When you're looking to minimise your corporation tax, it's all about being proactive. The key is to legally reduce your taxable profit before HMRC even looks at your books. This means meticulously claiming every allowable business expense, making smart use of capital allowances for asset purchases, and exploring powerful tax reliefs like R&D credits.

Ultimately, you're just making sure you only pay tax on the profit you’ve genuinely earned after accounting for all legitimate costs.

Your Starting Point for Tax Efficiency

Before diving into complex strategies, you need to get the basics right. Think of it like building a house – you need a solid foundation first. Corporation Tax is simply the government's slice of your limited company's profits. It’s not a tax on your total sales, but on what's left after you've paid all your business expenses.

This distinction is absolutely fundamental. Why? Because every single pound you spend on a legitimate business cost is a pound that HMRC cannot touch.

Grasping this is the first real step towards intelligent tax planning. A core strategy for influencing your corporation tax rate involves understanding the base rate entity for a lower company tax rate, which covers principles that are relevant across different tax systems. The idea is refreshingly simple: the more allowable costs you can correctly identify and claim, the smaller your taxable profit becomes.

The Core Concepts You Need to Know

Your journey to a lower tax bill really rests on two main pillars: allowable expenses and tax reliefs. These are the tools HMRC gives you to legally and ethically reduce what you owe.

-

Allowable Expenses: These are simply the day-to-day running costs of your business. We're talking about everything from staff wages and office rent to software subscriptions and your marketing budget. Forgetting even small expenses means you're voluntarily overpaying tax.

-

Tax Reliefs and Allowances: These are special government incentives put in place to encourage certain business activities. Think of them as rewards for investing in new equipment (Capital Allowances) or for innovating through research and development (R&D Tax Credits).

To help you get a clear picture of what's available, here's a quick summary of some of the most impactful allowances for UK businesses.

Key Corporation Tax Allowances at a Glance

| Allowance Type | What It Covers | Key Benefit |

|---|---|---|

| Annual Investment Allowance (AIA) | The purchase of most plant and machinery. | Allows you to deduct the full value of qualifying items (up to a limit) from your profits in the year of purchase. |

| Full Expensing | The purchase of new, main-rate plant and machinery. | Provides a 100% first-year tax deduction on qualifying new assets, with no spending cap. |

| R&D Tax Credits | Costs associated with innovative projects to create new products, processes, or services. | Offers significant tax relief, either as a corporation tax reduction or a cash payment, rewarding innovation. |

| Patent Box | Profits earned from patented inventions and certain other intellectual property. | Reduces the corporation tax rate on eligible profits to just 10%. |

These allowances are designed to fuel investment and growth, so it pays to know which ones apply to your business.

The goal isn't tax avoidance; it's tax efficiency. By meticulously accounting for every eligible expense and allowance, you ensure that your company's tax bill accurately reflects its true profitability, freeing up capital for reinvestment and growth.

For example, I see so many small business owners forget they can claim for using their home as an office or for professional subscriptions relevant to their industry. They might seem like minor details, but they add up significantly over a financial year and can make a real difference to your final profit figure. We’ll get into the nitty-gritty of specific expenses later, but adopting this detail-oriented mindset from day one is crucial.

Maximising Your Claimable Business Expenses

One of the most straightforward and powerful ways to lower your corporation tax is to get really disciplined about claiming every single legitimate business expense. So many business owners end up paying more tax than they need to, simply because they miss out on everyday deductions that seem too minor to bother with. Trust me, those small costs add up.

At its core, HMRC’s rule is simple: for an expense to be allowable, it must be “wholly and exclusively” for business purposes. That sounds black and white, but there's a lot of grey area in how you interpret it. This is where you can make a real difference to your bottom line. We're not just talking about the obvious stuff like rent or stock; it covers a massive range of costs that keep your company running day-to-day.

Think of it this way: every pound you spend on a legitimate business cost is a pound that you’re not paying tax on. Getting this right is fundamental to smart tax planning.

Looking Beyond the Obvious Deductions

Everyone remembers to claim the big-ticket items like office rent, stationery, and salaries. The real art to tax efficiency, though, lies in catching all the less obvious expenses that often slip through the cracks. These are the costs that can collectively save you thousands by year-end.

Here are a few categories that I often see business owners miss:

- Targeted Staff Training: Any course that genuinely improves an employee's ability to do their job is fully deductible. This could be anything from professional development workshops and online certifications to industry-specific training.

- Professional Subscriptions and Memberships: Are you paying for trade publications, memberships in bodies like the Chartered Institute of Marketing, or access to specialist software? These are all valid business expenses.

- The Full Scope of Digital Marketing: This goes way beyond your main ad campaigns. Things like your social media scheduling tools, SEO software, email marketing platforms, and even costs for stock photography are all part of the picture.

The best advice I can give is to change your mindset. Start seeing every business payment not just as cash leaving your account, but as a potential tax deduction. It keeps you on the lookout for legitimate ways to lower your taxable profit.

A Practical Example: A Small Consultancy Firm

Let's take a small digital marketing consultancy based in Stirling as an example. The director might initially think their main expenses are just their laptop and a few software subscriptions. But when you dig a little deeper, you can almost always uncover a whole host of other claimable costs.

Over the course of a year, their expenses might actually look more like this:

- Travel to a Client Meeting: That train fare from Falkirk to Glasgow for a project kick-off? It's fully deductible.

- Subsistence on the Go: The coffee and sandwich they bought while on that client trip can also be claimed as a reasonable subsistence cost.

- Industry Conference: The ticket for a major marketing conference in London, plus the associated travel and hotel, is a perfectly valid expense for professional development.

- Home Office Costs: They can claim a portion of their home's utility bills (gas, electricity, internet) based on the space and time dedicated to business use.

- Bank Charges: Even the monthly fees on the business bank account are a simple, but often forgotten, deduction.

Individually, these seem small. But when you add them all up, the total can easily run into the thousands. For a business with a taxable profit of £60,000, claiming an extra £5,000 in these overlooked expenses would cut their Corporation Tax bill by £950 (at a 19% rate). That’s real cash that goes straight back into the business, proving just how vital meticulous expense tracking is when you're learning how to minimise corporation tax.

Using Capital Allowances for Your Asset Investments

When your business buys new assets—whether that’s a couple of laptops, a fleet of delivery vans, or some heavy-duty manufacturing equipment—you open up one of the most effective routes to legally reduce your corporation tax. The mechanism behind this is called capital allowances, and it allows you to write off some, or often all, of an asset's value against your profits.

Think of it as HMRC's way of giving you a pat on the back for investing in your company's growth. Instead of treating the purchase as a simple day-to-day expense, capital allowances provide tax relief for these bigger, longer-term investments. Some of these schemes are incredibly powerful, offering immediate and substantial tax savings.

This is where a bit of forward-thinking pays off big time. Just buying a new piece of kit is one thing. But buying it at the right moment, with a solid grasp of the allowances available, can completely change your tax position for the year and give your cash flow a serious boost.

Understanding the Key Allowances

For most SMEs, the most important tool in the box is the Annual Investment Allowance (AIA). As it stands, the AIA lets you claim a 100% deduction on qualifying plant and machinery in the same year you buy them, up to a very generous £1 million limit. It’s a real game-changer if you’re planning any significant upgrades.

If you’re making even bigger investments in new and unused assets, Full Expensing works in a similar way, offering a 100% first-year allowance but without any upper spending cap. This is a massive help for businesses in sectors like manufacturing, construction, and logistics that are constantly buying expensive machinery.

The principle is straightforward: the more you can legally deduct from your profits, the less tax you'll have to pay. Capital allowances are a direct, government-approved method for turning essential business investment into immediate tax savings.

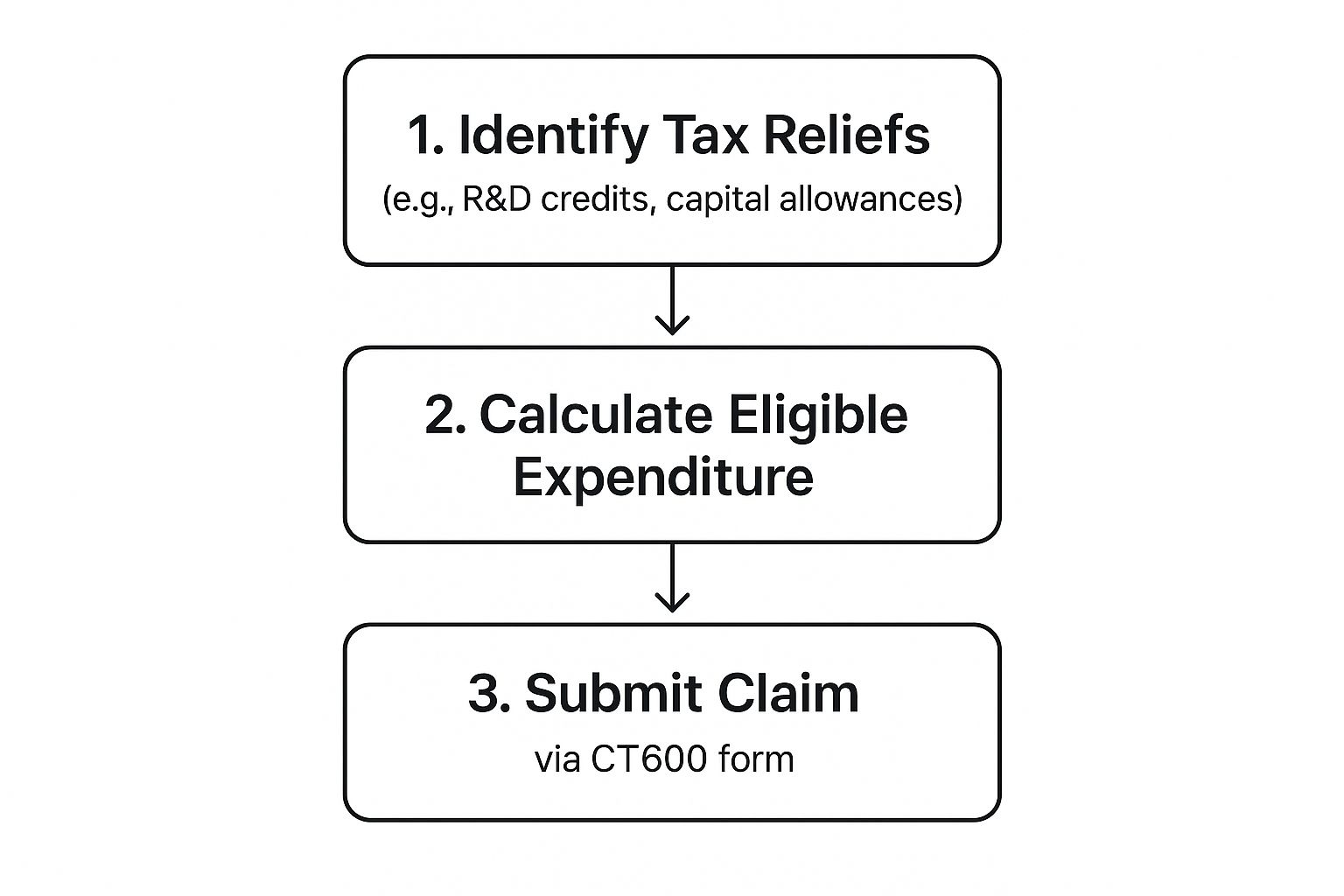

The process might sound complex, but it follows a logical path from identifying the investment to claiming the relief.

As you can see, claiming this kind of tax relief is a structured process. It starts with spotting opportunities like capital allowances and finishes with making a formal claim on your CT600 tax return.

A Practical Scenario: Timing is Everything

Let’s put this into a real-world context. Imagine a Falkirk-based engineering firm is heading towards its year-end with a projected taxable profit of £150,000. The directors know they need to replace an old CNC machine, which is going to set them back £80,000.

They’ve got two options:

- Wait and See: They could put off the purchase until the next financial year begins. In this case, their corporation tax bill would be based on the full £150,000 profit.

- Act Strategically: They could buy the new machine before the financial year ends. This move allows them to use the Annual Investment Allowance to deduct the full £80,000 from their profits right away.

By choosing option two, their taxable profit plummets from £150,000 to just £70,000. With the main corporation tax rate at 25%, that single, well-timed decision cuts their tax bill by £20,000 (£80,000 x 25%). That’s a huge cash saving that can be put straight back to work in the business.

Planning Your Asset Investments

This example makes it crystal clear: timing your investments is crucial. To get the most out of capital allowances, you need to be proactive.

- Audit Your Assets: Get a clear picture of what you own. Pinpoint any equipment that’s getting old, inefficient, or nearing the end of its useful life.

- Check Your Forecasts: Keep an eye on your projected profits. If it looks like you’re on track for a particularly good year, bringing forward a planned purchase can be a smart tax-planning move.

- Know What Qualifies: Most things you buy for your business will fall under "plant and machinery," but there are exceptions. Company cars, for instance, have their own set of rules, so it's vital to know what you can and can't claim for.

For companies involved in major asset investments, like property, tracking performance against key metrics for real estate investors is essential for strategic financial planning. A proactive approach ensures you’re not just buying assets, but investing in a smarter, more tax-efficient future for your business.

Exploring R&D and Creative Industry Tax Reliefs

If your business is innovating and creating something new, you might be sitting on one of the UK government's most generous tax incentives without even realising it. Many directors hear "Research and Development" and picture scientists in white lab coats, quickly deciding it doesn't apply to them. Honestly, this is a costly mistake that leaves a serious amount of cash on HMRC's table instead of in your business.

The reality is that R&D tax reliefs cover a much wider range of activities than you might think. Are you investing time and money to solve a tricky scientific or technological problem? If so, you could be eligible. This is a crucial strategy for any business looking to minimise corporation tax through genuine innovation.

And these schemes do more than just lower your tax bill. For companies that aren't yet making a profit, they can even lead to a cash payment directly from HMRC. That's right—your investment in innovation can be turned into a tangible financial boost to fuel your next stage of growth.

What Actually Counts as R&D?

The definition of R&D for tax purposes is surprisingly broad. It's not just about world-first inventions; it’s about any project where you're trying to achieve a noticeable improvement in a field of science or technology.

Think about the everyday challenges you face. The clever solutions you're developing could be your ticket to a hefty tax reduction.

Here are a few real-world examples that go way beyond the laboratory:

- Software Development: You’ve built a bespoke CRM system because the off-the-shelf options just couldn't handle your unique business processes.

- Engineering Hurdles: You’ve designed a new component for your manufacturing line that’s stronger, lighter, or more energy-efficient than what was previously available.

- Smarter Processes: You’ve developed a new, data-driven logistics system that significantly cuts waste and delivery times in your supply chain.

- Food Science: You've created a new recipe for a food product to get a longer shelf life without resorting to artificial preservatives.

The key isn't necessarily creating something the world has never seen before. It's about your company tackling a genuine technical challenge where the solution wasn't obvious or easy to find.

A Quick Example: A Tech Startup

Let's imagine a small software startup in Stirling. The team spends nine months and £100,000 on salaries and contractor fees to develop a new machine-learning algorithm for its clients. The project is tough and involves solving some significant technical problems along the way.

Under the SME R&D scheme, they can claim an enhanced deduction on these costs. This allows them to deduct much more than their actual spend from their profits, which can dramatically reduce their Corporation Tax bill. If the company isn't profitable yet, it could even surrender its loss for a cash credit of up to 14.5%. For our startup, that could mean a cash injection of thousands of pounds, straight from HMRC.

Don't Forget Creative Industry Reliefs

R&D isn't the only game in town. HMRC also offers a fantastic suite of tax reliefs for companies in the creative sector. They’re designed to support some of the UK’s most exciting industries and work much like R&D credits, giving you an enhanced deduction on production costs.

If your company operates in any of these areas, you should definitely be looking into them:

- Video Games Tax Relief (VGTR): For companies designing, producing, and testing new video games.

- Film Tax Relief (FTR): Aimed at productions that pass a cultural test or qualify as an official co-production.

- Animation Tax Relief (ATR): Supports animated productions made for broadcast or cinema release.

- High-End Television (HETV) Tax Relief: For scripted TV series with production costs over £1 million per broadcast hour.

Each of these reliefs has its own specific rules, but the payoff can be huge. A small indie game developer, for example, could claim relief on its core development costs, helping to turn a passion project into a much more financially stable business. This kind of targeted support is a clear signal that the government values and directly rewards creative and technical innovation through the tax system.

Is Your Innovation Locked In? The Patent Box Could Be the Key

While R&D tax credits are fantastic for rewarding the process of innovation, the Patent Box is all about rewarding the outcome. If your company has gone through the effort of securing a patent for its inventions, this powerful scheme can slash your Corporation Tax bill. Think of it as the government's way of encouraging you to commercialise your brilliant ideas right here in the UK.

Essentially, the Patent Box lets you pay a significantly lower Corporation Tax rate of just 10% on the profits you make from your patented inventions. With the main rate now at 25% for many companies, the difference is huge. For any innovative business, this isn't just a minor tweak; it's a major strategic advantage.

So, How Does It Actually Work?

The main challenge is figuring out which slice of your profit comes directly from your patented tech. After all, a product's success is a mix of its unique features, branding, marketing, and sales efforts. HMRC knows this, so there's a specific formula to calculate the "relevant IP profit" that qualifies for the lower rate.

This isn’t an automatic benefit—you have to actively opt into the scheme. It’s a formal election that signals to HMRC that you plan to apply the 10% rate. The good news is you have some flexibility; you can make this election up to two years after the end of the accounting period you want it to apply to.

First introduced back in April 2013, the regime offers a stark contrast in tax liability. For example, a company earning £1 million in profit from products protected by a patent would face a tax bill of just £100,000 under the scheme. Without it, at the main 25% rate, they'd be looking at a £250,000 bill. For more details on UK tax rates, you can discover more insights about UK corporation tax on pwc.com.

What Kind of Income Qualifies?

One of the best things about the Patent Box is its scope. It’s designed to cover worldwide income stemming from your patented inventions, and that goes far beyond just selling a single product.

Here’s what typically qualifies:

- Worldwide sales of a patented product: This is the most straightforward source of qualifying profits.

- Sales of items incorporating the patented invention: Even if your patented component is just one part of a larger product, a portion of that profit can qualify.

- Licensing fees and royalties: If you license your patent out to another company, that income stream is eligible.

- Income from infringement: Any damages you win from someone infringing on your patent also qualifies for the 10% rate.

The Patent Box transforms your intellectual property from a simple legal shield into a proactive tool for tax efficiency. It creates a powerful financial reason to not only innovate but to properly protect those innovations.

A Quick Look at a Real-World Scenario

Let's imagine a small manufacturing firm based in Falkirk. They’ve developed a groundbreaking new valve, which they've patented, that makes industrial pumps far more efficient. They sell these valves on their own and also build them into their complete pump systems.

Here’s how the numbers could stack up:

- Total Annual Profit: The company makes a healthy £400,000.

- Relevant IP Profit: After running the numbers through the Patent Box formula, they determine £150,000 of that profit is directly from their new valve technology.

- Tax Without the Scheme: At the standard 25% rate, their Corporation Tax bill would be a hefty £100,000.

- Tax With the Scheme: Now, they pay 10% on their IP profits (£15,000) and 25% on the remaining £250,000 (£62,500).

The final tax bill drops to £77,500. That’s a straight saving of £22,500 for the year, all because they made their IP work for them. For any innovative SME, looking into the Patent Box isn't just a good idea—it's essential financial planning.

Smart Pension Contributions and Salaries

How you pay yourself and your team is more than just a monthly payroll run; it's a strategic decision that can make a huge difference to your Corporation Tax bill. If you're not carefully structuring director salaries and making pension contributions, you're almost certainly leaving money on the table for HMRC.

Let’s be clear: this isn’t just about squirrelling cash away for retirement. This is an active, in-year strategy for extracting profits from your business in one of the most tax-efficient ways possible. Every single pound your company contributes to a pension is a pound deducted from its profits before the taxman ever sees it.

Finding the Sweet Spot for Director Salaries

For most owner-directors, the game is to draw a salary that’s just high enough to be personally beneficial without triggering unnecessary tax or National Insurance Contributions (NICs). That magic number usually sits right around the Secondary Threshold for Employer's NICs.

Why is this so effective? By paying yourself a salary up to this level, you're earning a qualifying year for your state pension without you or your company having to pay a penny in National Insurance. It’s a small, tax-free salary that simultaneously counts as an allowable business expense, chipping away at your taxable profits.

For the 23/24 tax year, a director might pay themselves a salary of around £9,100. This falls below the personal allowance, so no income tax is due, and it neatly avoids NICs for both parties. The full amount is deducted from the company's profits, directly lowering the Corporation Tax bill. Most directors then top up their income with dividends, which don't attract NICs.

Think of employer pension contributions as one of the last great ways to move significant funds from your company's bank account to your personal wealth, completely tax-free. It slashes your company's profit and bypasses personal income tax all in one move.

The Power of Employer Pension Contributions

While an efficient salary provides a tidy tax benefit, making company pension contributions is where the real savings kick in. For many directors, this is hands-down the single most powerful tool in the box for minimising corporation tax.

Here's how it works: when your limited company pays directly into your pension scheme, that contribution is treated as an allowable business expense. This creates a fantastic twofold effect:

- It cuts your company's profit: The entire contribution is deducted from your profits, which means a lower Corporation Tax bill. Simple as that.

- It avoids personal tax: Unlike a salary or dividend, the money lands in your pension pot without you paying a shred of Income Tax or National Insurance on it.

This technique is also incredibly flexible. Had a bumper year with profits to match? You can make a larger one-off contribution to bring that tax liability right down. The annual allowance for pension contributions is a very generous £60,000 for most people, giving you a huge amount of room for strategic tax planning.

Let’s look at a quick example. Say your company is heading for a pre-tax profit of £80,000. If you make a £30,000 employer pension contribution, you instantly reduce the taxable profit to £50,000. If your profits fall into the 25% tax band, that single action just saved your company £7,500 in Corporation Tax – and it all went straight into your personal retirement fund.

Got Questions About Corporation Tax? We've Got Answers

Stepping into the world of business tax can feel like learning a new language. I've had countless conversations with business owners wrestling with the same questions, so let's clear up some of the most common ones right now.

When Do I Actually Pay My Corporation Tax?

This one trips up so many people. The deadline for paying your Corporation Tax is nine months and one day after your company's accounting period ends. But here's the kicker: the deadline to file your Company Tax Return (the CT600 form) is a full 12 months after your year-end.

Yes, you read that right. The system is designed so that you have to pay the tax you owe before you officially file the return that finalises the calculation. It seems backwards, I know. This is exactly why keeping your books in good order throughout the year is non-negotiable—you need that data to accurately forecast what you'll owe.

Can I Claim My Own Salary as an Expense?

You certainly can. Paying yourself a director's salary is a perfectly legitimate business expense. It's deductible from your company's profits, which in turn lowers your Corporation Tax bill. Simple as that.

The real art here is paying yourself an efficient salary. For most directors, this involves setting your salary at a level that takes advantage of tax-free allowances (like the National Insurance threshold) without actually triggering any personal tax or NI contributions. Any income you need above that is usually better taken as a dividend.

So, Are Dividends a Business Expense Too?

No, and this is a crucial point to grasp. Dividends are completely different. They aren't an expense; they're a way of distributing profits to shareholders after Corporation Tax has been accounted for.

Because the company has already paid tax on those profits, you can't then claim the dividend payment as another deduction.

Think of it like this: a salary is a cost of running the business, which reduces your profit. A dividend is a share of the profit that's left over. One lowers your tax bill, the other doesn't.

What Happens If My Business Makes a Loss?

Nobody aims to make a loss, but if it happens, there's a silver lining from a tax perspective. When your company's allowable expenses are higher than its income, that trading loss can be put to good use.

You have a couple of strategic options:

- Carry it back: You can offset the loss against profits you made in the previous financial year. If you paid tax that year, this can trigger a welcome refund from HMRC.

- Carry it forward: You can hold onto the loss and use it to reduce taxable profits in future years, effectively shielding that income from Corporation Tax when you're back in the black.

This flexibility is a powerful tool for managing cash flow, particularly for start-ups or businesses navigating a tough patch.

At Stewart Accounting Services, we've helped countless businesses across Stirling, Falkirk, and Alloa make sense of all this. Our goal is simple: to handle the complexities so you can claim everything you're entitled to and structure your finances efficiently. We want to give you back your time, your money, and your peace of mind.

Ready to get a firm grip on your company's tax position? Get in touch today and let's see how we can help.