Let's ditch the old-school image of accountants hunched over massive ledgers. Instead, think of your finance team as the skilled crew of a ship. Accounting process automation is their state-of-the-art navigation system. It replaces the need to manually chart every single nautical mile, freeing them up to focus on the big picture: plotting the best course, anticipating storms, and steering your business towards profitable shores.

What Is Accounting Process Automation?

At its heart, accounting process automation is simply using smart software to handle the repetitive, rule-based jobs that used to eat up hours of human time. It’s not about making your finance professionals redundant; it’s about giving them a serious upgrade in their toolkit. You’re essentially promoting your team from data entry clerks to strategic financial advisors.

Instead of your team getting bogged down manually typing up invoices, chasing down approvals, or painstakingly reconciling bank statements line by line, the software handles it. This frees them up to do what humans do best: analyse the data, uncover valuable insights, and help you make genuinely better business decisions. This isn't a futuristic concept; it's rapidly becoming the standard for smart SMEs across the UK.

Moving Beyond Manual Entry

The days of drowning in a sea of paperwork are well and truly numbered. The shift towards automation in UK accounting has picked up serious pace, thanks to more accessible AI and Robotic Process Automation (RPA) tools. Inefficient chores like manual invoice entry are finally on the way out. You can dive deeper into the key automation statistics for 2025 to see just how much the industry is changing.

Making this move doesn't just save a bit of time; it fundamentally changes how your finance department works, creating a more resilient, accurate, and forward-looking foundation for your entire business.

By automating routine financial tasks, you're not just saving time; you're fundamentally changing the role of your finance function. It becomes a proactive, strategic partner in business growth rather than a reactive, administrative cost centre.

The Strategic Shift in Focus

When automation takes care of the grunt work, your team suddenly has the breathing room to focus on high-value activities that actively drive the business forward. This means more time is dedicated to:

- Financial Analysis: Actually digging into the numbers to understand what's driving profitability, spot emerging trends, and find opportunities to be more efficient.

- Cash Flow Forecasting: Building realistic predictions to manage your working capital smartly, ensuring you have the cash on hand when you need it for growth.

- Strategic Planning: Providing meaningful input into business planning, budgeting, and shaping your long-term financial strategy.

- Compliance and Risk Management: Making sure all your financial processes are consistent, easily auditable, and secure, which massively reduces the risk of human error.

This is the kind of transformation that's essential for any business owner looking to scale from six figures to seven and beyond. It gives you the crystal-clear, real-time financial view you need to navigate challenges and grab opportunities with confidence.

To really see the difference, let’s put the two approaches side-by-side.

Manual vs Automated Accounting At a Glance

The table below breaks down the stark contrast between traditional, manual accounting and a modern, automated approach. It highlights not just the difference in process, but the impact on your time, accuracy, and strategic capability.

| Task | Manual Approach | Automated Approach | Key Benefit |

|---|---|---|---|

| Invoice Processing | Manually keying in data from each invoice, checking for errors, and filing paper copies. | Software automatically captures data from invoices (e.g., via email or scanner), codes it, and sends it for approval. | 90% reduction in data entry time and fewer costly errors. |

| Expense Claims | Employees collect paper receipts, fill out forms, and submit them for slow, manual review and reimbursement. | Employees snap a photo of a receipt with their phone; software extracts the data and processes the claim automatically. | Faster reimbursements for staff and instant visibility on spending. |

| Bank Reconciliation | Printing bank statements and manually ticking off each transaction against the general ledger. A tedious, error-prone process. | The system automatically pulls in bank feeds daily and matches transactions against invoices and bills. | Real-time cash position and reconciliations done in minutes, not days. |

| Reporting | Compiling data from various spreadsheets to create monthly reports, often days or weeks after the month has ended. | Generating real-time financial reports (P&L, Balance Sheet, Cash Flow) with the click of a button. | Instant, accurate data for faster, more informed decision-making. |

As you can see, the benefits go far beyond just saving a few hours. Automation provides a level of accuracy, speed, and insight that manual processes simply can't match, allowing you to run your business based on what's happening now, not what happened last month.

How Accounting Automation Technology Works

To really get your head around accounting process automation, it helps to pop the bonnet and see how the engine works. It isn't magic. Instead, it's a set of specialised tools working in concert to mimic and, frankly, perfect the routine tasks humans used to do. Think of it as building your own digital finance team, custom-made for efficiency.

The first member of this team is your data entry specialist. This job is handled by a clever bit of tech called Optical Character Recognition (OCR).

Let's say an invoice from a supplier lands in your inbox. In the old days, someone would have to sit there and manually key in the supplier’s name, invoice number, date, and amount. OCR does this in a flash. It scans the document – whether it’s a PDF or a photo of a paper receipt – intelligently ‘reads’ the key details, and puts them right where they need to go in your accounting system. No typing required.

The Rise of Robotic Workers

Once the data is in, another piece of the puzzle takes over the next logical, repetitive step. This is Robotic Process Automation (RPA). Essentially, it’s a digital worker that follows a strict, pre-defined script. RPA is brilliant for jobs that are exactly the same every single time.

For instance, you could program an RPA ‘bot’ to do the following:

- Log into your online banking portal every morning at 9 AM.

- Find the statements page and download the latest transaction file.

- Upload that file straight into your accounting software.

- Log out and send you a quick email to say the job is done.

This whole sequence happens on its own, without a person needing to lift a finger. Your bank feeds are always up-to-date. The bot performs the exact same clicks and keystrokes you would, but it does it perfectly, 24/7, without ever getting tired or bored. This frees up your team from the daily grind of bank downloads, letting them focus on what matters: checking the numbers.

Accounting automation isn't one single technology. It's the organised collaboration between different specialised tools—like OCR for reading, RPA for doing, and AI for thinking—that collectively transforms your entire financial workflow.

The Intelligence Layer

The real game-changer, though, is the 'brain' of the operation: Artificial Intelligence (AI) and its partner, Machine Learning (ML). While OCR handles the reading and RPA handles the doing, AI brings the thinking and learning to the table. It's what makes the system genuinely smart.

AI works by sifting through huge amounts of data to spot patterns, make decisions, and even predict what might happen next. In an accounting setting, this translates into some incredibly useful abilities:

- Smart Categorisation: After OCR pulls details from a 'City Office Supplies' invoice, AI learns to automatically code this expense to 'Office Stationery' without you having to tell it every time.

- Anomaly Detection: AI can spot things that look out of place—a duplicate invoice number, or a payment to a brand-new supplier—and flag them for a human to check. It’s like having a fraud detection expert on guard duty.

- Predictive Insights: Over time, AI can analyse your cash flow patterns to forecast future bank balances, helping you make much smarter decisions about when to spend and when to save.

Together, these three technologies—OCR, RPA, and AI—are a powerful combination. OCR gets the data in, RPA moves it where it needs to go, and AI gives you the insights. To see how these tools work together in a broader context, it's worth exploring how intelligent process automation is changing the way businesses operate.

Key Accounting Workflows to Automate Now

Once you've grasped the "how" of automation, the next question is obvious: "where?" Figuring out which parts of your financial engine are ready for an upgrade is the secret to getting the best bang for your buck. For most UK businesses, the biggest wins come from automating the high-volume, repetitive tasks that eat up time and create frustrating bottlenecks.

Tackling these core areas first allows you to build a reliable, automated foundation. Not only does this free up your team almost immediately, but it also ensures the data flowing into your system is clean and accurate, paving the way for smarter, more strategic decisions down the line.

Let's look at the "before and after" of three critical workflows.

Transforming Accounts Payable

For many small businesses, the accounts payable (AP) process feels like managed chaos. Think piles of paper invoices, endless data entry, and the classic runaround of chasing managers for a signature on an urgent bill.

The old way of doing things usually looks like this:

- Invoices land in your post box or email, creating a jumble of paperwork to track.

- Someone on your team has to manually type every single detail—supplier name, date, amount, VAT—into your accounting software. It's a recipe for costly typos and accidental duplicate payments.

- A physical invoice then gets passed from desk to desk for approval, often getting lost for days or even weeks.

- Once it's finally approved, it's keyed in for payment and the paper copy is shoved into a filing cabinet.

Now, let's picture the "after" with accounting process automation. An invoice arrives in a dedicated email inbox. A tool like Dext or Xero instantly scans it, using smart technology to pull out all the key information and create a draft bill. The system then pings the right manager, who can approve it on their phone with a simple tap. The approved bill is then automatically lined up for payment, with a digital copy neatly attached to the transaction, creating a flawless audit trail.

This isn't just about moving faster. It creates a transparent, error-proof system that gives you a live, up-to-the-minute view of what you owe.

Revolutionising Accounts Receivable

On the other side of the coin is accounts receivable (AR)—the all-important job of getting paid. Done manually, it can be just as much of a headache as AP. It's a cycle of creating and sending invoices one by one, manually ticking off who's paid, and sinking valuable time into chasing late payments with calls and emails.

This constant follow-up pulls your team away from more valuable work and can even put a strain on your customer relationships. Worse, inconsistent chasing leads to unpredictable cash flow, putting a real squeeze on your business.

The goal of AR automation isn't just to send invoices faster; it's to shorten your entire cash conversion cycle. By getting paid quicker, you improve liquidity and create a more predictable financial environment for your business to grow.

With automation, your entire AR process becomes a well-oiled machine. You can set up recurring invoices for regular clients, which are created and sent out automatically without you lifting a finger. Even better, you can create automated reminder sequences. For instance, the system can send a gentle nudge three days before an invoice is due, another on the due date, and a firmer follow-up seven days later if it's still unpaid. This consistent, professional approach gets you paid much faster, with up to 73% of automated reminders being settled within a week.

Streamlining Expense Management

Employee expense claims are a notorious source of admin pain. The traditional routine involves staff hoarding crumpled receipts, tediously filling out expense forms, and then handing over a messy bundle of paperwork at the end of the month. This avalanche of admin then lands on your finance team, who have to manually check every claim and process the reimbursements.

Automation changes the game completely. An employee can simply snap a photo of a receipt with their phone. An app instantly pulls out the data, categorises the expense, and submits it for approval on the spot. Managers get a notification and can approve claims in seconds.

The result? Employees are paid back faster, and you get a real-time picture of company spending as it happens, not a month after the fact.

These are just a few high-impact examples. To see how these ideas play out in other areas, you can find great resources on how to automate payroll, billing, and timesheets and much more. Identifying your own bottlenecks is the first real step toward a more efficient and profitable business.

The Real Business Benefits of Automation

Sure, saving time is a great start, but the true impact of accounting process automation goes far deeper. It’s about forging a stronger, more resilient business from the ground up, starting with your finances. These aren't just minor tweaks; they represent a fundamental shift in how you manage, protect, and ultimately grow your company.

When you step away from manual drudgery, you unlock benefits that directly boost your bottom line and sharpen your long-term strategy. It's about achieving near-perfect accuracy, getting a live view of your cash flow, tightening up security, and most importantly, unleashing your finance team's true potential. Think of it as a strategic investment that pays dividends right across the business.

Achieve Superior Accuracy and Simpler Compliance

We've all been there. A single typo during manual data entry can throw off your entire financial picture, leading to bad decisions and hours of stressful backtracking. Automation practically eliminates this risk. By pulling data directly from the source—like bank feeds and digital invoices—it ensures your books are consistently clean and accurate.

This precision is a game-changer for compliance. For UK businesses, navigating regulations like Making Tax Digital (MTD) for VAT is non-negotiable. Automated systems keep your records in a compliant digital format, generating spot-on VAT returns straight from your real-time data. This makes submissions a breeze and creates a clear, auditable trail, turning any potential HMRC inspection into a much less daunting prospect.

Automation transforms compliance from a periodic headache into a smooth, continuous process running quietly in the background. Your records are always current and inspection-ready, giving you genuine peace of mind.

Gain Real-Time Cash Flow Visibility

Guesswork is the enemy of a healthy business. When your financial data is days or even weeks old, you’re essentially flying blind. Automation delivers what every business owner desperately needs: a live, up-to-the-minute view of your cash flow.

With automated bank feeds and invoice processing, you know exactly what cash you have, what you’re owed, and what bills are coming due—right now. This clarity allows you to:

- Make smarter spending decisions: Decide on that big purchase based on today's cash position, not last month's report.

- Be proactive, not reactive: Spot potential cash shortfalls weeks in advance, giving you plenty of time to act before they become a crisis.

- Seize opportunities with confidence: Invest in growth, knowing for certain that you have the funds to back it up.

This real-time insight empowers you to manage your working capital effectively and steer the business with certainty.

Strengthen Internal Controls and Fraud Detection

Automated workflows create a clear, unchangeable digital footprint for every single transaction. You can instantly see who approved a payment and when, creating a transparent system that dramatically strengthens your internal controls. This digital paper trail is a powerful deterrent to internal fraud.

What’s more, many modern systems use AI to act as a vigilant watchdog, flagging suspicious activity that a busy human might easily miss. For example, the system can automatically raise an alert for things like:

- Duplicate invoice numbers from the same supplier.

- An unexpected change in a supplier’s bank details.

- A payment request that is unusually large.

These features add a vital layer of security, protecting your company’s assets from both internal mistakes and external threats.

Empower Your Team as Strategic Advisors

Perhaps the most important benefit of all is the human one. Accounting process automation isn't about replacing your finance team; it’s about elevating them. By freeing your skilled people from the soul-crushing monotony of data entry and reconciliation, you empower them to do what they do best: think.

Their time is redirected towards analysing financial performance, forecasting future scenarios, and providing the strategic insights you need to drive growth. This is fast becoming a key differentiator. In fact, UK accounting firms that embrace technology are far more likely to see revenue growth than their counterparts, a trend highlighted in recent analysis of digital transformation priorities for UK accounting firms. Your team shifts from a backward-looking admin function to a forward-looking advisory board.

A Practical Guide to Implementing Automation

Thinking about automating your accounting processes can feel like a mammoth task, but it really doesn't have to be. By breaking it down into a simple, step-by-step plan, any UK SME can modernise its finances without getting bogged down. Don't think of it as one giant leap; see it as a series of small, well-planned steps.

This measured approach helps you build momentum, get your team on board, and see a return on your efforts much faster. The trick is to start small, prove it works, and then build from there.

Step 1: Evaluate Your Current Workflows

You can't fix a problem until you truly understand it. The first, and most important, step is to take an honest look at how you do things now. Where are the real bottlenecks and daily frustrations?

A fantastic way to do this is to physically map out a process. Grab a whiteboard and track the journey of a single supplier invoice, from the moment it lands in your inbox to the second it’s paid and archived. Make a note of every person who touches it, every delay, and every manual step along the way.

You're specifically looking for tasks that are:

- Highly Repetitive: Things like typing data from invoices into your software or manually matching bank transactions.

- Prone to Human Error: Those areas where a simple typo can cause a real headache.

- Time-Consuming: The processes that you know are eating up hours of your team’s week, every week.

Pinpointing these specific pain points gives you the perfect target for your first automation project. This isn't just a technical exercise; it's about finding the source of your team's biggest administrative headaches.

Step 2: Set Clear and Measurable Goals

Once you know what the problems are, you can set some proper goals. Vague aims like "we want to be more efficient" just won't cut it. You need concrete targets that clearly spell out what success will look like for your business.

For instance, your goals could be:

- "Cut our invoice processing time from 15 minutes per invoice down to less than 2 minutes."

- "Reduce data entry errors by 95% within the first three months."

- "Get our average time to be paid down from 45 days to under 30 days."

These kinds of metrics give you a solid benchmark. They turn the project from a hopeful experiment into a strategic business move with real, accountable results.

The most successful automation projects aren't about the software itself. They're about solving specific business problems with clear, quantifiable objectives.

Step 3: Select the Right Technology

Choosing your tools is a critical step, but it’s about far more than just a list of features. The best technology is the one that fits neatly into what you're already using. For most UK SMEs, this means looking at cloud accounting platforms like Xero and their brilliant ecosystems of connected apps. This integrated approach is what makes the data flow so smoothly.

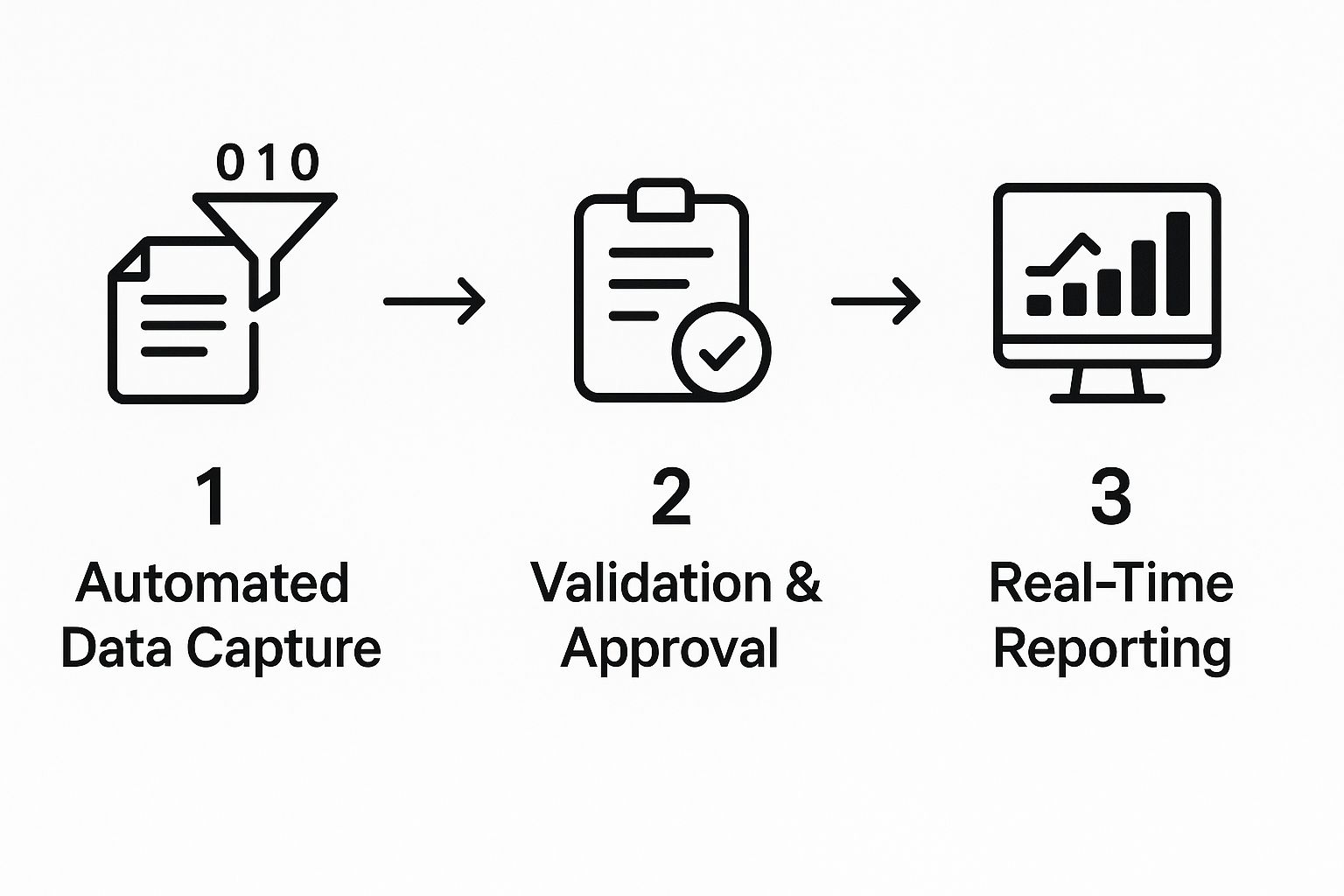

This diagram shows how information moves through a typical automated system, from capture to reporting.

As you can see, automation connects what used to be separate manual jobs into one seamless, efficient process.

Step 4: Implement a Phased Rollout

Whatever you do, don't try to boil the ocean by automating everything at once. Start with a single, high-impact area you identified back in step one. Pick one particularly painful workflow—like chasing expense receipts or processing supplier invoices—and focus all your energy on getting that right first.

This phased approach has huge benefits:

- Builds Momentum: A quick, early win proves the value of automation and gets the whole team excited about what's possible.

- Lets You Learn and Adapt: It gives you a safe space to get to grips with the new software and iron out any kinks in the process.

- Manages Change: It introduces new ways of working gradually, which massively reduces resistance and makes the transition smoother for everyone.

Once that first project is a proven success, you'll have the confidence and the buy-in to move on to the next one.

Step 5: Invest in Team Training and Support

Finally, never forget that technology is only as good as the people using it. Proper training and ongoing support are absolutely essential for making this work. This isn't about a single software demo; it's about helping your team understand the 'why' behind the change.

Show them how this new tool will eliminate their most boring tasks, freeing them up to focus on more interesting and valuable work. The industry is already moving this way; a huge percentage of UK accountancy firms have invested in cloud tools, and AI adoption for tasks like invoice processing is on the rise. You can read more about these trends in the Accountancy Age & HSBC Report.

By supporting your team through the change, you don't just get users; you create champions for your new, smarter way of working.

How UK Businesses Are Winning With Automation

It's one thing to talk about theory and best practices, but nothing hits home quite like seeing the results in the real world. All over the UK, small and medium-sized businesses are already using accounting process automation to sort out their biggest financial headaches. These aren't huge corporations with bottomless budgets; they’re growing companies that have simply found a smarter way to manage their money.

By looking at their stories, you can see exactly how these tools deliver real, tangible benefits. These examples are powerful proof that automation isn't just some abstract idea—it’s a practical solution that gives business owners back their time, frees up cash, and provides some much-needed peace of mind.

Let's look at a couple of anonymised case studies to see what this looks like on the ground.

E-commerce Retailer Tackles Invoice Overload

Picture a fast-growing online shop based in Manchester. Their success was actually creating a massive bottleneck: they were completely drowning in supplier invoices. With hundreds of purchase orders flying in every month, their small finance team was spending entire days just keying in data. It was slow, tedious, and, worse, full of costly typos and the occasional duplicate payment.

They decided to bring in an automated accounts payable system that plugged straight into their cloud accounting software. Suddenly, invoices arriving by email were scanned automatically, with all the important details captured in an instant. This one change made a huge difference.

- The Challenge: An overwhelming volume of supplier invoices was causing payment delays and costly data entry mistakes.

- The Solution: They adopted an automated invoice processing app that uses OCR technology to grab the data and sync it with their accounting platform.

- The Outcome: They slashed their invoice processing time by an incredible 80%. Duplicate payments became a thing of the past, and they could finally pay all their suppliers on time, strengthening those vital relationships.

Automation gave this e-commerce business the operational backbone it needed to scale. It transformed a chaotic, reactive chore into a controlled, efficient system, freeing up both people and cash to focus on growing the business.

Service-Based Firm Masters Project Profitability

Now, let's head to Glasgow and look at a creative agency. Their team of consultants is always out on the road, working on different client projects. Their biggest struggle? Tracking expenses and figuring out if each job was actually profitable. The old system of collecting a shoebox full of crumpled receipts and manually creating expense reports at the end of the month meant they were always looking in the rearview mirror.

They rolled out an expense management app, empowering their team to capture receipts as they happened. A quick photo with their phone was all it took to submit, categorise, and link an expense to the right project code.

The impact was immediate clarity. The directors could now see project budgets updating in real-time, which allowed them to make much smarter decisions about where to put their resources and how to price new work. Not only was their team reimbursed faster (a nice boost for morale), but the business finally had a precise, up-to-the-minute view of its financial health, project by project. It's a perfect example of how targeted accounting process automation can solve a very specific business pain point with incredible results.

Common Questions About Accounting Automation

Dipping your toe into accounting process automation is bound to stir up a few questions. It’s only natural. Business owners are right to wonder about things like security, costs, and what it all means for their team. Getting these concerns out in the open is the first step toward making a confident, well-informed decision for your business.

Let's walk through some of the most common questions we hear from businesses on the verge of taking this step.

How Secure Is My Financial Data?

This is usually the first question on everyone's mind, and for a very good reason. Your financial data is sensitive, and trusting a system with it is a big deal. The good news is that modern cloud accounting platforms are built from the ground up with security as their top priority, often providing a level of protection that would be nearly impossible to replicate on your own.

Reputable providers deploy several layers of defence to keep your information safe:

- Bank-Level Encryption: Think of this as a digital armour. Your data is scrambled both while it's travelling over the internet and while it’s sitting on their servers, making it completely unreadable to anyone without authorised access.

- Strict Access Controls: You are the gatekeeper. You decide exactly who on your team can see what, granting specific permissions so people only access the information they absolutely need for their job.

- Fortified Infrastructure: These platforms live in highly secure data centres that have 24/7 monitoring, advanced firewalls, and undergo regular, rigorous security audits to fend off any potential threats.

When you look at it closely, a top-tier cloud system is far more secure than the old way of doing things, like emailing sensitive spreadsheets around or storing everything on a single office computer that could easily be lost, stolen, or damaged.

Think of it like this: your financial data is safer in a modern digital vault, protected by elite security experts, than it is in a filing cabinet or on a single hard drive. These platforms invest millions in security so you don't have to.

Will Automation Make My Bookkeeper Redundant?

This is a persistent myth, but the truth is actually the complete opposite. Automation doesn’t replace your finance team; it empowers them. It takes the tedious, soul-crushing tasks of manual data entry and reconciliation off their plate for good.

This frees up your bookkeeper or accountant to focus on the kind of high-value work that really drives your business forward. Instead of being buried in paperwork, they can now spend their time:

- Analysing financial reports to uncover important trends.

- Providing strategic advice on managing your cash flow.

- Helping you build accurate budgets and financial forecasts.

In short, you’re helping their role evolve from a data processor into a strategic financial advisor. That’s a far more valuable asset for any growing business. For broader questions about automation or technology solutions, you might also find insights in their general list of frequently asked questions.

What Is the Typical Cost for a Small Business?

There isn’t a one-size-fits-all answer here, as the cost really hinges on what your business needs. Most modern solutions work on a flexible subscription basis, usually a monthly fee that scales with the features you use or the number of documents you process.

While it is an added line on your expense sheet, it's so important to see it as an investment rather than just another cost. The return you get on that investment often shows up remarkably fast. Once you account for the money saved by preventing expensive data entry mistakes, the hours your team gets back every week, and the financial gains from making quicker, smarter decisions, the system easily pays for itself.

Are you ready to stop worrying about paperwork and start focusing on growth? At Stewart Accounting Services, we specialise in implementing the right accounting automation to give you more time, more money, and a clearer mind. Book a call with us today to discover how we can help your business.