At its core, calculating VAT is straightforward: you multiply a price by the correct VAT rate. So, to add the standard 20% VAT to a £100 item, you’d work out £100 * 0.20, which gives you £20 in tax.

The real trick, though, is knowing which rate to use and whether you're adding it to a net price (VAT exclusive) or teasing it out of a gross total (VAT inclusive).

Why Accurate VAT Calculations Are So Important

Getting your VAT figures right is about so much more than just keeping HMRC happy. It's a cornerstone of your business's financial health. A simple miscalculation can send ripples through your entire operation, messing with your cash flow, skewing your pricing, and ultimately hitting your bottom line.

I've talked to countless small business owners who initially view VAT as just another tedious chore. But once they get the hang of it, that perspective shifts. It stops being a burden and starts becoming a tool for smarter financial management. That change in mindset is key to growing your business sustainably.

Getting to Grips with the Different VAT Rates

Before you can calculate anything, you need to know which rate applies. Not all goods and services are taxed the same in the UK. Everything falls into one of three main buckets:

- Standard Rate (20%): This is the one you’ll use most of the time. It applies to the majority of goods and services, from business consultancy fees to a new company laptop.

- Reduced Rate (5%): This lower rate is for specific items, such as domestic fuel and power, energy-saving materials like home insulation, and children's car seats.

- Zero Rate (0%): Some essentials are zero-rated. This means the rate is 0%, but you still have to record the sale on your VAT return. Think most food, books, newspapers, and children's clothing.

The Real-World Impact of Getting It Wrong

Using the wrong rate or formula can have serious consequences. If you accidentally charge 20% VAT on a zero-rated item, you've not only overcharged your customer but also created a liability you'll need to sort out with HMRC.

On the flip side, if you forget to charge VAT when you're supposed to, you could be facing a hefty, unexpected tax bill that wipes out your profits.

For many business owners, the "Aha!" moment comes when they realise accurate VAT management isn't just about avoiding penalties. It's about protecting cash flow, setting competitive prices, and reclaiming every penny you're entitled to on your own business purchases.

Since it was first introduced back in 1973 at a 10% rate, VAT has become a huge part of the UK's tax system. It now makes up around 20% of all central government revenue, which explains why compliance is so closely watched. If you're interested in the backstory, the House of Lords Library has a great overview of its 50-year history.

Working Out VAT From a Net Price (Adding VAT On)

Adding VAT to your prices is probably the most common calculation you'll do. It's something you'll handle every time you quote a job or send an invoice to a customer. Honestly, it's the bread and butter of day-to-day VAT compliance for any UK business.

The good news is that the process itself is pretty straightforward. You start with the price of your goods or services – what we call the net price – and multiply it by the correct VAT rate. This tells you how much tax to add on, giving you the final gross price your customer pays.

The basic formula is simple:

Net Price x VAT Rate = VAT Amount

Once you have that VAT figure, you just add it back to your original net price to get the final total for your invoice.

A Real-World Example: Using the Standard Rate

Let's see this in action. Say you're a freelance consultant, and you've agreed on a project fee of £800. This is your net price. Since your consulting services are standard-rated, you need to add VAT at 20%.

Here’s the breakdown for your invoice:

- Work out the VAT: £800 (Net Price) x 0.20 (the 20% VAT rate) = £160

- Calculate the total to charge: £800 (Net Price) + £160 (VAT Amount) = £960

Your final invoice to the client must clearly show the subtotal of £800, the separate VAT amount of £160, and a grand total of £960. It’s a legal requirement to show the VAT as a separate figure, both for your client's records and for your own.

I’ve seen many business owners take a shortcut by simply multiplying the net price by 1.20 to get straight to the final figure (£800 x 1.20 = £960). While it’s quick, this method skips a crucial step. You don't get the separate VAT amount, which you absolutely must have for a compliant VAT invoice.

What About the Reduced Rate?

The same logic applies perfectly to the other VAT rates. The only thing you need to change is the number you multiply by.

Imagine you own a company that installs energy-saving materials, a service that qualifies for the 5% reduced rate. You've just quoted a homeowner £1,500 for a full loft insulation job.

To calculate the final bill, you'd follow the exact same steps:

- Calculate the VAT amount: Take your net price and multiply it by the 5% rate.

- £1,500 x 0.05 = £75

- Determine the final invoice total: Add that VAT amount back to your original price.

- £1,500 + £75 = £1,575

The core process doesn't change, whether the rate is 20%, 5%, or even 0%. This consistency makes it manageable once you get the hang of it. By breaking the calculation down, you can confidently apply it to any part of your business, ensuring every single invoice you send is accurate and fully compliant with HMRC rules.

Extracting VAT From a Gross Price

Sometimes, you have to work backwards. Instead of adding VAT to a net price, you’re looking at a gross price—the final total—and need to figure out just how much VAT is tucked away inside. This is a crucial skill for accurate bookkeeping, especially when you're dealing with expense receipts that only show a single, final figure.

This is where a lot of business owners trip themselves up. The most common mistake? Taking the gross amount and simply trying to subtract 20%. For instance, if you have a £120 receipt, taking 20% off gives you £96. It seems logical, but it's wrong. The original net price wasn't £96; it was £100.

The correct way to pull the VAT out of a gross price is to divide. To get back to the net amount, you divide the gross price by 1 + the VAT rate.

- For the standard 20% rate, you divide the total by 1.20.

- For the reduced 5% rate, you divide the total by 1.05.

Once you have the net price, a simple subtraction is all it takes to find the VAT amount.

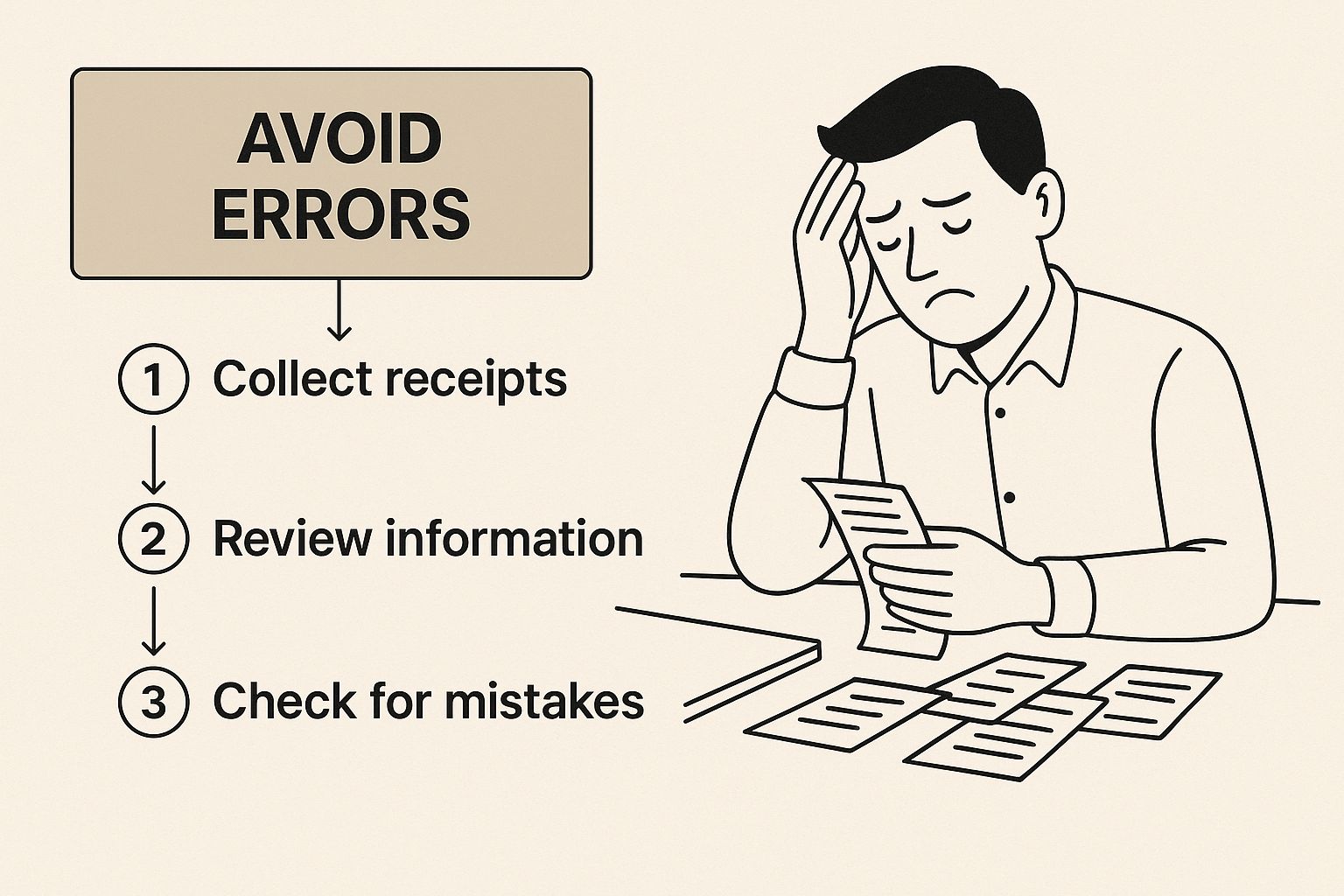

To help you avoid errors with receipts and ensure you reclaim every penny you're owed, this infographic breaks down the process visually.

As the graphic shows, a single wrong assumption can throw your numbers off. It really reinforces why using the correct division method for extracting VAT is so important.

Real-World Example: A Supplier Invoice

Let’s put this into a situation you've probably seen before. You get an invoice from a supplier for a total of £315. The invoice doesn't break down the VAT, but you know the service is standard-rated at 20%. You need to work out the VAT for your records.

Don't guess – just divide the total by 1.20.

- Find the Net Price: £315 ÷ 1.20 = £262.50

- Calculate the VAT Amount: £315 (Gross) – £262.50 (Net) = £52.50

Just like that, you can confidently record £262.50 as the business expense and £52.50 as the input VAT you can reclaim.

A quick tip from experience: For standard-rated items, an even faster way to find just the VAT amount is to divide the gross price by 6. In our example, £315 ÷ 6 = £52.50. This handy shortcut works because 20% is one-fifth of the net price, which mathematically makes it one-sixth of the gross price.

Working with Reduced Rate Expenses

The exact same logic applies to items at the reduced rate. Let’s say you’ve just paid a business energy bill that totals £210. Most business energy supplies fall under the 5% reduced VAT rate.

To find the VAT component, you just need to divide by 1.05.

- Calculate the Net Amount: £210 ÷ 1.05 = £200

- Isolate the VAT: £210 (Gross) – £200 (Net) = £10

Getting this reverse calculation right is non-negotiable if you're serious about precise financial records. It ensures your VAT returns are accurate, which is vital for staying compliant and for maximising the VAT you can claim back from HMRC.

VAT Calculation Cheat Sheet

To make things even clearer, here’s a quick-reference table. It's a great way to see the two main calculations side-by-side so you always know which one to use.

| Calculation Type | Example Price | Formula | VAT Amount | Final Price |

|---|---|---|---|---|

| Adding VAT | £100 (Net) | Net Price × 0.20 | £20 | £120 (Gross) |

| Extracting VAT | £120 (Gross) | Gross Price ÷ 6 | £20 | £100 (Net) |

Think of this table as your go-to guide. Pin it up near your desk or save a screenshot. It’s a simple way to avoid common pitfalls and keep your accounts spot-on every time.

Understanding VAT Registration and Rates

Once you've got the hang of the formulas, the real work begins: applying them correctly under HMRC's rules. The first question you need to answer is when you actually have to start charging and reporting VAT. It’s a common misconception that every business needs to do this from the get-go.

The UK rules are pretty black and white. If your business has a taxable turnover of more than £90,000 over any rolling 12-month period, you are legally required to register for VAT. This isn't a suggestion; it's a legal obligation.

As soon as you're registered, you must charge VAT on your sales, file regular VAT returns, and keep meticulous records. For a deeper dive, you can check out the history and thresholds of UK VAT.

But what if your turnover is well below that limit? You've still got a decision to make.

Should You Register for VAT Voluntarily?

Even if your turnover doesn't force your hand, you can choose to register for VAT voluntarily. This does mean you’ll have to add VAT to your prices and take on the associated paperwork. However, it unlocks a powerful advantage: you can reclaim the VAT you pay on your business expenses.

This can be a smart strategic move, especially if you have significant start-up costs or regularly purchase expensive, standard-rated items. Think about a creative agency buying high-spec computers and pricey software—reclaiming that 20% VAT can make a huge difference to cash flow. This is particularly relevant for online businesses, like those using the best places to sell digital products, where VAT rules are a critical part of the puzzle.

Input VAT vs. Output VAT

Once you're VAT-registered, your financial world will revolve around two core ideas:

- Output VAT: This is the VAT you charge your customers on your sales. Think of it as the tax you collect for HMRC.

- Input VAT: This is the VAT you pay on your business purchases, from stock to stationery. This is the tax you can potentially reclaim from HMRC.

Your VAT return is simply the process of squaring up these two amounts.

At its heart, a VAT return is a simple calculation: subtract the total Input VAT you've paid from the total Output VAT you've collected. If you've collected more than you've paid, you owe the difference to HMRC. If you've paid more than you've collected, you can claim a refund.

Getting this right is more than just compliance; it's good financial management. It shifts VAT from a simple line on an invoice to a core component of your financial strategy, helping you manage cash flow and keep your business on a solid, compliant footing.

Getting VAT Right: How to Avoid Common Pitfalls

Every business owner has a horror story about a VAT near-miss or, worse, a costly mistake. I've heard plenty over the years. Learning from where others have tripped up is one of the fastest ways to shore up your own financial processes. After all, when it comes to calculating VAT, tiny errors can snowball into major headaches and financial pain.

What are the most common tripwires? Applying the wrong rate is a big one. For instance, charging the standard 20% on something that should be zero-rated, like children's clothing, not only overcharges your customer but creates a real mess in your reporting. Another classic blunder is trying to find the VAT on a price by just subtracting 20% from the total. It’s a widespread error that will always give you the wrong figures for your records.

These mistakes are incredibly common, but the good news is they are also entirely avoidable with the right habits and tools.

Building Your Financial Safety Net

The best defence against mistakes isn't some complex, expensive system. It’s a solid, repeatable process that you stick to. It really is that simple.

A great starting point is to double-check every single sales invoice before it leaves your outbox. Does the VAT rate actually match the product or service you've sold? Is the VAT amount clearly listed as a separate figure? It takes seconds, but it can save you hours of stress later.

This same diligence needs to apply to your purchase invoices, too. Get into the habit of scrutinising receipts to make sure you're only reclaiming VAT on legitimate business expenses that carry a standard or reduced rate.

Here are a few practical steps you can take to build that safety net:

- Trust the Tech: Modern cloud accounting software is your best friend here. It's built to automate these calculations, which dramatically cuts down the risk of human error. Think of it as an investment that pays for itself in accuracy and peace of mind.

- Create a Rate "Cheat Sheet": It sounds basic, but it works. Make a simple list of your most common products or services and their correct VAT rates (20%, 5%, or 0%). Keep it pinned to your desk or saved on your desktop for quick reference.

- Schedule Regular Reviews: Don't let everything pile up until the VAT return deadline is looming. A quick monthly check-in on your books helps you spot and fix an issue before it becomes a much bigger problem.

The real goal here is to turn these checks into muscle memory. When accurate calculations become second nature, you free up mental energy to focus on what really matters—growing your business, not sweating compliance.

Don’t underestimate the collective impact of these small errors. The VAT Revenue Ratio (VRR), which measures how efficient a country's VAT system is, put the UK at 0.49 in 2022. That's a fair bit below the OECD average of 0.58. This gap highlights just how much potential revenue is lost to issues like incorrect rate application and compliance failures. You can dive deeper into these consumption tax trends from the OECD if you're interested.

To help prevent these costly errors, you might also look into tools like an AI-powered Finance Tax Document Analyzer, which can significantly reduce the chance of making common mistakes. Adopting these habits and using the right tools is your best strategy for staying compliant and financially secure.

Your Top VAT Questions, Answered

Even after you've got the hang of the basic formulas, real-world scenarios can throw a spanner in the works. Let's be honest, certain questions crop up time and time again when you're actually doing your books. Here are some quick, practical answers to get you past those common sticking points.

What’s the Quickest Way to Work Out 20% VAT?

The best shortcut depends on whether you're adding VAT to a price or trying to find it in a total you've already paid.

To add 20% VAT to your price, just multiply the net amount by 0.20. It’s that simple. If you’re charging £100 for a service, the VAT is £100 x 0.20, which gives you £20.

Need to find the VAT that’s already included in a gross price? The handiest trick in the book is to divide the total by 6. Say you have a receipt for £120; that total includes £20 in VAT (£120 ÷ 6). This little shortcut is a genuine timesaver for day-to-day bookkeeping.

Can I Work Out the VAT Backwards From a Total?

Yes, you absolutely can—and you’ll need to. This is what accountants call "extracting VAT," and it's a crucial skill for logging your expenses correctly, especially when a receipt only shows the final price. It’s how you figure out the VAT you’re allowed to reclaim.

For any standard-rated item, the proper way to do this is to divide the gross total by 1.20. That gives you the original price before VAT was added. From there, just subtract this net price from the gross total to find the exact VAT amount.

- For example: You have a supplier invoice for £180.

- Find the net price: £180 ÷ 1.20 = £150

- Find the VAT amount: £180 – £150 = £30

Using this method guarantees your figures are spot on for your VAT return.

A word of warning: one of the most common mistakes is trying to find the VAT by simply taking 20% off the total price. This will always give you the wrong number. Remember, VAT is calculated as 20% of the net price, not the gross, which is why the division method works.

Do I Charge VAT on Services or Just Products?

This is a big one. Many business owners assume VAT only applies to physical goods, but that's a misconception. In the UK, VAT is charged on most goods and services, unless they are specifically marked as exempt or zero-rated by HMRC.

In fact, a huge range of professional services are standard-rated. This typically includes things like:

- Business consulting and coaching

- Marketing and advertising work

- Graphic design and website development

- Accountancy and legal advice

Unless a service you provide is officially exempt (like some insurance or financial services), you should plan on applying the standard 20% rate as soon as you are VAT registered.

When Do I Actually Need to Register for VAT?

You are legally obligated to register for VAT with HMRC as soon as your VAT taxable turnover for any rolling 12-month period hits the government's threshold. For 2024, that threshold is £90,000.

It's not just about when you have to register, though. You can also register voluntarily before you reach that figure. This can be a smart move, particularly if your business buys a lot of standard-rated supplies or equipment, as it means you can start reclaiming the input VAT you're paying out.

Feeling like you're drowning in VAT returns and compliance paperwork? Let the experts take it off your plate so you can get back to what you do best. At Stewart Accounting Services, we provide personalised accounting and VAT support to help you save time, boost your profitability, and sleep better at night. Learn more and get in touch with our friendly team today.