For small and medium-sized enterprises (SMEs) across the UK, managing payroll is a complex, time-consuming, and high-stakes responsibility. Navigating HMRC's ever-changing regulations, handling auto-enrolment pensions, and ensuring every employee is paid accurately and on time can quickly divert your focus from core business activities. Many business owners, from limited company directors to sole traders with growing teams, find themselves trapped in a cycle of manual data entry, compliance worries, and costly software updates. This administrative burden not only drains valuable time but also introduces significant risks of errors and penalties.

But what if there was a way to reclaim those hours, reduce operational overheads, and gain access to dedicated expertise? This is where strategic payroll outsourcing becomes a powerful advantage. Handing over this critical function to a specialist provider does more than just get your staff paid; it unlocks significant efficiencies and strengthens your business's financial foundation. Exploring the benefits of outsourcing payroll is a crucial step for any UK business aiming for sustainable growth.

This guide moves beyond the surface-level advantages. We will explore seven core benefits, offering actionable insights and practical examples tailored for UK businesses. You will learn how outsourcing can drive cost savings, ensure flawless compliance, enhance data security, and ultimately give you the peace of mind to focus on what you do best: growing your enterprise.

1. Significant Cost Reduction and Predictable Financials

One of the most compelling benefits of outsourcing payroll is the immediate and substantial impact it has on your bottom line. For many small and medium-sized businesses, the true cost of managing payroll in-house is often underestimated. It extends far beyond the salary of the person processing it.

The Hidden Costs of In-House Payroll

When you calculate the total expense, you must factor in numerous direct and indirect costs that quickly accumulate. These include:

- Software and IT: Annual licensing fees for payroll software, plus the IT infrastructure and support required to maintain it.

- Training and Development: The expense of keeping your staff updated on ever-changing tax legislation and compliance rules through continuous professional development.

- Staff Time: The hours your team spends not just on processing payroll, but also on correcting errors, printing and distributing payslips, and handling employee queries. These are hours that could be invested in core, revenue-generating activities.

By outsourcing, you consolidate these scattered, often unpredictable expenses into a single, fixed fee. This transforms your payroll function from a costly internal department into a predictable operational expense, allowing for much more accurate budgeting and financial forecasting. For instance, a construction company with a fluctuating seasonal workforce can benefit significantly. Instead of paying a full-time administrator year-round, they pay a variable fee that directly reflects the number of employees on the payroll each month, aligning costs with operational activity.

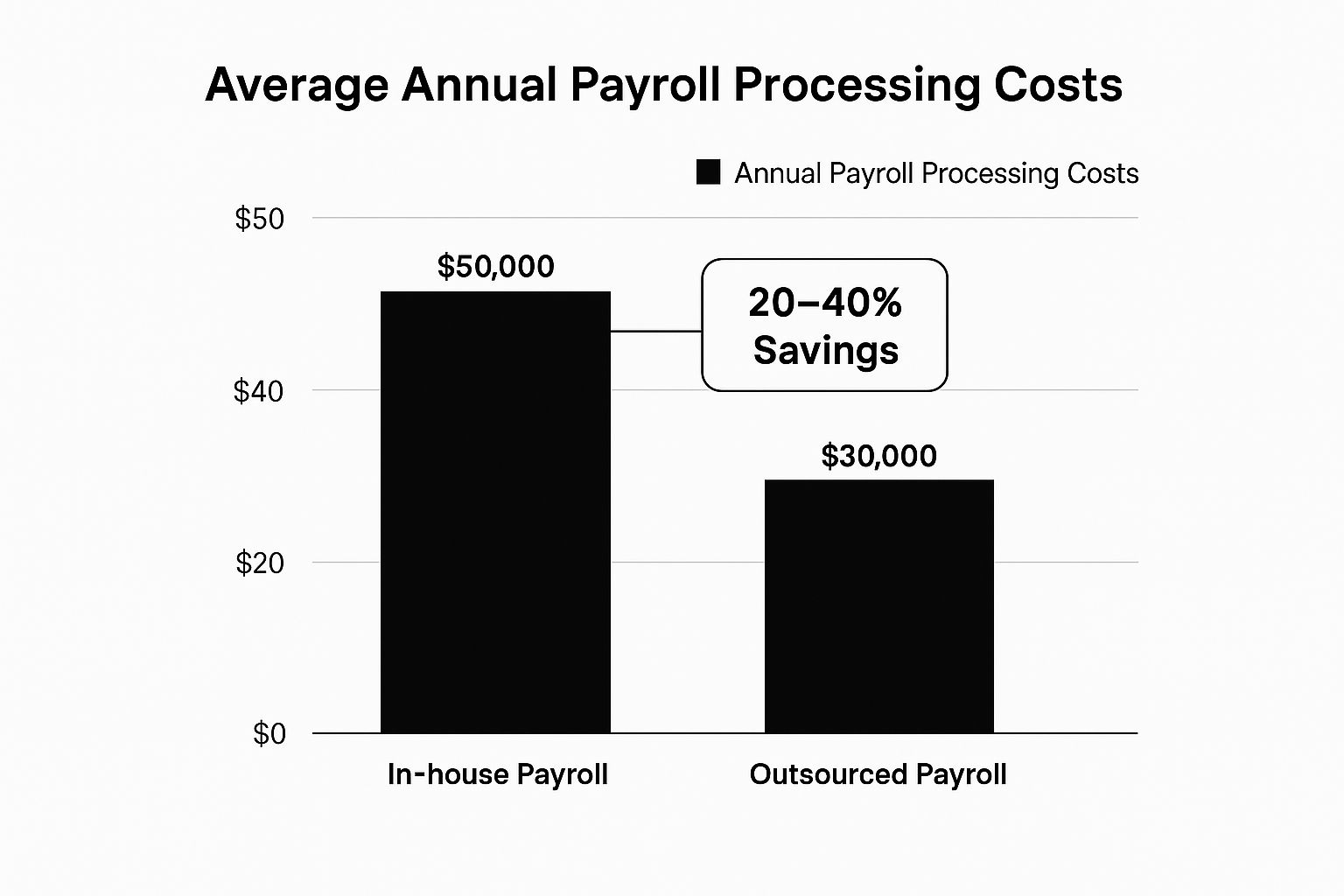

The following bar chart illustrates the potential savings when comparing the average annual costs of in-house versus outsourced payroll processing for a typical SME.

As the data shows, shifting to an external provider can reduce annual payroll costs by as much as 40%, freeing up significant capital to reinvest in business growth.

2. Enhanced Compliance and Risk Management

Navigating the complex and ever-changing landscape of tax laws and labour regulations is a significant challenge for any business. One of the most critical benefits of outsourcing payroll is entrusting this responsibility to dedicated experts, thereby safeguarding your business from costly compliance errors and legal disputes.

The High Stakes of Non-Compliance

The financial and reputational risks associated with payroll mistakes are substantial. A single miscalculation or late submission can trigger severe penalties from HMRC, while incorrect handling of statutory pay or deductions can lead to legal action from employees. The key areas of risk include:

- Tax and NI Contributions: Incorrectly calculating and remitting PAYE tax and National Insurance contributions can result in fines and detailed investigations from HMRC.

- Legislation Changes: Failing to keep up with annual changes to minimum wage rates, auto-enrolment pension thresholds, and statutory leave entitlements.

- Data Security: Protecting sensitive employee data is a legal requirement under GDPR. Breaches can lead to enormous fines and damage to your company's reputation.

Outsourcing transfers this immense burden to a provider whose core business is staying current with these regulations. They invest heavily in technology and continuous training to ensure every payslip is accurate and every submission is on time. For example, a retail business with high staff turnover and variable hours can avoid complex wage and hour violations by relying on a provider's system to calculate overtime and holiday pay accurately. This proactive risk management is invaluable.

Furthermore, entrusting payroll to a specialist is a key part of a robust risk mitigation plan. Understanding broader data security compliance strategies can further strengthen your company’s overall risk posture, protecting you on multiple fronts. By ensuring adherence to all relevant regulations, an outsourced provider not only saves you from potential penalties but also frees you to focus on strategic growth, confident that your legal obligations are being met.

3. Time Savings and Improved Efficiency

Perhaps the most universally valued commodity for any business owner or manager is time. Outsourcing payroll directly gives back this invaluable resource, allowing your team to shift its focus from mundane administrative duties to high-impact, strategic initiatives that drive business growth.

The administrative burden of payroll is significant. It involves meticulous data entry, calculating deductions, verifying hours, processing payments, and handling queries. Research from sources like Deloitte and the Harvard Business Review consistently shows that businesses can reclaim 10-15 hours per pay period by handing these tasks to an expert provider. This is one of the most immediate and tangible benefits of outsourcing payroll.

Reallocating Time for Strategic Value

Freed from the cycle of payroll processing, your team can concentrate on core business functions that generate revenue and foster growth. The reclaimed time can be strategically reinvested in numerous ways:

- Talent Development: HR managers can dedicate their time to creating robust training programmes, improving employee engagement, and refining recruitment strategies instead of chasing timesheets.

- Business Growth: Small business owners can focus their energy on market expansion, customer relationships, and product innovation rather than wrestling with tax calculations and compliance deadlines.

- Operational Excellence: The process itself becomes far more efficient. What might take an in-house team two full days of meticulous work can often be completed by a specialised provider in just a couple of hours, thanks to their optimised systems and expertise.

Outsourcing payroll is a powerful form of operational streamlining. For business owners looking to apply this efficiency principle to other areas, exploring a comprehensive guide to task automation for small enterprises can reveal further opportunities to enhance productivity. By implementing clear timelines, standardised approval workflows, and leveraging the provider’s employee self-service portals, you can transform payroll from a time-consuming chore into a swift, automated function.

4. Access to Advanced Technology and Features

Keeping up with technological advancements is a significant challenge for many growing businesses. Outsourced payroll providers, however, make it their business to invest in and offer cutting-edge technology, giving you access to sophisticated tools that would be prohibitively expensive to develop or licence independently. This is one of the key benefits of outsourcing payroll for a forward-thinking company.

Leveraging a Provider’s Tech Stack

A top-tier payroll provider offers a unified platform that goes far beyond simply processing wages. This technology is designed for efficiency, engagement, and strategic insight. The features you gain access to often include:

- Integrated Platforms: Seamless integration with your existing accounting, HR, and time-tracking software, creating a single source of truth for all employee data and eliminating manual data entry.

- Employee Self-Service Portals: Secure online portals and mobile apps where employees can view their payslips, update personal details, and manage holiday requests. This empowers your team and drastically reduces administrative queries.

- Advanced Reporting and Analytics: Real-time dashboards and customisable reports that provide deep insights into labour costs, overtime trends, and other key performance indicators, enabling data-driven decision-making.

By outsourcing, you are essentially leasing a state-of-the-art technology suite without the hefty price tag or maintenance overheads. For instance, a retail business with multiple locations can use a provider's mobile app to allow staff to clock in and out, view their shifts, and access payslips on the go. This not only streamlines operations but also enhances the employee experience, a critical factor in retaining talent.

Similarly, a consultancy firm can use the provider's advanced analytics to analyse project profitability by tracking labour costs against specific client accounts. This level of granular detail allows for more accurate future project quoting and better resource allocation, directly impacting the bottom line. Platforms like Rippling and BambooHR have popularised this by bundling powerful HR and IT features directly with payroll, showing how integrated technology can transform business operations.

5. Scalability and Business Growth Support

One of the most powerful yet often overlooked benefits of outsourcing payroll is its inherent ability to support and facilitate business growth. As your company evolves, your payroll needs will inevitably change. Handling this expansion in-house can create significant operational bottlenecks, requiring new software investments, additional staff, and complex process re-engineering.

Effortless Adaptation to Your Business Journey

An external payroll provider is built for scalability. Their infrastructure is designed to manage payroll for businesses of all sizes, from a five-person startup to a corporation with hundreds of employees. This means your payroll function can grow with you seamlessly, without any disruptive growing pains.

- Employee Fluctuation: Whether you are hiring ten new staff members for a major project or managing seasonal peaks common in retail or hospitality, an outsourced partner simply adjusts your account. You avoid the need to hire temporary admin staff or overwork your existing team.

- Geographic Expansion: Expanding into new regions or countries introduces a labyrinth of local tax laws, employment regulations, and reporting requirements. A quality provider with international capabilities handles this complexity, ensuring compliance in each new market without you needing to become a local payroll expert.

- Focus on Core Growth: By removing the administrative burden of scaling payroll, you and your leadership team can remain focused on strategic initiatives such as product development, market penetration, and customer service.

For example, a tech startup can rapidly scale from 10 to 100 employees in a year without ever needing to change its payroll system or hire a dedicated payroll manager. The outsourced service simply scales with their headcount, providing consistent, reliable payroll every cycle. This fluid scalability is a crucial component for any ambitious business, transforming payroll from a potential growth obstacle into a streamlined, supportive function that keeps pace with your success. This is a key reason why many high-growth companies like Shopify and Airbnb leveraged outsourced models in their early stages.

6. Improved Data Security and Privacy Protection

In today's digital landscape, protecting sensitive employee data is not just good practice; it's a legal and ethical necessity. Payroll information, which includes bank details, National Insurance numbers, and home addresses, is a prime target for cybercriminals. One of the most critical benefits of outsourcing payroll is leveraging the enterprise-grade security infrastructure that specialist providers offer.

The Vulnerabilities of In-House Data Management

Many small and medium-sized businesses lack the resources and expertise to implement the robust security measures required to adequately protect payroll data. The risks associated with managing this information in-house are significant and often underestimated. These vulnerabilities include:

- Insufficient Technology: Using standard office computers or unencrypted spreadsheets leaves sensitive data exposed to internal and external threats, including malware and ransomware.

- Lack of Physical Security: Storing paper records or on-site servers in unsecured locations creates a high risk of theft or unauthorised access.

- Human Error: A single mistake, such as sending an email to the wrong recipient or misplacing a document, can lead to a serious data breach with severe financial and reputational consequences.

Reputable payroll providers invest heavily in multi-layered security protocols that most businesses cannot afford to replicate independently. They utilise secure data centres with controlled access, employ advanced data encryption both in transit and at rest, and maintain redundant backup systems to ensure business continuity. This professional oversight significantly reduces the risk of payroll fraud, identity theft, and costly data breaches.

A key advantage is their adherence to internationally recognised security and privacy standards. For instance, a provider with SOC 2 Type II certification has undergone a rigorous, independent audit of its controls related to security, availability, and confidentiality. Similarly, compliance with ISO 27001 demonstrates a systematic approach to managing information security. For businesses operating in or dealing with Europe, using a provider compliant with GDPR (General Data Protection Regulation) is essential for avoiding substantial fines. This level of certified security offers business owners invaluable peace of mind, knowing their employees' most sensitive information is protected by industry-leading safeguards.

7. Enhanced Employee Experience and Self-Service

Beyond operational efficiency, one of the most significant benefits of outsourcing payroll is its positive impact on your team's day-to-day experience. Modern payroll providers offer sophisticated digital platforms that empower employees, foster transparency, and drastically reduce the administrative burden on your HR or management team.

Shifting from Admin Burden to Employee Empowerment

In a traditional setup, simple requests like accessing an old payslip, checking holiday allowance, or updating a home address create a constant stream of queries for your administrative staff. This is inefficient for the business and often frustrating for the employee who wants a quick answer. Outsourcing transforms this dynamic by providing access to user-friendly employee self-service (ESS) portals.

- 24/7 Access: Employees can log in securely from any device, at any time, to view and download their payslips, P60s, and other tax documents.

- Information Management: Staff can update their own personal details, such as bank information or contact addresses, ensuring data accuracy without HR intervention.

- Reduced HR Enquiries: By empowering employees with direct access, you can significantly cut down on the time your team spends handling routine payroll questions.

This shift is particularly valued by a modern workforce, where digital natives like Millennials and Gen Z expect instant, on-demand access to their information. For instance, a tech start-up with a distributed, remote team can provide a consistent and professional experience for every employee, regardless of their location. An employee in Scotland can access their payslip just as easily as an employee in London, strengthening company culture and satisfaction. Some businesses report a reduction in payroll-related HR enquiries by over 60% after successfully implementing a self-service portal, freeing up valuable time for strategic initiatives.

Benefits Comparison of Top 7 Payroll Outsourcing Advantages

| Feature | Implementation Complexity 🔄 | Resource Requirements ⚡ | Expected Outcomes 📊 | Ideal Use Cases 💡 | Key Advantages ⭐ |

|---|---|---|---|---|---|

| Cost Reduction and Financial Savings | Low – straightforward outsourcing | Low – eliminates payroll staff & software | Significant cost savings (20-40%) | Small to mid-size businesses seeking cost cuts | Predictable expenses, reduced overhead |

| Enhanced Compliance and Risk Management | Medium – relies on provider expertise | Medium – requires trusted provider | Reduced compliance risk, penalty protection | Companies facing complex tax/regulation needs | Expert knowledge, automated tax filings |

| Time Savings and Improved Efficiency | Medium – initial setup & integration | Medium – automation tools & training | 10-15 hours saved per pay period | Businesses wanting to free HR from admin tasks | Faster processing, focus on strategic tasks |

| Access to Advanced Technology and Features | Medium to high – technology adoption | Medium to high – tech infrastructure | Enhanced reporting, real-time analytics | Businesses needing mobile & integrated payroll | Cutting-edge tools, mobile access, analytics |

| Scalability and Business Growth Support | Low to medium – flexible scaling | Low to medium – variable costs | Seamless employee scaling, multi-location support | Growing businesses, seasonal/remote workforce | Easy growth accommodation, multi-market ready |

| Improved Data Security and Privacy Protection | Medium – security protocols needed | Medium – relies on provider security | Strong data protection, regulatory compliance | Businesses handling sensitive payroll data | Enterprise-grade security, compliance |

| Enhanced Employee Experience and Self-Service | Low to medium – portal setup & training | Low to medium – user support & systems | Increased employee satisfaction, reduced HR load | Organizations prioritizing employee engagement | 24/7 access, reduced HR inquiries, mobile use |

Make the Strategic Switch: Free Up Your Time, Money, and Mind

Navigating the complexities of payroll is a significant undertaking for any business, regardless of size. As we have explored, the demands go far beyond simply paying employees on time. They encompass intricate compliance obligations, data security protocols, and the constant need for accuracy to maintain employee trust. The decision to manage this in-house often seems like a standard operational cost, but as we've detailed, it carries hidden expenses in time, potential penalties, and diverted focus.

The core message is clear: outsourcing payroll is not merely an administrative delegation; it is a powerful strategic manoeuvre. The tangible benefits of outsourcing payroll create a ripple effect across your entire organisation. By handing this function to dedicated experts, you reclaim your most valuable assets: your time, your financial resources, and your mental clarity. This shift allows you to pivot from reactive problem-solving to proactive, growth-oriented activities that drive your business forward.

From Tactical Task to Strategic Advantage

Let's distill the transformative impact into its most critical takeaways. Moving to an outsourced model empowers your business by:

- Securing Your Bottom Line: You convert unpredictable payroll expenses into a fixed, manageable cost, eliminating surprise fees from software updates or error corrections.

- Fortifying Your Compliance: You gain peace of mind knowing that specialists are navigating the ever-changing landscape of HMRC regulations, auto-enrolment, and data protection on your behalf.

- Unlocking Strategic Focus: The hours your team once spent on payroll administration can be reinvested into core business functions like customer service, product development, and market expansion.

- Future-Proofing Your Operations: A professional payroll service scales with you, seamlessly handling growth from a small team to a larger workforce without requiring you to overhaul internal systems.

Ultimately, making this strategic switch is about recognising where your energy delivers the most value. When considering the broader landscape of business services, understanding the factors that make for successful outsourcing partnerships can inform your strategic switch to solutions like payroll outsourcing, including insights on top outsourcing destinations. For UK businesses, a local, expert partner provides an unparalleled level of specialised support. Freeing yourself from the burden of payroll allows you to concentrate on the vision that inspired you to start your business in the first place.

Ready to experience the comprehensive benefits of outsourced payroll for your business? The team at Stewart Accounting Services offers expert, reliable payroll management tailored for UK small and medium-sized businesses, ensuring compliance and efficiency. Contact Stewart Accounting Services today to discover how we can help you save time, reduce stress, and focus on what truly matters: growing your business.