Let’s start with a quick, real-world scenario. Imagine your business buys a new computer for £1,500 using cash from its bank account. Under double-entry bookkeeping, two things happen simultaneously: the Cash account goes down by £1,500 (a credit), while the Equipment account goes up by £1,500 (a debit). The books remain perfectly balanced.

Understanding the Core of Double Entry Bookkeeping

Before we dive into more detailed examples, it’s crucial to get your head around the one idea that underpins all of modern accounting. Picture your business finances as a set of perfectly balanced scales. Every single transaction, from buying a coffee to landing a huge contract, has to add equal weight to both sides to keep things level.

This fundamental principle is wrapped up in what’s known as the accounting equation. It’s the bedrock of the entire double-entry system and the "why" behind every journal entry you'll ever make.

The Accounting Equation: Assets = Liabilities + Equity

This isn't just a dry formula to memorise; it's a logical statement about your business's financial reality. It states that everything your company owns (its assets) must be equal to all the claims against those assets.

The Three Core Components

These "claims" come from two places: what you owe to others (Liabilities) and what the owners have put in (Equity).

Let’s take a closer look at the three core components of this equation. The following table breaks down what each element actually means for your business.

The Accounting Equation at a Glance

| Component | What It Means for Your Business |

|---|---|

| Assets | These are the valuable resources the business controls. Think cash in the bank, your computers, company vehicles, stock you plan to sell, and even money your customers owe you (accounts receivable). |

| Liabilities | These are your financial obligations to others—essentially, what your business owes. This includes bank loans, unpaid supplier bills (accounts payable), and outstanding credit card balances. |

| Equity | This is the owner's stake in the business. It’s what’s left over for the owners after you subtract all the liabilities from the assets. It includes the initial investment and any profits kept in the company. |

The magic of the double-entry system is that every transaction you record will touch at least two of these accounts, making sure that the equation always stays in balance. This self-checking mechanism is precisely what makes double-entry bookkeeping so powerful and reliable for tracking the financial health of a business.

The Rules of Debits and Credits Explained

To really get to grips with double-entry bookkeeping, we need to look past the accounting equation and learn the language of transactions: debits and credits. First things first, try to forget what you think these words mean. "Credit" doesn't always mean more money, like it does on your bank statement. In accounting, these terms are simply directions – left and right.

A debit (Dr) is just an entry made on the left side of a ledger, while a credit (Cr) is an entry on the right. Whether a debit or credit adds to or subtracts from an account's balance depends entirely on what kind of account it is. This is the bit that trips most people up, but there's a handy mnemonic to make it stick.

The DEAD CLIC Memory Tool

One of the easiest ways to memorise the rules is by using the acronym DEAD CLIC. It’s a lifesaver.

-

DEAD tells you which accounts are increased by Debits:

- Expenses (like rent or salaries)

- Assets (things you own, like cash or equipment)

- Drawings (money the owner takes out of the business)

-

CLIC tells you which accounts are increased by Credits:

- Liabilities (money you owe, like loans)

- Income (your sales revenue)

- Capital (the owner's investment in the business)

Every single transaction you record will have at least one debit and one credit, which is what keeps the whole system in balance. For example, if you pay a £100 electricity bill (an Expense) using cash (an Asset), you would debit the Expense account to show it has increased, and credit the Asset account to show your cash has decreased.

By recording both sides of the coin, this system creates a robust, self-checking financial record. It's a method so reliable that its principles have been central to commerce for centuries.

The core ideas of double-entry bookkeeping arrived in the UK well before the 1800s, spreading from Italian merchants to financial hubs like London. This systematic approach was a huge leap forward from the far simpler single-entry method, which just couldn't provide the accuracy needed for increasingly complex trade operations. You can discover more insights about its historical diffusion and impact on British finance.

This structured approach is brilliant because it helps prevent errors and leaves a crystal-clear audit trail. Getting your head around the DEAD CLIC rules is the key to unlocking the power of any double-entry bookkeeping system, turning these abstract concepts into a genuinely practical tool for your business.

A Practical Look at Double-Entry Bookkeeping

Theory and acronyms can only take you so far. The best way to truly get to grips with double-entry bookkeeping is to see it in action. Let's walk through a real-world scenario with a fictional new business, 'Pixel Perfect Designs,' a freelance graphic design company.

We'll follow Jane, the owner, as she makes her first five business transactions and see exactly how each one is recorded.

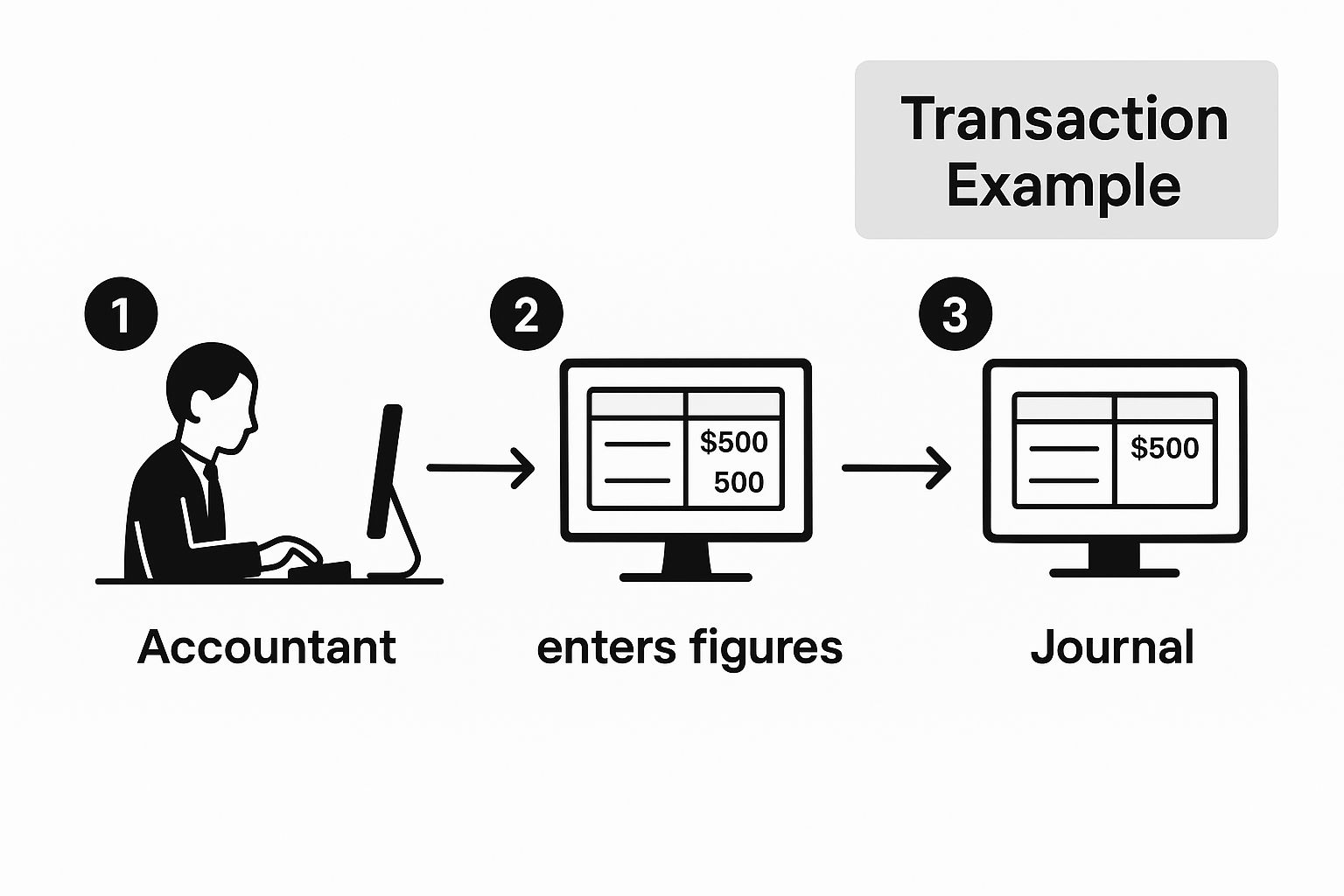

This handy visual guide shows how an accountant might log these common transactions.

The infographic gives a great overview of creating journal entries, which is the heart of keeping balanced books. Now, let's build these entries step-by-step for Pixel Perfect Designs.

Transaction 1: The Initial Investment

To get the business off the ground, Jane invests £5,000 of her personal savings. This action gives the company cash (an asset) and, at the same time, increases Jane's stake in the business (her equity).

- Debit: The Cash account increases by £5,000.

- Credit: The Owner's Capital account increases by £5,000.

You can see how the entry reflects a perfectly balanced exchange. Both sides of the fundamental accounting equation have grown by the same amount.

Transaction 2: Buying a Computer

Pixel Perfect Designs needs a powerful computer to handle design work. The business buys one for £2,000, paying with cash from its bank account. This isn't an expense; think of it as an asset swap. The business is simply trading one asset (cash) for another (equipment).

The journal entry for this looks like this:

- Debit: The Equipment account (an asset) goes up by £2,000.

- Credit: The Cash account (also an asset) goes down by £2,000.

The total value of the company's assets hasn't changed at all, and the books stay perfectly balanced.

Transaction 3: Purchasing Software on Credit

Next up, the business needs specialised design software costing £600. It gets the software now but arranges to pay the supplier next month. This creates a liability – a formal promise to pay money that is owed.

- Debit: The Software account (an intangible asset) is increased by £600.

- Credit: The Accounts Payable account (a liability) is also increased by £600.

In this case, the company's assets have increased, but so have its liabilities, keeping everything in equilibrium.

This two-sided approach is the very essence of the double-entry system. It tells the full financial story, showing not just what the business gained, but also how it was paid for. That's a level of detail you just don't get with simpler methods.

Transaction 4: Completing a Project for Cash

Great news! Pixel Perfect Designs finishes its first project, and the client pays the £1,500 invoice straight away. This transaction boosts the company's cash balance (an asset) and its revenue (which increases equity).

The journal entry is quite straightforward:

- Debit: The Cash account is increased by £1,500.

- Credit: The Service Revenue account is increased by £1,500.

This is a key transaction, as it directly improves the company's profitability and its cash position.

Transaction 5: Paying a Monthly Subscription

Finally, the business pays its £50 monthly subscription for cloud storage. This is a classic operating expense. It reduces the company's cash (an asset) and, because it's a cost of doing business, it also reduces the owner's equity.

- Debit: The Subscriptions Expense account is increased by £50.

- Credit: The Cash account is decreased by £50.

Each of these steps shows how every single business action has a dual effect. By carefully recording both sides of every transaction, the double-entry system provides an accurate, reliable, and continuously balanced picture of a company's financial health.

Visualising Transactions with T-Accounts

Journal entries are the official, step-by-step instructions for your financial records, but let's be honest—they can feel a bit abstract. To really get a feel for how the money is moving, accountants turn to a simple but brilliant tool: the T-account.

Just as its name suggests, it’s a visual layout of an individual account shaped like the letter 'T'. The account's name goes on top, debits are listed on the left, and credits go on the right. It’s a wonderfully straightforward way to see the impact of every transaction.

Let's plot our journal entries from the 'Pixel Perfect Designs' example onto these diagrams. This is where the double-entry system truly comes to life.

Posting Transactions to T-Accounts

Now, we'll take the five journal entries we made for Pixel Perfect Designs and "post" them to their individual T-accounts. This is how you watch an account's balance grow or shrink over time.

- Cash Account: This one saw a lot of action. It was debited (increased) by £5,000 from the initial investment and another £1,500 from the client payment. It was then credited (decreased) when the company spent £2,000 on the computer and £50 on the software subscription. The final balance gives you a clear picture of the cash on hand.

- Equipment Account: This account was debited just once for £2,000 when the computer was bought, neatly establishing the asset's value on the books.

- Accounts Payable: As a liability account, this was credited £600 for the unpaid software invoice. This T-account now clearly shows that the business owes that money.

This method of tracking finances is far from new. The core principles were famously put to work by the Medici family’s bank back in 15th-century Florence. Their "Venetian method" made its way to the UK through trade routes, establishing the balanced debit and credit system that dramatically improved financial accuracy. If you're curious, you can learn more about how double-entry bookkeeping changed the world.

Seeing the Balance in Action

When you update T-accounts with every transaction, you’re essentially creating a live financial map of your business. Each diagram tells one part of the story, clearly showing how every action has an equal and opposite reaction somewhere else in your accounts.

T-accounts transform the rules of debits and credits from abstract concepts into a clear, visual dashboard. They are the missing link that helps business owners truly understand the financial health of their company at a glance.

This visual proof reinforces that the fundamental accounting equation—Assets = Liabilities + Equity—is always in balance. It's this reliable, self-checking foundation that has made the double-entry system the gold standard in accounting for over 500 years.

Why This System Is a Game-Changer for Your Business

Getting your head around the mechanics of double-entry bookkeeping is one thing. But truly understanding why it matters is what separates the businesses that thrive from those that just get by. Think of it less as a stuffy accounting rule and more as a powerful framework for financial health and clarity.

At its core, the system has a brilliant, self-correcting feature built right in. Since every debit must have an equal and opposite credit, your books are designed to stay perfectly in balance. If the numbers don't add up, it's an immediate red flag that something's gone wrong, helping you catch small mistakes before they snowball into major headaches.

Getting a Crystal-Clear Financial Picture

A balanced set of books gives you an accurate and reliable snapshot of your company’s financial position at any moment. This kind of visibility is absolutely essential for making smart decisions.

- Smarter Strategy: You can properly assess how profitable you are, get a grip on your cash flow, and make realistic plans for growth.

- Reduced Fraud Risk: By creating a clear trail of where every penny comes from and where it goes, a double-entry system makes it much harder for internal fraud to go unnoticed.

This level of precision is the bedrock of trustworthy financial reporting.

Your key financial statements, like the Profit and Loss report and the Balance Sheet, are a direct product of a well-kept double-entry system. Honestly, trying to create them without it is a near-impossible task.

These reports are non-negotiable. You'll need them to secure a business loan, file your taxes correctly with HMRC, or show potential investors that your company is on solid ground. To get the most out of this system and keep things running smoothly, many businesses now use tools to automate your bookkeeping processes and maintain flawless records.

Ultimately, using a double entry bookkeeping system example isn't just about ticking a compliance box. It’s about building a stable financial foundation that supports real, sustainable growth and gives you complete peace of mind.

Common Questions About Double Entry Bookkeeping

Even with clear examples, it's natural for a few questions to pop up when you're getting to grips with double-entry bookkeeping. Let's tackle some of the most common queries that business owners have when they first encounter this method.

Working through these points will help firm up your understanding and give you the confidence to apply these principles in your own business.

What Is the Real Difference Between Single and Double Entry?

Think of single-entry bookkeeping as being like your personal chequebook register. You simply log cash coming in and cash going out. It’s easy, but it’s an incomplete picture because it only tracks your cash flow.

Double-entry bookkeeping, however, tells the whole story. For every single transaction, it records two effects. It doesn't just show that cash left your bank account; it also shows why – perhaps to buy a new computer (an asset) or pay a supplier (reducing a liability). This creates a complete, self-balancing financial picture that helps you catch errors right away.

Can I Use Double Entry Without an Accountant?

Absolutely. In fact, most modern accounting software is built specifically for this. Platforms like Xero, QuickBooks, or Wave are designed around double-entry principles, but they do all the heavy lifting behind the scenes.

When you enter a sales invoice or categorise a purchase, the software automatically creates the correct debit and credit entries for you. While an accountant is brilliant for getting you set up, offering strategic advice, and handling tax, these tools make managing your day-to-day books entirely possible on your own.

Double-entry is the engine that powers your accounts. Accounting software is the user-friendly dashboard that puts you in the driver's seat, translating your business activity into reliable financial data without you needing to be a mechanic.

Do I Really Need to Memorise Debits and Credits?

Honestly, you don't need to become a master accountant, especially with good software. But having a basic grasp of the logic is incredibly useful.

Knowing the core rules—like ‘debits increase assets’ and ‘credits increase revenue’—helps you make sense of your financial reports and spot when something looks off. It’s a bit like driving a car; you don’t need to know how the engine works, but understanding what the warning lights on the dashboard mean is essential for a smooth journey.

Navigating the world of bookkeeping is fundamental to growing your business. At Stewart Accounting Services, we provide expert guidance to ensure your finances are accurate, compliant, and a powerful tool for success. Find out how we can help at https://stewartaccounting.co.uk.