At its heart, the decision between setting up as a limited company or a sole trader boils down to a classic trade-off: simplicity versus protection. The sole trader route is wonderfully straightforward with minimal admin, making it a perfect starting point for freelancers or new ventures. On the other hand, a limited company offers that crucial liability protection and can be far more tax-efficient, which is why it’s often the go-to choice as a business matures and profits climb.

Choosing Your UK Business Structure

Picking the right legal structure for your business is one of those foundational decisions that has ripple effects on your tax, personal liability, and day-to-day admin. The choice between being a sole trader or incorporating as a limited company isn't just about filling out a few forms; it genuinely shapes how the world sees your business, how HMRC taxes you, and how much personal risk you're shouldering.

For many entrepreneurs just starting out, the sole trader path is the one of least resistance. Legally, you and your business are one and the same. This means getting started is quick, and the ongoing paperwork is about as simple as it gets—usually just a single annual Self Assessment tax return is all that's required. It’s an ideal setup for anyone testing a business idea or running a smaller operation where profits are still modest and the legal risks are low.

A limited company, however, is a completely separate legal entity from its owners (the shareholders). This crucial separation creates a protective "corporate veil" between your business and personal finances. It means your personal assets, like your home or savings, are shielded if the business runs into debt or faces legal action. For many, this protection alone is the single biggest reason to incorporate.

Core Differences at a Glance

While you can run a successful business either way, how they operate on a daily basis is worlds apart. Take tax, for instance. A limited company pays Corporation Tax on its profits, and you're taxed personally on any money you take out. This creates far more opportunities for strategic tax planning compared to the sole trader structure, where all your profits are simply taxed as personal income.

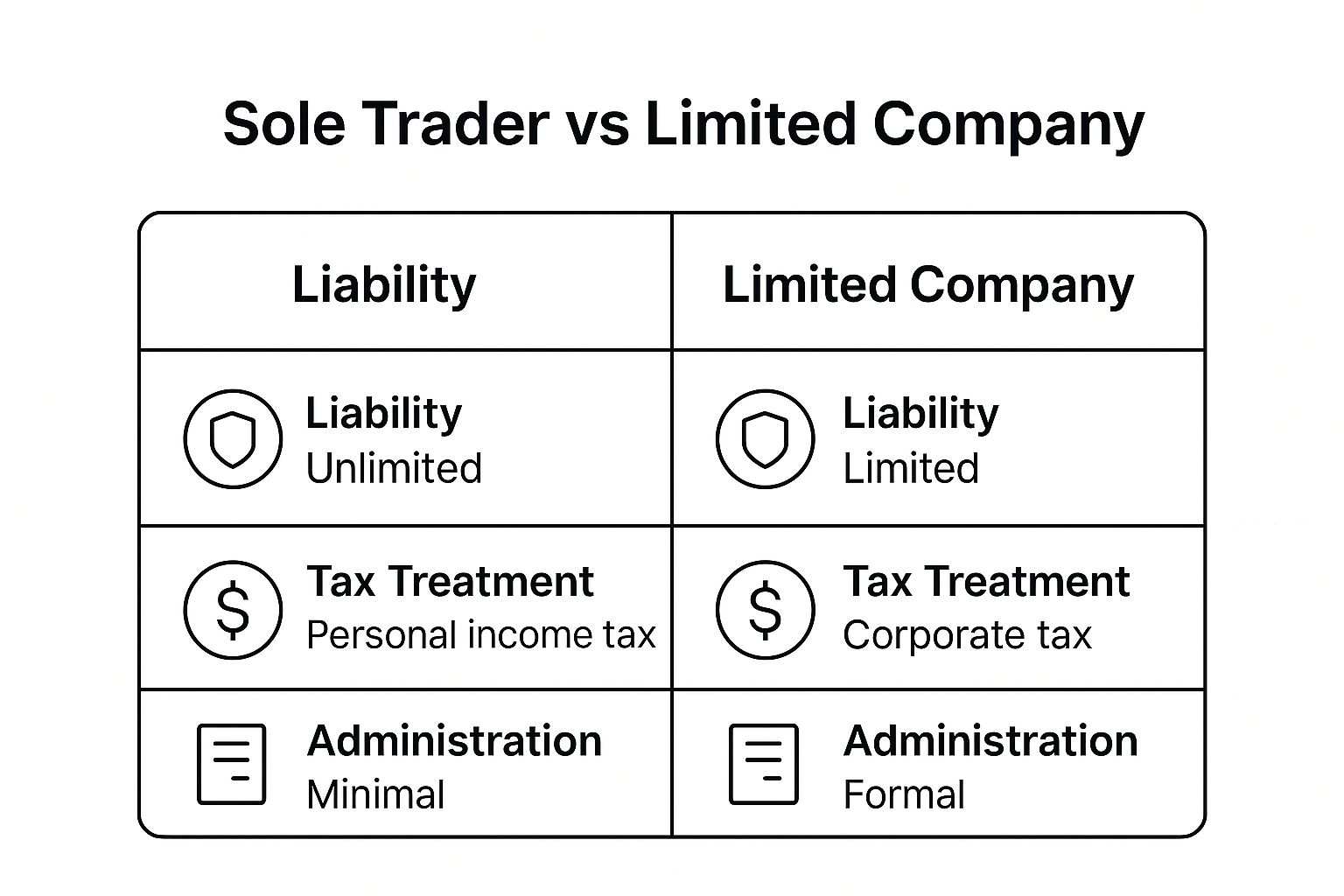

The image below zeroes in on the three most critical distinctions: your personal liability, how you're taxed, and the administrative load you can expect.

This visual really gets to the point: what a sole trader gains in simplicity, a limited company gains in formality and protection.

To help you see the differences side-by-side, let's break them down in a simple table.

Sole Trader vs Limited Company At a Glance

Here’s a quick-reference table that highlights the fundamental differences between these two popular structures. Think of it as a high-level cheat sheet.

| Feature | Sole Trader | Limited Company |

|---|---|---|

| Legal Status | You and the business are a single legal entity. | The company is a separate legal entity from its owners. |

| Personal Liability | Unlimited. Your personal assets are at risk for business debts. | Limited. Liability is restricted to your investment in the company. |

| Tax Treatment | Profits are taxed as personal income via Self Assessment. | Profits are subject to Corporation Tax. Owners are taxed on salaries/dividends. |

| Administration | Minimal. Register with HMRC and file an annual tax return. | More complex. Must file annual accounts and a Confirmation Statement. |

As you can see, the right choice really depends on your specific circumstances and future ambitions.

When you're weighing up the options, it’s always a good idea to dig deeper and get specific insights for Ltd company founders. Getting a firm grip on these fundamental differences is the first, most important step toward making a smart decision that aligns with your business goals and your personal appetite for risk.

Understanding Your Personal Liability

Of all the points to weigh up in the limited company vs sole trader debate, this is arguably the most critical. Personal liability isn't just a bit of legal jargon; it fundamentally changes the level of risk you shoulder as a business owner and dictates what’s on the line if things go south.

When you're a sole trader, the law doesn't see a difference between you and your business. You are the business. This seamless identity means you are personally on the hook for every debt, every bill, and every legal claim that comes your way.

This is what's known as unlimited liability. In simple terms, if your business can't pay its debts, creditors can come after your personal assets to get what they're owed. We’re talking about your personal savings, your car, and even your family home.

The Sole Trader Scenario

Let's make this real. Imagine Alex, a freelance web developer, operates as a sole trader. Alex wins a big contract to build a sophisticated e-commerce site. Unfortunately, a nasty bug in the code causes the client's website to crash during a major sales event, costing them £50,000 in lost revenue.

Naturally, the client sues Alex for damages. But because Alex is a sole trader, they aren't just suing "Alex's Web Dev Business" – they are suing Alex, the person. If the court finds Alex responsible, he is personally liable for the full £50,000.

This is where the stark reality of unlimited liability kicks in:

- First, they'll go for Alex's business bank account.

- If that's empty, they can legally pursue his personal savings.

- Still not enough? Bailiffs could seize personal assets, like his car, to be sold at auction.

- In the worst-case scenario, a charging order could be placed on his home, potentially forcing a sale to clear the business debt.

A single business dispute could completely dismantle your personal financial world. It’s a risk that quietly grows as your business takes on bigger and more valuable projects.

The Limited Company Difference

Now, let's rewind. This time, Alex has set up "Alex Web Dev Ltd," a private limited company. The business is now its own separate legal entity, completely distinct from Alex the individual. This creates a legal firewall – often called the "corporate veil" – between his business finances and his personal life.

When the same client sues for the same £50,000, they are now suing Alex Web Dev Ltd. The company is responsible for its own debts, not Alex.

A limited company provides limited liability. This means your personal financial risk is typically capped at the value of your investment in the business—often just the nominal value of your shares. Your personal assets are protected from business creditors.

The outcome here is completely different. The company's liability is restricted to its own assets, meaning the cash in the business bank account and any equipment it owns. Alex’s personal savings, his car, and his home are off-limits. The most he personally stands to lose is whatever he put into the company, which could be as little as the £1 value of his initial share.

This protection is the main reason why so many entrepreneurs choose to incorporate. It allows you to take calculated business risks without betting your family's financial security. For many, when it comes down to the limited company vs sole trader decision, this one factor is compelling enough to make the choice clear.

A Practical Comparison of Tax Obligations

How you’re taxed is arguably the single biggest decider when weighing up the limited company vs sole trader question. It has a direct, tangible impact on your take-home pay, how much time you spend on financial admin, and your overall bottom line. The two setups are worlds apart in how they're taxed, each with its own rulebook and opportunities for smart planning.

For a sole trader, things are wonderfully simple: the business’s profits are your personal income. While that sounds great at first, it can become a tax headache as your earnings climb. A limited company, on the other hand, is taxed as a completely separate entity. This creates a two-step process that unlocks far more flexibility in how you manage your tax affairs.

How a Sole Trader Is Taxed

When you're a sole trader, there’s no legal line between you and your business. Because of this, every penny of profit your business makes in a tax year is treated as your personal income and gets taxed through the Self Assessment system.

Your tax bill is worked out based on these total profits, not just the money you decide to take out for yourself. It’s made up of two main parts:

- Income Tax: This is charged at the standard personal rates (basic, higher, and additional).

- National Insurance Contributions (NICs): You’ll usually be paying both Class 2 and Class 4 NICs on your profits.

This direct link is easy to get your head around, but it can lead to a hefty tax bill once your income pushes past the higher-rate threshold.

A Sole Trader Example in Practice

Let's put this into a real-world context. Imagine a freelance consultant, operating as a sole trader, who makes a profit of £60,000 in one tax year. A simplified look at their tax situation would be:

- Income Tax: After using up their Personal Allowance, a chunk of their income is taxed at the basic rate, with everything above the threshold getting hit with the higher rate.

- National Insurance: They'll also owe Class 4 NICs on profits between the lower and upper limits, plus a flat-rate weekly amount of Class 2 NICs.

The combined total means a significant slice of their hard-earned profit goes straight to HMRC. To soften the blow, it’s worth looking into all the available freelancer tax deductions which can help lower your taxable profit.

How a Limited Company Is Taxed

Setting up a limited company creates a two-stage tax system, as the business is its own legal 'person'. First, the company pays tax on its profits. Second, you pay personal tax on whatever money you take out of it.

Here’s a breakdown of how that works:

- Corporation Tax: The company pays Corporation Tax on its annual profits. These profits are calculated after deducting all allowable business expenses, which crucially includes any salary you pay yourself as a director.

- Personal Tax: You are then taxed individually on the income you draw from the company.

This separation gives you much more control over your personal tax bill. You get to be strategic about how and when you pay yourself, which is a massive advantage over the sole trader route.

Key Insight: The ability to leave post-tax profits in the company and draw them out later—or in a more tax-efficient way—is the number one reason many successful sole traders eventually decide to incorporate.

Extracting Money: Salary vs Dividends

As a company director, you have two main options for getting paid, and most business owners use a blend of both to be as tax-efficient as possible.

- Salary: You can pay yourself a director's salary. This counts as an allowable business expense, which lowers the company's profit and, in turn, its Corporation Tax bill. The common strategy is to pay yourself a small, tax-efficient salary that stays below the main National Insurance thresholds.

- Dividends: After the company has paid Corporation Tax, any remaining profit can be paid out to shareholders as dividends. Dividends aren't subject to National Insurance and are taxed at lower rates than salary income, making them a very appealing way to take home your profits.

Choosing between a sole trader and a limited company structure has major consequences for your tax bill and risk exposure in the UK. For the 2025/26 tax year, sole traders are looking at personal income tax rates of 20%, 40%, or 45% on their profits, plus National Insurance. In contrast, a limited company pays Corporation Tax, which starts at 19% for profits under £50,000 and climbs to 25% for profits over £250,000. This setup lets owners take out profits through dividends, which are often taxed more favourably than a straight salary. It’s this key difference that convinces many businesses to incorporate as their profits and operational risks grow. This distinct tax treatment is a crucial element when comparing a limited company vs sole trader.

Comparing Administrative and Compliance Costs

Beyond tax and liability, the day-to-day administrative burden is a huge factor in the limited company vs sole trader debate. The straightforward nature of being a sole trader is worlds apart from the formal, and often costly, compliance demanded of a limited company. Getting your head around these differences is key to picking a structure that fits not just your financial goals, but also how much time you're willing to spend on admin.

If you’re a sole trader, the admin load is refreshingly light. Your main legal duty is to keep a good record of your income and expenses, then file a single Self Assessment tax return each year. It’s a simple process that keeps compliance costs very low.

In contrast, a limited company is governed by a much stricter set of rules. The administrative tasks are more complex, more numerous, and the consequences for getting them wrong are far more serious. This heavier workload is the price you pay for the perks of limited liability and potential tax savings.

The Simplicity of Sole Trader Administration

As a sole trader, your compliance journey is direct and uncomplicated, boiling down to just two core tasks. This minimalist approach is a massive plus for freelancers and new business owners who would rather focus on their work than get bogged down in paperwork.

Your key duties are:

- Registering for Self Assessment: This is a simple online process with HMRC to let them know you're self-employed.

- Annual Tax Return: You'll need to file one Self Assessment tax return each year, declaring your business profits.

The costs are tiny. There’s no registration fee, and many sole traders handle their own tax returns, especially when they’re just starting out. The whole system is designed to be as simple and cheap as possible, letting you get your business off the ground with minimal fuss.

The Formal Obligations of a Limited Company

A limited company's administrative world is far more demanding. From the moment you incorporate, you enter a world of formal duties and public record-keeping that requires careful management and, more often than not, professional help.

Key obligations include:

- Company Formation: You must officially register your company with Companies House, which has a small fee.

- Statutory Records: You're required to maintain official company registers, like a list of directors and shareholders.

- Annual Accounts: Each year, you have to prepare and file detailed statutory accounts with Companies House. These are public documents.

- Confirmation Statement: An annual statement must be submitted to confirm the company’s registered details are still correct.

- Company Tax Return (CT600): A separate Corporation Tax return must be filed with HMRC for the company itself.

While a limited company offers significant protection and tax advantages, these benefits come at the cost of increased administrative responsibility. The time and financial commitment required for compliance should be a primary consideration in your decision.

These tasks usually mean you’ll need to hire an accountant, with annual fees ranging from several hundred to a few thousand pounds, depending on how complex your business is. It's also important to factor in the weight of other regulations, such as the rules around GDPR compliance and data protection.

This really highlights the core trade-off: the sole trader structure is all about ease and low cost, while the limited company demands a much bigger investment of both time and money to keep everything above board.

How Your Structure Impacts Growth and Credibility

Choosing between a limited company and a sole trader isn’t just about ticking a box on a form. It’s a decision that fundamentally shapes how the world sees your business and, crucially, how much it can grow. This choice sends a clear signal to potential clients, banks, and investors about your long-term ambitions.

For many, incorporating as a limited company immediately projects a sense of stability and professionalism. There’s a certain gravity that comes with having "Ltd" after your business name, especially when dealing with larger corporate clients who often have strict procurement policies that favour incorporated businesses.

This perception of permanence can be a real competitive edge when you’re pitching for a big project or tendering for a public sector contract.

Securing Larger Contracts and Building Trust

While being a sole trader is perfectly suited to many business models, some larger organisations can view it as a higher-risk proposition. They might worry that a sole trader is a less permanent arrangement, which can be a real concern for projects that span months or even years.

A limited company, on the other hand, is formally registered at Companies House with its accounts on public record. This provides a layer of transparency and reassurance that can make all the difference when a client is weighing you up against a competitor.

This isn’t just anecdotal; the numbers back it up. Recent Companies House data reveals that around 90% of new business registrations are now limited companies. It’s a clear trend showing that even with the extra admin, entrepreneurs are choosing incorporation for the credibility and protection it offers. You can explore more of these UK business structure trends for 2025 on cgincorporations.com.

Ultimately, the formal structure of a limited company signals a commitment to longevity and regulatory compliance, which is a powerful way to build trust with high-value clients.

Raising Capital for Business Growth

When it comes to funding your growth, the two structures couldn't be more different. Your business's ability to expand is often tied directly to its access to capital, and your legal setup plays a massive role in what's available to you.

As a sole trader, your financing options are almost always linked to your personal finances.

- Personal Savings: Dipping into your own pocket is the most common way to get started.

- Business Loans: Lenders will typically look at your personal credit score and may require you to secure the loan against personal assets, like your home.

- Owner Investment: All capital comes from you and you alone.

There’s no straightforward way to sell a stake in the business to an outsider without completely changing your legal structure. This can put a hard ceiling on how fast and how far your business can really scale.

A limited company's ability to issue shares is its single greatest advantage for ambitious growth. It transforms the business from a personal project into a saleable asset that can attract external investment.

A limited company, by its very design, is built to accommodate investment and growth. The structure allows you to issue shares—essentially small slices of ownership—in exchange for capital.

This unlocks a whole new world of funding opportunities:

- Angel Investors: Wealthy individuals looking to invest in promising early-stage businesses.

- Venture Capital (VC) Firms: Professional investment firms that back businesses with high-growth potential.

- Crowdfunding: Raising money from a large group of people online, often in exchange for equity.

- Employee Share Schemes: A fantastic way to attract and retain top talent by offering them a piece of the action.

Bringing on investors isn't just about the cash, either. It’s about gaining access to their expertise, their contacts, and their mentorship. For any entrepreneur dreaming of scaling up or disrupting an industry, the limited company structure isn't just an option—it’s practically a requirement.

Common Questions When Choosing Your Business Structure

Once you get past the big-picture topics like tax and liability, the decision between becoming a sole trader or setting up a limited company often boils down to a few practical questions. How will this choice actually affect my day-to-day work? What happens when I want to grow? What about my personal financial goals, like getting a mortgage?

Let's dig into the common queries we hear from business owners wrestling with this decision.

Can I Switch From a Sole Trader to a Limited Company?

Absolutely. This is a very well-trodden path for successful businesses. The process is called 'incorporation', and it's the natural next step when your business starts to outgrow the simplicity of the sole trader model. It's usually triggered by rising profits, the need to protect your personal assets, or an opportunity to bring in investors.

Making the switch means registering a new limited company with Companies House and then officially transferring all the assets and operations of your sole trader business over to it. You’ll also need to let HMRC know that you’re ceasing self-employment.

While it’s a common move, it’s not something to be taken lightly. I always recommend working with an accountant to manage the transition smoothly. They can give you vital guidance on valuing your business assets for the transfer and help you navigate the tax implications to make sure everything is handled correctly.

What Happens if My Business Makes a Loss?

How losses are treated is one of the most fundamental differences between the two structures, and it can really impact your finances, especially in those tough early days.

As a sole trader, any business losses can be set against other personal income from the same or previous tax year. For example, if you had a part-time job while getting your venture off the ground, a business loss could lower your overall tax bill and might even result in a tax refund from HMRC. This flexibility is a huge plus for startups.

For a limited company, the situation is different. Any losses are contained within the business itself and can't be used to reduce your personal income tax. Instead, those losses can be carried forward to offset against future company profits, which will lower your Corporation Tax bill in the years to come. In some specific situations, they can also be carried back against profits from the previous year.

The Bottom Line: A sole trader can use business losses to get immediate relief on their personal tax bill from other income. A limited company's losses can only be used to reduce the company's tax bill, either in the future or, sometimes, the past.

Which Structure Is Better for Getting a Mortgage?

This is a tricky one, and there’s no single right answer. It really depends on the lender and your specific financial picture, as they assess income from sole traders and limited company directors in very different ways.

For a sole trader, the process is often more straightforward. Lenders will typically want to see the net profit figures on your last two to three years of tax returns (your SA302s and tax year overviews). As long as your profits are healthy and consistent, most mortgage brokers can handle the application without much fuss.

Proving your income as a limited company director can be more complicated. Many high street lenders will only consider the official salary and dividends you've paid yourself. This can cause a real headache if you've been smartly leaving profits in the company for reinvestment or tax efficiency.

However, a growing number of specialist mortgage lenders understand how company directors work. They're often willing to look at the bigger picture and may factor in your share of the company's retained profits when assessing what you can afford. The key is to work with a mortgage broker who specialises in self-employed applicants—they know which lenders to approach.

Do I Need a Separate Business Bank Account?

The rules here are black and white for one structure and just plain common sense for the other.

- Limited Company: It's a Legal Requirement. A limited company is a separate legal person, which means its finances must be kept completely separate from your own. Opening a dedicated business bank account is one of the very first things you have to do after you incorporate. Mixing company and personal money is a major compliance no-no.

- Sole Trader: It's Strongly Recommended. While it’s not legally mandatory, running all your business income and outgoings through a separate bank account is one of the smartest things you can do. It makes bookkeeping a hundred times easier, ensures your records are spot-on for your Self Assessment tax return, and helps you see at a glance how your business is actually doing. Plus, it just looks more professional to your clients.

Trying to untangle business expenses from your personal weekly shop at the end of the tax year is a nightmare you can easily avoid. A separate account is a simple step that saves a huge amount of time and potential trouble down the line.

Navigating the complexities of business structures, tax obligations, and compliance can be demanding. At Stewart Accounting Services, we provide expert guidance to help sole traders and limited companies in Central Scotland and across the UK make the right financial decisions. Whether you need help with your Self Assessment or want to plan your company's growth, we can help you achieve more time, more money, and a clearer mind. Explore our services at https://stewartaccounting.co.uk.