That sinking feeling when you spot a mistake on a past VAT return is something most business owners have felt. Don't panic. Correcting VAT errors is usually far more straightforward than you think, but you do need to act quickly and follow the right steps.

For most small slip-ups, you can simply make an adjustment on your next VAT return. However, for bigger mistakes or anything deliberate, you’ll need to formally tell HMRC what’s happened.

What to Do The Moment You Find a VAT Error

Finding a mistake in your books can make your heart skip a beat, but the way forward is a clear process, not a crisis. Your first move isn't to frantically call HMRC. It’s to get all your facts straight. You need to understand the full picture before you can figure out the best way to fix it.

Think of yourself as a detective. Your job is to find out exactly what went wrong and, just as importantly, why it happened. Was it a simple typo when entering a sales figure? A misunderstanding of a complex VAT rule? Or maybe the wrong VAT rate was applied to a whole batch of transactions? Pinpointing the root cause is a critical first step.

Work Out the Real Financial Impact

Once you know the 'what' and the 'why', it's time to crunch the numbers. You need to calculate the net value of the error, which isn't always as simple as it sounds. You have to balance out any underpayments against any overpayments from the same accounting period.

For instance, you might discover you undercharged a customer by £500 in output tax. But in that same quarter, you also realised you forgot to reclaim £200 of input tax from a supplier invoice. In this scenario, the net error is an underpayment of £300, not the full £500. It's this net figure that HMRC cares about.

Pull together a clear, detailed record that includes:

- The exact VAT period(s) affected by the error.

- A clear description of what each mistake was.

- The amount of VAT you either underpaid or overpaid for each transaction.

- The final, total net value of all the errors combined.

From my experience, a surprising number of these issues trace back to dodgy invoices. Making sure your team knows exactly what should be on a VAT invoice can stop these problems from ever starting.

Take your time with this part. A thorough, well-documented investigation doesn't just prepare you for the next steps; it shows HMRC you’re taking your obligations seriously. That kind of diligence can make a real difference if they start considering penalties.

Choosing Your Correction Method

With all the facts laid out, you can now decide on the right way to correct the mistake. HMRC gives you two main options, and your choice almost always comes down to the net value of the error you calculated.

The two paths are:

- Adjusting your next VAT return: This is the easiest route, but it’s only for smaller errors that fall below a certain threshold.

- Making a formal disclosure: For anything over the threshold, or for errors that were made deliberately, you have to notify HMRC directly. This is usually done through their online service or by submitting a Form VAT652.

Getting your internal processes right is a massive help when dealing with VAT corrections. Learning how to create truly effective how-to guides for your team can massively improve accuracy and compliance across the board.

Next, we’ll get into the specific financial thresholds that separate these two methods, so you can confidently pick the right approach for your situation.

Getting to Grips with HMRC’s Correction Thresholds

https://www.youtube.com/embed/Ecupb16DKiU

When it comes to correcting a VAT mistake, the size of the error really does matter. It dictates the entire process you need to follow. HMRC has set out clear financial thresholds that separate minor slip-ups you can fix on your next return from more significant errors that demand a formal disclosure.

Getting your head around these limits is the key to choosing the right path and staying on the right side of the taxman. It’s the main fork in the road; get this bit right, and the rest is straightforward. Get it wrong, and you could end up creating more headaches for yourself down the line.

The Key Numbers for VAT Corrections

The most common threshold you'll hear about is for net errors under £10,000. If the total value of your mistakes in a VAT period adds up to less than this, you can usually make a simple adjustment on your next VAT return. This is by far the easiest way to handle things.

But there's another layer to this. You can also use this simple adjustment method for net errors that fall between £10,000 and £50,000, but there’s a catch. This is only allowed if the error amount is less than 1% of your turnover – that's the figure you put in Box 6 of the VAT return you're submitting.

This two-part check is designed to keep things proportional. It stops larger businesses from quietly adjusting chunky sums of money, even if they're under £50,000, without giving HMRC a heads-up.

Putting It Into Practice: A Quick Example

Let's see how this works in the real world.

Imagine a marketing agency finds it undercharged VAT on a few client projects in the last quarter. They run the numbers and calculate the net error is £12,000.

At first glance, that's over the simple £10,000 limit. But their turnover for the current VAT period they’re about to file is £1.5 million.

To see which method to use, they need to calculate 1% of that turnover:

- 1% of £1,500,000 = £15,000

Because their £12,000 error is less than this £15,000 ceiling, they’re in the clear. They can correct the mistake by simply adjusting their next VAT return.

Now, if their turnover had been lower, say £800,000, the 1% limit would only be £8,000. In that scenario, their £12,000 error would have breached the threshold, forcing them to make a formal disclosure to HMRC.

Key Takeaway: It's not just about the absolute value of the error. Once you go over £10,000, you must compare the mistake to your turnover for the current return period. Forgetting this second step is a really common pitfall.

Don't Forget the Four-Year Time Limit

There’s another critical rule to keep in your back pocket: the time limit. You can only correct accidental errors that happened within the last four years. This four-year clock starts ticking from the end of the VAT accounting period where the mistake was made.

So, if you dig up an error from five years ago where you underpaid VAT, you generally don't have to correct it, as long as it was a genuine mistake. The flip side is also true – if you overpaid, you sadly can't claim that money back if it’s outside this four-year window.

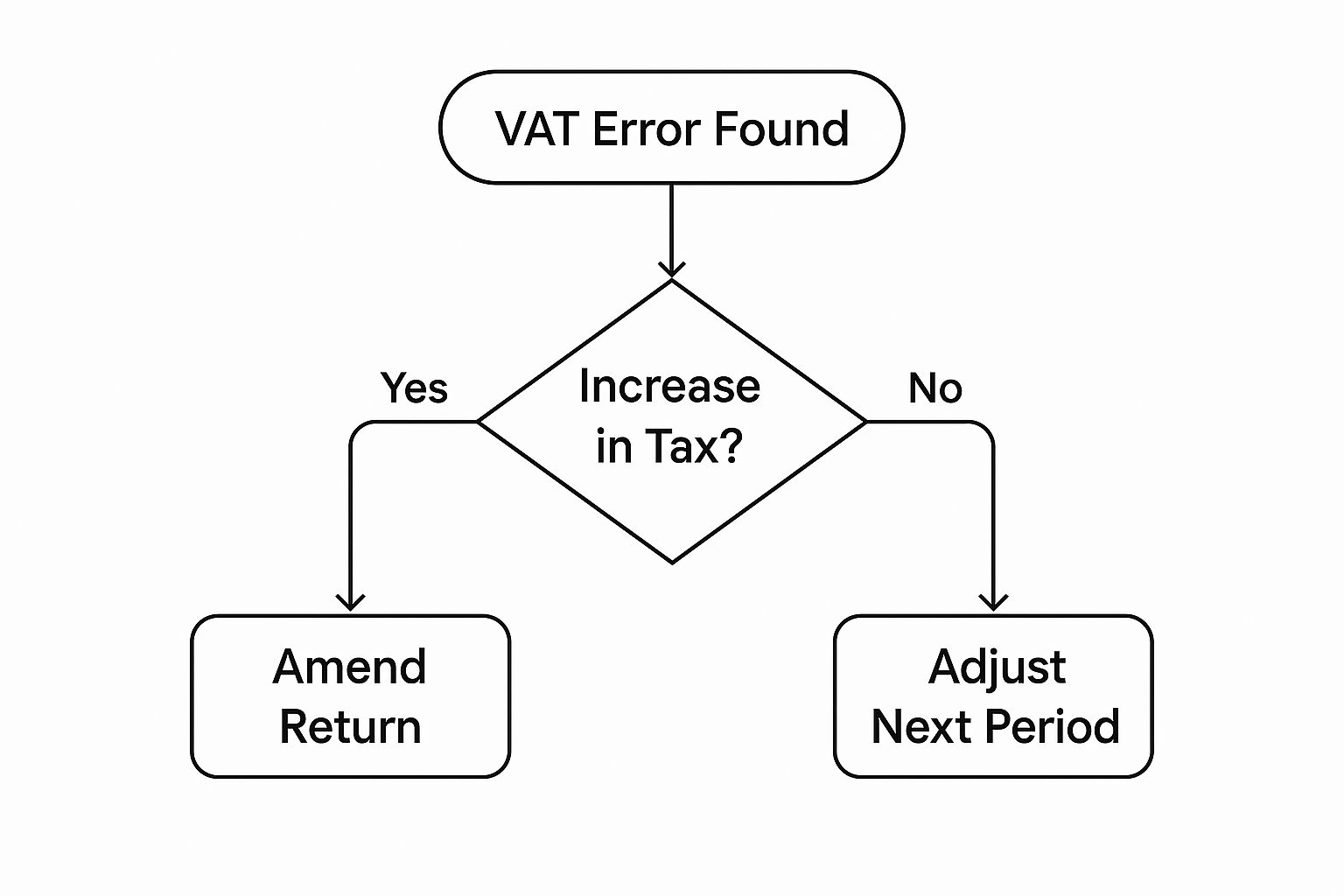

This quick diagram helps visualise the decision-making process.

As you can see, the first question is whether the error means you owe more tax, which helps steer you towards either amending a past return or adjusting the next one.

It’s crucial to remember that these limits are only for genuine, unintentional errors. If HMRC finds that a mistake was made deliberately, the rules change completely. You must disclose it immediately, no matter how small the amount or how long ago it happened.

To quickly summarise which method you should be using, this table breaks it down based on the value of the error.

VAT Error Correction Method at a Glance

| Net Error Value | Condition | Correction Method |

|---|---|---|

| Under £10,000 | No turnover condition applies. | Adjust on your next VAT return. |

| £10,000 – £50,000 | Net error is less than 1% of your Box 6 turnover. | Adjust on your next VAT return. |

| £10,000 – £50,000 | Net error is more than 1% of your Box 6 turnover. | Submit Form VAT652 to HMRC. |

| Over £50,000 | No turnover condition applies. | Submit Form VAT652 to HMRC. |

| Any value | The error was deliberate. | Submit Form VAT652 to HMRC. |

Ultimately, the UK's system is designed to be practical. Since July 2008, these rules have allowed businesses to handle minor issues without fuss. Anything that falls outside these thresholds, or was done deliberately, needs to be formally reported using HMRC's VAT652 form. You can find more on the nuances in this detailed tax adviser article.

Handling Small Errors on Your Next VAT Return

Thankfully, for most minor VAT slip-ups, HMRC provides a straightforward fix: you can simply adjust your next VAT return. This is the go-to method for small errors because it avoids the hassle of submitting separate forms or formally disclosing the mistake.

Think of it as a built-in self-correction tool. As long as the error falls below certain financial thresholds, you can handle it in your current VAT period. It’s a practical approach that saves everyone time, but you have to get it right.

The key is making sure your mistake qualifies. If the net value of all errors you’ve found for a past period is under £10,000, you’re generally good to go. This threshold can extend up to £50,000 in some cases, provided the error is less than 1% of your turnover for that return period.

How to Calculate the Net Error Adjustment

First things first, you need to work out the exact figure to adjust. It's not just about one mistake; you need to find the net error. This means you have to offset any VAT you've overpaid against any VAT you've underpaid in the same return period.

Let's look at a real-world example. Imagine a small retailer realises they’ve been charging the standard 20% VAT on a line of children's clothing, which should have been zero-rated.

- Output Tax Overpayment: They’ve incorrectly paid £1,200 in output tax to HMRC.

- Input Tax Underclaim: While investigating, they find a supplier invoice they forgot to claim, which had £300 of input tax on it.

In this case, both errors work in the business's favour. The £1,200 overpayment is owed back to them, and so is the unclaimed £300. The total net adjustment is £1,500, which they can reclaim from HMRC.

Making the Adjustment in Your Software

With your net figure calculated, the next step is to plug it into your accounting software. Whether you use Xero, QuickBooks, or another platform, the principle remains the same. You'll be adjusting the figures that populate Box 1 (VAT due on sales) and Box 4 (VAT reclaimed on purchases).

For our retailer, that £1,500 net error is a refund due. They would increase the total in Box 4 (VAT reclaimed) by £1,500. This simple action reduces the total amount they owe HMRC for the current period. If you need a refresher on the basics of putting a return together, our guide on how to do VAT returns is a great place to start.

Key Takeaway: You absolutely must keep a detailed record of why you made the adjustment. Don't just change the numbers and move on. Maintain a clear log explaining the error, the period it belongs to, and how you calculated the correction.

Keeping Good Records and Avoiding Common Mistakes

Meticulous record-keeping isn't optional here. If HMRC ever opens an enquiry, they will want to see the audit trail for any adjustments you've made. Your correction records should clearly state:

- The date you found the error.

- The VAT period the mistake happened in.

- A simple description of the problem (e.g., "Incorrect VAT rate on zero-rated goods").

- The amount of VAT overpaid or underpaid.

- The full calculation showing how you arrived at the net adjustment.

A very common pitfall is to focus on one significant error while missing smaller ones from the same period. Always take a moment to double-check everything before finalising your adjustment. You need to correct the true net position, not just a single transaction, otherwise you risk creating a new error that will need fixing down the line.

Handling Significant Errors with Form VAT652

While adjusting your next VAT return is a handy fix for small slip-ups, some mistakes are simply too big to be swept under the rug that way. When an error crosses certain financial thresholds—or if it was made deliberately—you have to make a formal disclosure to HMRC. This is often called Method 2, and it involves notifying them directly, usually through their online service or by submitting Form VAT652.

Don't let the sound of a "formal disclosure" intimidate you. Think of it as a structured, transparent way to get things right. It's a direct conversation with HMRC that, when you handle it properly, protects your business from much bigger headaches down the line.

The first, most critical step is knowing when you must take this route. The rules are pretty black and white, so understanding where you stand is essential to correcting your VAT records properly.

When Is Formal Disclosure a Must?

You’re required to use the formal disclosure route in a few specific scenarios. There’s no grey area here; if your error fits any of these criteria, you have to notify HMRC directly.

This method gets triggered when the net value of your mistake:

- Is more than £50,000. This is a hard limit. Any error over this amount automatically requires a formal notification.

- Is between £10,000 and £50,000 and it also happens to be more than 1% of your Box 6 turnover for the VAT period in which you discovered the error.

- Was deliberate, no matter the amount. This is for any mistake you knowingly made, whether you were understating sales or overclaiming input tax.

HMRC takes deliberate errors very seriously. Trying to bury a deliberate mistake in a routine adjustment on your next return is a recipe for disaster and will almost certainly lead to higher penalties.

A Crucial Insight: Making a voluntary, unprompted disclosure is one of the most powerful things you can do. When you tell HMRC about an error before they find it, it can dramatically reduce penalties. For careless mistakes, penalties can often be cut right down to zero. It shows you're taking your tax responsibilities seriously.

How to Complete Your Notification to HMRC

Whether you use the online portal or fill out the actual Form VAT652, the information you need to provide is the same. Your goal is to give HMRC a full, clear picture of what went wrong. Vague or incomplete submissions will only invite more questions and scrutiny.

For each error you’re correcting, be prepared to provide:

- The VAT period it happened in: Pinpoint the exact quarter or month.

- A clear description of the error: Be specific. Saying "Input tax was overclaimed on exempt supplies" is far better than a vague "Made a mistake with expenses."

- The amount of VAT underpaid or overpaid: Detail the precise figures for each individual mistake.

- How the error occurred: A brief, honest explanation of what caused it is vital. Was it a software glitch, a misunderstanding of the rules, or just plain human error?

This detailed breakdown isn't just about ticking boxes; it helps HMRC assess the behaviour behind the mistake, which directly influences any potential penalties they might apply.

The good news is that for most honest mistakes, there are clear time limits. HMRC requires businesses to correct VAT errors within a 4-year time limit from the end of the accounting period where the error occurred. This rule, however, goes out the window for deliberate mistakes—those have no time limit for correction. You can find more details about the VAT error correction process on quaderno.io.

Ultimately, using Form VAT652 is about taking control of the situation. It’s your chance to correct the record properly, minimise financial penalties, and maintain a good relationship with the tax authorities.

Navigating Digital Corrections and Common Pitfalls

The move to Making Tax Digital (MTD) was meant to make everything more accurate, but let's be realistic – mistakes still happen. Knowing how to sort them out in this digital-first world is essential for staying on the right side of HMRC.

One of the biggest tripwires I see is with formal disclosures. When you notify HMRC of a larger error using their online service, there’s a golden rule: do not go back and change the original figures in your accounting software. That first, incorrect submission needs to stay exactly as it is in your records.

Think of your notification to HMRC as the official fix. It creates a clean, clear audit trail. If you start tinkering with historical data in your MTD software after you've already filed, you're just creating mismatches that will cause major headaches if HMRC ever decides to take a closer look.

What Isn't a VAT Error

It’s just as important to know what doesn't count as a mistake. Some things are just part of the normal ebb and flow of VAT accounting. If you try to correct these as "errors," you’ll end up filing incorrectly and could even face penalties.

These are standard adjustments, not errors:

- Bad Debt Relief: This is for when you need to claim back VAT you’ve already paid on an invoice that, unfortunately, your customer is never going to settle.

- Capital Goods Scheme Adjustments: These are the routine tweaks you make to the input tax claimed on big-ticket assets over several years.

- Partial Exemption Adjustments: This is the yearly calculation you have to do if your business makes both taxable and exempt supplies.

These all have their own specific procedures and belong in the relevant VAT return period. They aren't historical mistakes.

The error correction process is strictly for genuine blunders—things like using the wrong tax rate or a simple calculation slip-up. Standard VAT accounting adjustments are a different beast altogether.

Avoiding Common Correction Pitfalls

When you're in the thick of correcting a VAT error, a few common mistakes can catch out even the most careful business owner. Knowing what they are can save you a world of pain.

First up, people often get the 1% rule wrong for errors between £10,000 and £50,000. The key is that the 1% is calculated against your Box 6 (turnover) figure on the return where you're making the adjustment—not the return where the mistake originally happened. That's a crucial distinction that determines which correction method you can use.

Another classic pitfall is poor record-keeping. A quick note in your files saying "Corrected VAT error" just won't cut it. You absolutely must keep a detailed log explaining what the error was, which period it belongs to, how it occurred, and the full breakdown of how you calculated the net VAT adjustment. This is non-negotiable.

With MTD, the need for solid digital records has become paramount. The whole system relies on a clear, unbroken digital trail from transaction to submission. We cover this in more detail in our guide on VAT digital record keeping.

Finally, since so many errors come down to simple human mistakes during data entry, it pays to be proactive. If you can automate data entry to reduce errors, you're not just saving time; you're cutting off a major source of potential VAT headaches at the root.

Common Questions on Correcting VAT Errors

Even with the best guidance, dealing with VAT errors can throw up some tricky questions. When you're looking back at historical mistakes, thinking about potential penalties, or just trying to get the calculations right, it’s easy to feel a bit overwhelmed.

Let’s walk through some of the most common queries I hear from business owners. Getting these details right means you can fix the original mistake and handle the whole process with confidence.

What If I Find an Error from More Than Four Years Ago?

This is a classic "what if" scenario, and the answer really depends on which way the error went. HMRC has a standard four-year time limit for correcting unintentional errors, often called the 'capping' period.

If you dig up a mistake from, say, five years ago where you accidentally overpaid VAT, you generally can't claim a refund. I know it’s frustrating, but once that four-year window has closed, the money is lost.

But what if you underpaid? The rules are different here. For a genuine, non-deliberate mistake that old, you're typically not required to tell HMRC or pay the difference. The time limit effectively protects you.

The big exception here, and it's a crucial one, is for any error that was deliberate. If you intentionally hid sales or created false records, the rulebook gets thrown out. HMRC can go back as far as 20 years to assess underpaid tax in cases of deliberate behaviour. You are legally obliged to disclose this kind of error, no matter how long ago it happened.

A Quick Tip from Experience: Even if an old, unintentional error doesn't need correcting, it’s good practice to document it for your own records. Just make a simple note of the error, the VAT period, the amount, and why you took no action (i.e., it was outside the four-year cap). It creates a clear paper trail, just in case it's ever queried down the line.

Will I Be Penalised for Voluntarily Correcting an Error?

It’s possible, but telling HMRC about a mistake yourself is the single best thing you can do to reduce or even completely avoid a penalty. The penalty system is based on behaviour, with HMRC classing mistakes as anything from taking 'reasonable care' to being 'careless' or 'deliberate'.

When you make what’s known as an 'unprompted disclosure'—that is, you tell them before they find it—you're showing that you’re a responsible taxpayer.

Here’s a practical look at how that plays out:

- For a 'careless' error: An unprompted disclosure can bring the penalty right down to 0%. If you wait for HMRC to find it (a 'prompted disclosure'), the minimum penalty jumps to 15%.

- For a 'deliberate' error: A penalty is almost certain, but coming forward can slash it. Disclosing a deliberate error yourself might lead to a 20-35% penalty, whereas waiting for HMRC to catch you could see that figure hit 70%.

Being proactive always pays off. It demonstrates your commitment to getting things right and can make a massive difference to your bottom line.

Do I Need to Correct Both Input and Output Tax Errors?

Yes, absolutely. To figure out the true size of a mistake, you have to calculate the 'net error'. This just means you have to add up all the mistakes in a single VAT period and offset them against each other.

You can't just cherry-pick the errors you want to fix. It's a case of accounting for everything—both the errors that favour you (like overpaid output tax) and those that favour HMRC (like underpaid output tax).

Let’s run through a quick example.

Imagine a small consultancy discovers two mistakes in its Q2 VAT return:

- They forgot to charge VAT on a project, which resulted in an underpayment of £6,000 in output tax.

- In that same quarter, they also failed to reclaim VAT on new office computers, an underclaim of £2,500 in input tax.

The net error here isn't £6,000. It's the difference between the two figures: £3,500 (£6,000 – £2,500). This is the number you'd use to check against the correction thresholds (£10,000, 1% of turnover, etc.) to decide on the right correction method.

How Do Interest Charges Work on VAT Corrections?

If your correction means you owe more VAT to HMRC, they may charge you interest on the amount that was paid late. This is officially called 'default interest'.

It’s really important to realise that this isn’t a penalty. Think of it as commercial restitution—it's there to compensate HMRC for the time they were without the money that was rightfully theirs.

Interest is calculated from the original due date of that VAT return right up until the day you pay the outstanding amount in full. The rate can change over time, but by making a voluntary correction and settling the bill promptly, you stop the interest clock from ticking.

And it works both ways. If your correction shows that HMRC owes you a refund, they may pay you interest on the amount you overpaid.

Navigating the complexities of VAT can be a challenge. At Stewart Accounting Services, we specialise in taking the stress out of VAT returns, corrections, and compliance, giving you the peace of mind to focus on your business. Find out how we can help at https://stewartaccounting.co.uk.