At its core, doing a VAT return is a simple calculation: you figure out the VAT you’ve charged your customers, then subtract the VAT you've paid on your own business expenses. The difference is what you report and either pay to HMRC or claim back. For pretty much every business in the UK now, this is all handled digitally through what’s known as Making Tax Digital (MTD) compatible software.

Getting to Grips with VAT Before You Start

Before you even think about software or submissions, you need a solid grasp of what Value Added Tax (VAT) actually is. I always tell clients to think of it as a tax on consumption that gets added at each point a product or service is sold. Your business acts as the collector, but it's the end customer who really foots the bill.

Getting this right from day one will save you a world of pain down the line. The very first question to ask is whether you even need to be registered for VAT.

The VAT Registration Threshold

In the UK, the law says you must register for VAT once your VAT-taxable turnover tops £90,000 in any rolling 12-month period. This is a crucial point many new business owners miss – it’s not tied to the tax year or your company's financial year. It’s a continuous, rolling calculation.

Think of a freelance consultant billing £8,000 a month. They'll breach that threshold well within a year. On the other hand, a local coffee shop might have high sales figures, but only its turnover counts towards the threshold, not its profit.

A Quick Tip: Plenty of businesses choose to register for VAT voluntarily, long before they hit the £90,000 mark. Why? Because it lets them reclaim the VAT on their own purchases. For a new business buying lots of equipment or stock, this can be a huge cash flow advantage.

Understanding the Different VAT Rates

Not everything is taxed the same, and this is where things can get tricky. You'll need to apply the correct rate to whatever you sell. There are three main rates to know:

- Standard Rate (20%): This is the one you’ll see most often. It applies to the vast majority of goods and services, from a haircut to a new laptop.

- Reduced Rate (5%): You'll find this on specific things, like home energy or children’s car seats.

- Zero Rate (0%): This covers many essentials, like most food from a supermarket (but not a hot takeaway!) and kids' clothes. You don't charge any VAT, but you still have to record the sale on your return.

VAT is a massive source of income for the government. That 20% standard rate has been around since 2011 and applies to roughly half of all household spending. The 5% rate covers a much smaller slice of things like domestic fuel. If you're interested in the numbers, the OBR website has detailed statistics on how VAT impacts the UK economy.

Knowing which rate applies to your products or services is non-negotiable. An IT contractor will almost always charge the standard rate, while a baker will sell mostly zero-rated goods. Mixing these up is one of the quickest and most common ways to make an expensive error on your VAT return.

Getting Your Financial Ducks in a Row

Before you even think about logging into HMRC’s portal, the real work for your VAT return happens behind the scenes. An accurate return is built on a foundation of meticulously organised records. This isn't about just keeping receipts; it's about having a system that gives you a clear, auditable trail of every penny that comes in and goes out.

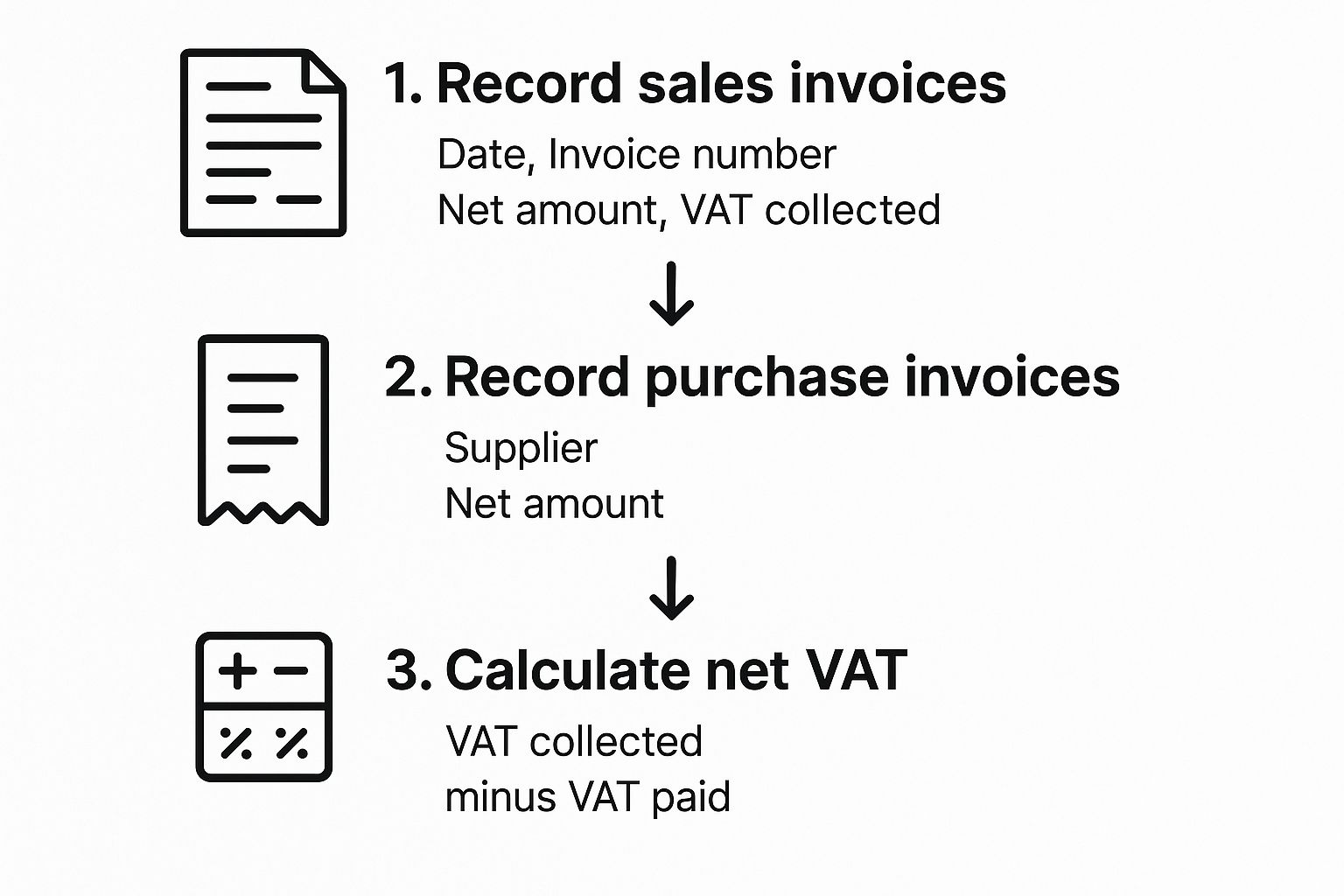

The whole process boils down to two key figures: output VAT and input VAT. Simply put, output VAT is the tax you’ve charged your customers, and input VAT is the tax you’ve paid on your own business purchases. Your goal is to get a crystal-clear total for each.

Sorting Your Sales from Your Purchases

First things first, you need to split all your transactions into these two piles. Every sale you make that's subject to VAT has to be accounted for, right down to the last detail.

On the flip side, you need to document every single business expense you've been charged VAT on. This covers everything from the stock you buy and raw materials you use, right through to your business's mobile phone contract.

A classic mistake I see all the time is businesses trying to reclaim VAT on personal expenses or on purchases from suppliers who aren't even VAT registered. A crucial rule of thumb: if the invoice doesn't have a valid VAT number on it, you can't reclaim a thing.

Solid financial organisation is the absolute bedrock of a stress-free VAT return. For a deeper dive into this, you might find this guide on effective tax record keeping really useful. Nailing this structured approach is what separates a smooth filing from a frantic scramble.

Why a Proper VAT Invoice Is Non-Negotiable

Just having a receipt isn't going to cut it when you want to reclaim input VAT. HMRC is very clear on this: you need a valid VAT invoice for every single expense you claim. This isn't a friendly suggestion; it's a hard and fast rule.

A proper VAT invoice has to show certain information:

- A unique invoice number

- The seller's name, address, and VAT registration number

- The date the goods or services were supplied (the 'tax point')

- Your business name and address

- A clear description of what you bought

- A breakdown showing the net amount, the VAT rate, and the total VAT charged

Take filling up your company van, for instance. That little credit card slip you get from the pump is useless for VAT purposes. You need the full VAT receipt that itemises the cost of the fuel and the VAT element separately. If you can't produce it during an inspection, HMRC can—and will—disallow your claim, and you could face penalties.

This is where modern accounting software like Xero really comes into its own. You can just snap a picture of the invoice with your phone and attach it directly to the transaction. It creates an impeccable digital record, so you never have to worry about losing that vital piece of paper again. Getting this right turns VAT returns from a quarterly nightmare into a simple admin task.

Getting Your VAT Return Submitted Under Making Tax Digital

Right, you’ve got your records in shape. Now for the actual submission. Since April 2022, the game completely changed with Making Tax Digital (MTD) becoming mandatory for all VAT-registered businesses. The days of logging into the old government gateway to manually type in your figures are long gone. Everything now has to be filed through MTD-compatible software.

Honestly, this is a good thing. It has made the whole process much more direct and has significantly cut down on the kind of silly mistakes that are easy to make when you're manually keying in numbers. Your accounting software now talks directly and securely to HMRC's systems, pulling the figures straight from your books to fill out the VAT return. This seamless "digital link" is the whole point of MTD.

Connecting Your Software and Giving it a Final Once-Over

The first time you file this way, you'll need to give your software permission to speak to HMRC on your behalf. Don't worry, it's a simple, one-time task. You'll be prompted to log in with your Government Gateway ID to authorise the connection.

The journey starts on the official government website where you first sign up for Making Tax Digital for VAT.

As you can see from the GOV.UK page, there are a few steps to complete before your software can be properly connected.

Once you’re linked up, your software will generate a draft VAT return. Now, this is crucial: your job is to be the human check. Never just click 'submit' without looking. Cast your eye over the summary. Do the figures align with how the quarter felt? Does the total sales figure look about right? Is the amount of VAT you're reclaiming on purchases what you'd expect? This is your final opportunity to spot a miscategorised expense or a duplicated sales invoice before it lands on HMRC’s desk.

Remember, in the UK, the VAT registration threshold was bumped up from £85,000 to £90,000 in taxable turnover from April 2024. If you're over that, you must file these returns, usually every three months. You can get a deeper dive into the specific VAT regulations in the UK on thetaxcom.co.uk.

What Those Boxes on the VAT Return Actually Mean

Even though your software is doing most of the heavy lifting, it’s vital you understand what the numbers represent. A VAT return has nine boxes, but for most small businesses, these are the ones that really matter:

- Box 1 (VAT due on sales): This is the total output VAT you've charged on your sales during the period. Simple as that.

- Box 3 (Total VAT due): This is the sum of Box 1 and Box 2. Box 2 is for VAT on acquisitions from other EU countries, which is less common for many UK SMEs these days.

- Box 4 (VAT reclaimed on purchases): Here's all your input VAT. It’s the VAT you’ve paid on legitimate business expenses that you can claim back.

- Box 5 (Net VAT to be paid or reclaimed): This is the bottom line. It's the difference between Box 3 and Box 4. If the number is positive, that's what you owe HMRC. If it's negative, you're due a refund.

After giving everything a thorough final check, all that's left is to follow the prompts in your software to submit the return. The data is sent instantly to HMRC, and you'll get a confirmation right away. This digital handshake officially closes out your VAT period, replacing the old, clunky filing process for good.

Time to Calculate: Will You Be Paying HMRC or Getting a Refund?

Okay, you've done the hard work of gathering your records and plugging the numbers into your MTD software. Now comes the moment of truth: working out whether you owe HMRC money or if a refund is coming your way.

The calculation itself is surprisingly straightforward. While your software does the heavy lifting, knowing the logic behind it is essential. It helps you sanity-check the final figure and spot any glaring mistakes before you hit 'submit'.

At its heart, the formula is simple: take the total output VAT you charged customers (from Box 1) and subtract the total input VAT you paid on your own business purchases (from Box 4).

The Core Formula for Your VAT Bill

This simple sum determines your final position with HMRC for the quarter.

Total Output VAT (what you charged) – Total Input VAT (what you paid) = Net VAT Due or Reclaimable

If the result is a positive number, it means you collected more VAT from your sales than you paid on your purchases. That difference is what you owe to HMRC.

If it's a negative number, congratulations! You've paid more VAT than you collected, and HMRC owes you a refund. This is actually quite common, especially for new businesses with hefty start-up costs and initially low sales.

Think of a new retail shop. They might spend £10,000 on stock and shop fittings before opening their doors, allowing them to reclaim £2,000 in input VAT. If their first quarter's sales only generate £800 in output VAT, they'd be due a welcome £1,200 refund from HMRC.

To give you a clearer picture, here’s a quick look at how this might play out for two very different types of businesses over a single quarter.

VAT Calculation Example: Service vs Retail Business (Quarterly)

| Financial Item | Service Business Example (e.g., Consultant) | Retail Business Example (e.g., Shop) |

|---|---|---|

| Total Sales (Net) | £15,000 | £25,000 |

| Output VAT (Box 1) | £3,000 | £5,000 |

| Total Purchases (Net) | £2,000 (software, office rent) | £18,000 (stock, rent, utilities) |

| Input VAT (Box 4) | £400 | £3,600 |

| VAT Calculation | £3,000 – £400 | £5,000 – £3,600 |

| Final Position | £2,600 VAT Payment Due | £1,400 VAT Payment Due |

As you can see, even though the retail business had higher sales, its significant stock costs dramatically reduced its final VAT bill compared to the consultant.

Meeting the Deadline and Making Your Payment

Once you have that final figure, the clock starts ticking. For most businesses filing quarterly, the deadline to both submit your return and make your payment is one calendar month and seven days after the end of the accounting period. Miss it, and you’re looking at penalties.

If you owe HMRC, you have a few options for settling up:

- Direct Debit: This is often the most hassle-free method, as the payment is taken automatically.

- Online or telephone banking: Use Faster Payments to send the money directly.

- Debit or corporate credit card: You can pay online through the government's portal.

- At your bank or building society: A more traditional but still valid option.

These payments are a cornerstone of the UK economy. After a dip during the pandemic, VAT receipts have bounced back, growing from £101.6 billion in 2020-21 to a projected £170 billion for 2024-25. If you're curious, you can discover more about UK VAT revenue trends on statista.com.

On the other hand, if you’re due a refund, HMRC will typically pay it straight into your designated bank account. They aim to process refunds within 30 days of receiving your return, but in my experience, it’s often much quicker—sometimes landing in as little as 10 working days, provided your records are in good order.

Common VAT Return Mistakes and How to Avoid Them

Look, even the most meticulous business owner can slip up on their VAT return. It happens. The trouble is, these seemingly small mistakes can snowball into big headaches—think incorrect payments, compliance checks, and even penalties from HMRC.

The good news? Most of these pitfalls are surprisingly common and, more importantly, completely avoidable. Knowing where others trip up is half the battle. A lot of the time, it boils down to a simple misunderstanding of the rules, a rushed entry, or just messy records. A little bit of diligence now can save you a world of stress later.

Reclaiming VAT on Non-Business Expenses

This is a classic. One of the most frequent errors we see is business owners trying to reclaim input VAT on things that aren't purely for business. It’s an easy trap to fall into, especially if you’re a sole trader and your personal and business finances are closely linked.

Let's say you buy a new laptop. You use it 80% of the time for your graphic design work but the other 20% is for watching Netflix. In this scenario, you can only reclaim the VAT on the business portion of that cost. Claiming the full 100% is a definite no-go.

To stay on the right side of the line, always ask yourself: "Is this purchase wholly and exclusively for my business?" If there's any personal use, you must work out the business percentage and claim only that. I always recommend keeping a note of how you calculated that split, just in case HMRC ever wants to see your workings.

Simple Data Entry Errors

You'd think that with Making Tax Digital (MTD) software, manual errors would be a thing of the past. Not quite. Mistakes can still sneak in at the very first step—when you're keying in an invoice or an expense. A transposed number or a misplaced decimal point might seem minor, but it can throw your final VAT figure way off.

A simple typo on an invoice for £10,000.00 that gets entered as £1,000.00 can drastically alter your VAT calculation. Always double-check your figures before finalising them in your accounting software, as this is your last line of defence.

What to Do If You Find a Mistake

Realising you've made a mistake after you've filed can send a shiver down your spine, but don't panic. It's usually quite simple to put right. The method you use just depends on the size of the error.

- For net errors under £10,000: You can usually just correct it by making an adjustment on your next VAT return. Simple.

- For net errors over £10,000 (or for any deliberate errors): This is a bit more serious. You must formally tell HMRC what’s happened by filling out Form VAT652.

The crucial thing is to act the moment you spot the problem. Being proactive and transparent with HMRC is always the best strategy. It shows you're taking your tax responsibilities seriously and are committed to getting things right.

A Few Common VAT Return Questions Answered

Getting to grips with VAT can feel like learning a new language. When you're busy running your business, it's easy to get bogged down in the details. Here are some straightforward answers to the questions we hear most often about VAT returns.

What if I Have Nothing to Pay or Reclaim? Do I Still Need to File?

Yes, you absolutely do. This is a common trip-up for new businesses or during quiet periods.

Even if you have no VAT to pay to HMRC or reclaim from them—what’s known as a “nil return”—you are still legally required to submit your VAT return by the deadline. Missing it can lead to penalties, so it's a step you can't afford to skip, regardless of your sales or purchase activity in the period.

What’s the Real Difference Between VAT Exemption and Zero-Rated VAT?

This one causes a lot of confusion, but the distinction is critical for your bookkeeping and your bottom line. While your customer doesn't pay VAT in either case, how they're treated on your return is completely different.

-

Zero-Rated: Think of items like most food, books, or children's clothes. These are still technically part of the VAT system, but the rate is set at 0%. You have to report these sales on your return, and crucially, you can reclaim the VAT you paid on any costs related to producing them.

-

Exempt: These are goods and services that are completely outside the scope of VAT. This includes things like insurance, financial services, or postage stamps. You don't charge VAT on these sales, but—and this is the key part—you cannot reclaim any VAT on your related expenses.

For your cash flow, the difference is huge. With zero-rated sales, you get back the VAT you spend. With exempt sales, you don’t. Getting this right is fundamental to accurate VAT accounting.

How Long Do I Need to Hang on to My VAT Records?

HMRC is very clear on this: you must keep all your VAT records for at least six years. This isn’t just your invoices and receipts; it covers your VAT account, credit notes, and even records of goods you’ve taken for private use.

These records need to be kept in good order—accurate, complete, and easy to read. This is where MTD-compatible software is a lifesaver. It automatically creates a digital trail, keeping everything securely archived and ready for inspection. It’s a lot less stressful than rummaging through dusty boxes if HMRC ever comes knocking.

Feeling like you're drowning in VAT paperwork? The team at Stewart Accounting Services can take the entire process off your hands. We’ll handle your VAT obligations from start to finish, ensuring everything is submitted accurately and on time, so you can focus on what you're passionate about. Let us untangle the complexity for you. Find out more at https://stewartaccounting.co.uk.