Let's be honest, the words "Self Assessment" can make even the most seasoned professional’s shoulders tense up. But it really doesn’t have to be that annual nightmare you dread. Think of it less as a huge, complicated puzzle and more as a series of straightforward steps. With a bit of organisation, you can get through it without the last-minute panic.

This guide is here to give you some practical help with your self assessment tax return, breaking down the entire process from start to finish. Once you know what you’re doing, it becomes just another task to tick off the list.

Getting Started With Your Self Assessment

Before you even think about filling in forms, it’s worth understanding why you need to file in the first place. It’s a common misconception that Self Assessment is just for the self-employed. In reality, plenty of people get caught in the net for all sorts of reasons. Figuring out if you're one of them is the first hurdle.

So, Who Actually Needs to File a Return?

You might be surprised. It’s not just for sole traders and business partners. HMRC requires a much wider range of people to declare their income via Self Assessment.

You'll almost certainly need to file a tax return if you fit into one of these categories:

- You earned over £100,000 in the last tax year.

- You're a company director (unless it's for a non-profit and you received no pay or benefits).

- You received untaxed income, like rent from a property you let out, or you earned tips and commission that weren't taxed through your payroll.

- You or your partner earned over £50,000 and claimed Child Benefit. This triggers the High Income Child Benefit Charge, which is handled through Self Assessment.

Why Filing Early is a Game-Changer

I know, I know—the deadline is ages away. It’s tempting to put it off, but trust me, getting your tax return sorted early is one of the smartest financial moves you can make. It’s not about being a keener; it’s about taking control.

For one thing, it gives you a clear view of your tax bill well in advance, so there are no nasty surprises in January. You have months to plan for the payment. And if you’re lucky enough to be due a refund, you’ll get that money back in your bank account much faster.

It seems more and more people are catching on. In the first week of the 2024 to 2025 tax year alone, nearly 300,000 returns were filed with HMRC. You can read more about the benefits of early filing on GOV.UK.

Expert Tip: Filing early isn’t just about avoiding a fine. It’s a strategic financial move that reduces stress, gives you a better handle on your cash flow, and gets any refund you're owed back in your pocket sooner.

When you're ready to get started, the government's official portal is your first stop.

This is the main login page where you'll need your Government Gateway user ID and password to access your online tax return securely.

Getting Yourself on HMRC’s Radar: The Registration Process

First things first, before you can even think about your income and expenses, you need to tell HMRC you exist. This means registering for Self Assessment. It’s a crucial first step, and honestly, it’s one where a lot of people get tripped up. Getting this right from the start saves a world of headaches later on.

The way you register isn't the same for everyone; it really depends on your personal circumstances. HMRC has different routes depending on why you need to file a tax return in the first place.

Finding Your Correct Registration Path

So, how do you let HMRC know you need to send them a tax return? It all comes down to your situation. Following the right procedure is key to getting set up correctly in their system.

Here are the most common scenarios I see:

- You've just gone self-employed: If you're a new sole trader, you need to register for both Self Assessment and Class 2 National Insurance. It's a two-in-one job.

- You're not self-employed: Maybe you're a landlord earning rental income or you've made some money from investments. In this case, you just need to register for Self Assessment on its own.

- You're joining a business partnership: This has its own specific process. The partnership as a whole needs to be registered, and then you have to register yourself as a partner individually.

The official government website has separate, clearly marked pathways for each of these situations. It’s designed to guide you to the right place.

This is the government page where it all begins.

As you can see, it directs you based on whether you're self-employed or not, making it fairly straightforward to find the correct starting point.

What is a Unique Taxpayer Reference (UTR)?

After you've registered, keep an eye on the post. HMRC will send you a letter containing your Unique Taxpayer Reference (UTR). This is a ten-digit number that becomes your personal ID for absolutely everything related to Self Assessment.

Think of it as your tax-specific National Insurance number. You'll need it every single time you file online, call HMRC, or ask an accountant like Stewart Accounting Services to deal with them for you.

Your UTR is the key to your Self Assessment account. Keep it somewhere safe, but also somewhere you can find it easily. You’ll be asked for it constantly.

A word of warning: the UTR letter is sent by post and can take a couple of weeks to show up. Don't leave your registration until the last minute, because waiting for this number can create a real bottleneck if you’re pushing up against a deadline.

Get Your Ducks in a Row First

To make the whole registration process as smooth as possible, do yourself a favour and get all your information together before you even start.

Having everything you need to hand is the best way to avoid a stressful start to your tax journey.

You will definitely need:

- Your National Insurance number

- Basic personal details (full name, date of birth, address)

- Business details (when you started, business name, address, and what your business does)

Crucially, the deadline to register for Self Assessment is 5th October after the tax year ends. So, for the 2023/24 tax year (which ended on 5th April 2024), the registration deadline is 5th October 2024. Miss that date, and you could be looking at penalties before you've even filed. It's a date to circle in your calendar.

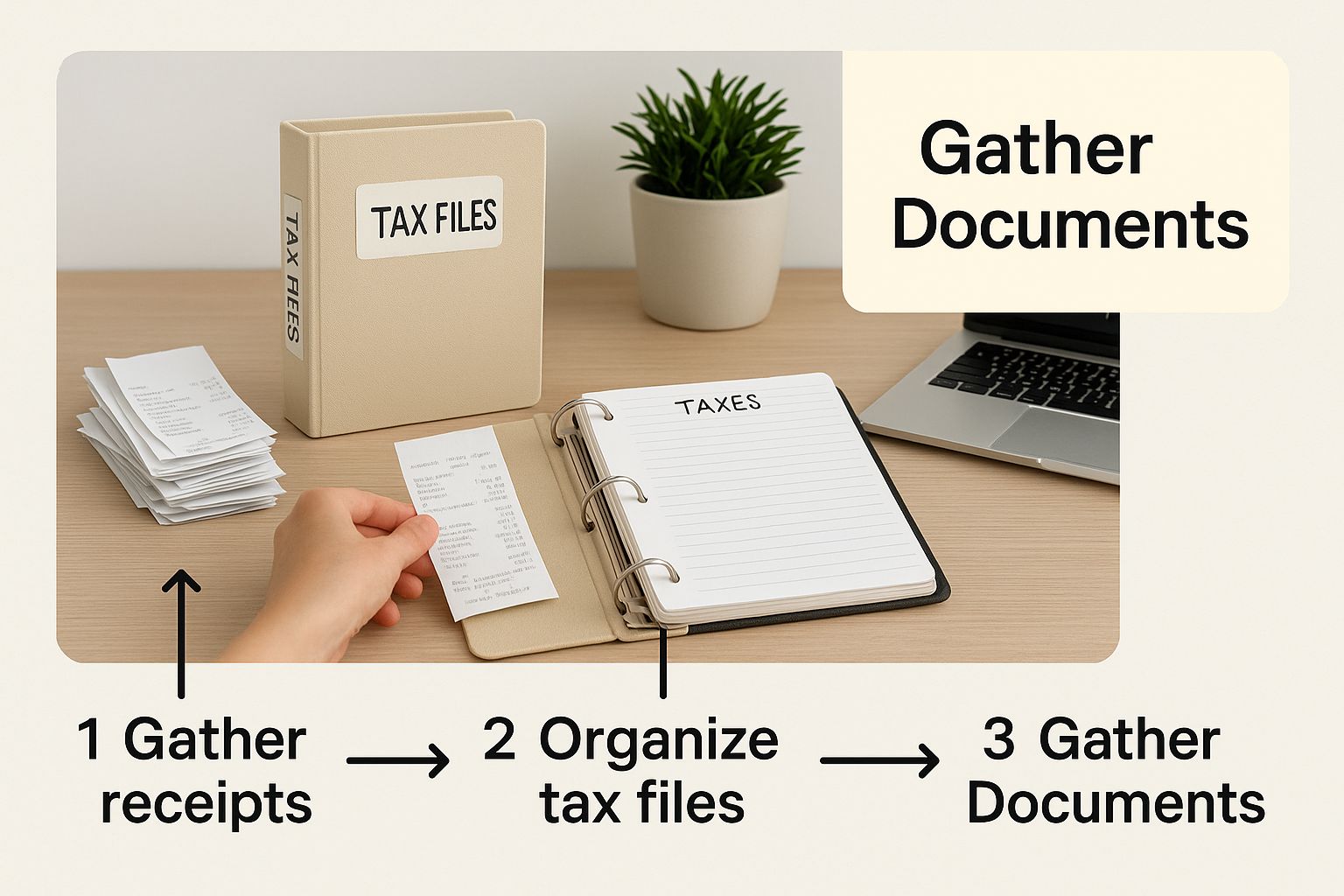

Right, let's get your paperwork sorted. This is honestly the part of the tax return process that trips most people up, but getting it right from the start makes everything else a million times easier. Without organised records, you’re just guessing, and HMRC doesn’t like guesswork.

Think of it as laying the groundwork. If your numbers are solid and you've got the documents to prove them, the actual form-filling becomes a simple matter of data entry. This is where you build the complete financial story of your year.

Tallying Up Your Income

First things first, you need to account for every single penny you’ve earned. It's not just about the big invoices from your main line of work; you need to track down all of it. One of the most common slip-ups I see is people forgetting about smaller, less frequent income streams.

Your income checklist should include:

- Business Takings: This is the big one for most self-employed people. Pull together all your sales invoices, payment confirmations, and bank statements showing customer payments.

- Rental Income: If you're a landlord, you’ll need a clear record of all the rent you've received from your tenants over the tax year.

- The 'Other' Stuff: This is where things get missed. Did you earn interest on a savings account? Receive dividends from shares? Make a bit of cash from a side hustle? It all needs to be declared.

The Power of Allowable Expenses

Once you know what you’ve earned, it's time to figure out what you spent to earn it. These are your allowable expenses, and they are your best friend when it comes to reducing your tax bill. Claiming every legitimate expense is absolutely key to making sure you're not overpaying.

The official rule is that an expense must be 'wholly and exclusively' for your business. For example, if you're a freelance photographer and you buy a new camera lens, that’s a straightforward business expense. But if you buy a new laptop and use it for work 60% of the time and for personal browsing the other 40%, you can only claim 60% of the cost.

This is why good record-keeping is non-negotiable. You need receipts, invoices, and bank statements for every single expense you claim. If HMRC ever decides to take a closer look, you'll need that paper trail to prove your claims are legitimate.

Here's a simple test I tell my clients: ask yourself, "Did I spend this money purely to help my business make a profit?" If the answer is a clear "yes," it's almost certainly an allowable expense. This is so much easier if you keep your business and personal bank accounts separate.

Essential Documents for Your Tax Return

To give you a clearer picture, I've put together a checklist of the most common documents you'll need. Having these ready before you start will save you a massive headache later on.

| Document Type | Example/Details |

|---|---|

| Proof of Income | Sales invoices, business bank statements, rental agreements, dividend vouchers. |

| Expense Receipts | Receipts for stock, materials, software subscriptions, travel tickets, and utility bills. |

| Bank Statements | Both business and relevant personal statements to cross-reference transactions. |

| Mileage Log | A detailed record of all business journeys, including dates, destinations, and miles. |

| Payroll Records (if applicable) | P60s, P45s, and P11D forms for any employment income or benefits. |

| Pension Contributions | Statements from your personal pension provider showing how much you've paid in. |

| Previous Tax Return | Useful for reference, especially if your circumstances haven't changed much. |

This isn't an exhaustive list, but it covers the essentials for most self-employed people and landlords. The goal is to have a document for every number you put on your return.

Common Expenses People Forget to Claim

It’s painful to see people pay more tax than they need to, especially when it’s because they simply didn't realise they could claim for something. It’s not just about stock and materials; the list of what you can claim is surprisingly long.

Here are a few that often get missed:

- Mileage: Using your personal car for a client meeting? You can claim a flat rate per mile from HMRC. Just keep a log!

- Working From Home: You can claim a portion of your household running costs like electricity, heating, and council tax. There's a simplified flat rate or you can calculate the exact business proportion.

- Professional Subscriptions: Your annual fee to a professional body or a subscription to a trade journal is usually tax-deductible.

- Software & Phone Bills: That monthly subscription to accounting software like Xero is a business expense. So is the business portion of your mobile phone bill.

The government actually provides some handy online calculators to help you work out simplified expenses for your vehicle or using your home as an office. Using the official tools on the GOV.UK site is always the safest bet to ensure your calculations are spot on.

A final, crucial point on paperwork: you need to keep it. By law, you must hold onto your records for at least 5 years after the 31 January submission deadline for that tax year. Having solid, effective document retention policies in place from day one will save you from a frantic, stressful search for a tiny receipt from four years ago.

A Practical Walkthrough of the Online Tax Form

Alright, you’ve got your financial records in order and your UTR number is ready to go. Now for the main event: tackling the online tax form itself. The first time you log into the HMRC portal, it can feel a bit overwhelming, like you’ve been handed the keys to an aeroplane cockpit. But trust me, it’s much more intuitive than it looks. This is where getting some practical help with your self assessment tax return can be a real game-changer.

The great thing about the online form is that it’s dynamic—it adapts to your specific situation. It starts with a series of simple questions about your different income streams during the tax year. Based on your answers, it then builds a personalised return for you. So, if you're a freelance writer, you won't be bogged down with irrelevant pages about being a company director.

This customisation is a lifesaver. It filters out all the noise and only shows you what's absolutely necessary, which makes the whole process feel much less intimidating.

Navigating the Self-Employment Section (SA103)

For anyone who’s a freelancer, contractor, or sole trader, the self-employment pages (officially known as the SA103) are the core of your return. This is where you’ll put in your total turnover and claim all those allowable expenses you’ve been carefully tracking all year.

First, you’ll enter your total sales for the tax year. After that, you’ll find boxes for various expense categories, like travel, materials, or office costs. If you’ve kept good records, this part is pretty much a simple data entry task.

One thing that often trips people up here is the trading allowance. This is a £1,000 tax-free allowance for trading income. If your total income from self-employment is under £1,000, you don't even need to register for Self Assessment.

If your income is over £1,000, you face a choice. You can either deduct your actual, specific business expenses or claim the flat £1,000 trading allowance. You can't do both.

Let’s say you’re a freelance graphic designer who earned £15,000. Your actual expenses on software and a new monitor came to £800. In this scenario, deducting your real expenses makes sense. But if you only had £300 in expenses, claiming the £1,000 trading allowance is the smarter move by far, as it reduces your taxable profit by a much larger amount.

Declaring Income From Property (SA105)

If you’re a landlord, the form will guide you to the property pages (the SA105). The setup here is very similar to the self-employment section. You'll enter your total rental income and then list your allowable expenses one by one.

Common expenses for landlords usually include:

- Landlord insurance policies

- Letting agent or management fees

- Repairs and maintenance (but not capital improvements)

- Ground rent and service charges

Just like with self-employment, there’s also a £1,000 property allowance. The rules are the same: if your rental income is below this threshold, you have nothing to report. If it’s higher, you can choose to claim this allowance instead of your actual expenses—a really handy option for landlords with very low running costs.

Handling Other Income Sources

The online form has dedicated sections for all sorts of other income you might need to declare. You’ll only see these if your initial answers indicated they were relevant to you.

These often include:

- Interest from banks and building societies: Most of this is now tax-free thanks to the Personal Savings Allowance, but you must declare it if you exceed your allowance or if you’re a higher-rate taxpayer.

- Dividends: A key section for company directors or anyone who owns shares.

- Capital Gains: Sold a major asset, like a second property or some valuable shares? This is where you’ll calculate and declare any Capital Gains Tax you owe.

Self Assessment is a huge part of the UK tax system. For the 2023-2024 tax year alone, an estimated 7.0 million people were required to file because of self-employment or rental income. It's also interesting to see how people approach it; 75% of those earning over £50,000 used an agent, while 63% used software. You can dig into more of these tax filing trends from GOV.UK.

One last piece of advice from experience: save your progress regularly. The portal has a "Save and continue" button on every page. Use it religiously. There is nothing more frustrating than your Wi-Fi dropping and wiping out an hour of work. Before you hit that final submit button, you’ll get a full summary of your return, giving you a chance to review every single figure one last time.

Submitting Your Return and Paying What You Owe

You’ve wrestled with the forms, crunched the numbers, and checked everything twice. That feeling when you finally hit ‘submit’ is a huge relief, but you’re not quite over the finish line yet. Now comes the part where you settle up with HMRC.

The moment you submit your return online, HMRC's system instantly calculates your tax liability for the year. You'll see a full breakdown of the Income Tax and National Insurance you owe. Don't just skip to the final figure at the bottom—it’s worth taking a minute to actually understand how they arrived at that number.

Think of this calculation as your financial report card for the tax year. It shows your total income, factors in your personal allowance, and then lays out the tax due on each income band, plus your National Insurance contributions. It’s the logic behind the bill.

Getting Your Tax Paid

Once you've had a look at the calculation, it's time to pay. HMRC gives you a few different ways to do this, so you can pick whatever suits you best. The crucial thing is to get the payment process right so the funds land in your account without any fuss.

The government's own payment portal is the best place to start, as it gives you a clear overview of all your options.

This page is your gateway for paying online, with everything from a simple bank transfer to using a debit card, all designed to make the process as painless as possible.

Here are the most common ways people pay their tax bill:

- Online Bank Transfer: You can send the money straight from your bank account. The key here is to use your 11-character payment reference, which is just your 10-digit UTR number with a 'K' on the end.

- Debit Card Online: A very quick and straightforward option you can do directly on the GOV.UK website.

- At Your Bank: If you still have a paying-in slip from HMRC, you can pop into your local bank or building society to make the payment.

- Budget Payment Plan: This is a smart move if you want to get ahead. You can set up a plan to make regular, advance payments towards next year’s bill, which really helps with budgeting.

I can’t stress this enough: always, always use the correct payment reference. If you don't, HMRC has no idea who the money is from, and that can lead to some seriously stressful letters and phone calls down the line.

What on Earth Are Payments on Account?

One of the biggest head-scratchers for anyone new to Self Assessment is the idea of Payments on Account. In simple terms, these are just advance payments towards your next year's tax bill.

You’ll be asked to make them if two conditions are met:

- Your last Self Assessment tax bill was more than £1,000.

- Less than 80% of the tax you owed was already paid at source (for example, through your job’s PAYE scheme).

Each payment is exactly half of your previous year's tax bill, with deadlines on 31 January and 31 July. Let’s say your tax bill for the 2023/24 tax year is £3,000. You'd have to make two payments on account for the 2024/25 tax year: the first £1,500 by 31 January 2025, and the second £1,500 by 31 July 2025.

The first time you encounter Payments on Account, it can feel like a nasty shock. You're effectively paying last year's bill and half of next year's all at once. It's a massive cash flow hit that you absolutely need to plan for.

It's also worth remembering that the tax system doesn't stand still. The government is always looking for ways to automate things, and new rules are coming in that will require online platforms to report seller incomes directly to HMRC. You can get a better sense of these upcoming changes to the UK tax system on evansentwistle.co.uk. Keeping an eye on these developments is just part of the game.

Finally, once you've submitted your return and paid the bill, your last job is to keep good records. Download a PDF of your tax return summary and the calculation, and save a copy of your payment confirmation. You need to hang onto this paperwork for at least five years. If this all sounds like a lot, getting some expert help with your self assessment from a firm like Stewart Accounting Services can ensure everything, from submission to record-keeping, is handled perfectly.

Common Self-Assessment Mistakes to Avoid

Even with the best intentions, it's surprisingly easy to slip up on your tax return. Getting help with your self-assessment isn't just about filling in the boxes; it's about navigating the common traps that can lead to overpaying tax or, even worse, an enquiry from HMRC. A few simple errors can cause a world of stress down the line.

One of the most frequent mistakes I see is people simply forgetting about all their income sources. It's easy to remember your main business takings, but what about that small freelance project from last May? Or the interest earned on a savings account, or the dividends from a handful of shares? Every single stream of income, no matter how small it seems, needs to be declared.

This kind of oversight can be costly. Forgetting to declare even a few hundred pounds can result in penalties and interest charges if HMRC discovers the omission later on.

Incorrectly Claiming Expenses

On the flip side of undeclared income is the tricky business of incorrectly claimed expenses. The "wholly and exclusively" rule for business expenses catches a lot of people out. It’s tempting to claim for things that have a dual business and personal use, but getting that split wrong is a definite red flag for HMRC.

Here are a few classic expense errors to watch out for:

- Claiming for 'Entertaining' Clients: Taking a client out for lunch is a great business practice, but unfortunately, it’s not an allowable expense for tax purposes.

- Everyday Commuting: The cost of travelling from your home to your normal place of work (like your office or workshop) cannot be claimed.

- Capital Improvements vs Repairs: Fixing a leaky roof on a rental property? That’s a repair and is allowable. Replacing the entire roof to improve the property? That’s a capital expense and is not.

These distinctions are subtle, but they are absolutely crucial for getting your return right.

The goal is to claim everything you are legitimately entitled to, but not a penny more. Over-claiming expenses, even accidentally, can trigger an investigation and lead to penalties. Diligent record-keeping is your best defence here.

What to Do If You Spot a Mistake

That heart-sinking moment when you realise you’ve made an error after hitting 'submit' is a familiar feeling for many. But don't panic. HMRC makes it surprisingly easy to amend your tax return online. You actually have 12 months from the 31st January filing deadline to make any changes.

All you need to do is log back into your HMRC online account, find the relevant tax year, and select the option to amend your return. You can then correct the figures and resubmit. The system will automatically recalculate your tax liability. It’s a straightforward process designed to help you correct honest mistakes without any fuss. Getting it right, even after the fact, is always the best course of action.

Common Self Assessment Questions Answered

Even the most seasoned self-filer runs into questions now and then. Here are some quick, practical answers to the queries that pop up most often when we're helping clients with their tax returns.

What Happens If I File My Tax Return Late?

Let's be blunt: missing the 31 January deadline hurts. HMRC applies an immediate £100 penalty the very next day, and that's just the start. It doesn't matter if you don't owe any tax or have already paid what you think you owe—the penalty is for late filing, not late payment.

The situation gets worse the longer you leave it. After three months, daily penalties kick in. At the six-month mark, you're hit with another penalty of £300 or 5% of the tax due, whichever is higher. Honestly, it’s a spiral you want to avoid. If you see the deadline approaching and know you're going to struggle, the best thing you can do is get professional advice, and fast.

I’ve Lost My UTR Number—What Should I Do?

It happens to the best of us. Your ten-digit Unique Taxpayer Reference (UTR) is essential, but misplacing it isn't a disaster. The first place to look is on any past correspondence from HMRC, like a previous tax return or a payment reminder.

If you draw a blank, don't worry. You can find your UTR by logging into your Government Gateway account. Alternatively, you can give the Self Assessment helpline a call. They won't give it to you over the phone for security reasons, but they will post it to the address they have on file for you. Just be aware this can take a week or two to arrive, so don't leave it until the last minute.

Can I Switch From Paper To Online Filing?

Yes, you absolutely can, and we strongly encourage it. The biggest advantage is the deadline. You get an extra three months, with the online deadline on 31 January compared to the paper one on 31 October. That extra breathing room can make all the difference.

Making the switch is straightforward. You just need to register for HMRC's online services using your UTR. Once you've set up your Government Gateway account, you can file your return digitally, save your progress as you go, and see your tax calculation instantly. It’s a much smoother process all around.

Navigating these little hurdles is exactly where getting the right support pays off. For personalised help and guidance on your specific tax situation from Stewart Accounting Services, get in touch with our team today. We'll make sure you hit every deadline and take the stress out of the process. https://stewartaccounting.co.uk