Missing an HMRC deadline? You’ll drop straight into the red zone with a £100 fixed penalty, no questions asked. Picture HMRC’s late filing system as a traffic light—green means you’re on time, amber signals a warning, and red pushes you into rising fines.

How HMRC Late Filing Penalties Work

Every missed deadline triggers automatic charges across five main returns. Understanding the basics helps you see how penalties stack up.

- Self Assessment: £100 initial penalty, then £10 daily once you’re three months late (capped at £900), plus further percentage-based levies.

- Corporation Tax: Starts at £100 and can climb past £1,000 for repeat or extended delays.

- VAT: Filing late brings a 5% penalty on the VAT due, plus daily interest on any unpaid balance.

- PAYE/RTI: Fines range from £100 to £400, depending on your payroll size and how often you miss submissions.

- CIS: A 1% monthly penalty on total deductions applies, up to a maximum of 15%.

For instance, a sole trader filing their Self Assessment just one week after the 31 January deadline still faces that immediate £100 fine.

Real World Impact

When Jane, a freelance designer, filed her return one week late she encountered:

- A £100 fixed penalty straight away.

- No additional daily charges until the three-month mark.

- The looming threat of even higher fees after six months.

“A short delay today can cost you hundreds later,” advises a Stewart Accounting expert.

In the following sections, we’ll walk you through calculating exact costs, lodging an appeal on grounds of reasonable excuse and setting up a smoother filing process.

What You’ll Gain

- A clear breakdown of the 5 tax return penalties you might face

- Worked examples that reveal daily charges and fixed fines

- Practical steps to file on time, from reminders to record-keeping

- Advice on appealing penalties with solid supporting evidence

- Tips on using software, respecting deadlines and knowing when to seek an accountant’s help

Next up, we’ll dive into each tax category’s penalty schedule and share tactics to keep you firmly in the green.

Understanding Key Concepts Around Penalties

Getting to grips with penalties starts by imagining your VAT return as a monthly household bill you can’t afford to miss. Once you frame it that way, HMRC’s deadlines feel more familiar—and a lot less scary.

Defining Fixed And Daily Penalties

Missed deadlines trigger a fixed penalty—think of it as a one-off fine straight into your account. After a set grace period, daily penalties kick in, stacking up like an ever-running parking meter.

For instance, a late Self Assessment brings an immediate £100 charge. Then, after three months, HMRC adds £10 per day until you file. Corporation Tax follows a similar path but switches penalty bands for repeat offences.

A single missed date can spark a chain reaction of fines.

Comparing Individual And Corporate Rules

Individuals deal with Self Assessment or VAT returns; companies handle CT600 and Corporation Tax filings. The distinction is simple:

- Self Assessment deadlines fall on 31 January, like rent day for a tenant.

- CT600 returns hinge on your company’s year end, similar to an annual home inspection.

- VAT filings come in monthly or quarterly, much like subscription payments.

- PAYE and CIS submissions mirror weekly or monthly meter readings.

Thinking in these everyday terms makes it easier to slot each tax task into your calendar.

How HMRC Calculates Charges

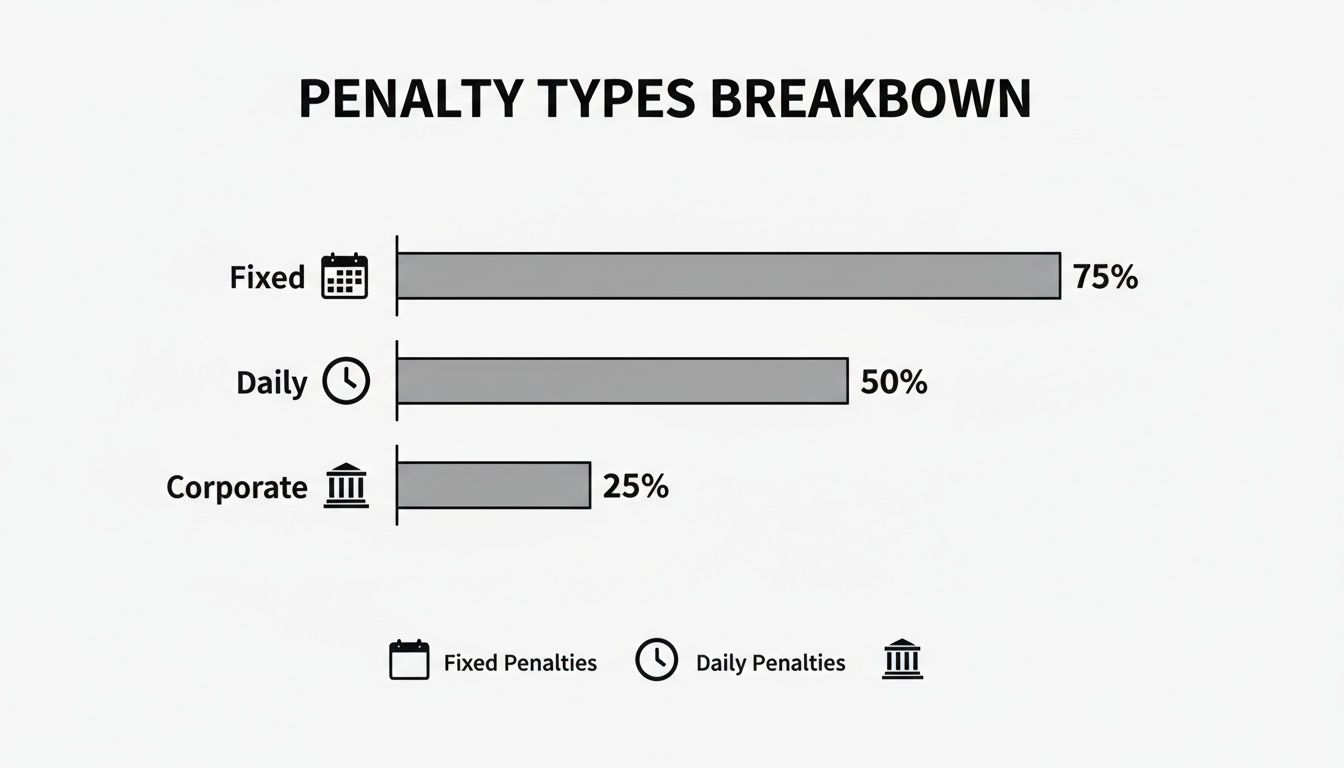

HMRC blends several penalty types to arrive at a final bill:

| Type | What It Means |

|---|---|

| Fixed | One-off fines |

| Daily | Increasing fees for each day |

| Percentage | A share of the tax you owe |

Caps keep penalties from spiralling out of control—daily charges top out around £900, and further surcharges apply at six- and twelve-month marks. This mix creates a tailored penalty based on how late you are and what you owe.

Understanding how each part fits unravels the complexity.

Spotting A Single Missed Date Domino

Missing one deadline can feel like the first domino in a long row. A slip on your VAT return sparks daily fees; miss those surcharges and you soon face percentage penalties too.

Recognising this chain reaction underlines why it pays to act quickly. Every day you delay makes the problem and the bill grow.

Encouraging Prompt Filing

Think of HMRC’s penalty structure as traffic lights:

- Green: File on time—zero fees.

- Amber: One day late—no extra cost yet.

- Red: Fixed penalty arrives, followed by daily fines.

This colour-coded approach turns abstract numbers into visual cues you can follow, reducing stress and steering you towards on-time submissions.

Relating To Everyday Tasks

Anchoring tax chores in household routines cements them in your mind:

- Annual Self Assessment is like spring cleaning—skip it and clutter (i.e. fines) piles up.

- VAT filing feels like your monthly energy bill—small lapses quickly inflate.

- CT600 returns mirror a building inspection—neglect it and you face hefty follow-up costs.

These metaphors help you slot filings into weekly, monthly or annual habits—just like any other chore.

Conclusion Of Key Concepts

By weaving in relatable analogies and breaking down each penalty, you’ve laid the groundwork for precise calculations and proactive planning. Next, we’ll unpack the specific penalty schedules and key dates for each tax type.

Pairing a digital calendar with reliable cloud accounting software ensures alerts pop up—just like reminders for rent or mortgage payments. With this conceptual map in hand, you’ll slash your stress levels and dodge late-filing penalties for good.

Stewart Accounting Services can help you set up these systems and guide you through HMRC’s maze. Think of us as your co-pilot on the compliance journey, keeping you on safe, penalty-free ground.

Penalty Structures For Each Tax

Missing a tax deadline can feel like stepping on a landmine. One wrong move and charges start mounting. Here, you’ll find a clear breakdown of how HMRC penalties stack up for Self Assessment, Corporation Tax, VAT, PAYE RTI and CIS returns. We’ll cover what you owe immediately, at three months and beyond, with real numbers you can plug straight into your own scenarios.

You’ll learn:

- When fixed fines hit

- How daily and percentage penalties kick in

- What caps limit your charges

Self Assessment Penalty Breakdown

If your Self Assessment return arrives late after the 31 January deadline, HMRC applies a £100 fixed penalty straight away. Let’s see how that escalates:

- £100 fixed charge immediately after 31 January

- £10 per day from day 1 past three months, capped at £900

- At six months, an extra £300 or 5% of the tax due (whichever is higher)

Concrete terms make this easier to absorb. For instance, a self-employed sole trader who files on 1 May would already be sitting on £100 + £10 × 1 day = £110, and with each day adds more until the £900 cap.

This screenshot shows the Self Assessment summary page from Wikipedia, highlighting key deadlines and eligibility criteria.

Corporation Tax Penalty Breakdown

Corporation Tax filings follow a similar ladder of fines, but with extra teeth for repeat offenders. From 1 April 2026, late filing penalties double under Schedule 18 of the Finance Act 1998. Here’s the rundown:

- £100 for the first missed CT600 deadline

- £200 if this is the second late filing within three years

- £1,000 for the third successive default (higher for companies with over 50 employees)

- £2,000 minimum once the return is over three months late

You can dive into the detailed HMRC changes on Increases to Corporation Tax late filing penalties.

Penalty Comparison Across Taxes

Below is a side-by-side snapshot of initial fines, three-month penalties and any extra charges you might face. Use it as a quick way to compare each regime.

| Tax Type | Initial Penalty | Three Month Penalty | Additional Charges |

|---|---|---|---|

| Self Assessment | £100 fixed | £10 per day (up to £900) | £300 or 5% at six months |

| Corporation Tax | £100 fixed | Doubles to £400 | At least £2,000 after three months |

| VAT | 5% of VAT due | N/A | Daily interest on unpaid balances |

| PAYE RTI | £100 (small); £400 (large) | Not applicable | Fine varies by payroll size |

| CIS | 1% per month of deductions | Capped at 15% | No further charges beyond cap |

This comparison makes it plain how some systems rely on fixed penalties, others on daily or percentage charges.

Other Taxes Overview

Beyond Self Assessment and Corporation Tax, three more returns attract late-filing fees:

- VAT: You pay 5% of the VAT due as a penalty. On top of that, interest runs daily on any unpaid balance from the next day after your deadline.

- PAYE RTI: Late reports cost £100 for small payrolls and £400 for larger ones. These fines reset each payroll period.

- CIS: Contractors face a 1% penalty on total monthly deductions, capped at 15% over the whole period.

For deeper details on VAT late filing penalties, check out our guide on VAT late filing penalties.

Using The Penalty Table

Pick the tax type in the first column. Match your lateness period. Read across to pinpoint your charge. It’s that straightforward—no more hunting through HMRC’s long guidance notes.

Use this table as your quick reference to avoid unexpected HMRC fines.

Imagine a CT600 that’s four months overdue:

- £100 initial penalty

- £200 second-failure fine

- £2,000 minimum for being over three months late

Total: £2,300

Tweak the days late and you’ll see exactly how each step affects your bill. Combine this with the Self Assessment screenshot and the comparison table, and you’ve got a full-colour map of HMRC’s late-filing landscape.

Stay on track by filing promptly—and you’ll keep those penalties in the rear-view mirror.

Penalty Timelines And Daily Charges

Missing a tax deadline can feel like coins slipping through a crack in your budget. HMRC’s late-filing penalties start small but grow fast, so it pays to know the timetable. Let’s walk through each stage to keep your costs under control.

When Fixed Penalties Kick In

As soon as the Self Assessment deadline of 31 January passes, HMRC adds a £100 fixed penalty. It’s a bit like an alarm bell—ignore it and the charges escalate. Corporation Tax follows the same rule, while VAT, PAYE RTI and CIS each have their own first penalty triggers.

How Daily Fees Build Up

If you’re still not filed three months later, daily fines begin. HMRC tacks on £10 for every day your return is late. After ninety days, that adds up to a £900 cap—equivalent to handing HMRC £70 per week just for waiting.

Surcharge Milestones

At six months overdue, you face a fresh surcharge: 5% of the tax owed or £300, whichever is higher. Twelve months late brings another 5% or £300 on top. These percentage penalties aim to jolt you into action and can quickly outweigh the fixed fees.

Penalty Timeline Summary

Here’s a snapshot of how charges accumulate over time:

| Delay Period | Penalty Rate | Cap Or Amount |

|---|---|---|

| Day 1 | £100 (fixed) | N/A |

| 3 months | £10 per day | £900 |

| 6 months | 5% of tax due or £300 | N/A |

| 12 months | 5% of tax due or £300 | N/A |

Use this quick reference when scheduling your filings to avoid unwelcome surprises.

Other Tax Return Schedules

Different returns follow a similar tiered pattern:

- Corporation Tax: £100 fixed, then doubling for repeat defaults, rising to £1,000 and £2,000 after three months.

- VAT: Immediate 5% penalty on the unpaid VAT, plus daily interest on any balance left.

- PAYE RTI: £100 per period for smaller employers, £400 for larger ones.

- CIS: 1% monthly on total deductions, capped at 15% of annual payments.

Worked Example

Imagine a sole trader who misses the Self Assessment deadline by 100 days:

- Day 1 penalty: £100

- Days 91–100 at £10 per day: £100

- Total so far: £200

- They still have £800 before hitting the £900 daily cap

- At six months, a further charge of £300 or 5% of the tax owed kicks in

This simple breakdown shows how quickly costs can mount.

Visual Reference From HMRC

This graphic from HMRC outlines each penalty phase—fixed fees, daily charges and percentage surcharges. Keep it handy as you plan your tax timetable.

Check out our guide on UK tax deadlines you can’t afford to miss to set up reminders and steer clear of penalties in future.

Appealing And Reducing Penalties

Missing a deadline feels like a heavy weight. Yet there’s a clear route through HMRC’s appeals process that can lighten the load if you know what to do.

When can you make a case? HMRC recognises a “reasonable excuse” – think serious illness or a sudden IT blackout. Gathering firm evidence, then moving swiftly, boosts your odds of success.

Here’s a practical roadmap:

- Identify the specific tax return and the date you missed.

- Collect documents or system logs that explain what happened.

- Choose whether to appeal online or by post.

- Submit your appeal within 30 days if you can.

- Keep an eye on your progress through HMRC’s online services.

Once you’ve applied, HMRC typically replies within 30 days. In many instances, you can discuss a payment plan and pause further penalties while clearing the balance.

“A reasoned, documented appeal wins cases,” notes an HMRC adviser

Gather Supporting Evidence

Start by pulling together all relevant paperwork:

- Medical notes, hospital letters or a doctor’s certificate.

- IT logs and email timestamps if a server crash or software fault is to blame.

- Anything else that ties directly to your missed deadline.

Arrange these items with date stamps and a simple index. That way, reviewers won’t lose time hunting for proof.

Online And Postal Appeals

For speed and convenience, most people go the online route:

- Log into HMRC’s portal.

- Fill in the appeal form.

- Attach scanned copies of your evidence.

If you prefer paper, use form SA370 for Self Assessment—or the equivalent for other taxes. Send everything by recorded delivery, then keep your proof of posting safe.

Negotiating Time To Pay

After you’ve lodged your appeal, consider a Time To Pay arrangement.

Call HMRC Debt Management on 0300 200 3835. Have a realistic payment schedule ready along with an estimate of your income.

Often you’ll agree on monthly instalments over up to 12 months. This formal plan halts daily or percentage penalties until you’ve settled the debt.

First Time Penalty Relief

If you haven’t filed late in the past three years, you might qualify for HMRC’s First Time Filing Penalty Waiver. It can wipe out the initial £100 fixed penalty on a self-assessment return.

Bear in mind, though, it doesn’t cover interest on unpaid tax.

Over five years leading to 2025, HMRC issued 600,000 late filing penalties to individuals who didn’t owe any income tax—often those on very low incomes. Many are now calling for broader relief. Learn more on taxpolicy.org.uk.

A structured checklist sets your appeal apart

Appeal Checklist

- Medical evidence: a doctor’s note near your deadline.

- Technical logs: screenshots or email records.

- Correspondence: letters or emails with HMRC or third parties.

- Financial hardship: bank statements or benefit letters.

- Legal notices: court orders or police reports.

Making Tax Digital Changes

From April 2026, MTD for Income Tax will introduce a points system for missed deadlines. Each missed quarterly update adds one point; reaching two points brings a £200 fine.

This approach pushes us towards regular compliance instead of one big annual rush.

When To Contact An Accountant

If your appeal becomes knotty or HMRC challenges your evidence, it’s time to call in an expert. Stewart Accounting Services can review your case, package your evidence, and guide you through Time To Pay talks.

We help SMEs throughout Central Scotland and across the UK with swift, practical support.

Check out our guide on penalties for late tax payments to get deeper tips and examples: Penalties For Late Tax Payments

Contact us for a free consultation on penalty appeals—our team is ready to tailor advice to your situation.

Don’t wait.

Steps To Avoid Future Penalties

Avoiding HMRC penalties is always cheaper than footing the bill later. A few small habits can keep your filings on track and your stress levels down.

Embed simple alerts and routine checks so you spot upcoming cut-off points well before they arrive.

Use Reliable Calendar Reminders

First, tie every tax return deadline to phone and email alerts. These digital nudges ensure dates don’t slip under your radar.

Use layered reminders: a one-month warning, a one-week prompt and a day-before check-in. This countdown builds urgency without last-minute panic.

- Sync calendars across devices to dodge missed notifications.

- Colour-code VAT, CT600 and SA deadlines for an instant visual cue.

- Share alerts with your accountant or team to boost accountability.

Adopt Cloud Accounting Software

A cloud accounting app acts like an extra pair of eyes, flagging deadlines and tracking your progress in real time. No more hunting through spreadsheets for missing figures.

Look for tools that interface with HMRC’s Making Tax Digital API and come with built-in checklists, so you know exactly which steps are complete.

| Feature | Benefit |

|---|---|

| Auto Alerts | Notifies you before each deadline |

| Real Time Dashboard | Tracks your filing status at a glance |

| HMRC Integration | Submits data directly and reduces errors |

Central dashboards cut down manual uploads and highlight any gaps across Self Assessment, VAT, Corporation Tax and PAYE.

Create Month End Routine And Outsource When Helpful

At each month end, set aside time to gather receipts, reconcile accounts and draft figures. This mini audit stops small errors from ballooning into major headaches.

If your workload grows, outsourcing to a cloud-savvy accountant can add a safety net. They can auto-pull data, spot discrepancies and save you from scramble-mode at year end.

- Install cloud accounting software and grant your accountant access.

- Schedule a recurring month-end meeting to review draft numbers.

- Keep a monthly checklist of receipts, invoices and reconciliations.

- Automate bank feeds for instant transaction matching.

A month-by-month check builds confidence and cuts stress before filing deadlines

Plan your Making Tax Digital integration early so uploads happen quarterly, not annually. Spreading the workload means fewer last-minute dashes to beat the clock.

Monitor Progress With Before And After Checklists

A before-filing checklist ensures every section of your return lines up with your accounts. After you hit submit, run an after-filing review to confirm HMRC has received everything without hiccups.

Compare your calendar entries, accounting records and HMRC confirmations. This cross-check prevents overlooked items and sneaky late fees.

- Review remittance prompts from HMRC to catch any missing confirmations.

- Archive proof of submission emails or screenshots as evidence.

- Update your master calendar with lessons learned for next time.

When in doubt, reach out to Stewart Accounting Services for a bespoke filing schedule and regular check-ins. We set up reminders, manage your software and review returns so that late filing penalties stay in the past.

Consistent use of alerts, cloud tools and monthly routines turns tax filing from a scramble into a smooth habit. This disciplined approach is your best defence against future fines and gives you peace of mind.

When To Seek Professional Help

If deadlines still slip or your returns become more complex, it’s time to bring in an expert. An accountant can automate checks and handle filings on your behalf.

- Your business income exceeds your software limits and needs more in-depth reporting.

- You’ve missed more than one deadline and want to arrange a Time To Pay plan.

Frequently Asked Questions

What happens if I miss a deadline by one day?

Even being just 24 hours late can trigger a £100 fixed penalty. You won’t see daily fines until after three months, but that initial charge applies straight away. If this is your first missed deadline, you might be eligible for First Time Penalty Relief.

How can I view my penalty charges online?

Log in to your Government Gateway and pick the relevant tax return account. Under Statements and Payments, you’ll find details of fixed penalties, daily charges and any surcharges. Download or screenshot the summary to keep with your records.

What steps do I take if a software error caused the delay?

Save all error messages, timestamps or server logs that show the failure. In your HMRC portal, submit an appeal under “Reasonable excuse” and upload your evidence. If the digital route doesn’t work, post form SA370 to challenge a Self Assessment penalty by post.

Common Questions And Actions

What options exist for small businesses facing repeated fines?

You can apply for a Time To Pay arrangement, which pauses new penalties and lets you spread the bill. HMRC may also grant a discretionary waiver if you show improved filing routines. Often, a quick process review—like setting up calendar reminders—can stop repeat triggers.

How do I appeal a late filing penalty?

- Note which return was late and the exact date.

- Appeal online or by post within 30 days of the notice.

- Attach supporting documents (doctor’s notes, IT logs, etc.).

- Wait for HMRC’s decision, typically within 30 days.

Keeping your evidence in order and appealing early will improve your chances of success.

Where can I find official HMRC guidance on late filing penalties?

HMRC offers PDF guides and an interactive penalty calculator for each tax category:

Start your penalty appeal with expert guidance from Stewart Accounting Services for tailored support and peace of mind.