When you get hit with a Corporation Tax bill that your business can't cover right away, it's easy to feel a sense of dread. But there's a clear, structured path forward that many directors have successfully navigated.

A corporation tax payment plan, which HMRC officially calls a 'Time to Pay' arrangement, is a formal agreement that lets your company settle its tax bill in manageable monthly instalments. It’s a genuine lifeline designed for otherwise healthy businesses that have run into temporary cash flow problems, helping them clear their debt over a set period.

Getting to Grips with the 'Time to Pay' Arrangement

Let's be clear: needing to set up a payment plan isn't a sign of failure. It’s a practical tool for companies dealing with the kind of financial headwinds that can catch anyone off guard. From my experience, HMRC would much rather work with you to find a realistic solution than resort to more drastic measures like starting insolvency proceedings.

Think of this arrangement as creating essential breathing room. It gives you the space you need to stabilise, get your finances back on track, and refocus on what you do best—running your business.

What HMRC Wants to See

To get an agreement over the line, you need to convince HMRC of two things: your business is fundamentally sound, and your cash flow issues are genuinely temporary. It all comes down to a few core principles.

- Act Fast: Don't just sit on the bill and wait for the red reminder letters to start piling up. Contacting HMRC as soon as you know there's a problem shows you're taking the debt seriously.

- Be an Open Book: You’ll need to provide a full and honest picture of your company's financial situation. Hiding details will only hurt your case.

- Make a Sensible Offer: Your proposed payment schedule can't be based on guesswork. It needs to be backed by a solid cash flow forecast that proves you can stick to the plan.

This is more important than ever. The main corporation tax rate jumped to 25% in April 2023, up from 19%. That's a significant increase that can really squeeze a company's finances, making these payment plans a critical tool for many.

Before you even think about proposing a plan, you need to know exactly what you owe. A great first step is to use a tool like our Corporation Tax Calculator to get a precise figure.

To help you prepare, here’s a breakdown of what HMRC will be looking for when you make your proposal.

Key Factors for a Successful Payment Plan Application

This table summarises the essential elements HMRC considers when you propose a 'Time to Pay' arrangement.

| Factor | Why It Matters to HMRC | How to Prepare |

|---|---|---|

| Proactive Contact | Shows responsibility and a genuine intent to pay. They are far more receptive to those who call them first. | Contact HMRC as soon as you realise you can't pay the full amount by the deadline. Don't wait for them to chase you. |

| Clear Explanation | They need to understand why you can't pay. Was it a major client paying late, or an unexpected cost? | Prepare a brief, honest summary of the events that led to the shortfall. Avoid vague excuses. |

| Realistic Proposal | The proposed monthly payment must be affordable for you and acceptable to them. It needs to clear the debt in a reasonable timeframe. | Create a simple cash flow forecast for the next 12 months to prove you can afford the proposed instalments. |

| Commitment to Future Taxes | They need assurance that you can and will meet all future tax liabilities on time. | Make sure all your other tax returns (like VAT and PAYE) are up to date and be ready to confirm this. |

Getting these four elements right will massively increase your chances of getting a "yes" from HMRC. It's all about demonstrating that you have a credible plan to get back on solid ground.

Checking if Your Company Is Eligible

Before you even think about calling HMRC, it’s worth taking a moment to work out if your company actually qualifies for a corporation tax payment plan. HMRC isn’t just ticking boxes; they’re looking for a genuine, provable reason for your payment struggles and solid evidence that your business is still viable in the long run.

Think of it this way: a manufacturing business that suddenly loses its main supplier has a clear-cut case. Production grinds to a halt, sales dip, and cash flow dries up. This is a classic short-term problem that HMRC will likely see as a valid reason to set up a Time to Pay arrangement.

On the flip side, some situations are non-starters. If your company has a track record of filing late or defaulting on previous tax payments, HMRC will probably see this as a sign of poor management, not a temporary blip. They’ll be far less inclined to offer a payment plan if they believe the underlying business is in trouble.

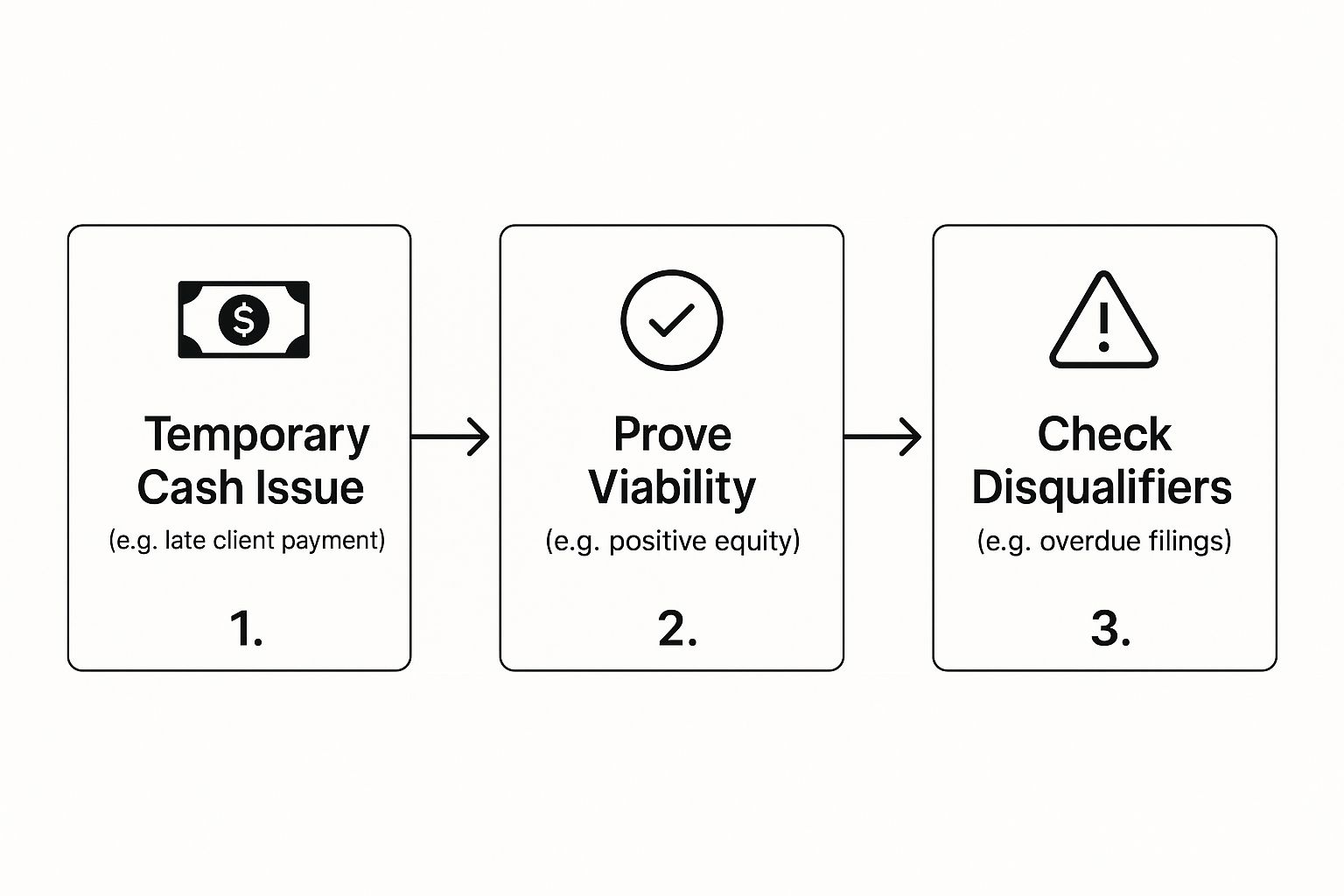

This infographic gives you a good idea of how HMRC thinks when they're reviewing a request.

As you can see, it all comes down to proving that your cash flow problem is temporary and that your business has a future.

Understanding HMRC's Perspective

HMRC's approach is actually quite practical—they want to get the tax they're owed. With corporation tax receipts hitting a massive £88.3 billion in 2022-23, they have a strong incentive to work with businesses. After all, a healthy company that can pay its bill over a few months is a much better prospect than one forced into insolvency. You can read more about the trends in corporation tax receipts on GOV.UK.

The single most important question you need to answer for HMRC is this: "Is this a short-term cash flow problem in a viable business, or is the business itself failing?" Your entire case hangs on proving it’s the former.

Being prepared is everything. Before you pick up the phone, make sure you have your recent management accounts, a list of confirmed future sales or orders, and a clear, honest explanation for why you’re in this position. Showing them you have a clear path back to profitability will put you in a much stronger position to negotiate a corporation tax payment plan.

How to Negotiate Your Payment Plan with HMRC

Setting up a payment plan with HMRC isn't about asking for a favour; it's a negotiation. Your success will come down to one thing: preparation. Going into that call unprepared is a recipe for disaster and will likely end with a firm "no". You need to approach HMRC’s Payment Support Service with a clear, well-thought-out proposal, not just a problem.

The key is to shift the conversation from a desperate plea for help into a structured, professional discussion about your business's finances. Before you even pick up the phone, you need to have all your ducks in a row.

Getting Your Information Ready for the Call

Being organised isn't just about making the call go smoothly; it shows HMRC you're taking the situation seriously. If you're scrambling for figures or can't answer basic questions, it instantly damages your credibility.

You'll need:

- Your Company's UTR: The 10-digit Unique Taxpayer Reference for your business.

- The Exact Tax Bill: The precise amount of Corporation Tax you owe, as shown on your CT600 return.

- A Clear Reason for Non-Payment: Be ready to explain exactly why you can't pay the full amount on time. For example, "Our biggest client, who makes up 40% of our revenue, is 60 days late on their invoice, which has created a temporary cash flow gap."

- Your Payment Proposal: You must know exactly what you can realistically afford to pay each month and over what period.

Since 2011, all Corporation Tax returns have been filed online, with payments made electronically. HMRC's systems are efficient, and they expect the same level of organisation from you. For more background, you can find details on HMRC's digital tax requirements on GOV.UK.

To make sure you don’t miss anything crucial, use this checklist to gather your information before dialling.

Essential Information for Your HMRC Call

| Information Category | Specific Details Required | Quick Tip |

|---|---|---|

| Business Identifiers | Your 10-digit Company UTR and your Companies House number. | Have these written down in front of you. Don't rely on memory. |

| Tax Bill Details | The precise Corporation Tax amount owed and the payment deadline. | Double-check the figure against your latest CT600 filing. |

| The 'Why' | A brief, factual reason for the payment difficulty (e.g., client bankruptcy, unexpected costs). | Avoid vague excuses. Stick to specific business events. |

| Your Financial Picture | Current bank balance, key monthly income, and essential outgoings. | This proves your proposed payment is based on real numbers. |

| Your Payment Offer | The exact monthly amount you can afford and the number of months to clear the debt. | Calculate this beforehand. Don't try to work it out on the call. |

Having these details to hand turns a potentially stressful call into a straightforward business conversation.

How to Frame the Conversation for Success

When you get through to an advisor, the way you present your case is just as important as the numbers themselves. You need to walk them through the situation logically, proving you're in control and have a plan.

Start with a straightforward explanation of why you're calling. Be honest about the situation and briefly mention what you're doing to fix it—whether that’s chasing down late payments or cutting non-essential spending.

Your payment offer should be a solution you’re presenting, not a question you’re asking. Don't say, "What can you do for me?" Instead, confidently state, "Looking at our cash flow, we can pay £X per month for Y months to clear this liability."

This proactive approach completely changes the dynamic. It shows the HMRC advisor you’ve done your homework, analysed your finances, and are putting forward a workable solution. It positions you as a responsible director actively managing a temporary problem, making them far more likely to agree to your terms.

How to Craft a Proposal HMRC Can't Refuse

When you're trying to set up a corporation tax payment plan, your success boils down to one thing: a credible proposal. This isn't the time to guess or pluck a number out of thin air. You need to present a realistic figure that your cash flow proves you can consistently afford.

The absolute foundation of a convincing proposal is an honest cash flow forecast. It's a simple case of mapping out your guaranteed monthly income and then subtracting your essential business outgoings. We're talking about the non-negotiables like rent, salaries, and key supplier costs.

Whatever is left over is the maximum you can realistically commit to your tax debt. It can be tempting to offer a higher figure to look good, but that’s a rookie mistake. If you miss just one payment, the whole arrangement can fall apart, so be honest with yourself and with HMRC.

Building Your Case with a Cash Flow Forecast

A solid forecast does more than just give you a monthly payment figure. It’s your evidence. It shows HMRC that your financial issues are temporary and, more importantly, that you have a clear plan to get back on your feet. Without this proof, you're just asking for a favour; with it, you're presenting a viable business case.

Your forecast should look ahead for the next 6 to 12 months. That’s the sweet spot—it’s long enough to demonstrate a pattern of recovery but not so far into the future that it becomes pure guesswork.

Keep in mind that a typical Time to Pay arrangement lasts around 6 to 12 months. If you pitch a payment schedule that stretches on for years, it sends a red flag to HMRC that your business might not be viable in the long run.

I’ve seen it time and time again: a realistic, well-supported proposal always wins. Offering £500 a month backed by a clear forecast is infinitely more powerful than a vague promise to pay £2,000 that you can't actually prove you can afford.

Once you get the green light, you'll need to make the agreed payments. For a full rundown on the different ways to do this, check out our guide on how to pay Corporation Tax online.

Ultimately, a well-prepared proposal changes the entire dynamic. You're no longer just someone with a tax problem. You're a responsible director actively managing a temporary setback, making HMRC far more likely to grant you the breathing room your business needs to recover.

Common Mistakes to Avoid

Getting HMRC to agree to a payment plan feels like a huge weight off your shoulders. But don't get too comfortable. I've seen too many businesses get a 'Time to Pay' arrangement only to have it collapse because of a few common, and entirely avoidable, mistakes.

The single biggest error? Going silent. It’s tempting to ignore that ringing phone or let the brown envelopes pile up, but this is the fastest way to get your plan cancelled. To HMRC, silence looks like avoidance, and they will pull the plug on your agreement without a second thought.

Don't Let Other Taxes Slide

Your 'Time to Pay' arrangement for Corporation Tax doesn't exist in a vacuum. A critical mistake is thinking you can let other tax obligations slip while you focus on clearing this one debt. That's not how it works.

You absolutely must stay current with all your other tax duties. This includes:

- VAT: Get your returns filed and payments sent on time, every time.

- PAYE: Make sure your employees' National Insurance and income tax deductions are paid by the deadline.

HMRC sees your entire tax picture. If you fall behind on PAYE or VAT, they'll see it as proof that the business's financial problems are bigger than you let on, and they'll cancel your Corporation Tax plan.

Remember, a 'Time to Pay' arrangement is a lifeline based on trust. Defaulting on other tax payments shatters that trust. It sends a clear signal to HMRC that your business might not be viable, leaving them with little choice but to take sterner action.

Honesty and proactivity are your best tools here. If you can see you’re going to struggle with an upcoming instalment, you need to call HMRC before you miss the payment. Owning the problem upfront shows you're on top of things and might allow you to adjust the plan.

Of course, this means having a solid grasp of your numbers. It's the perfect time to explore new ways to improve cash flow to create a bit of a safety net. Proving you're also using smart strategies to reduce business expenses will also put you in a much stronger position if you ever need to have that difficult conversation with HMRC.

Got Questions? We've Got Answers

When you're trying to set up a Corporation Tax payment plan, a lot of questions can pop up. It's completely normal. Let's walk through some of the most common ones we hear from business owners just like you.

What if HMRC Says No to My Offer?

First off, don't panic if HMRC rejects your initial proposal for a ‘Time to Pay’ arrangement. It happens, and usually for a couple of key reasons: maybe the company has a history of late payments, or the monthly amount you've offered just isn't seen as realistic for the size of the debt.

Your immediate next step should be to ask the HMRC advisor on the phone exactly why it was turned down. If the issue is simply that your proposed payment is too low, you might be able to hash out a new, more acceptable figure right there on the call.

If it's a more complicated problem, it’s often best to politely end the call. Take a step back, get some professional advice, and then go back to HMRC with a much stronger, better-prepared proposal.

Does HMRC Stop Charging Interest During the Plan?

Unfortunately, no. A payment plan doesn't hit pause on the interest. Late payment interest will keep being added to whatever amount you still owe, and it accrues daily.

The longer your repayment plan, the more interest you'll end up paying on top of the original tax bill. It’s absolutely vital to factor this extra cost into your cash flow forecasts to make sure the plan remains affordable from start to finish.

Can I Just Set This Up Online?

This is a common point of confusion. While you can sort out payment plans for things like Self Assessment or VAT through an online portal, that's not the case for Corporation Tax.

To get a plan in place, you must call HMRC’s Payment Support Service directly. This phone call is non-negotiable because they need to have a proper conversation to understand your company's specific situation before they can agree to any terms.

Will a Payment Plan Hurt My Company's Credit Rating?

A 'Time to Pay' arrangement is a private matter between your company and HMRC. It's a confidential agreement, so it won't be reported to credit reference agencies like Experian or Equifax. It simply doesn't show up on your public credit file.

Here’s the crucial bit, though: completely failing to pay your tax can lead to serious legal action, like a County Court Judgement (CCJ). A CCJ will show up on your credit file and cause significant damage. Setting up a payment plan is how you proactively avoid that disastrous outcome.

If you’re concerned about the potential fallout, you can learn more about what happens if you cannot pay your tax bill in our detailed guide.

At Stewart Accounting Services, we're experts at helping businesses find their footing in tricky financial situations, and that includes negotiating directly with HMRC. If you need a hand securing a payment plan and getting your business finances sorted, get in touch with our team today.