Let's get straight to it. The days of deducting all your mortgage interest from your rental income are long gone. Instead, UK landlords now get a 20% tax credit on their mortgage interest payments. It’s a major change from the old system and has a real impact on how much tax you'll pay.

How Mortgage Interest Relief Works for UK Landlords Now

The big shake-up came from Section 24 of the Finance Act, which completely changed the game for landlords. This bit of legislation phased out the old, much simpler way of handling finance costs.

It used to be so straightforward. You’d simply subtract your entire mortgage interest bill from your rental income before the taxman even looked at it. This was a huge help, especially for higher-rate taxpayers who got relief at their 40% or 45% rate. It directly shrunk your taxable profit.

But things are different now. The move to a tax credit system was fully bedded in by April 2020 after being introduced gradually from 2017. Today, every landlord receives a tax credit worth 20% of their mortgage interest costs, no matter what their personal tax bracket is. You can get more background on these regulatory changes for UK landlords on Which.co.uk. The calculation is now a two-step affair: your tax is worked out on your full rental profit first, and only then is the credit applied to shave a bit off the final bill.

Key Takeaway: Because you no longer deduct the interest upfront, your declared rental income is higher. This can be a real sting, as it might bump basic-rate taxpayers into the higher-rate bracket, even when the actual cash profit from their property hasn't changed at all.

The Old System vs. The New System

To really see the difference this makes to your wallet, a side-by-side comparison is the best way to grasp the financial hit.

Let's cook up a quick scenario. Imagine a landlord who's a higher-rate taxpayer, pulling in £12,000 a year in rent and paying £5,000 in mortgage interest.

Mortgage Interest Relief Old System vs New System

| Metric | Old System (Pre-2020) | New System (Post-2020) |

|---|---|---|

| Rental Income | £12,000 | £12,000 |

| Mortgage Interest | -£5,000 | £0 (not deducted here) |

| Taxable Profit | £7,000 | £12,000 |

| Tax Due (at 40%) | £2,800 | £4,800 |

| Tax Credit Applied | N/A | -£1,000 (20% of £5,000) |

| Final Tax Bill | £2,800 | £3,800 |

As you can see, the new rules mean this landlord's annual tax bill has jumped by £1,000.

The fundamental problem is that your tax is now based on your gross rental income before you factor in your biggest cost—the mortgage. This is why the mortgage interest deduction on a rental property isn't really a "deduction" anymore; it's a relief credit applied at the very end.

Understanding the Impact of Section 24 on Your Tax Bill

If you're a landlord in the UK, you’ve almost certainly heard of Section 24. Officially known as Section 24 of the Finance Act 2015, this legislation completely changed the game for how rental property taxes are handled. Forget the jargon for a moment; what really matters is understanding how it directly affects your bank balance.

The government's stated goal was to level the playing field, making the financing of buy-to-let properties more consistent with other types of investments. But for many landlords, especially those in the higher tax brackets, the practical result has been a much bigger tax bill each year.

The Real-World Financial Squeeze

So, what’s the biggest change? It all comes down to how your taxable income is calculated. In the past, you'd simply deduct your mortgage interest costs from your rental income, and you were taxed on the profit. Simple.

Now, things are very different. Your gross rental income gets added to your other earnings (like your salary from a job) before any tax relief for mortgage interest is factored in.

This new way of doing things can artificially inflate your total income on paper. The real danger here is that it can push you into a higher tax bracket, even if the actual cash you've made from your property hasn't changed by a single penny. It’s entirely possible to go from being a basic-rate taxpayer to a higher-rate one purely because of this calculation method.

A landlord earning £45,000 from their job and £15,000 in rent might have previously stayed in the basic rate band after deductions. Under Section 24, their total income is assessed as £60,000, pushing a portion of it into the 40% tax bracket before the credit is applied.

A Practical Example of Section 24 in Action

Let's walk through a real-world scenario to see how this actually works. Picture a landlord with these annual figures:

- Rental Income: £15,000

- Mortgage Interest Paid: £5,000

- Other Allowable Expenses (repairs, insurance etc.): £2,000

Under the new rules, the mortgage interest is completely ignored when working out your profit. This is the absolute core of the legislation governing the mortgage interest deduction rental property rules. The calculation now follows a specific order: non-finance costs are subtracted first, and your finance costs are dealt with separately as a tax credit. If you want to dive deeper, UK Landlord Tax has some excellent detailed guidance.

Here’s the step-by-step impact:

-

Calculate Your Taxable Profit: First, you only subtract the non-finance costs from your rental income.

- £15,000 (Rental Income) – £2,000 (Other Expenses) = £13,000 Taxable Profit

-

Work Out Your Initial Tax Liability: This £13,000 is added to your other income to figure out your tax bill. Let's assume you're a higher-rate taxpayer (40%). Your tax on the rental profit would be:

- £13,000 x 40% = £5,200 Tax Due

-

Apply the Tax Credit: Now, you get to apply the 20% tax credit based on your mortgage interest.

- £5,000 (Mortgage Interest) x 20% = £1,000 Tax Credit

-

Find Your Final Tax Bill: Simply subtract the credit from the tax you owe.

- £5,200 – £1,000 = £4,200 Final Tax Bill

As you can see, it's a far more involved process than just taking your costs away from your income. It's a fundamental shift that really requires some forward planning to manage properly.

Calculating Your Mortgage Interest Tax Credit Accurately

Knowing the rules is one thing, but getting the numbers right is where the rubber really meets the road. Calculating your tax credit isn’t just a matter of dropping a single figure into a box on your tax return. It's about methodically gathering all your qualifying finance costs and working through the calculation to make sure you claim exactly what you're entitled to.

Frankly, getting this right is essential for managing the hit that Section 24 can have on your bottom line. It demands a clear, step-by-step process to turn what feels like a mountain of paperwork into a final, defensible figure for HMRC.

If you want to get a proper handle on your figures throughout the year, it's worth getting comfortable with analyzing your financial data in Excel. Staying organised makes tax time so much less of a headache.

What Counts as a Finance Cost

First off, let’s be clear about what HMRC means by ‘finance costs’. The term is broader than just the interest part of your monthly mortgage payment. To get the most out of your tax relief, you need to account for every eligible cost.

From my experience, landlords often miss a few of these:

- Mortgage Interest: This is the big one, of course – the interest element of your buy-to-let mortgage payments.

- Mortgage Arrangement Fees: Did you pay a fee to the lender to set up the mortgage in the first place? That counts.

- Broker Fees: The fee you paid your mortgage broker for helping you find and secure the loan is also allowable.

- Interest on Other Property Loans: If you took out a separate loan for things like a new kitchen or to furnish the property, the interest on that loan qualifies as well.

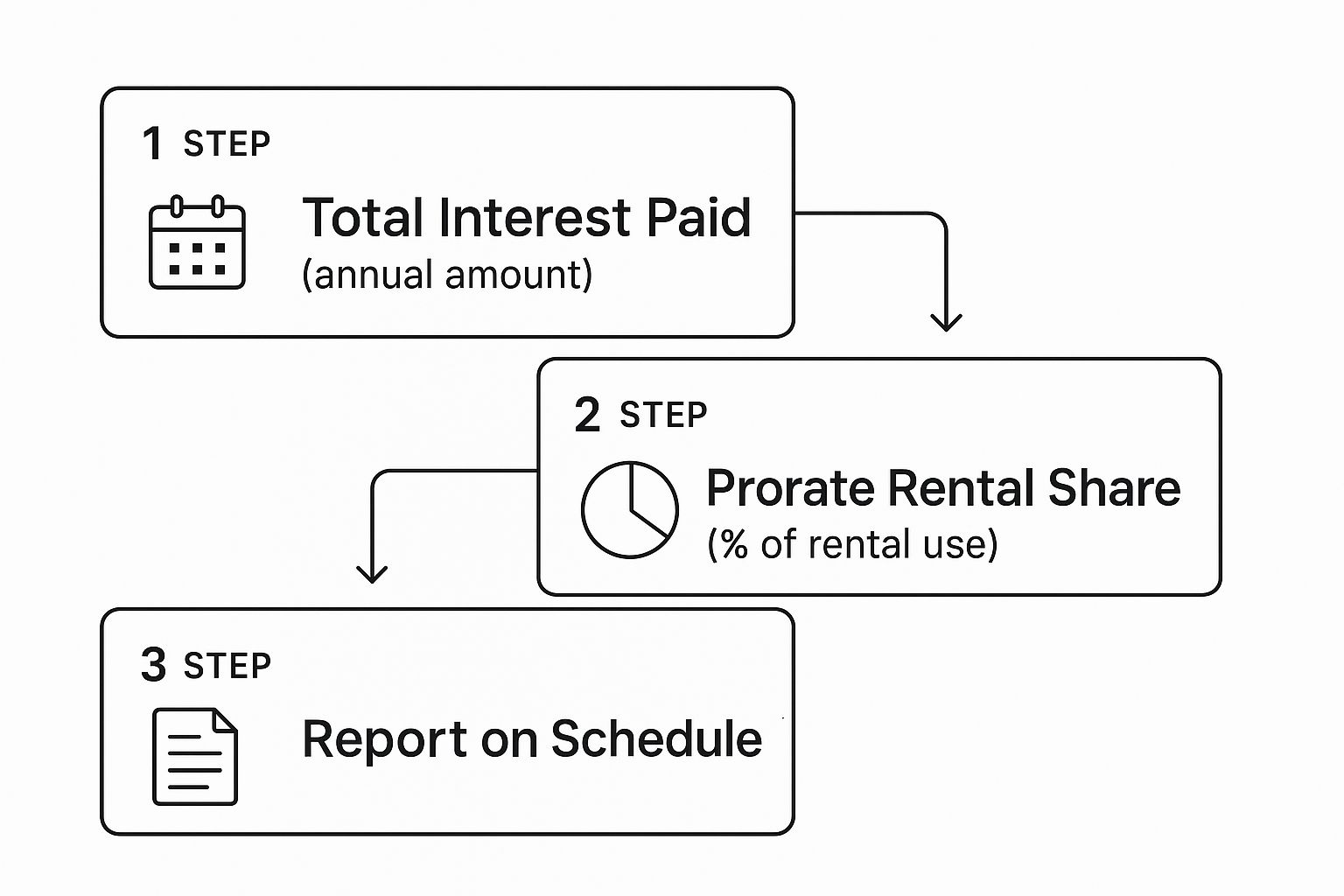

This infographic gives a great visual breakdown of how to handle the deduction on your tax return.

As you can see, it boils down to identifying all your finance costs for the year and then making sure that figure is reported correctly on your tax forms.

A Case Study Calculation

Let's walk through a real-world example to see how this works in practice. We'll use a landlord named Sarah. Applying this logic to your own numbers should make the process much clearer.

Sarah is a higher-rate taxpayer, and here are her annual figures for her rental property:

- Total Rental Income: £18,000

- Total Finance Costs: £7,500 (this includes her mortgage interest plus a £500 arrangement fee)

- Other Allowable Expenses: £3,000 (things like insurance and repairs)

Here’s how Sarah calculates her tax bill and the credit she can claim.

First, work out the taxable profit.

This is a key step. You subtract only your non-finance costs from your rental income.

- £18,000 (Income) – £3,000 (Expenses) = £15,000 Taxable Profit

Next, calculate the initial tax liability.

As a higher-rate (40%) taxpayer, her initial tax bill on that profit is straightforward.

- £15,000 x 40% = £6,000 Tax Due

Then, calculate the tax credit.

Now we bring in the finance costs. The credit is a flat 20% of her total finance costs.

- £7,500 (Finance Costs) x 20% = £1,500 Tax Credit

Finally, determine the final tax bill.

She simply subtracts the credit from her initial tax liability.

- £6,000 (Tax Due) – £1,500 (Credit) = £4,500 Final Tax Bill

By following this structured calculation, Sarah can confidently report her figures to HMRC. This worksheet-style approach removes the guesswork and ensures she correctly applies the mortgage interest deduction rental property rules to her specific situation, avoiding overpayment and staying compliant.

Finding Every Allowable Expense to Reduce Your Tax Bill

Since the old system of a direct mortgage interest deduction for rental property has been phased out, your strategy needs a serious shift. It's now absolutely crucial to identify and claim every single allowable expense you're entitled to. This isn't just about good bookkeeping anymore; it's a core part of protecting your rental profits from a much bigger tax bill.

These expenses are subtracted directly from your rental income before any tax is worked out, which lowers your taxable profit from the get-go. This is a completely different mechanism from the finance cost tax credit, which only comes in at the end of the calculation. Getting this right is your best defence against the financial impact of Section 24.

Day-to-Day Running Costs You Can Claim

It's surprising how many landlords miss out on the full scope of their day-to-day running costs, essentially giving money away to the taxman. You need to look past the obvious and account for every penny spent to keep your property running and occupied.

Some of the most common, and fully deductible, expenses include:

- Letting Agent and Management Fees: The entire cost of hiring an agency to find tenants, handle rent collection, or manage the property is deductible.

- Insurance: This covers your specific landlord insurance policies for buildings, contents, and any public liability cover you have.

- Service Charges and Ground Rent: If your property is a leasehold, any mandatory fees you pay are allowable.

- Direct Costs: Things like council tax or utility bills can be claimed if your tenancy agreement states that you'll pay for them, not the tenant.

While some of these might seem like minor outgoings on their own, they can make a massive difference to your tax liability when added up over the year.

Landlords in the UK can still fully deduct legitimate rental expenses such as property repairs, letting agent fees, professional fees, and costs for utilities or insurance if paid by the landlord. A landlord must carefully track these deductible expenses to offset the tax impact of the limited mortgage interest relief. Discover more insights about landlord tax relief from Property Accountants.

Understanding Repairs vs Improvements

This is one of the trickiest areas for landlords, and one where HMRC is particularly vigilant. You absolutely must understand the difference between a repair and a capital improvement, as confusing the two can lead to disallowed claims and even penalties.

Here’s the breakdown from an expert's point of view:

-

Repairs are deductible. A repair simply brings an asset back to its original working condition. Think of it as maintenance. Replacing a few storm-damaged roof tiles or getting a faulty boiler fixed are perfect examples. You can deduct these costs from your rental income in the year you pay for them.

-

Improvements are not. An improvement goes further by upgrading, enhancing, or adding something that wasn't there before. Building a new extension or converting a loft are clear capital improvements. You can't deduct these costs from your rental income now. Instead, they are added to the property's initial cost, which can help lower your Capital Gains Tax when you eventually sell up.

Let's use a real-world example. Say you have to replace a damaged laminate kitchen worktop. If you replace it with a new, standard laminate one, that's a repair. But, if you decide to upgrade to a high-end granite worktop, it becomes a bit more complex. The cost of a like-for-like laminate replacement is the repair, while the extra cost for the granite is the improvement element.

This is why keeping detailed records, invoices, and receipts is non-negotiable. With solid proof, you can confidently justify your claims if HMRC ever decides to take a closer look at your tax return.

Right, let's get down to the brass tacks: reporting everything correctly to HMRC. Getting your rental income and expenses declared accurately is non-negotiable, and figuring out where each number goes on your tax return can feel a bit like cracking a code. But once you have the roadmap, you can tackle your Self Assessment with confidence, knowing you’re claiming every penny of tax relief you're entitled to for your mortgage interest.

It all hinges on the SA105, the 'UK Property' supplementary pages of your tax return. This is your chance to tell HMRC the full story of your property business for the year – what came in, what went out, and, crucially, what your finance costs were. Getting this bit right is how HMRC works out your 20% tax credit.

Where Your Figures Go on the SA105 Form

Think of the SA105 form as a financial snapshot. Each box has a specific job, and putting a figure in the wrong place can throw your whole tax calculation off. Your gross rental income goes in one spot, your day-to-day running costs in another, and your finance costs have their own dedicated box. It's vital not to mix them up.

Here’s a look at the exact spot on the SA105 where your finance costs need to live.

That highlighted box – Box 44, 'Residential finance costs' – is where you'll enter the grand total of your mortgage interest and any other allowable finance fees for the tax year. By putting the figure here, you're not actually deducting it from your profits. Instead, you're flagging it for HMRC so they can apply your 20% tax credit correctly.

Staying on Top of Deadlines and Paperwork

To fill out these forms without a last-minute panic, good record-keeping is your best friend. Seriously, it's not something you can wing at the end of the year. You need to keep organised records of every bit of rental income and every single expense.

This means holding onto:

- Bank statements showing rent payments.

- Receipts for any repairs or maintenance.

- Your annual mortgage statement, which clearly shows the interest you’ve paid.

Remember, HMRC can ask to see these records for up to six years after the tax year they relate to, so a good filing system is essential.

A bit of organisation throughout the year saves a world of pain come January. Neglecting your records can lead to a mad scramble, missed deadlines, and even penalties from HMRC.

Here are the key dates you absolutely cannot miss:

- Register for Self Assessment: By the 5th of October following the end of the tax year.

- Paper Tax Return Deadline: Midnight on the 31st of October.

- Online Tax Return Deadline: Midnight on the 31st of January.

- Pay Your Tax Bill: Midnight on the 31st of January.

Meeting these deadlines is just as crucial as the numbers you submit. At Stewart Accounting Services, we walk landlords through this maze all the time, helping them stay compliant and stress-free. Reporting everything properly ensures you don’t pay a penny more in tax than necessary and keeps you on the right side of HMRC.

Your Questions on Rental Mortgage Interest, Answered

Even with a good grasp of the rules, it's completely normal to have a few "what if" questions lingering. The switch from a straightforward mortgage interest deduction to a 20% tax credit has left many UK landlords scratching their heads about certain situations.

Let's dive into some of the most common questions I hear from clients. I'll give you direct, practical answers to help you feel confident when tackling your tax return.

Do Basic Rate Taxpayers Still Get the Tax Credit?

Yes, they do. The 20% tax credit on finance costs is applied across the board, no matter which income tax band you fall into. It's a flat rate for every individual landlord.

The real pinch from Section 24, however, is felt by those paying tax at the higher (40%) and additional (45%) rates. Before this change, they enjoyed tax relief at their marginal rate, which made a huge difference to their bottom line. Now, they get the same 20% credit as everyone else, which often leads to a much bigger tax bill.

What Happens if My Mortgage Interest is More Than My Profit?

This is a very common scenario, particularly when you're just starting out or if you’ve had a year with high finance costs. If your mortgage interest bill ends up being higher than your rental profits, your tax credit for that year will be capped.

The credit is calculated as 20% of the lowest of three amounts:

- Your total finance costs for the year (e.g., mortgage interest).

- Your property profits after all other allowable expenses are deducted.

- Your adjusted total income for the tax year.

The good news? You don't lose out on the relief completely. Any finance costs that couldn't be used are carried forward. You can add them to next year's total, allowing you to claim the credit when your profits are healthier.

Are Limited Companies Affected by These Rules?

No, not at all. The Section 24 restrictions on mortgage interest relief are specifically targeted at individuals who own property in their personal names.

If a property is owned through a limited company, it falls under Corporation Tax rules. This means the company can still deduct 100% of its mortgage interest and other finance costs as a business expense before its tax is calculated. This is precisely why incorporating a property portfolio has become such a popular strategy for landlords since these changes were introduced.

Can I Include Mortgage Arrangement Fees in My Claim?

Absolutely. The term ‘finance costs’ is actually wider than just your monthly interest payments. It's designed to cover the various one-off costs you incur when setting up a mortgage.

Make sure you're adding these expenses to your total finance cost figure:

- Mortgage arrangement or product fees charged by your lender.

- Valuation fees that were a condition of the mortgage application.

- Fees paid to a mortgage broker for finding and securing the loan.

Tallying all these up and putting the total in Box 44 of your Self Assessment ensures you’re claiming the maximum 20% tax credit you're entitled to.

Trying to stay on top of property tax complexities can feel like a full-time job. At Stewart Accounting Services, we specialise in helping landlords make sense of the rules, stay compliant, and keep their tax bill as low as possible. If you need some expert guidance, visit us at Stewart Accounting Services to see how we can help.