It’s easy to think of a business exit strategy as something for the distant future, a plan for an ending. In reality, it’s the complete opposite. It's a proactive financial blueprint that should guide your company’s journey from the very beginning. This is your roadmap for how you'll eventually step away from the business, making sure you get the most value out of it and achieve your personal goals.

Why Every Founder Needs a Business Exit Strategy

So many entrepreneurs pour their heart and soul into building a fantastic company, but they completely forget to ask one crucial question: "What's my end game?" Thinking about an exit can feel almost wrong when you're laser-focused on growth, but it's genuinely one of the most strategic moves you can make. An exit strategy isn't about throwing in the towel; it's about building your business with a clear purpose.

Think of it like building a house. You wouldn't just start laying bricks without a detailed architect's drawing. That blueprint defines the foundations, the layout, and every material choice, all to ensure the final building is solid, liveable, and holds its value. Your exit strategy does exactly that for your business.

A well-defined exit plan changes your entire mindset. You shift from simply running a business to consciously building a valuable asset. It forces you to look at your company through the eyes of a future buyer or successor and make choices that align with what they'll value most.

This forward-thinking perspective gives you a clear framework for every decision, influencing everything from how you organise your finances to the team you bring on board.

Focus on Building Transferable Value

When you operate with an exit plan in mind, you stop thinking just about the day-to-day profits and start focusing on building transferable value. This is all about prioritising the systems, processes, and metrics that make your business an attractive proposition to someone else. It's about creating a company that can not only survive but thrive without you at the helm 24/7.

The benefits of this approach are huge:

- Strategic Growth: You'll naturally concentrate on improving the key performance indicators (KPIs) that buyers really care about, like recurring revenue, healthy profit margins, and a diverse customer base.

- Operational Efficiency: It pushes you to document your processes properly and develop a strong management team, which makes the business far less dependent on you personally.

- Risk Mitigation: Having a plan in place prepares you for the unexpected. Whether it’s a sudden health problem, a major market shift, or a surprise offer, you'll be able to respond from a position of strength, not desperation.

Secure Your Personal and Financial Future

At the end of the day, an exit strategy is your ticket to personal freedom. It's the mechanism that turns all those years of hard work, sleepless nights, and personal sacrifice into tangible wealth. Without a plan, you run the very real risk of leaving a huge amount of money on the table or being backed into a corner, forced to sell on someone else's terms.

A proactive plan puts you in control of your own destiny. It lets you decide when you want to leave, how much money you need to secure your financial future, and what kind of legacy you want to leave behind.

Starting this process at least 3-5 years before you think you might want to leave is key. It gives you the runway you need to get the business in peak condition, tidy up the financials, and position it to command the highest possible price. It’s not just a plan for leaving; it's your strategy for winning.

Navigating the UK Business Exit Landscape

It’s one thing to understand what a business exit strategy is in theory, but putting it into practice in the real world is a completely different ball game. The route you take isn’t just about your personal ambitions; it's heavily shaped by the specific market forces you're operating in. For UK business owners, the current exit landscape is a complex and shifting terrain, influenced by everything from economic headwinds and changing tax laws to major generational trends.

To move past generic advice, you need a clear, boots-on-the-ground picture of this environment. Successfully timing your exit and getting the best possible value means understanding the currents pulling the market in different directions. These factors create both significant challenges and unique opportunities, but only for those who are prepared.

A major driver of change right now is widespread economic uncertainty. Recent research shows that a staggering 56% of UK business owners are now thinking about an exit purely because of rising taxes and economic instability. This pressure is creating a complicated market. We’re seeing financially strained smaller companies struggling, which often leads to them being snapped up by larger, more stable firms at potentially lower valuations. You can get a deeper sense of these UK business exit patterns and predictions from HedgeThink to better understand the market.

This climate of caution is directly changing how deals get done. Buyers are more risk-averse than ever, which means straightforward all-cash offers are becoming harder to come by.

The Rise of Complex Deal Structures

As buyers look to shield themselves from risk, we're seeing a definite shift towards more creative and complex deal structures. Instead of a simple, one-off payment, many sales now involve elements tied to performance. This means part of your final payout depends on how well the business does after you've handed over the reins.

Getting your head around these options is vital for any modern negotiation:

- Earn-Outs: A portion of the sale price is paid to you later, but only if the business hits pre-agreed targets (like revenue or profit goals) under its new ownership.

- Seller Financing: Here, you essentially act as the bank. You lend the buyer a portion of the purchase price, and they pay you back over time with interest. It can make the deal more affordable for them while giving you a steady income stream.

- Partial Exits: You sell a majority stake but hold onto a minority share. This lets you cash out a significant portion now while still having skin in the game, benefiting from the company's future growth.

These structures aren't just clever accounting; they're a direct response to market conditions. They are designed to bridge the valuation gap between what you believe your business is worth and what a buyer is willing to risk in an unpredictable economy.

Knowing these deal types gives you the flexibility to find a solution that works, massively increasing the chances of getting a deal over the line.

Generational and Regulatory Pressures

Beyond how deals are structured, broader trends are reshaping the UK exit landscape. One of the biggest is the "great retirement" of the baby boomer generation. A huge number of experienced entrepreneurs are reaching the age where they want to step back, flooding the market with businesses for sale. Naturally, this increased supply can create more competition among sellers.

At the same time, the UK's tax environment is a massive factor. Changes to regulations like Capital Gains Tax (CGT) can dramatically affect the net amount you walk away with. Even the prospect of future tax hikes is often enough to speed up an owner's decision to sell, creating windows of intense market activity.

Finally, interest from international buyers can swing wildly based on currency exchange rates and the UK’s regulatory climate. A strong pound might put some overseas investors off, while a weaker pound can make UK businesses look like an absolute bargain. A well-thought-out exit plan has to juggle all of these connected pieces, giving you the power to make smart decisions based on the real-world UK landscape you're in.

Choosing Your Ideal Business Exit Route

Think of your exit strategy as the final, most crucial chapter of your business's story. It’s not just about selling up; it's about defining what success looks like for you after years of hard work. The "best" path isn't a one-size-fits-all solution. It's the one that perfectly lines up with your personal goals, your financial needs, and the legacy you want to leave behind.

Before you can pick a destination, you need to understand the map. That means getting to grips with the different exit routes available, looking past the headline sale price to consider things like timing, control, and what happens to the business you poured everything into.

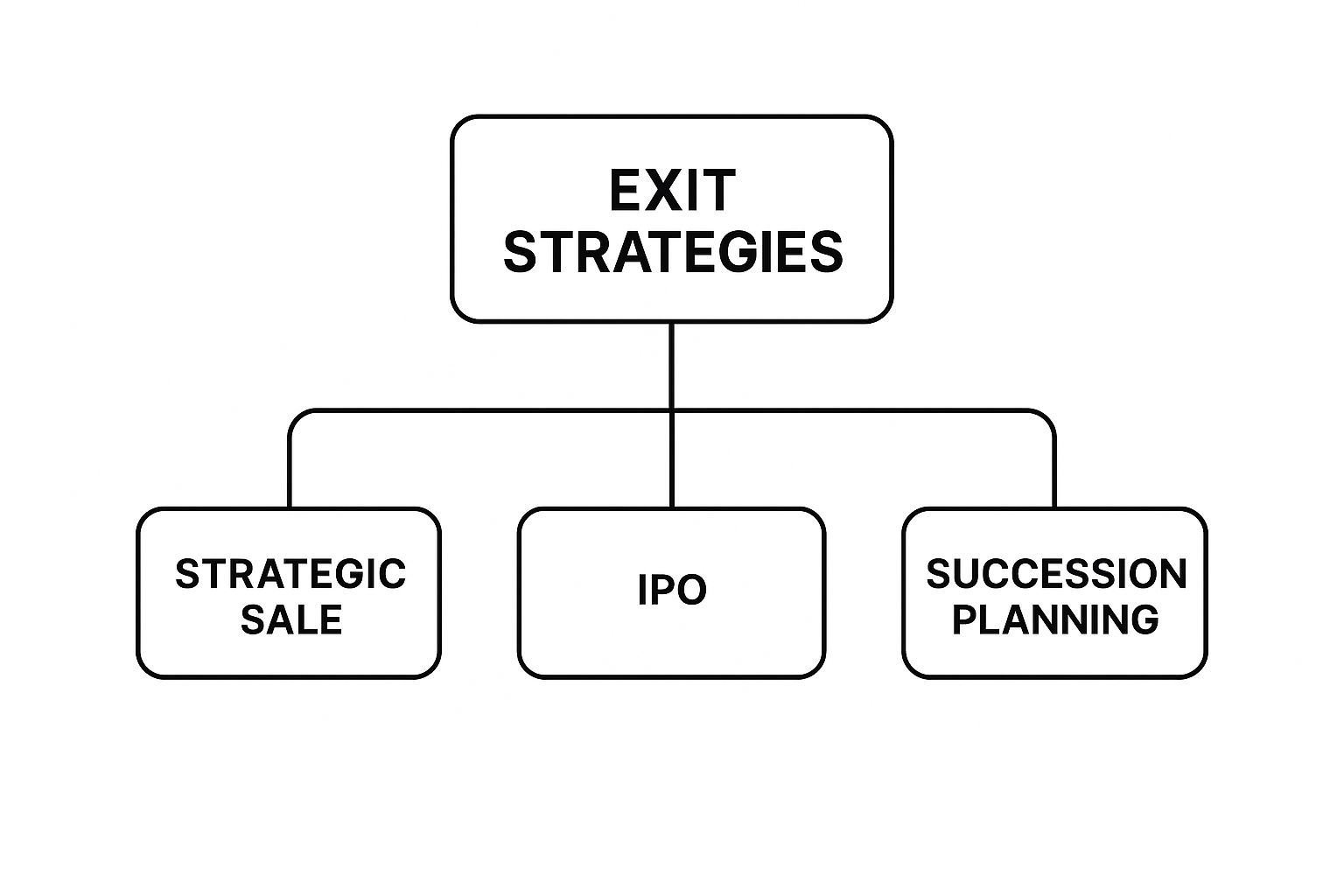

This graphic offers a great high-level overview of the main avenues you can take.

As you can see, the options generally fall into three buckets: selling to an outsider (like a competitor), going public with an IPO, or keeping it in the "family" through internal succession, whether that's to your actual family or your trusted management team.

Comparing Common Business Exit Strategies

To help you weigh your options, this table breaks down the most common exit routes, comparing them on the factors that usually matter most to business owners: the potential payday, how quickly it can happen, and how well your legacy is protected.

| Exit Strategy | Potential Value | Speed | Legacy Preservation | Ideal For |

|---|---|---|---|---|

| Trade Sale | Highest | Moderate | Low to Moderate | Owners seeking maximum financial return. |

| Private Equity Sale | High | Moderate to Fast | Low | Owners wanting a quick, lucrative exit. |

| Management Buyout | Moderate | Moderate to Slow | High | Owners prioritising continuity and staff wellbeing. |

| Family Succession | Low to Moderate | Slow | Highest | Owners focused on building a multi-generational legacy. |

| Liquidation | Lowest | Fast | None | Owners needing a clean break from an unviable business. |

Looking at them side-by-side makes it clearer how each route serves a different end goal. Your job is to decide which of these outcomes aligns with your vision for the future.

Routes Focused on Maximum Financial Return

For many entrepreneurs, the end goal is simple: get the best possible financial return for their years of dedication and risk. If that's you, then you're likely looking at a sale to an external party.

A trade sale is often the top contender here. This is where you sell your company to another business, usually a larger player in your industry. They might be a direct competitor or a company looking to expand into your market. Because they see strategic value in what you’ve built—your customers, your tech, your market position—they’re often willing to pay a premium, leading to the highest valuation.

The other main option is a third-party sale to a private equity (PE) firm. PE groups buy businesses with a plan to grow them quickly and sell them on for a profit. This can also be a very financially rewarding path. It's also worth looking into innovative structures like Angel List Roll-Up Vehicles, which offer creative ways for founders to achieve a high-value exit.

Be aware of the trade-off. Maximising your financial return almost always means giving up control. A new owner will have their own plans, and the company culture and way of doing things you established are unlikely to survive intact.

Routes That Prioritise Legacy and Continuity

What if leaving the business in good hands matters more to you than the absolute highest price tag? If preserving your legacy is the priority, then your focus should shift to internal succession strategies.

- Management Buyout (MBO): An MBO involves selling the company to your existing management team. This is a fantastic option for continuity. The people who know the business best take the helm, ensuring a seamless transition for employees and customers. The main hurdle is often financial, as your team will likely need to secure significant funding to buy you out.

- Family Succession: This is the classic legacy exit—passing the torch to the next generation. It can be incredibly rewarding, but it's fraught with complexity. A successful handover requires years of careful planning to manage family dynamics and properly prepare your successors for leadership.

The Final Option: Liquidation

Sometimes, the most practical and logical decision is to simply wind the company down and sell off its assets. This is called liquidation.

While it often carries a negative stigma, liquidation can be a planned and sensible exit. It might be the right call if the business is no longer profitable, or if you simply can't find a suitable buyer. It provides a clean break, but it almost always results in the lowest financial return, as assets are sold for a fraction of their true market value. Think of it as a practical, but rarely a desirable, end.

Ultimately, choosing the right exit demands some serious soul-searching. You have to weigh the financial windfall of a trade sale against the peace of mind that comes from an MBO or the personal satisfaction of a family succession. Each path requires a different kind of preparation and leads to a completely different life after you walk away.

How UK Tax Changes Impact Your Exit Timing

Timing your business exit is a delicate dance. You’re constantly weighing up market conditions against your own personal readiness to step away. But there’s a third, powerful partner in this dance for UK business owners, one that can dramatically change how much money you walk away with: tax.

For anyone running a business in the UK, tax isn’t just some minor detail you sort out later. It’s a core part of the entire strategic puzzle. The rules governing things like Capital Gains Tax (CGT) and various reliefs can shift with every new government budget, which essentially turns your exit plan into a moving target.

This creates a real strategic tightrope. Do you sell now to lock in the current, predictable tax rates, even if the market isn't quite at its peak? Or do you hold on, hoping for a better valuation down the line, but risking a future where a much bigger chunk of your life's work goes straight to HMRC? It’s a dilemma that splits opinion right down the middle, and there’s no single, easy answer.

Navigating the Tax Dilemma

The reality is that these policy shifts are actively shaping when owners decide to call it a day. Recent data paints a vivid picture of just how polarised these decisions have become. A 2025 survey of 500 UK business owners found that while 44% chose to postpone their exit plans in the last year due to market jitters, another 41% deliberately brought their plans forward. You can explore the full findings on how tax shifts are influencing exit timelines from S&W Group.

What was driving this rush for the door? Overwhelmingly, it was tax.

- 28% fast-tracked their sale because they were worried about upcoming cuts to Business Property Relief, a change that could make passing a business to the next generation far more expensive.

- 20% sped things up out of fear that future budgets would bring hikes to CGT rates.

Only a small 15% of owners felt their timing was unaffected, which really hammers home just how much tax now dominates modern exit planning.

This data tells a very clear story: tax is no longer a passive calculation you do after the fact. It has become an active, powerful force that directly influences the single most important decision an owner will make—when to leave their business.

The Importance of Proactive Tax Planning

The lesson here is crystal clear. You simply cannot afford to keep your business exit strategy and your tax strategy in separate boxes. They have to be developed hand-in-hand, right from the beginning. Waiting until you have a buyer lined up to think about tax is a classic, and often very costly, mistake.

Getting a chartered accountant who specialises in this area on board well in advance is non-negotiable. They can help you shape your business and your exit in the most tax-efficient way possible, not just for the rules today, but with an eye on potential changes on the horizon.

This proactive approach gives you the power to:

- Optimise Your Structure: Some company structures are far more tax-friendly upon exit than others. Making these kinds of changes takes time, so it’s something you need to be thinking about years ahead.

- Maximise Reliefs: You can make full use of available reliefs like Business Asset Disposal Relief (what used to be called Entrepreneurs' Relief) to significantly lower your final tax bill.

- Time Your Exit Intelligently: With expert guidance, you can make an informed decision on whether selling now or waiting makes more sense for your specific financial situation.

Ultimately, successfully navigating the UK's tax system is a vital part of making sure you get the best possible reward for your years of hard work. It demands foresight, professional advice, and a plan that treats tax not as an afterthought, but as a central strategic pillar.

Unique Challenges for Family-Owned Businesses

Family firms are the bedrock of the UK economy, but when it's time to plan an exit, they play by an entirely different rulebook. For these businesses, an exit is never just a cold financial transaction. It's an emotional, high-stakes process, wrapped up in personal identity, delicate relationships, and the weight of a family legacy.

To get this right, you have to strike a tough balance between sharp business sense and preserving family harmony. It means looking beyond the spreadsheets and valuations to deal with the powerful human element at the heart of it all. Honestly, your most important tool isn't a calculator; it's open, honest communication, started years before you even think about selling.

For a family business, the conversation about an exit is about far more than money. It's a dialogue about the future of the family's name, its values, and its place in the community. Rushing this or sidestepping the difficult talks is a surefire recipe for conflict that can poison both the business and family ties for decades.

This delicate balancing act has been made even trickier by recent shifts in UK tax policy.

The Rise of Intra-Family Transfers

For many family firms, the dream exit strategy is simple: keep it in the family. An intra-family transfer, where ownership passes to the next generation, is often seen as the best way to protect a hard-won legacy. This can happen through a direct sale or, as is increasingly common, by gifting shares.

With family-owned businesses making up around 85% of all private sector enterprises in the UK, succession is a massive topic. However, recent changes in the October 2024 Budget, which tightened the rules around Capital Gains Tax and Business Property Relief, have made these transfers more expensive. Because of this, gifting shares has become a key tactic for owners looking to pass the torch while navigating these new tax hurdles. You can find more insights on how these tax changes are shaping 2025 exit strategies from Hillier Hopkins.

When Keeping It in the Family Isn't the Answer

Sometimes, the bravest and smartest decision is to admit that keeping the business in the family just isn't the right move. This can be a gut-wrenching realisation, but pushing a succession onto relatives who don't have the passion, the skills, or even the desire to run the company is a guaranteed path to ruin.

In these moments, frank conversation is everything. The objective is to separate the business asset from the family legacy. It is entirely possible to secure your family’s financial future without forcing the next generation into a role they are ill-suited for.

Here are the main alternatives to think about:

- Management Buyout (MBO): Selling to a loyal and skilled management team can be a fantastic compromise. It keeps the business in trusted hands, ensures continuity, and rewards the very people who helped you build it, often preserving the unique culture you worked so hard to create.

- Trade Sale: Selling to a larger company in your industry can often deliver the highest financial return. This can secure significant wealth for the family for generations to come, even if it means another name goes up over the door.

Getting through these conversations takes real courage and foresight. It’s about putting the long-term health of the business and the wellbeing of your family members first.

Building Your Actionable Exit Plan Framework

Let's move from the abstract idea of an exit strategy to the real work: building a concrete plan you can actually use. This isn't about theory; it's about creating a practical framework that you can start putting into action today. The single most powerful thing you can do to maximise your company’s value is to have a well-structured plan, started years before you ever intend to sell.

Think of it as the instruction manual for making your business as bulletproof and appealing as possible to a future owner. Each step builds on the last, forging a clear path to your end goal. The whole process can feel a bit daunting, so let's break it down into manageable stages.

Many owners make the mistake of treating their exit plan as a one-off document to be filed and forgotten. It’s far better to see it as a living strategy that grows with your business—a series of deliberate actions designed to shape your company for its next chapter.

The journey doesn't start with spreadsheets and projections. It starts with you.

Define Your Personal and Financial Finish Line

Before you can map out your business's future, you need to be brutally honest about your own. What does a successful exit actually look like for you, personally? It really comes down to a few core questions:

- What's your number? How much money do you realistically need from the sale to fund your retirement, your next big idea, or whatever else you have planned? Be specific.

- What's your timeline? Are you looking to be out in three years, five years, or is ten more realistic? This timeline will set the pace for everything that follows.

- What’s your role after the sale? Do you want to walk away completely, or would you consider staying on for a handover period or even a consulting gig?

Answering these questions gives you a clear finish line. It puts all your business decisions into context and ensures the company's goals are pulling in the same direction as your personal ones.

Get a Realistic Business Valuation

Once you know where you're going, you need to know where you're starting from. This is where a professional business valuation comes in—it’s a non-negotiable, essential step. A valuation gives you an objective, realistic snapshot of what your business is worth on the open market today.

This number is your baseline. It instantly shows you the gap between your company’s current value and the financial target you just set. But a good valuation delivers more than just a figure; it uncovers your business’s strengths and, crucially, its weaknesses from a buyer’s perspective. That insight is gold because it tells you exactly where to focus your energy to boost its value over the coming years.

Assemble Your A-Team of Advisors

Trying to navigate a business exit on your own is a recipe for disaster. You need a team of specialist advisors who live and breathe the legal, financial, and tax complexities of these deals. Your "A-Team" should include:

- A Chartered Accountant: They'll be vital for cleaning up your financials, structuring the deal for tax efficiency, and assisting with the valuation.

- A Solicitor: You need an expert to handle the mountain of legal paperwork, from contracts to the final sale agreement.

- A Financial Advisor: Their job is to help you manage your personal wealth after the sale is complete.

- An M&A Specialist (optional): For larger or more complicated sales, these experts are brilliant at finding qualified buyers and negotiating the best possible terms.

Getting this team in place early means every decision you make is informed by expert advice, helping you sidestep costly errors. As part of this preparation, getting your head around the due diligence process is critical. You can use this essential due diligence checklist for deal success to get organised. Being prepared shows you're serious and can make the final negotiations much smoother.

Common Questions About Business Exit Strategies

It’s only natural to have questions when you start thinking about your exit plan. After all, it's one of the biggest financial decisions you'll ever make. Getting clear answers to these common worries is the first step towards feeling confident about the path ahead.

Let's dive into some of the top questions I hear from business owners who are starting to map out their future.

How Long Does It Take to Sell a Business?

There’s no single answer here, but a realistic timeframe is anywhere from six months to over two years. The exact time it takes hinges on a few big variables: how attractive your business is to buyers, the state of the market, the complexity of the deal, and frankly, how organised you are.

This is precisely why you'll hear experts recommend starting your exit planning 3-5 years in advance. Think of it as giving yourself a proper runway. This lead time allows you to get your house in order – tidying up the financials, strengthening operations, and fixing any issues a buyer would quickly spot. It’s all about building value so you can get a smoother sale and a better price when the time comes.

What Is the Biggest Mistake Owners Make When Exiting?

Without a shadow of a doubt, the most common and costly mistake is simply waiting too long to start. So many owners see their exit as some far-off event, not as a crucial part of their business journey. This reactive mindset is a huge gamble.

Waiting until you have to sell—whether because of burnout, a health scare, or an unexpected offer—almost always means you'll get a lower price. It forces you into a rushed process where you lose control and miss out on opportunities. You're negotiating from the back foot.

Starting early flips the script completely. Proactive planning lets you strategically boost your business's value and appeal to buyers long before you need to leave. This puts you firmly in the driver's seat, controlling the timing and the terms.

How Do I Know What My Business Is Really Worth?

Those free online valuation calculators can be tempting, but they'll only give you a ballpark figure at best. For a number you can actually rely on, there's no substitute for a formal business valuation from a qualified professional. This isn't just a "nice to have"; it's a cornerstone of any serious exit strategy.

A professional valuator goes much deeper, looking at every layer of your business. This includes:

- Financial Performance: They'll pore over your revenue, profit margins, and cash flow.

- Assets: This covers everything from tangible assets like equipment and property to intangible ones like your brand reputation and intellectual property.

- Market Position: Your competitive edge, customer loyalty, and the wider industry trends all factor into the final number.

Getting a professional valuation early on gives you a realistic benchmark. Even better, it acts as a roadmap, showing you exactly where you need to focus your efforts to increase what your business will be worth when you decide to sell.

A well-planned exit requires expert financial guidance from the very beginning. Stewart Accounting Services specialises in helping business owners prepare for a successful future by optimising their finances and developing a clear strategic roadmap. Discover how we can help you build value and prepare for your ideal exit.