Figuring out buy-to-let tax can feel like trying to solve a puzzle, but the basic idea is quite simple. You pay Income Tax on your rental profits. That’s it. Think of your rental property as a small business: HMRC taxes you on what’s left after you’ve paid all your legitimate running costs.

Getting your head around this single principle is the best starting point for handling your tax responsibilities properly.

Understanding Your Core Buy To Let Tax Obligations

For anyone just starting as a landlord, the world of property tax can seem daunting, full of strange terms and hidden rules. The easiest way to cut through the noise is to view your property venture as a business. The rent you collect is your turnover, and the costs of running the place are your expenses. You only pay tax on the profit.

This simple formula is the foundation of your main tax duty: paying Income Tax. Any profit you make from your property gets added to your other income, like your salary from your day job. This total figure determines which Income Tax band you fall into for the year.

The Main Taxes Landlords Face

As a UK landlord, you’ll generally come across three main taxes, each popping up at a different stage of your investment journey.

- Income Tax: This is the one you’ll deal with every year. It’s paid on the profits you make from the rent you collect.

- Stamp Duty Land Tax (SDLT): This is a one-off tax you pay right at the beginning when you buy the property.

- Capital Gains Tax (CGT): This comes into play at the very end when you sell the property. It’s a tax on the profit you’ve made from the property’s value increasing over time.

Knowing when each of these taxes applies is key to good financial planning. Income Tax is all about your year-to-year cash flow, SDLT hits your initial budget, and CGT affects the final profit you walk away with.

At its heart, buy to let tax is about transparency. HMRC just wants a clear, honest account of your property's financial performance each year—from the rent you've received to the money you've spent keeping it in good shape.

What Does HMRC Consider Rental Income?

When you’re totting up your income, it’s not just about the monthly rent. HMRC takes a wider view. Your taxable income includes any payment you get from a tenant for using the property. This could be things like service charges for cleaning a shared hallway, or even if you pay a utility bill and then charge it back to them.

It's a common slip-up to miss these extra bits of income, which can lead to trouble with HMRC down the line. By being clear from the start on what counts as income and what you can claim as an expense, you set yourself up for stress-free tax management. Once you're comfortable with the basics, you can start exploring strategies to save money on real estate taxes and make your investment work even harder for you.

Calculating Your Rental Profit The Right Way

When it comes to lowering your buy to let tax bill, nothing is more effective than claiming every legitimate deduction you're entitled to. The whole game is about accurately calculating your rental profit, which is simply your total rental income minus your ‘allowable expenses’.

Think of it this way: HMRC only wants to tax your actual profit, not every penny of rent that lands in your bank account. Any money you spend purely for the purpose of renting out your property can usually be deducted from your income first.

This shifts tax from something you just have to pay to something you can actively manage. By keeping a sharp eye on your spending, you make sure you only pay what you truly owe.

Identifying Your Allowable Expenses

So, what actually counts as an allowable expense? In short, these are the day-to-day running costs of your property business. HMRC’s golden rule is that the expense must be ‘wholly and exclusively’ for the purpose of renting out the property.

Here are some of the most common costs landlords can claim back:

- Letting agent and management fees: The fees you pay for finding tenants or having the property managed.

- Landlord insurance: This covers buildings, contents, and public liability policies.

- Maintenance and repairs: Think fixing a leaky tap, mending a broken window, or getting a faulty boiler running again.

- Accountancy fees: The cost of hiring a professional to handle your tax return.

- Direct property costs: Things like council tax, ground rent, and utility bills that you cover during void periods.

Nailing your profit calculation starts with getting a firm grip on these deductions. To take your planning a step further, you could also explore investing in properties offering a secure long-term yield, as this fundamentally shapes your long-term returns and tax strategy.

The Crucial Difference Between Repairs and Improvements

One of the biggest tripwires for landlords is telling the difference between a repair and a capital improvement. Get this wrong, and you could face disallowed claims and a nasty, unexpected tax bill.

A repair is simply an expense that brings an asset back to its previous condition. Replacing a few storm-damaged roof tiles is a classic repair. These costs are allowable expenses, meaning you can deduct them from your rental income in the same year.

A capital improvement, however, is any spending that enhances or upgrades the property beyond its original state. Building an extension or converting the loft are clear examples. These are not allowable expenses you can claim against your rental income.

A simple way to think about it is to ask yourself: "Am I fixing something, or am I adding something new?" Fixing is a deductible repair; adding is a non-deductible improvement.

But don't toss those receipts for improvements! While you can't deduct them from your rental income now, they aren't lost. You can use these costs to reduce your Capital Gains Tax bill when you eventually sell the property, so keeping meticulous records is still vital.

Let’s run through a quick example. Imagine a landlord named Sarah owns a buy-to-let flat.

Example Calculation

-

Annual Rental Income: Sarah’s tenant pays £1,200 per month, bringing in a total of £14,400 for the year.

-

Identify Allowable Expenses: Over the year, she has paid for:

- Letting agent fees: £1,440

- Landlord insurance: £250

- Gas safety certificate: £80

- Repairing a faulty oven: £150

- Accountancy fees: £300

-

Total Allowable Expenses: Adding these up gives a total of £2,220.

-

Calculate Taxable Profit: Sarah simply subtracts her expenses from her income: £14,400 – £2,220 = £12,180.

Sarah’s Income Tax will be calculated on her £12,180 profit, not the full £14,400 of rent she collected. It's a straightforward calculation that shows just how powerful good record-keeping can be in managing your buy to let tax.

The Impact Of Mortgage Interest Tax Relief Changes

If there's one change that has truly shaken up the buy to let tax world in recent years, it's the reform of mortgage interest relief. Known in the industry as Section 24, this single piece of legislation has completely rewritten the rulebook on profitability for individual landlords.

Not so long ago, things were simple. You could deduct your full mortgage interest payments from your rental income, treating it just like any other business expense. This directly reduced your taxable profit and, in turn, your final tax bill. That straightforward approach is now a thing of the past.

These new rules were phased in over a few years and have been fully in place since April 2020. Getting your head around them is non-negotiable if you want to accurately forecast your returns and stay on the right side of HMRC.

From Full Deduction To A Basic Rate Credit

The old system of deducting your finance costs has been scrapped entirely. In its place is a new system that provides a tax credit instead.

This credit is locked at the basic income tax rate of 20%, and that’s the crucial part. It doesn't matter if you're a basic, higher, or additional rate taxpayer – everyone gets the same 20% credit.

Here’s a simple way to think about it:

- The Old Way: It was like getting a percentage discount. If you were a 40% taxpayer, you effectively got 40% relief on your mortgage interest.

- The New Way: Now, it’s as if everyone gets a flat-rate voucher worth 20% of their mortgage interest costs, regardless of their actual tax bracket.

This might sound like a minor tweak, but the financial implications are massive, particularly for landlords paying higher rates of tax.

The new system means you now pay tax on rental income that you've already used to pay your mortgage interest. For many, this has inflated their taxable income without them actually earning a single extra penny.

Since this change was fully rolled out, landlords now receive a basic rate tax credit of 20% on their mortgage interest. Crucially, they must declare their rental profits before deducting that interest. For higher and additional rate taxpayers (at 40% and 45%), this means a substantially bigger tax bill on the same rental earnings. For a deeper dive, you can get more expert analysis on buy-to-let mortgages and their tax implications from Veracityfp.co.uk.

How Section 24 Affects Your Tax Bill

The most immediate and painful effect of Section 24 is how it inflates your declared income on paper. Because you can no longer deduct the mortgage interest, your total income appears much higher, which can easily push you into a higher tax bracket.

Let's walk through a real-world example to see the damage. We'll use a higher-rate taxpayer to illustrate the point.

Example Scenario Before Section 24

- Annual Rental Income: £15,000

- Mortgage Interest Costs: £6,000

- Other Allowable Expenses: £2,000

- Taxable Profit: £15,000 – £6,000 – £2,000 = £7,000

- Tax Bill at 40%: £7,000 x 40% = £2,800

Nice and simple. Now let's run the same numbers under the current rules.

Example Scenario After Section 24

- Calculate Taxable Profit (without mortgage interest): £15,000 – £2,000 = £13,000. Notice how your on-paper profit has shot up.

- Calculate Initial Tax Due: £13,000 x 40% = £5,200.

- Calculate Your Tax Credit: £6,000 (mortgage interest) x 20% = £1,200.

- Calculate Final Tax Bill: £5,200 – £1,200 = £4,000.

Just like that, this landlord's tax bill has jumped from £2,800 to £4,000 – an increase of £1,200 – without their actual cash profit changing at all. It's this very calculation that has prompted so many landlords to consider moving their properties into a limited company structure to soften the blow.

Navigating Stamp Duty on Additional Properties

Long before your first rent cheque lands in your bank account, you’ll face a hefty upfront tax that every savvy property investor needs to budget for. It’s called Stamp Duty Land Tax (SDLT), and for landlords, it comes with an extra sting in the tail.

When you buy a home to live in, SDLT is calculated on a tiered basis. But if you’re buying an additional property—which virtually every buy-to-let investment is—you’re going to be hit with a higher rate.

And we’re not talking about a small bump here. It's a significant surcharge that can add thousands of pounds to your initial outlay. Forgetting to factor this in can throw your entire financial forecast off course right from the get-go.

Understanding the 3 Percent Surcharge

The crucial difference for landlords is the 3% surcharge that gets added on top of the standard SDLT rates. This extra levy applies to the full purchase price of any additional property costing £40,000 or more.

This surcharge was a game-changer for the UK buy-to-let tax landscape when it came in. Since April 2016, landlords have had to swallow this extra 3%, dramatically increasing the capital needed to get into the rental market. You can read more about how ongoing tax changes affect landlords from our friends at Propertynotify.co.uk.

To make this clear, let's look at how the rates stack up against each other.

SDLT Rates Comparison For Residential vs Buy To Let Properties

The table below really highlights the difference between buying your own home and buying an investment property.

| Property Value Band | Standard Residential SDLT Rate | Buy To Let / Additional Property SDLT Rate |

|---|---|---|

| Up to £250,000 | 0% | 3% |

| £250,001 to £925,000 | 5% | 8% |

| £925,001 to £1.5 million | 10% | 13% |

| Over £1.5 million | 12% | 15% |

As you can see, the landlord rate is consistently 3% higher across every single band.

A Worked Example: The Landlord Premium

Seeing the numbers in a real-world scenario makes the impact of this buy-to-let tax surcharge hit home. Let's run the numbers for a property purchased for £300,000.

First, what would a regular homebuyer pay for their main residence?

- The first £250,000 is taxed at 0% = £0

- The remaining £50,000 is taxed at 5% = £2,500

- Total SDLT for a main home = £2,500

Now, let's see what the bill looks like for a landlord buying the exact same property as an investment:

- The first £250,000 is taxed at 3% = £7,500

- The remaining £50,000 is taxed at 8% = £4,000

- Total SDLT for a buy-to-let = £11,500

The difference is stark. In this scenario, the landlord must find an additional £9,000 in cash just to cover the tax bill. This is why accurately budgeting for SDLT is a non-negotiable step in any property investment plan.

This upfront cost eats directly into your return on investment and inflates the total capital you need to raise before you can even think about finding tenants. It’s a crucial piece of the buy-to-let tax puzzle that has to be solved right at the very start of your journey.

Should You Buy Property Through a Limited Company?

One of the biggest conversations among landlords these days revolves around using a limited company to hold property. Since the government cracked down on mortgage interest relief for individual owners, setting up a corporate structure has become an incredibly popular strategy for managing buy to let tax.

But is it the right move for you? It helps to think of it like choosing between being a sole trader or a fully-fledged registered business. One path is simpler with far less paperwork, but the other opens up a different set of financial rules that can be a game-changer, especially as your portfolio grows.

The Core Tax Advantage: Full Mortgage Interest Relief

The number one reason landlords are flocking to incorporation is to get around the harsh effects of Section 24. While individual landlords are now restricted to a 20% tax credit on their mortgage interest, a limited company can deduct 100% of its mortgage interest costs as a legitimate business expense. This happens before profits are even calculated.

That single difference can make a massive dent in the company's taxable profit, leading to a much smaller tax bill. After all allowable costs are deducted, the profit that’s left is hit with Corporation Tax, not your personal Income Tax.

This is a crucial distinction. For the 2024/2025 tax year, Corporation Tax is set at 19% for companies with profits under £50,000, rising to 25% for those with profits over £250,000. There's a taper for businesses falling between those two figures. This structure has fuelled a huge rise in landlords buying through Special Purpose Vehicles (SPVs), which are essentially limited companies set up just for holding property. You can find a detailed breakdown of the pros and cons of limited company buy-to-let mortgages here.

Downsides and Complexities to Consider

While the tax benefits look tempting on paper, running a limited company adds layers of cost and admin that simply don't exist when you own property in your own name. It's definitely not a magic bullet, so you have to weigh up the drawbacks carefully.

Some of the potential hurdles include:

- Higher Mortgage Costs: Lenders almost always charge higher interest rates and heftier arrangement fees for limited company mortgages.

- The Admin Burden: You'll be on the hook for filing annual accounts with Companies House and a separate company tax return with HMRC. For most people, this means hiring an accountant.

- Getting Your Money Out: You can't just transfer profits to your personal bank account. You have to formally pay yourself through a salary or dividends, and both have their own tax rules and implications.

- The "Double Tax" Trap: Think about it: the company pays Corporation Tax on its profits. Then, when you take that money out for yourself, you pay personal tax on it (either Dividend Tax or Income Tax).

Operating through a limited company offers significant advantages for managing buy-to-let tax on profits, but it also creates a formal barrier between your personal and business finances. This structure demands more rigorous financial discipline and professional oversight.

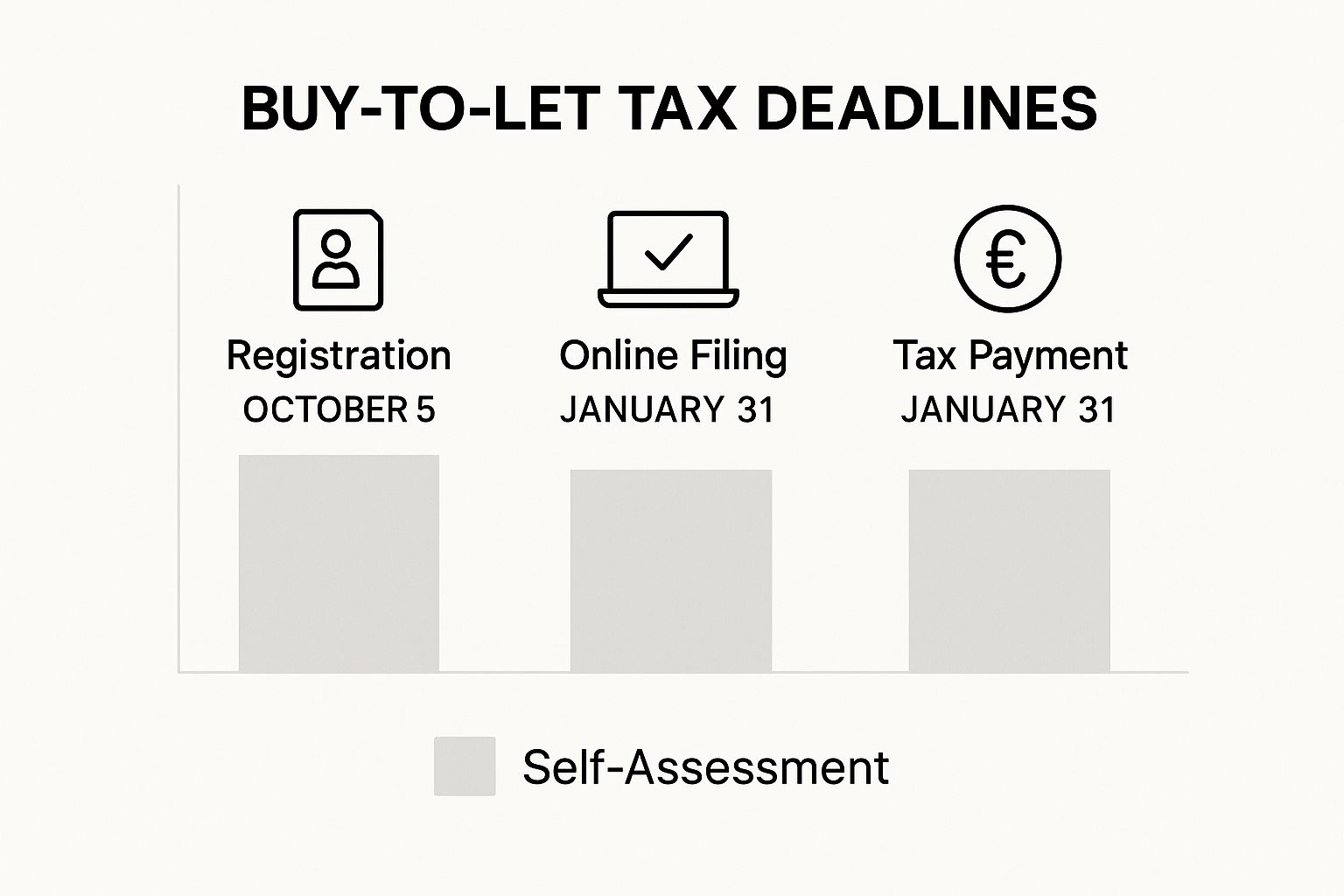

The image below gives a snapshot of some of the key tax deadlines you’ll need to juggle, whether you're a sole landlord or running a company.

As you can see, while the deadlines themselves are straightforward, adding company-specific duties to the mix definitely increases the workload.

Individual vs Limited Company Ownership: Key Differences

To help you visualise the trade-offs, here's a direct comparison of the two ownership structures.

| Feature | Individual Landlord | Limited Company |

|---|---|---|

| Mortgage Interest Relief | Restricted to a 20% tax credit (Section 24). | 100% of interest is deductible as a business expense. |

| Tax on Profits | Income Tax (20%, 40%, or 45%). | Corporation Tax (19% – 25%). |

| Extracting Profits | Rental profit is automatically personal income. | Requires formal salary or dividends, creating a second tax event. |

| Admin & Compliance | Annual Self Assessment tax return. | Annual accounts, company tax return, confirmation statement. |

| Mortgage Availability | Wide range of products, often with lower rates and fees. | More specialised products, typically with higher costs. |

| Personal Liability | Personally liable for all property-related debts. | Liability is limited to the company's assets. |

This table shows there’s a clear balance to be struck between tax efficiency and operational simplicity.

Making The Right Decision For Your Portfolio

So, who really benefits from going down the limited company route?

As a general rule, incorporation starts to make sense for higher-rate taxpayers who own several properties and have significant mortgage costs. For these landlords, the savings from being able to deduct all their mortgage interest usually far outweigh the extra admin and higher financing costs.

On the other hand, if you're a basic-rate taxpayer with just one or two properties, you might find that the added expense and hassle of running a company completely wipe out any potential tax benefits. Ultimately, the decision comes down to your personal tax situation, the size of your portfolio, and your long-term plans. It's a strategic choice that really needs careful calculation and professional advice to get right.

Filing Your Tax Return and Keeping Good Records

Knowing the rules of buy-to-let tax is one thing, but actually staying on top of it all year round is where the real work begins. This all comes down to mastering the admin side of being a landlord, which really boils down to two things: keeping meticulous records and filing your tax return on time.

Think of your records as the story behind the numbers on your tax return. Without that story, your carefully claimed deductions are just figures on a page, and HMRC might have a few questions. Good bookkeeping is your best friend come tax season and your strongest defence if they ever come knocking.

The Self Assessment Process for Landlords

If you’re earning money from a property, you have to tell HMRC about it. For almost every landlord, this means getting familiar with the Self Assessment system. It can feel a bit daunting at first, but once you break it down, it's perfectly manageable.

First things first, you need to get registered. If you’ve never done a Self Assessment before, you must register by 5th October after the tax year you started earning rent. Pop that date in your diary right now, because missing it can lead to penalties before you’ve even started.

Once you're in the system, it's time to file. There are two key deadlines you absolutely cannot miss:

- 31st January: This is the big one for online filing. It’s also the day your tax payment is due.

- 31st October: The deadline if you're filing an old-school paper return, though the vast majority of landlords find it much easier to do it all online.

What Records Should You Keep?

Being a good record-keeper is about more than just chucking receipts in a drawer and hoping for the best. It's about building a simple, organised system that shows you exactly where your property business stands financially. This isn't just for HMRC; it's crucial for you to manage your buy-to-let tax properly.

Your records are more than just a compliance chore; they are a vital business tool. They provide the data needed to track profitability, make informed decisions, and confidently claim every allowable expense you are entitled to.

So, what should you be holding onto? Here’s a basic checklist for every landlord:

- Income Records: A simple log of all rent payments, showing who paid, how much, and when.

- Expense Receipts: Proof for everything you've spent, from letting agent fees and insurance to that emergency plumber you had to call out.

- Bank Statements: For both your personal account (if rent goes in there) and, ideally, a separate business account for your properties.

- Tenancy Agreements: Keep copies of every agreement, past and present.

- Mortgage Statements: You'll need these to prove the exact amount of mortgage interest you've paid.

For landlords with a growing portfolio, trying to manage all this with spreadsheets can quickly become a headache. It's often worth a look to compare property management software to see how a dedicated tool can automate most of this for you.

Looking ahead, HMRC is slowly but surely pushing everyone towards a digital-first system with Making Tax Digital (MTD). The start date for landlords has been delayed, but the change is definitely coming. Getting into the habit of digital record-keeping now isn't just smart—it's getting your business ready for the future of tax.

Common Questions About Buy-to-Let Tax

When you're a landlord, a few common tax questions tend to pop up again and again. Even seasoned property investors can get stumped by the specifics. Let’s clear up some of the most frequent queries we hear.

Think of this as your go-to guide for those nagging "what if" moments that inevitably arise. Getting these details right is key to staying on HMRC's good side and running a tax-efficient business.

Do I Pay Tax If My Rental Property Is Empty?

This is a big one. What happens during those dreaded void periods when you've got no tenant and no rent coming in?

The short answer is no, you don't pay Income Tax if you have no rental income. Tax is calculated on your profits, so if there's no money coming in, there's no profit to tax. Simple as that.

Here’s the good news, though. You can still claim for the running costs you incur while the property is empty but available to let. Things like council tax, utility bills, and landlord insurance are all considered allowable expenses. These costs create a loss, which you can then carry forward to offset against profits in future years, ultimately lowering your tax bill down the line.

What Is The Difference Between Repairs And Improvements?

This is easily one of the most crucial distinctions to get your head around in the world of buy-to-let tax. Mixing these two up can lead to a rejected claim and an unwelcome bill from the taxman.

-

Repairs are all about restoring something to its previous condition. If a boiler breaks and you get it fixed, that's a repair. Replacing a few storm-damaged roof tiles? That’s a repair too. These are allowable expenses, meaning you can deduct the cost from your rental income for the year.

-

Improvements, on the other hand, involve upgrading or enhancing the property beyond its original state. Think about adding a brand-new conservatory or installing a high-tech security system for the first time. These are classed as capital expenses and can't be deducted from your rental income.

The golden rule to remember is this: are you fixing something that was already part of the property, or are you adding something entirely new or making it significantly better? Fixing is a repair; adding is an improvement.

While you can't claim improvements against your yearly profits, don't throw those receipts away. Keep them in a safe place, because these costs can be used to reduce your Capital Gains Tax bill when you eventually sell the property.

Managing the nuances of property tax can be complex. The team at Stewart Accounting Services specialises in helping landlords across the UK navigate their tax obligations with confidence, ensuring you claim everything you're entitled to. Find out how we can help you stay compliant and maximise your returns at https://stewartaccounting.co.uk.