?

For most small and medium-sized businesses, a monthly check is a solid routine. It’s like a regular health check-up that shows you exactly where you stand with your operational cash flow.

Think of your monthly working capital review as taking your business’s pulse. It helps you catch small problems before they grow into full-blown emergencies.

That said, if your business is growing quickly, dealing with seasonal peaks and troughs, or navigating a shaky economy, you’ll want to check it more often. A weekly glance can give you the foresight you need to stay ahead of any cash flow crunches.

Getting working capital right is fundamental to building a business that lasts. At Stewart Accounting Services, we specialise in helping UK SMEs find financial clarity and build a foundation for growth. Book a discovery call today and let's get your numbers working for you.