When you're running a business in the UK, outsourcing your bookkeeping isn't just about handing off a chore. It's a strategic decision that gives you access to top-tier financial management, keeps you on the right side of regulations like Making Tax Digital, and, most importantly, buys you back precious time. It turns bookkeeping from a headache into a professional, scalable service that actually helps you grow.

Why Smart UK Businesses Outsource Bookkeeping

For most growing UK companies, the moment you realise you need help with the books comes out of the blue. It might be when a director finds themselves glued to a screen reconciling bank statements on a Friday night instead of planning the next big move. Or perhaps it’s the sting of a penalty notice for a late VAT return.

The first instinct is often to hire someone in-house. But when you look closer, there's a much smarter path: outsourcing.

Deciding to outsource is about more than just trimming the payroll. It's a complete shift in how you view your company's financial health. It’s an admission that your talent is in running your business, not getting bogged down in the ever-changing world of financial rules or trying to master accounting software.

In-House vs Outsourced Bookkeeping: A Quick Comparison

To really understand the difference, it helps to see the two options side-by-side. Hiring an employee comes with a lot of hidden costs and responsibilities, while outsourcing offers a more flexible, expertise-driven model.

| Factor | In-House Bookkeeper | Outsourced Service |

|---|---|---|

| Cost Structure | Fixed salary plus NI, pension, holiday/sick pay, training. | Predictable monthly fee based on workload. |

| Expertise | Limited to the knowledge of one individual. | Access to a team of specialists and senior advisors. |

| Scalability | Difficult to scale; requires hiring/firing. | Easily scales up or down as your business needs change. |

| Technology | You bear the full cost of software licences and updates. | Costs are shared across all clients; they use the best tools. |

| Continuity | Vulnerable to holiday, sickness, or staff turnover. | Uninterrupted service guaranteed. |

| Compliance | Responsibility falls on you and your employee. | The firm takes responsibility for staying current with regulations. |

Ultimately, the choice comes down to what you value more: direct control over a single employee or the flexible expertise and peace of mind that comes with a dedicated external team.

Beyond Cost-Cutting: The Strategic Imperative

While saving on overheads is a fantastic benefit, the true value of outsourcing your bookkeeping lies in the strategic doors it opens.

Think about the real cost of hiring a skilled finance professional in the UK. It’s not just their salary. You’ve got National Insurance contributions, pension schemes, holiday pay, ongoing training, and software licences to think about. It all adds up. An outsourced firm simply absorbs these costs. You get an entire team of experts for one, predictable monthly fee, which turns a hefty fixed cost into a manageable operational expense.

This approach is also incredibly scalable. As your business grows and you process more transactions, your bookkeeping support grows right along with you—no need for a painful, drawn-out recruitment process. This flexibility is why the UK's Business Process Outsourcing (BPO) market, which includes bookkeeping, is forecast to reach around £31.46 billion by 2025.

Gaining Expertise and Ensuring Compliance

A huge driver for UK businesses is staying compliant, especially with HMRC's Making Tax Digital (MTD) rules. MTD means businesses must keep digital records and submit tax returns using approved software. If you're not familiar with the nitty-gritty, this can be a serious and time-consuming headache.

An expert bookkeeping service does more than just log transactions. They make sure your records are MTD-compliant, your VAT returns are spot-on and filed on time, and your financial data is primed and ready for your accountant at year-end. That kind of peace of mind is priceless.

Before you jump in, it's also worth thinking about the bigger picture. Understanding your options is key. A really insightful article on Automation Vs. Outsourcing: Which Is Right For Your Business breaks down how these two models can work together to create a stronger foundation for your company.

By choosing to outsource, you’re not just offloading tasks. You’re embedding deep, specialist knowledge right into the heart of your operations. This ensures accuracy and frees you and your team to focus on what you do best: driving the business forward.

Defining Your Bookkeeping Needs Before You Commit

Before you even start Googling outsourcing bookkeeping services, the most important work happens right inside your own business. It's tempting to jump straight into finding a provider, but I've seen many businesses stumble because they rushed this first step. Taking the time to do a proper internal review is what separates a successful partnership from a costly mistake.

You need to look past just the obvious tasks. It’s not just about what needs doing, but how it's currently done, where your processes are breaking down, and what it’s genuinely costing you. Only with that clarity can you find a firm that truly aligns with your operations and budget.

Auditing Your Current Financial Workflows

First thing's first: map out your entire financial process. I mean everything, from the moment a customer pays you to the final bank reconciliation at the end of the month.

Think about who is actually involved. Is your sales manager wasting half a day chasing overdue invoices? Is your operations director stuck manually keying in supplier bills? You’d be surprised how often this "time tax" gets paid by people who should be focused on growing the business. A professional bookkeeper can knock out in a few hours what takes an untrained team member an entire day of frustration.

Here’s a quick exercise: roughly tally the hours your non-finance staff spend on financial admin each month. Now, multiply that by their approximate hourly pay. That figure is a significant hidden cost—money you could be saving while freeing up your team to focus on what they do best.

Once you have a clearer picture of who does what, the real pain points start to emerge. Are you constantly wrestling with reconciling payments from different gateways like Stripe and PayPal? Does the thought of preparing your quarterly VAT return fill you with dread?

These are the exact problems you need to bring to the table when you start talking to potential bookkeepers.

Defining Your Scope Of Work

With your audit complete, you can now build a clear brief of what you need an external partner to handle. This isn't a one-size-fits-all situation. The bookkeeping needs of an e-commerce business selling online are worlds apart from a local construction company with CIS obligations.

Use these categories to build a detailed picture of your requirements.

Essential Daily and Weekly Tasks:

- Bank and Credit Card Reconciliation: How many business bank accounts and credit cards do you have? Do they all need to be reconciled weekly?

- Sales Invoicing: Will you need someone to create and send invoices to your customers?

- Purchase Invoice Processing: Who is going to enter supplier bills into the system and get them ready for payment?

- Receipt and Expense Management: How are you currently capturing receipts? Do you need a better system for your team to submit expenses?

Crucial Monthly and Quarterly Duties:

- VAT Returns: Do you need help preparing and submitting your MTD-compliant VAT returns to HMRC?

- Payroll Processing: Will you require support running payroll for your employees, including handling pension auto-enrolment?

- Management Accounts: Do you want monthly reports, like a Profit & Loss statement and Balance Sheet, to see how your business is really performing?

Finally, be honest about your tech setup. Are you already up and running with cloud accounting software like Xero or QuickBooks, or is everything still managed on spreadsheets? A good firm can absolutely help you make the switch, but they need to know your starting point.

Walking into a conversation armed with these details shows you’re serious and helps you get accurate quotes for the services you genuinely need.

How to Choose the Right Bookkeeping Partner

Picking a firm for your outsourced bookkeeping services goes way beyond just comparing prices. Think of it less like hiring a supplier and more like bringing a key player onto your team. The right partner won’t just crunch the numbers; they’ll become a source of financial clarity, helping you make smarter, more confident decisions.

It’s really about finding a firm whose expertise, communication style, and tech-savviness match your own business goals. This is an investment in your company's long-term financial health and operational sanity.

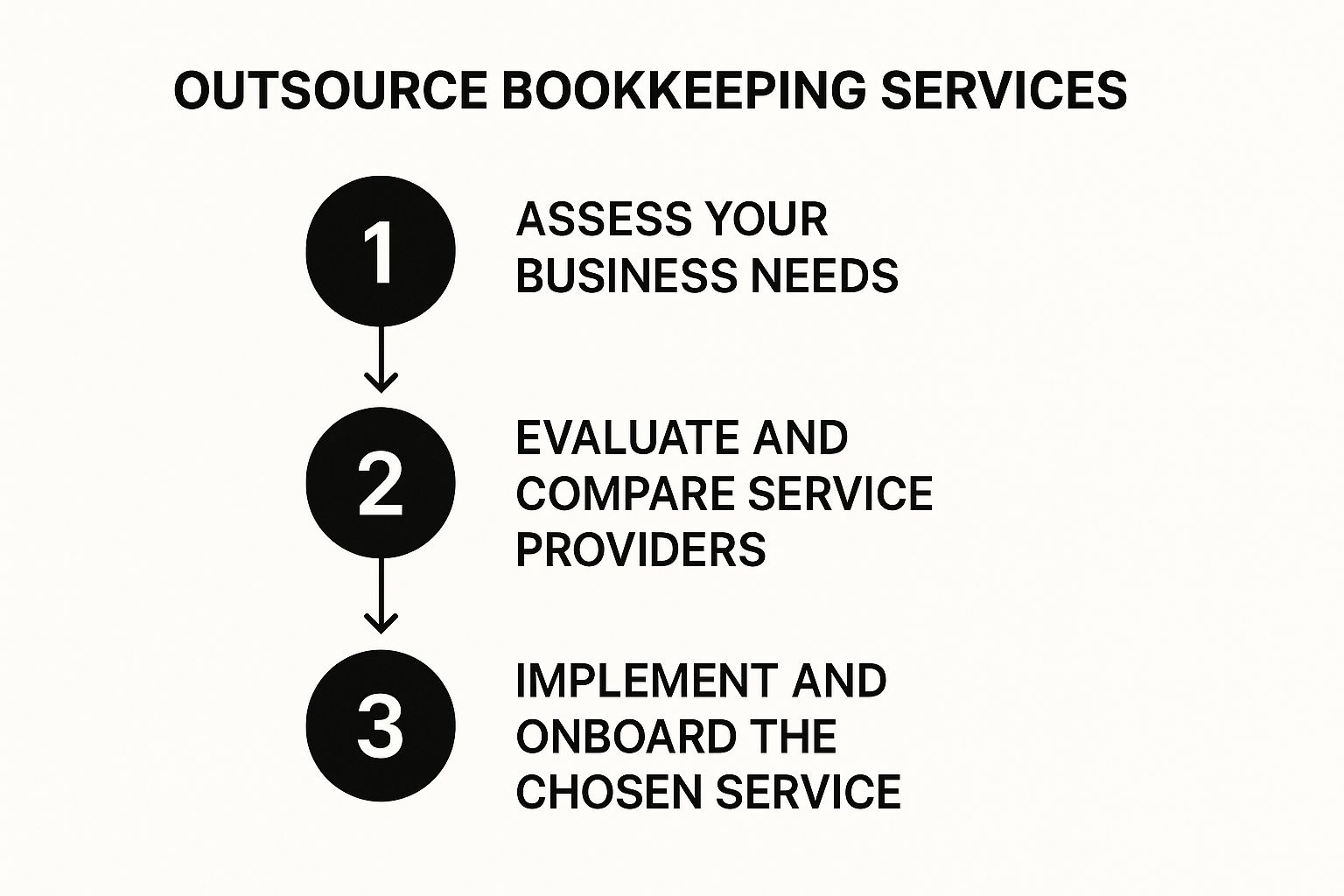

This infographic lays out the crucial steps for finding the right fit.

As you can see, a structured approach is the key to a successful partnership—from looking inward at your own needs to carefully vetting your options and ensuring a smooth handover.

Verify Expertise and Accreditations

Let's be honest, not all bookkeeping providers are cut from the same cloth. Your first port of call should be to check their credentials and, crucially, their industry experience. A firm that mainly handles e-commerce clients probably isn’t the best choice for a construction company wrestling with the Construction Industry Scheme (CIS).

Don't be shy about asking potential partners for specifics on their experience with businesses just like yours.

You should also look for recognised professional accreditations. In the UK, a couple of key bodies to look out for are:

- AAT (Association of Accounting Technicians): This qualification shows they have a solid grasp of practical accounting and bookkeeping skills.

- ICB (Institute of Certified Bookkeepers): This is a global body that holds its members to high ethical and professional standards.

These aren't just fancy logos for a website. They signal a real commitment to professional standards and ongoing development. It means the firm is held accountable for the quality of their work, which gives you peace of mind.

Assess Their Technology Skills

In this day and age, being comfortable with cloud accounting software is completely non-negotiable. Your potential partner needs to be an expert in platforms like Xero, QuickBooks, or Sage. And it's not just about data entry; they should be able to help you unlock the full potential of the software.

During your first few chats, it’s worth probing their technical knowledge:

- Which accounting platforms are they certified partners with?

- How do they manage secure document sharing and receipt capture?

- Can they help automate parts of your workflow, like setting up bank feeds or integrating payment systems?

The right partner won’t just use the software; they’ll use it to make your life easier. They’ll show you how to pull up real-time dashboards and reports, giving you a crystal-clear view of your finances whenever you need it. This kind of transparency is the hallmark of top-tier outsourced bookkeeping services.

Understand the Pricing Structure

Pricing can be a minefield, so it’s vital to understand exactly what you’re paying for. You'll typically encounter two models: fixed-fee and hourly rates. For most small businesses, a fixed-fee model is the way to go. It gives you predictable costs, so you can budget properly without any nasty surprises.

When you get a quote, check that it breaks down every single service included. Will they handle your VAT returns? Is payroll an extra cost? What about preparing management reports? A transparent quote prevents headaches and misunderstandings later on.

Interestingly, the current pressure on the UK accounting industry has made these fixed-price models more competitive. With 67% of UK accounting firms citing recruitment and retention as a major challenge, many are turning to outsourcing themselves. This trend can work in your favour, giving you access to high-level expertise without the hefty overheads of an in-house hire. You can read more about the challenges driving this shift in this insightful article on outsourced bookkeeping.

Ask the Right Questions and Check References

Finally, don't be afraid to dig deep during your consultations, and always, always ask for references. There’s no better way to find out what it’s really like to work with a firm than by speaking to their existing clients.

Here are a few essential questions to have ready for any potential partner:

- Who will be my day-to-day contact, and what's the best way to communicate?

- Can you share some case studies or testimonials from businesses in my sector?

- What does your onboarding process for a new client look like?

- How do you guarantee the security and confidentiality of my financial data?

Choosing your bookkeeping partner is a critical business decision. By taking the time to carefully vet their experience, tech skills, pricing, and reputation, you can build a relationship that will support and strengthen your business for years to come.

Bringing Your New Bookkeeping Partner Onboard

You've done the hard work and picked the perfect firm for your outsourcing bookkeeping services. What comes next is arguably the most important part: the onboarding. This isn't just about handing over a box of receipts; it's about building a solid foundation for a long-term partnership. The goal is to create a seamless, secure system where information flows effortlessly, giving you more insight into your finances than ever before.

Things usually kick off with an engagement letter. This document lays everything out in black and white—the scope of work, who's responsible for what, and the terms of your agreement. Once that's sorted, the real work of integrating systems begins. A modern bookkeeping firm won't ask you to email stacks of confidential papers. Instead, they'll welcome you into their secure, cloud-based world.

Setting Up Secure Software and Tools

Giving someone access to your financial data can feel a bit daunting, but any professional firm will handle this with the utmost security. They'll need access to a few key platforms to manage your books efficiently, and they'll walk you through setting this up, ensuring you only grant the permissions they absolutely need.

Here’s what that usually looks like in practice:

- Cloud Accounting Software: They'll ask you to add them as a new user to your existing software, whether it’s Xero, QuickBooks, or Sage. Crucially, you can assign them a specific role (like 'Advisor') that gives them what they need to work without allowing them to, say, make bank payments.

- Bank Feeds: Forget downloading and sending bank statements. You'll set up a direct bank feed, which creates a secure, read-only link between your business bank account and the accounting software. It automatically pulls in transaction data every day, saving a massive amount of time and cutting out the risk of human error.

- Receipt Capture Apps: Say goodbye to the shoebox full of crumpled receipts. You’ll get set up with a tool like Dext or AutoEntry. You and your team can just snap a photo of a receipt on a phone, and the app automatically extracts the key data and sends it straight into your accounting software.

This entire setup is designed to give your bookkeeper the real-time information they need while you always maintain full ownership and control of your accounts.

Getting into the Collaborative Groove

The real magic of modern outsourcing bookkeeping services is the collaborative environment that cloud technology fosters. It doesn’t leave you in the dark; it gives you a crystal-clear window into your finances.

In fact, many business owners I've worked with find that bringing in an outsourced partner actually improves their own internal processes. Exploring solutions like how hosted desktops make your accountancy firm more efficient can centralise everything into one secure hub for all your financial operations.

Take a look at the Xero dashboard, for example. It’s one of the most popular platforms in the UK for a reason. It gives you an instant, real-time snapshot of your business's financial health.

With a dashboard like this, you can see your cash flow, who owes you money, and what bills are due—all without having to ask for a single report.

The point of this whole integration is to build a system, not just to delegate a list of tasks. Your bookkeeper manages the nitty-gritty data entry, and you get to see the live results. It means you can check your bank balance before a big purchase or see which clients are dragging their feet on payments, right from your laptop or phone.

Finally, a smooth onboarding process will establish clear lines of communication. Your new firm will introduce you to your main point of contact and clarify the best way to get in touch, whether that’s via email, a client portal, or scheduled check-in calls. A good firm makes sure the whole process is demystified, leaving you feeling confident and in control from day one.

Growing Your Partnership for Lasting Success

Once you've selected a firm for your outsourcing bookkeeping services, it's tempting to think the job is done. But the real work—and the real value—comes from building a genuine partnership. This isn't a one-off transaction; it's a relationship that needs communication and attention to truly flourish. Think of it less as a "set it and forget it" task and more as a dynamic collaboration that will evolve right alongside your business.

The foundation of any great long-term partnership is a steady, predictable rhythm of communication. It’s not about breathing down your bookkeeper's neck. It's about creating a clear and consistent flow of information so everyone knows where they stand.

Finding Your Communication Groove

Right from the start, you need to work out a communication style that suits both you and your bookkeeping firm. Every business owner has their own preferences for how they like to receive information, and your provider will have their own established processes. The trick is finding a happy medium.

A solid communication plan should sort out the basics:

- A dedicated point person: You need to know exactly who to call or email. This simple step cuts out confusion and gets you answers faster from the person who understands your business best.

- Agreed-upon channels: Will you use email for most things? A secure client portal for documents? Or maybe quick phone calls for urgent queries? Decide this early on.

- Realistic response times: Ask about their standard service level agreements. A good firm will have no problem telling you when you can expect a reply.

Getting this structure in place removes the guesswork and builds a foundation of trust. Before you know it, your outsourced bookkeeper will feel like a core part of your own team.

In my experience, the most successful outsourced relationships are built on regular, scheduled check-ins. A simple 30-minute call each month to go over the management reports can be invaluable. It’s where you spot trends, flag potential cash flow issues, and have those strategic conversations you’d otherwise never find the time for.

Setting Clear Expectations for Reporting and Reviews

To make confident decisions, you need timely, accurate financial data. It's as simple as that. Work with your bookkeeping partner to set a clear schedule for when you'll receive key reports. This isn't just about accountability; it's about making sure you have the right information at the right time.

Here are some typical reporting deadlines you should agree on:

- Monthly Management Accounts: You might set a deadline for receiving your Profit & Loss, Balance Sheet, and Cash Flow statements by the 15th of the following month.

- Quarterly VAT Returns: Make sure you're both clear on the process and internal deadlines for reviewing and filing your VAT returns with HMRC, well before the official cut-off.

- Ad-hoc Reports: What's the process if you suddenly need a specific report for a loan application or a board meeting? Discuss how to handle these one-off requests.

This proactive approach keeps you in control. The UK’s bookkeeping industry is now valued at around £6.6 billion, largely because online platforms and automation have made outsourced services incredibly efficient. This shift allows firms to deliver the kind of timely, data-rich reporting that modern businesses thrive on. You can read more about these UK bookkeeping industry trends and see how they can benefit your SME.

Working Together to Fine-Tune Your Workflows

Your business is always changing, and your bookkeeping processes should change with it. The true payoff of a long-term partnership is this ability to continuously improve how you work together. As time goes on, you and your bookkeeper will naturally spot ways to make things run a bit smoother.

Maybe you could automate your invoice reminders or introduce a slicker way to manage employee expenses. Be open to their ideas—after all, they've seen what works (and what doesn't) across hundreds of other businesses. By giving constructive feedback and listening to their suggestions, you ensure your outsourcing bookkeeping services continue to add real value, saving you time and boosting your bottom line.

Your Questions Answered

When you're thinking about outsourcing your bookkeeping, it’s only natural to have a few questions. Making the right choice for your business means getting clear answers, so let’s dive into some of the things business owners ask us most often.

How Much Should I Expect to Pay for Outsourced Bookkeeping in the UK?

The honest answer? It really depends. The cost to outsource your bookkeeping in the UK isn't a one-size-fits-all figure. It hinges on the size of your business, how many transactions you have each month, and the complexity of your finances.

A micro-business with straightforward needs might find a package for around £100-£200 per month. For a larger company that needs the full works—management accounts, regular VAT returns, and payroll—the investment could be upwards of £1,000 per month.

Most good firms work on a fixed-fee basis, which is a lifesaver for budgeting. It means no nasty surprises. My advice is to always ask for a detailed, itemised quote so you know exactly what you're paying for before you sign anything.

Is My Financial Data Genuinely Secure with an Outside Firm?

Absolutely, and it has to be. A reputable bookkeeping firm stakes its entire reputation on data security. They use highly secure, encrypted cloud accounting software and have robust internal data protection policies that are fully compliant with GDPR.

Don't be shy about quizzing them on their security setup. You're well within your rights to ask:

- Where is my data physically stored?

- Can you tell me precisely who will have access to it?

- Do you enforce multi-factor authentication for all system logins?

A professional provider won't just answer these questions; they'll welcome them. They know that your trust is the foundation of a successful partnership.

Will I Lose Control of My Finances if I Outsource?

This is probably the most common worry I hear, but the reality is the complete opposite. When done right, outsourcing your bookkeeping actually gives you more control and a clearer view of your finances than you've ever had before.

Modern cloud platforms like Xero or QuickBooks give you a live, 24/7 window into your company's financial health.

Think about it: instead of getting a stale report weeks after the month has ended, you can log in anytime, from anywhere, and see your real-time cash flow, who owes you money, and what bills are due. Your bookkeeper manages the nitty-gritty, freeing you up to focus on the big-picture strategy that actually drives your business forward.

What's the Real Difference Between a Bookkeeper and an Accountant?

It helps to think of them as two specialists working on the same team. A bookkeeper is your on-the-ground financial expert, focused on the day-to-day. They're meticulously recording every transaction, managing your sales and purchase ledgers, reconciling your bank accounts, and ensuring your records are clean, accurate, and up-to-date.

An accountant then takes that perfectly organised data and uses it for more strategic, high-level work. They'll handle things like in-depth financial analysis, tax planning, preparing your official annual accounts, and providing advice on business growth. In short, fantastic bookkeeping is the bedrock that makes great accounting possible.

Ready to gain more time, more money, and a clearer mind? Stewart Accounting Services offers expert bookkeeping and accounting support tailored for UK SMEs. We handle the numbers so you can focus on growth.