Figuring out how to pay yourself as a UK company director is one of the most important financial decisions you'll make. For years, the go-to strategy has been a combination of a low salary topped up with higher dividend payments. This isn't just a quirk of accounting; it's a savvy approach that works with the UK tax system to boost your take-home pay while keeping the company's tax bill down.

The Director's Pay Dilemma: Salary vs Dividends

This is the central question every director grapples with. It's not just a box-ticking exercise for your accountant—it's strategic financial planning that has a direct impact on your personal wealth and the health of your business. To get it right, you first need to understand the fundamental differences between taking a salary and drawing dividends.

A salary is what you receive as a formal employee of your own company. The great thing about a salary is that it's a business expense, meaning it reduces your company's profit and, therefore, its Corporation Tax liability. The downside? Once you go above certain thresholds, both you (as the employee) and your company (as the employer) have to pay National Insurance Contributions (NICs).

Dividends, on the other hand, are distributed to shareholders from the company's profits after Corporation Tax has been paid. The major upside here is that dividends are completely free of National Insurance. This single fact is the main reason the low-salary, high-dividend model is so popular among small business owners.

Why a Mix Is Almost Always Better

You might be tempted to go all-in on one or the other, but that's rarely the most efficient route. A salary-only approach will see you and your company paying significantly more in NICs. Conversely, relying solely on dividends means your pay isn't a business expense, which hikes up your Corporation Tax bill. More importantly, it won't count as a qualifying year towards your State Pension.

Combining the two really does give you the best of both worlds. It’s a flexible and tax-efficient strategy that most UK tax professionals recommend. A small, regular salary provides a stable income stream—crucial for personal budgeting and things like mortgage applications. Dividends offer the tax savings, but remember, they can only be paid if your company has enough retained profit after tax. Their availability is tied directly to your business's performance.

While dividend tax rates are much more favourable than income tax (for example, the basic rate is 8.75% compared to 20% for income tax), it's a delicate balancing act. You can get a clearer picture of how accountants tailor this strategy by reviewing expert insights into director pay strategies.

Quick Look: Salary vs Dividends at a Glance

To make the choice a bit clearer, let's lay out the key differences side-by-side. This table gives you a snapshot of the main characteristics and tax implications of drawing a salary versus taking dividends as a UK limited company director.

| Feature | Salary | Dividends |

|---|---|---|

| Tax Treatment | An allowable business expense, reducing Corporation Tax. | Paid from post-tax profits; not a business expense. |

| National Insurance | Subject to both employee and employer NICs above thresholds. | No National Insurance Contributions for either party. |

| Personal Tax | Taxed via PAYE at standard Income Tax rates (20%, 40%, 45%). | Taxed at lower dividend rates (8.75%, 33.75%, 39.35%). |

| Payment Basis | Paid to you as an employee for work performed. | Paid to you as a shareholder from available profits. |

| State Pension | Counts as a qualifying year for the State Pension if above the LEL. | Does not count towards State Pension qualification. |

As you can see, each has its distinct advantages and disadvantages. The right mix depends entirely on your personal and business circumstances each tax year.

The key takeaway is that your remuneration strategy isn't a "set it and forget it" decision. It requires balancing your immediate need for cash with long-term goals like pension contributions and managing both personal and corporate tax liabilities effectively.

Finding Your Optimal Director's Salary

Figuring out what to pay yourself as a director isn't just about plucking a number out of thin air. This salary is the bedrock of your entire pay strategy. It's what determines your National Insurance contributions and, just as importantly, secures your state benefits down the line.

The goal here is to find the 'sweet spot'. For most UK company directors, the most effective place to start is by setting a salary that sits neatly between two key HMRC thresholds: the Lower Earnings Limit (LEL) and the Secondary Threshold (ST). Let's break down why this specific range is the key to unlocking a tax-efficient structure.

The Power of the Lower Earnings Limit

First things first, let's talk about the Lower Earnings Limit, or LEL. Think of it as the minimum you need to earn to get a 'qualifying year' towards your State Pension and other benefits. For the 2024/25 tax year, that figure is £6,760 a year (£564 a month).

Paying yourself a salary at or above this level is, frankly, non-negotiable if you want to protect your future. It's like making a deposit into your pension pot without any money actually leaving your account. How? Because earnings between the LEL and the Primary Threshold are treated as if National Insurance has been paid, even though no deductions are made.

Navigating the Key NIC Thresholds

Once you've cleared the LEL, the next markers on your map are the National Insurance thresholds for you (the employee) and your company (the employer). These are the points where you or the business actually start paying.

Here are the key thresholds you need to know for the 2024/25 tax year:

- Lower Earnings Limit (LEL): £6,760 per year. Earning above this gets you a qualifying year for your State Pension.

- Secondary Threshold (ST): £9,100 per year. This is the point where the company starts paying employer's NICs.

- Primary Threshold (PT): £12,570 per year. This is where you (the employee) start paying your own NICs. It’s handily aligned with the Personal Allowance for income tax.

For a sole director with no other sources of income, the most tax-efficient salary usually falls between the Secondary Threshold (£9,100) and the Primary Threshold (£12,570).

A popular and effective strategy is to pay yourself a salary of £12,570. At this level, you pay zero employee's National Insurance and zero income tax. While the company will have a small employer's NIC bill on the amount above £9,100, this larger salary creates a bigger business expense, ultimately saving you more in Corporation Tax.

Why This Salary Range Is the Sweet Spot

Setting your salary at £12,570 hits several strategic goals at once. It maximises the salary that your business can claim as an expense against Corporation Tax without you personally having to pay any tax or NICs.

Let's look at the numbers. A £12,570 salary is fully deductible for the company. This reduces your profits subject to Corporation Tax (at 19% for small companies) by that entire amount, saving the business £2,388.30. Yes, there's a small employer's NIC bill to pay, but the Corporation Tax saving almost always outweighs this minor cost. It's a trade-off that makes financial sense.

This calculation is the cornerstone of your entire salary vs. dividend decision. To truly get this right and navigate the sometimes tricky financial landscape, using solid financial analytics can give you the clarity you need for these big decisions.

Ultimately, this specific salary level gets you your State Pension qualifying year, maximises the tax relief for your company, and leaves you with the biggest possible pot of post-tax profits to draw your dividends from. It’s the perfect launchpad for the rest of your remuneration strategy.

Maximising Your Take-Home Pay With Dividends

Once you’ve nailed down your director's salary, your next move is to use dividends to draw further profits from your company in the most tax-efficient way possible. A salary is a business expense, but a dividend is different—it's a distribution of profits to the shareholders. This isn't just semantics; it fundamentally changes how the money is taxed and handled in your accounts.

There’s one golden rule you absolutely cannot ignore: dividends can only be paid from post-tax retained profits. What does that mean in practice? Your company must have already settled its Corporation Tax bill, and there must be enough profit left on the books to cover the dividend you plan to issue. Paying a dividend you can't afford is known as an 'illegal dividend,' and it can land you in serious trouble with HMRC, often forcing you to repay the money.

Understanding the Tax Rules on Dividends

So, why are dividends the cornerstone of the classic "how much should I pay myself as salary vs dividends?" debate? It all comes down to their preferential tax treatment. While they aren’t subject to National Insurance like a salary, they aren’t completely tax-free either. The tax you personally pay on them follows its own set of rules and bands.

For the 2024/25 tax year, here's the breakdown:

- The Dividend Allowance: Every individual has a tax-free Dividend Allowance, which for this tax year is £500. This means the first £500 you receive in dividends is yours to keep, tax-free, no matter what your other income is.

- Dividend Tax Bands: Once you’ve used up that £500 allowance, any further dividends are taxed based on your income tax band. It’s crucial to remember that your dividend income is stacked on top of your other income (like your salary) to determine which band you fall into.

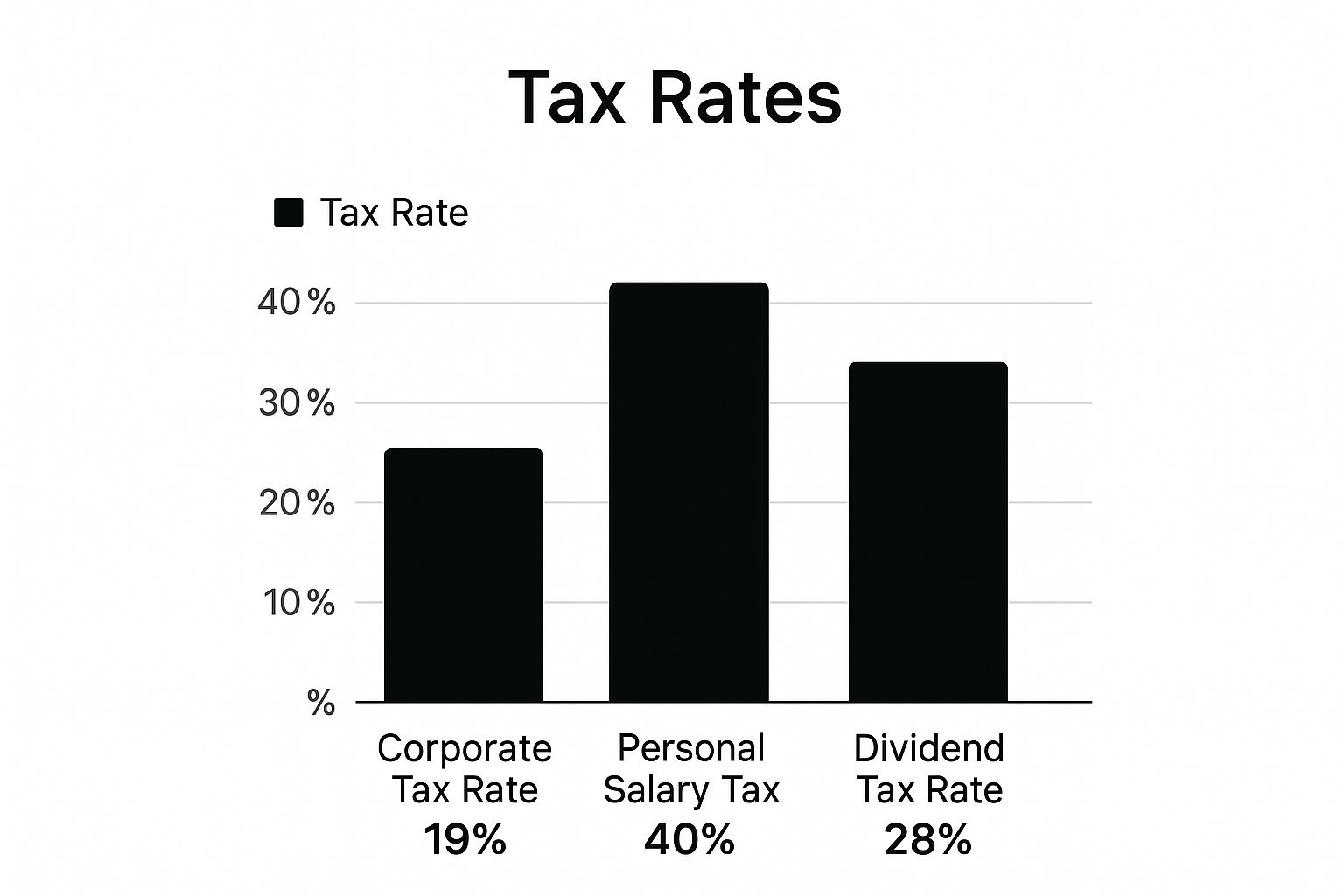

To give you a clearer picture, let's compare the tax rates. It’s here that the advantage of dividends really becomes obvious, especially once you've exhausted your tax-free allowances.

UK Dividend & Income Tax Rates Comparison

This table shows the current personal income tax rates versus dividend tax rates across the different tax bands in the UK.

| Tax Band | Income Tax Rate | Dividend Tax Rate |

|---|---|---|

| Basic Rate | 20% | 8.75% |

| Higher Rate | 40% | 33.75% |

| Additional Rate | 45% | 39.35% |

As you can see, the tax hit on dividends is significantly lower across the board compared to taking the same amount as additional salary.

This visual illustrates why, after using up personal allowances, dividends are almost always preferred over a higher salary.

Even at the highest level, the dividend tax rate is comfortably below the equivalent rate for salary income. This highlights the built-in tax advantage of this structure.

A Practical Scenario for Maximising Your Pay

Let's walk through a real-world example. Say you've set your director's salary at the optimal £12,570, perfectly using up your tax-free Personal Allowance. Now, you want to take as much in dividends as you can before you’re pushed into the higher-rate tax bracket.

The basic rate tax band tops out at £50,270. Since your salary has already used up £12,570 of that, you have a remaining capacity of £37,700 in your basic rate band (£50,270 – £12,570).

This £37,700 is your dividend sweet spot—the maximum you can receive before becoming a higher-rate taxpayer. Here's how the tax on those dividends would be calculated:

- First £500: Completely tax-free, thanks to your Dividend Allowance.

- Remaining £37,200: This portion is taxed at the basic dividend rate of 8.75%.

Your total dividend tax bill would be £3,255 (£37,200 x 0.0875). So, your total take-home pay from this strategy would be your £12,570 salary plus your £37,700 in dividends, less the £3,255 tax. This leaves you with a net income of £46,015. This is a popular combination recommended by accountants because it strikes a great balance between NI savings and income tax efficiency. You can find more detail on this common salary and dividend approach at fawcetts.co.uk.

By strategically drawing dividends right up to this threshold, you extract the maximum profit from your company at the lowest possible tax rate. Any dividends you take beyond this point will be taxed at the much steeper higher rate of 33.75%.

Staying Compliant: The Essential Paperwork

Declaring a dividend isn't as simple as just moving cash from your business account to your personal one. To ensure your payments are legitimate in HMRC's view, you must follow the correct legal process. If you don't, HMRC could reclassify your dividends as salary, which would trigger a nasty, unexpected bill for both income tax and National Insurance.

To keep everything above board, you must create two key documents for every single dividend payment:

- Board Meeting Minutes: This is a formal, written record showing that the company directors met to approve and declare the dividend. It needs to be signed and filed safely with your company records.

- Dividend Vouchers: Think of this as a receipt for each shareholder. It's a certificate that should detail the company name, the date, the shareholder's name, and the amount of the dividend paid.

These documents are your proof that the payments were lawful distributions of profit, not just a salary in disguise. Keeping this paperwork in perfect order is a simple, but absolutely non-negotiable, part of any tax-efficient pay strategy.

Real-World Director Pay Scenarios

The theory behind salary and dividends is one thing, but seeing how the numbers play out in the real world is where it all starts to make sense. Abstract concepts like tax bands and allowances suddenly become much clearer when you apply them to actual business situations.

So, let's walk through three distinct scenarios. Each one reflects a common position UK company directors find themselves in, breaking down the tax implications and, most importantly, the final take-home pay.

Scenario 1: The Solo Consultant

First up, meet Alex. Alex is an IT consultant running their own limited company. It’s been a good year, and for the 2024/25 tax year, the business has generated a profit of £60,000 before paying Alex anything. With no other sources of personal income, Alex wants to take out that profit as tax-efficiently as possible.

The classic low-salary, high-dividend strategy is the obvious choice here.

- Salary: Alex sets their salary at £12,570. This is a smart move. It perfectly aligns with the tax-free Personal Allowance and the Primary Threshold for employee National Insurance, meaning no income tax or personal NI contributions are due.

- Company Impact: This salary is a business expense. The company will have to pay a small amount of employer's NICs—£478.86 to be exact—on the salary portion above the Secondary Threshold (£12,570 – £9,100 = £3,470 @ 13.8%).

- Corporation Tax: The profit is now reduced by the salary and the employer's NI. The new taxable profit is £47,041.14 (£60,000 – £12,570 – £478.86). At a 19% Corporation Tax rate, the company pays £8,937.82.

- Available for Dividends: After the taxman has taken his share, the company is left with £38,103.32 in retained profit, all of which can be paid out as a dividend.

Now, we need to look at Alex's personal tax on that dividend payment.

- The first £500 of the dividend is tax-free, thanks to the Dividend Allowance.

- The remaining dividend income, £37,603.32, falls squarely within the basic rate band and is taxed at 8.75%. This results in a personal tax bill of £3,290.29.

Alex’s Take-Home Pay:

Salary: £12,570 (tax-free)

Dividends: £38,103.32

Less Dividend Tax: -£3,290.29

Total Net Income: £47,383.03

Scenario 2: The Two-Director Business

Next, let's look at a design agency run by Ben and Chloe. They are 50/50 shareholders, and the company has made a healthy £120,000 in pre-tax profit. This is where it gets a bit more complex, because their personal situations are different.

Ben has no other income. Chloe, however, receives £10,000 a year from a rental property she owns. That rental income eats up a huge chunk of her tax-free Personal Allowance, which complicates any pay strategy.

They decide they should both take the same salary of £12,570.

- For Ben, it's just like Alex's situation—no income tax or NI to pay.

- For Chloe, it's a different story. Her £10,000 rental income uses most of her £12,570 Personal Allowance. This leaves only £2,570 of her allowance to set against her salary. The remaining £10,000 of her salary is now taxable at the 20% basic rate, costing her £2,000 in income tax.

From the company's perspective, things are more straightforward.

- Total Salary Expense: £25,140 (£12,570 x 2)

- Total Employer's NICs: £957.72 (£478.86 x 2)

- Taxable Profit: £93,902.28 (£120,000 – £25,140 – £957.72)

- Corporation Tax (at a 21.5% blended rate): £20,188.99

- Available for Dividends: £73,713.29, which they'll split equally (£36,856.65 each).

This example is a great reminder that a one-size-fits-all approach rarely works. Because of her rental income, Chloe will take home less than Ben, even though the company is paying them identically.

Scenario 3: The High-Profit Company

Finally, let's consider a very successful e-commerce business run by a sole director, Sarah. Her company's profit is a substantial £200,000. Sarah wants to draw a significant income but is rightly cautious about hitting the higher tax rates.

Like the others, Sarah starts by taking a £12,570 salary.

- Company Taxable Profit: £186,951.14 (£200,000 – £12,570 salary – £478.86 NICs)

- Corporation Tax (at a 23.9% blended rate): £44,681.32

- Available for Dividends: £142,269.82

Sarah decides to draw £100,000 in dividends, which pushes her well into the higher-rate tax band. Here's how her personal tax on that dividend shakes out:

- Basic Rate Band: The first slice of her dividends (£37,700 of the total basic rate band) is taxed.

- £500 is covered by her Dividend Allowance (tax-free).

- The next £37,200 is taxed at 8.75%, which comes to £3,255.

- Higher Rate Band: The rest of the dividend falls into the higher rate band, where the tax is a much steeper 33.75%.

- £62,300 (£100,000 dividend – £37,700 used in basic band) is taxed at 33.75%, which equals £21,026.25.

It's also worth noting that her total income of £112,570 (£12,570 salary + £100,000 dividend) means her Personal Allowance starts to taper away, adding to the tax bill. But for simplicity, we'll focus just on the dividend tax here.

Sarah's Dividend Tax Bill: £3,255 + £21,026.25 = £24,281.25

From that £100,000 dividend, her take-home amount is £75,718.75. While still a very healthy sum, it really highlights how sharply the tax burden increases once your income crosses that basic rate threshold. In Sarah’s position, you’d seriously consider other ways to extract value, like making significant pension contributions from the company to reduce the overall tax hit.

More Ways to Draw Money from Your Business

Getting the salary and dividend mix right is a huge part of being tax-efficient, but it’s not the whole picture. If you stop there, you’re leaving money on the table. A truly savvy director looks at every legitimate way to draw value from their company.

We're talking about more than just your monthly paycheque. There are several other HMRC-approved methods for moving money from your business account to your personal pocket, often trimming both your Corporation Tax and personal tax bills in the process. These aren't shady loopholes; they're smart financial planning.

The Best-Kept Secret for Tax Efficiency: Pension Contributions

Let's start with what is arguably the single most powerful tool in your arsenal: director pension contributions. While your salary and dividends give you cash in hand today, your pension is about building serious wealth for your future in an incredibly tax-friendly wrapper.

Here’s how it works: your limited company pays directly into your personal pension scheme. This payment is treated as an allowable business expense, meaning you can deduct the full amount from your profits before the taxman comes knocking.

For a company paying Corporation Tax at 19%, a £10,000 pension contribution instantly shaves £1,900 off your tax bill.

But the good news doesn't end there.

- No National Insurance: The company pays no employer’s NI, and you pay no employee’s NI on the contribution. That's a huge saving right off the bat.

- No Income Tax: The money lands in your pension without you personally paying a penny of income tax on it.

- Tax-Free Growth: Once the money is in your pension pot, it grows free from UK capital gains tax and income tax.

Think of it this way: every pound your company invests in your pension simultaneously cuts its own tax bill and builds your personal wealth, all without triggering any immediate tax for you. It’s a genuine win-win-win.

Don’t Forget to Claim Your Expenses

Another fundamental—and often overlooked—way to get money out of the business is simply by reimbursing yourself for every legitimate business expense you've paid for personally. This isn't income, so it isn't taxed. It's just the company paying you back for costs incurred on its behalf.

A classic example is the home office. If you regularly work from home, you can claim a flat rate from HMRC or go a step further and have your company pay you a fair market rent for the space you use. The rental route needs a formal agreement, but it can let you claim a much more significant amount.

Be meticulous about tracking other common costs too:

- Business Mileage: You can claim 45p per mile for the first 10,000 miles you drive in your own car for business each year, dropping to 25p per mile after that. This is meant to cover fuel, insurance, and general wear and tear.

- Travel and Subsistence: This covers everything from train tickets and hotel rooms to meals you buy while you're away on business.

- Equipment and Subscriptions: Any software, professional memberships, or even stationery you've bought for the business can be claimed back.

A Quick Word on Benefits in Kind

Finally, you can take value out of the company through "benefits in kind," though you need to tread carefully here as they almost always have tax consequences. A benefit in kind is anything non-cash that your company provides for your personal use, like a company car or private health insurance.

These perks might sound great, but they aren't truly "free." HMRC calculates a cash equivalent for the benefit, which is then added to your total income for the year, meaning you'll pay income tax on it. The company also gets hit with Class 1A National Insurance on the value of that benefit.

For instance, if your company pays for your private medical insurance, the annual premium is treated as taxable income for you. Company cars are even more complicated; the tax you pay depends on the car’s list price and its CO2 emissions. While electric vehicles currently have some fantastic tax advantages, you absolutely must do the maths to figure out if a benefit is actually worth it once all the tax is factored in.

Answering Your Questions on Director Pay

Even with the best plan in place, it’s natural to have questions. The rules around director pay can feel a bit tangled, but once you get to grips with the practical side of things, you'll feel much more confident managing your own remuneration.

Let's walk through some of the most common queries that come up when directors are trying to strike the right balance between salary and dividends.

Can I Pay Myself Only in Dividends?

In short, yes, you can legally pay yourself entirely in dividends and take no salary. But from a tax-planning perspective, it’s almost never the best move.

If you skip a salary altogether, you miss out on a couple of really important benefits. For a start, you won't be making a "qualifying year" for your State Pension, which could leave a dent in your retirement income down the line. What's more, your company misses out on a key tax deduction. A director's salary is a legitimate business expense, which lowers your company's profit and, as a result, its Corporation Tax bill.

The smartest strategy usually involves taking a small salary—often set around the National Insurance threshold. This simple step secures your State Pension entitlement and gives your company a valuable tax break, making it a far better approach than relying on dividends alone.

Taking a small, optimised salary before drawing any dividends is the foundation of a tax-efficient pay structure for most company directors.

What Happens If My Company Has No Profits?

This is an absolutely critical point every director needs to understand. Dividends can only be paid out of post-tax retained profits. If your company hasn't made a profit, or if losses from previous years have wiped out any current profits, then you simply cannot legally declare a dividend.

Trying to pay a dividend without sufficient profits is a serious misstep. This is known as an 'illegal' or 'ultra vires' dividend. The consequences aren't trivial, either. HMRC could reclassify the payment as a director's loan that you have to repay to the company. Worse, they might treat it as salary, landing you with a bill for backdated tax and National Insurance.

Always make sure you have up-to-date accounts that clearly show there are enough retained profits to cover any dividend you plan to declare.

Do I Need an Accountant for This?

While you could technically run your own PAYE payroll and handle the dividend paperwork yourself, I would strongly advise against it. The tax and National Insurance landscape is always changing. Allowances, thresholds, and regulations are tweaked almost every year.

A good accountant does so much more than just crunch numbers. They offer crucial strategic advice that’s specific to you and your business. They’ll keep you compliant with HMRC, make sure all the paperwork is filed correctly and on time, and, most importantly, structure your income in the most tax-efficient way possible.

Honestly, the fee you pay for professional advice is usually a drop in the ocean compared to the tax you could save and the reassurance you get from knowing it’s all being handled properly. It’s a small price to pay to avoid very costly mistakes.

Getting your head around director pay is just one piece of the puzzle. At Stewart Accounting Services, we help you look beyond the compliance grind. We offer strategic guidance to improve your finances, boost your profits, and give you back your time and peace of mind. Find out how our tailored accounting services can support your growth.