As a director, one of the most fundamental decisions you'll make is how to handle your annual accounts. When I'm asked, "Do I really need an accountant, or can I file my limited company accounts myself?" the honest answer is, yes, you can legally file them yourself. But the real question is, should you?

This decision goes far beyond just saving a few quid. It's about weighing up your time, managing risk, and setting your business up for future growth. Think of it as your first major strategic financial choice, one that signals how you value your own expertise and where you focus your energy.

The Director's Choice: Accountant vs. DIY Filing

For the UK's 4.87 million active companies, this isn't a small decision. Filing your limited company accounts means preparing detailed reports for both Companies House and HMRC. Each has its own rigid deadlines, specific formats, and complex rules. A simple mistake can lead to automatic penalties, and a more serious one could trigger a stressful and costly investigation. This is where professional guidance often proves its worth.

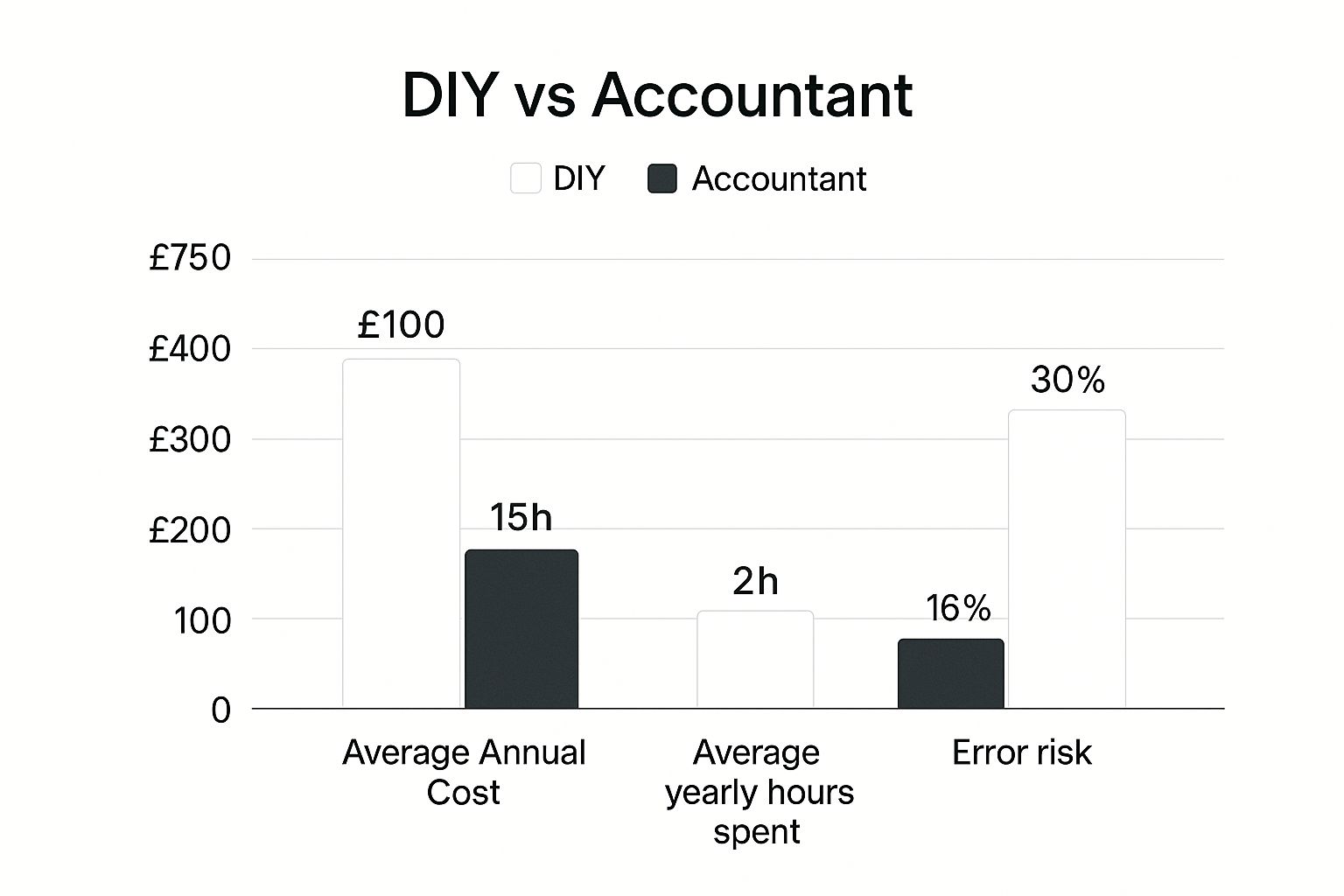

Ultimately, you're looking at a classic trade-off: cost versus time and risk. The infographic below gives a great visual summary of what you're committing to with each path.

As you can see, going it alone might seem cheaper at first glance, but it demands a huge investment of your time and exposes you to a much higher risk of getting things wrong.

At a Glance: DIY Filing vs. Hiring an Accountant

To help you see the differences side-by-side, here’s a quick comparison of the main factors you should consider. This table breaks down the essentials of each approach.

| Factor | DIY Accounting (Self-Filing) | Hiring an Accountant |

|---|---|---|

| Upfront Cost | Low. Mainly software costs (£20-£50/month) and your time. | Higher. Annual fees can range from £800 to £2,000+. |

| Time Investment | High. You'll spend hours on bookkeeping, learning rules, and filing. | Low. You provide the records; they handle the rest. |

| Risk of Errors | High. It's easy to misunderstand rules or make data entry mistakes. | Low. Professionals are trained to ensure accuracy and compliance. |

| Tax Efficiency | Limited. You might miss out on legitimate tax-saving opportunities. | High. They actively look for ways to reduce your tax bill legally. |

| Peace of Mind | Low. The worry of deadlines and potential fines is always there. | High. Confidence that your accounts are filed correctly and on time. |

| Strategic Advice | None. You are on your own when it comes to financial planning. | High. A good accountant offers valuable advice on growth and cash flow. |

While this table gives a high-level view, the best choice really depends on your business's complexity and your own confidence with numbers.

An accountant’s value isn't just in the forms they file; it's in the peace of mind they provide and the strategic financial blind spots they uncover, allowing you to focus on actually growing your business.

Navigating Your Legal Duties as a Director

When you become a director of a limited company here in the UK, you take on a set of legal responsibilities that are non-negotiable. It’s not just about getting paperwork filed on time; you're personally on the hook for the absolute accuracy of your company’s statutory accounts and Corporation Tax return.

These aren't just any old forms. They are formal reports that need to give a "true and fair" picture of your company's financial position, all while sticking to strict accounting rules. At the end of the day, the buck stops with you. Pleading ignorance won't cut it with HMRC or Companies House if something is wrong.

With around 4.87 million private companies now operating in the UK, the administrative load on directors is heavier than ever. Each one, regardless of its size or whether it's even trading, has to file annual accounts. This reality forces you to make a critical choice: do you go it alone or bring in a professional? If you want to dig deeper, you can explore more UK business statistics to see just how busy the landscape is.

Core Filing Obligations

Your main responsibilities boil down to two crucial submissions:

- Statutory Accounts: These documents are sent to Companies House, usually within nine months of your company's financial year-end. They must include things like a balance sheet and a profit and loss account, all prepared to very specific standards.

- Company Tax Return (CT600): This goes to HMRC, also typically within nine months of your year-end. It's where you declare your profit or loss for the year and work out how much Corporation Tax you owe.

The single most important thing to grasp is your personal liability. As the director, you are held personally accountable for any inaccuracies or late filings. This can lead to fines, penalties, and in serious cases, even legal action.

The penalties for missing the Companies House deadline are automatic and unforgiving. They start at £150 and can climb to a painful £1,500 for a private company. On top of that, HMRC's penalties for a late tax return or late payment can be even harsher, quickly racking up interest on any tax you haven't paid.

The Real Cost-Benefit Analysis: Accountant vs. DIY

When you’re running a limited company, deciding whether to hire an accountant or file your accounts yourself feels like a straightforward cost comparison. It’s not. The choice goes far deeper than just an accountant's fee versus the "free" option of doing it yourself.

To make the right call, you need to weigh up the genuine costs and benefits across four key areas: the direct financial outlay, your own time commitment, the risk of getting it wrong, and the potential for strategic growth. Let's dig into what each path really means for your business.

Financial Costs: Direct and Hidden

At first glance, the finances seem simple. An accountant will charge you anywhere from a few hundred to several thousand pounds a year, depending on how complex your business is. Doing it yourself? The main cost is just your accounting software subscription.

But this view misses the hidden financial traps of the DIY route. The biggest risk is failing to claim all the tax reliefs and allowances your company is entitled to. A good accountant lives and breathes this stuff; they're trained to spot every opportunity, from R&D tax credits to capital allowances on new equipment.

I've seen it time and again: business owners who do their own taxes often leave money on the table. An accountant’s fee can frequently pay for itself through the tax savings they uncover, turning what looks like a cost into a smart investment.

Then there are the potential penalties. One small mistake in your Corporation Tax calculation or a slip-up when filing your statutory accounts can attract fines and interest charges from HMRC and Companies House. These penalties can easily dwarf the cost of hiring a professional in the first place.

Your Time Is a Business Asset

As a business owner, your time is your most precious resource. Every hour you spend trying to get your head around accounting rules or battling with filing software is an hour not spent on what truly drives your business forward—making sales, talking to customers, or improving your product.

Think about the learning curve. If you’re not already familiar with UK GAAP or standards like FRS 102 and FRS 105, you'll have to sink a significant amount of time into just learning the fundamentals. And it's not a one-and-done job; the rules change, and you have to keep up.

Let's put some real numbers on it:

- The DIY Approach: You could easily spend 40-60 hours a year on bookkeeping, researching regulations, preparing the final accounts, and handling the submissions.

- Working with an Accountant: This typically drops to just 5-10 hours a year, mostly spent getting your records organised and liaising with them.

That’s a potential saving of an entire working week. What could you achieve with that extra time? It's also worth noting that options like UK outsourced bookkeeping services can bridge the gap, freeing up your time without the full cost of a chartered accountant, making the decision less about money spent and more about time well invested.

When DIY Accounting Is a Smart Move

Deciding to go it alone and file your own limited company accounts can seem like an easy way to save money, especially when you're just starting out. And for some businesses, it absolutely is. But this route is really only suitable for companies with a very straightforward financial setup.

Think of it this way: if you're a single director, your business has a low volume of simple transactions, and you're comfortable with numbers, then handling the accounts yourself is certainly achievable. The moment things get more involved, however, the risks of getting it wrong can quickly start to outweigh any initial cost savings.

The DIY Business Checklist

Before you roll up your sleeves and dive into the books, run through this quick checklist. If you find yourself answering "no" to any of these questions, it's a strong signal that bringing in an accountant would be the wiser, safer bet.

- No Employees: Are you a solo director with no payroll to run?

- Not VAT Registered: Is your annual turnover comfortably below the VAT registration threshold?

- Simple Transactions: Are your sales and expenses basic, with no complexities like company assets, stock control, or foreign currency transactions?

- Time and Confidence: Do you genuinely have the time to dedicate to learning the rules and filing correctly, and are you confident you can get it right?

Choosing to self-file is less about saving money and more about whether your business's simplicity allows for it. The moment complexity enters the picture—through growth, hiring, or new regulations—the value of professional expertise becomes undeniable.

With over 4.4 million self-employed individuals in the UK, many new directors face this exact decision. While modern accounting software and HMRC's online services have made self-filing more accessible, the strict compliance rules for corporation tax and statutory accounts mean that mistakes can be costly. This is precisely why so many directors ultimately decide that an accountant's fee is a price worth paying for peace of mind and tax efficiency. You can explore more data on this growing trend by reviewing these insights on UK self-employment trends from Statista.

When an Accountant Becomes an Essential Investment

For many business owners, the question of whether to hire an accountant or file their own limited company accounts feels like a tough one. But often, the business itself will answer it for you. There’s a clear tipping point where the DIY route, which felt so sensible in the early days, suddenly becomes a minefield of risk.

That moment often arrives with growth. Take hiring your first employee. Suddenly, you're not just running a business; you're also managing PAYE registration and payroll. The same goes for crossing the VAT registration threshold of £90,000. You’ve instantly become a tax collector for HMRC, which comes with a whole new world of rules and strict deadlines. These are classic signs that it’s time to call in a professional.

Beyond Basic Compliance

The real game-changer, though, is when your focus shifts from just 'getting the numbers filed' to using those numbers to make smarter decisions. This is where an accountant truly earns their keep. Their expertise becomes invaluable when you start dealing with significant business assets, trying to manage complex stock levels, or needing reliable cash flow forecasts to plan your next move. They turn your financial data into a genuine roadmap for growth.

An accountant does far more than just prepare year-end accounts. They build a credible financial story for your business—a story that's essential for winning the trust of investors, banks, and other partners.

If your limited company is looking for a loan, for example, a good accountant is your best ally for meeting essential business loan requirements. Their involvement dramatically improves your chances of getting approved because they ensure your financial statements are not only accurate but professionally presented. This turns their fee from a cost into a strategic investment.

This forward-looking financial planning is what truly separates professional accounting from self-filing. An expert can structure your affairs to be as tax-efficient as possible, spot opportunities to save money you might have missed, and provide the solid financial foundation you need to scale. They don’t just look back at what happened; they help you build a more profitable future.

A Framework for Your Final Decision

Deciding whether to file your limited company accounts yourself or bring in a chartered accountant is one of those foundational business choices. There’s no universal right answer here. The best path is the one that fits your company's current situation and where you plan to take it in the future.

This kind of thinking—weighing your own skills against professional expertise—is a valuable business habit. You’d use a very similar logic when debating whether to engage a business broker. It always comes down to a clear-eyed assessment of your needs versus an expert's value.

Your final decision shouldn't be driven by cost alone. Instead, weigh the true value of your time, your comfort level with compliance risk, and the strategic edge that a financial expert can provide.

Ultimately, this choice dictates how you allocate your most precious resources: your time and your money. Be honest about your business complexity, your confidence with numbers, and your growth ambitions. Your answers will make it clear whether an accountant is simply an expense you can avoid or a vital investment in building a resilient, profitable company.

Your Questions, Answered

What’s the Going Rate for a Limited Company Accountant?

It really depends on the size and complexity of your business. For a straightforward package covering your annual accounts and Corporation Tax return, you’re typically looking at a fee somewhere between £600 and £1,500 a year.

Of course, if you need more hands-on help – think regular bookkeeping, quarterly VAT returns, or running payroll – that figure will climb. It's all about matching the level of service to your specific needs.

What Software Should I Use If I Go It Alone?

If your business is incredibly simple, HMRC offers a free joint filing service that sends the necessary information to both Companies House and HMRC. For most businesses, though, dedicated commercial software is a much better bet.

Platforms like Xero, QuickBooks, or FreeAgent are all HMRC-approved and designed to handle day-to-day bookkeeping, making it much easier to pull together the reports you need for your final submission.

What’s the Worst That Can Happen If I Make a Mistake?

Unfortunately, errors on your official filings can hit you in the wallet. Both HMRC and Companies House can issue financial penalties for inaccuracies. Get your Corporation Tax calculation wrong, and you'll be on the hook for interest charges and potentially a hefty penalty on top.

Fixing mistakes isn't straightforward either; amending and resubmitting accounts is a tricky, time-consuming process that can cause a lot of stress.

One of the biggest, often overlooked, advantages of using a chartered accountant is their professional indemnity insurance. If they make a mistake, their insurance provides a financial safety net to cover the fallout—a protection you simply don't have when you file yourself.

Can an Accountant Actually Save Me More Than I Pay Them?

In many cases, absolutely. A good accountant does far more than just file your accounts; they actively look for ways to make your business more tax-efficient. By spotting legitimate expenses, reliefs, and allowances you might never have known about, they can significantly lower your tax bill.

When you add up these tax savings and factor in the avoidance of costly penalties, it's common for an accountant's value to far outweigh their annual fee.

Ready to gain more time, more money, and a clearer mind? Stewart Accounting Services offers expert guidance for limited companies across the UK. Get in touch today to see how we can help your business thrive.