For a small business owner in the UK, payroll is a whole lot more than just paying your people. It’s a make-or-break function that affects your legal standing, your team's happiness, and your bottom line. Think of a payroll service as an expert co-pilot for your business, taking care of the tricky navigation through tax codes and reporting so you can keep your eyes on the horizon. This guide will break it all down, offering practical advice to help you turn what feels like a chore into a real business advantage.

Why Getting Payroll Right Is So Important

In the UK, payroll isn't just another task on the list for a small business; it's the very heartbeat of the company. It sits at the crucial intersection between you, your team, and HM Revenue & Customs (HMRC). Get it wrong, and you’re looking at serious problems, from hefty fines to a complete breakdown in employee trust. But get it right, and you build a solid foundation of reliability and professionalism.

The sheer number of small businesses in the country really puts this into perspective. Enterprises with 0-49 employees are the true backbone of the UK economy. There are 5.45 million of them, making up over 99% of all businesses. Together, they employ nearly 13 million people. It’s no surprise, then, that outsourcing payroll has become such a common strategy to ensure everything is done accurately and on time. You can dig into more UK business data over at money.co.uk to see the bigger picture.

More Than Just a Payslip

Proper payroll management is about so much more than just moving money from one account to another. It’s a complex web of calculations, deductions, and reporting that needs to be perfect every single payday. Even one tiny mistake can cause a ripple effect, creating unnecessary stress for your employees and a compliance nightmare for you.

Here are a few key responsibilities that show just how vital it is:

- HMRC Compliance: Calculating and submitting the correct Pay As You Earn (PAYE) tax and National Insurance contributions is absolutely non-negotiable.

- Employee Morale: Your team expects to be paid correctly and on time, every time. It’s a fundamental part of the deal. Errors can quickly destroy morale and trust.

- Pension Auto-Enrolment: UK law requires you to enrol eligible staff into a workplace pension scheme. This is a complex area with strict legal duties you have to get right.

- Statutory Payments: You’re legally required to manage payments for things like sick leave, maternity, or paternity pay correctly, and that demands careful administration.

For any small business, mastering payroll is non-negotiable. It's about protecting your business from financial risk, keeping your talented team happy, and freeing up your valuable time to focus on what you do best—growing your enterprise.

Getting a handle on these elements is the first step toward building a solid system. For a deeper dive, take a look at these essential payroll best practices to help keep everything efficient and compliant.

What Does a Payroll Service Actually Do?

Let’s pull back the curtain on what payroll services for small business UK providers really get up to. Forget the official jargon for a moment; we're talking about the practical, week-in, week-out tasks that can easily swallow a business owner's time. In fact, many small businesses spend an average of 30 hours a year just running payroll—time that could be poured back into growing the company.

Trying to manage payroll yourself is a bit like being your own car mechanic. Sure, you can handle the simple stuff, but when something complex goes wrong, you risk a breakdown that’s both costly and time-consuming to fix. Outsourcing, on the other hand, is like having a specialist mechanic on speed dial. They have the right tools, years of expertise, and a proven process to keep your business running like a well-oiled machine.

A good provider acts as a true extension of your team, taking on the repetitive but absolutely vital job of paying your people correctly and on time. Let's break down exactly what you get to hand over.

Core Calculations and Processing

At its heart, a payroll service is a powerful calculation engine. Its main job is to take each employee's gross pay—whether they’re on a fixed salary or paid by the hour—and turn it into the final figure that hits their bank account. And trust me, it’s rarely simple multiplication.

The service has to accurately account for overtime, bonuses, commissions, and any other variables. From there, it calculates and subtracts all the mandatory deductions before arriving at the net pay.

These crucial calculations include:

- PAYE Tax: Working out the precise income tax to withhold based on each person's unique tax code.

- National Insurance: Calculating both employee and employer National Insurance Contributions (NICs)—a common trip-up for businesses doing it themselves.

- Pension Contributions: Deducting employee contributions for your auto-enrolment scheme and figuring out your required employer top-up.

- Other Deductions: Handling things like student loan repayments or court-ordered attachments of earnings.

Managing Statutory and Variable Payments

Beyond the regular monthly salary, UK employment law requires employers to manage various statutory payments. This is where a payroll service really earns its keep, navigating the complexities and ensuring you’re always compliant when life happens.

For example, they'll handle Statutory Sick Pay (SSP), correctly calculating who is eligible and how much they should receive when they're off ill. They also manage all the family-related leave, like Statutory Maternity Pay (SMP) and Paternity Pay (SPP), which come with their own distinct rules and processes for claiming money back from HMRC.

Handing these complex calculations to an expert service eliminates guesswork. It protects you from accidentally underpaying someone or falling foul of your legal duties during what is often a sensitive time for your employee.

Reporting and Payslip Generation

A huge part of the job is creating clear, compliant documents for both your team and the taxman. For every single pay period, the service generates a detailed payslip for each employee. This isn't just good practice; it's a legal requirement to show gross pay, a full breakdown of deductions, and the final net pay.

At the same time, they're handling your reporting obligations to HMRC. Strong payroll management is vital not just for compliance, but for supporting the entire employee life cycle, keeping finances smooth from a new starter's first day to their last. This includes sending all the necessary data through the Real Time Information (RTI) system every time you run payroll, which keeps you firmly on the right side of the authorities.

Navigating Key UK Payroll Regulations

For most small business owners, getting to grips with UK payroll law is a real headache. The rules can feel like a tangled mess of acronyms and deadlines, but staying compliant isn't just about ticking boxes—it's about protecting your business from some pretty hefty fines from HMRC.

This is exactly why so many businesses turn to professional payroll services for small business UK providers. They act as a vital safeguard. Let's break down the three absolute pillars of UK payroll you have to get right.

The Pulse of Payroll: Real Time Information (RTI)

Think of Real Time Information (RTI) as the live heartbeat of your payroll. Gone are the days of sending a massive, single report to HMRC at the end of the tax year. Now, you’re required to submit your payroll data electronically every single time you pay your team. This gives HMRC a constant, up-to-the-minute picture of what’s happening.

In practice, this means sending a Full Payment Submission (FPS) on or before each payday. This report details precisely who you've paid, how much they earned, and all the deductions for tax and National Insurance. It’s a continuous flow of data that has to be spot-on every single time.

The need for this accuracy is only growing. As of March 2025, small businesses with 1 to 9 employees saw an increase of 6,000 jobs from the previous month, bringing the total to 4,241,500 employees. The UK’s PAYE system, now driven by RTI, adds a layer of complexity that pushes many owners to get expert help.

Your Pension Duties: Auto-Enrolment

Auto-Enrolment is the government’s workplace pension scheme, and it's not optional. As an employer, you have a legal duty to automatically enrol eligible staff into a pension plan and pay into it.

Your core responsibilities here include:

- Assessing Your Workforce: Each payday, you need to check which employees are eligible based on their age and how much they’ve earned.

- Choosing a Pension Scheme: You must select a qualifying pension scheme for your staff to join.

- Enrolling Staff and Making Contributions: You have to enrol the right people and make sure your employer contributions are paid on time, every time.

- Communicating with Your Team: You’re legally required to write to all your staff to explain what Auto-Enrolment means for them.

Trying to manage the setup and day-to-day running of a workplace pension can be tricky. A simple mistake can lead to daily fines that quickly escalate, which makes getting expert guidance a very smart move. To get started, have a look at our guide on setting up a payroll scheme.

The Construction Industry Scheme (CIS)

If your business is in the construction industry, you have another set of rules to contend with: the Construction Industry Scheme (CIS). This system dictates how contractors must handle payments to their subcontractors for construction work.

Under CIS, the contractor has to deduct money from a subcontractor's payment and send it straight to HMRC. These deductions are essentially advance payments towards the subcontractor's tax and National Insurance. The rate you deduct depends on the subcontractor's status: 20% for those registered for CIS, or a much higher 30% for those who aren't.

Managing CIS properly means verifying every subcontractor with HMRC, applying the correct deduction rate, and issuing monthly statements. It’s another administrative burden that, if you get it wrong, can cause serious trouble. For construction businesses, specialist payroll support isn’t a luxury—it’s essential.

UK Payroll Compliance Checklist for Small Businesses

To help keep you on the right track, here’s a quick summary of the key regulatory duties for small business owners.

| Compliance Area | What It Means for Your Business | Common Pitfall to Avoid |

|---|---|---|

| Real Time Information (RTI) | You must submit payroll data to HMRC every time you pay employees. | Missing the "on or before" payday submission deadline, which can trigger automatic penalties. |

| Auto-Enrolment Pensions | You must enrol eligible staff into a workplace pension and make contributions. | Forgetting to reassess employees each pay period, especially those with variable hours or pay. |

| Construction Industry Scheme (CIS) | If you're a contractor, you must deduct tax from subcontractors' pay and submit it to HMRC. | Failing to verify a subcontractor's status with HMRC before paying them, leading to incorrect deductions. |

| National Minimum Wage | You must pay all staff at least the legally required minimum wage rate for their age. | Accidentally underpaying by not factoring in all working time, such as training or travel. |

Keeping on top of these areas is fundamental to running a compliant payroll. Each has its own nuances and deadlines, making a structured approach or professional support a real asset.

The Real-World Benefits of Outsourcing Your Payroll

Let’s get practical. Beyond the technical definitions, what tangible advantages do you actually get when you hand your payroll over to the experts? For most small business owners in the UK, it’s not just about ticking a box. It's a smart, strategic decision that pays dividends in three critical areas: getting your time back, protecting your profits, and gaining some much-needed peace of mind.

This isn’t just a minor administrative change. Think of it as an investment in efficiency and growth. Outsourcing transforms a complex, high-stakes chore into a smooth, automated process, freeing you up to focus on what you do best—running and growing your business.

Reclaim Your Most Valuable Asset: Your Time

Every hour you spend buried in spreadsheets, calculating deductions, or battling with payroll software is an hour stolen from sales, strategy, or talking to your customers. On average, small businesses sink 30 hours a year just keeping their payroll running, and that’s assuming everything goes smoothly. This administrative quicksand can seriously stifle growth and lead to burnout.

When you bring in professional payroll services for small business UK, you instantly reclaim those hours. Just think about what you could do with that extra time:

- Focus on Core Operations: Instead of chasing timesheets, you could be perfecting your products or improving your service.

- Drive Business Growth: That time could be spent on a new marketing push, networking, or exploring fresh revenue streams.

- Improve Customer Relationships: You can invest more energy in building the strong client connections that are the lifeblood of any small business.

It’s not just you, either. This shift also takes the pressure off your team. Outsourcing payroll can dramatically reduce the administrative load on your internal human resources management staff, allowing them to concentrate on vital areas like employee development and retention.

Protect Your Bottom Line from Costly Errors

Trying to manage payroll in-house might seem like a way to save a few pounds, but the hidden costs and potential penalties often make it the more expensive route. One simple miscalculation or a missed HMRC deadline can lead to hefty fines that dwarf the cost of an outsourced service. It’s a common pitfall, with a shocking number of small businesses getting penalised for payroll tax mistakes.

Outsourcing isn’t an expense; it’s a form of financial insurance. It shields your business from the costly risks of non-compliance and human error, protecting your hard-earned profits.

Professional payroll services safeguard your finances in a few key ways. For starters, you can ditch expensive payroll software subscriptions and the constant need for training. More importantly, their expertise minimises the risk of costly payment errors, ensuring you're not accidentally overpaying an employee or, worse, underpaying your tax bill. To dive deeper, check out our guide on the benefits of outsourcing payroll.

Achieve Compliance and Peace of Mind

The UK’s payroll rules are a moving target. New legislation and updated regulations are always just around the corner, and keeping up with it all is practically a full-time job. When you have an expert managing your payroll, you can finally relax, confident that your business is fully compliant with all the latest rules from HMRC, including RTI and auto-enrolment.

This is why the trend towards outsourcing is accelerating. With around 30.3 million payrolled employees in the UK, it’s predicted that nearly two-thirds of UK SMEs will outsource their payroll by 2025. The driving forces are simple: the need for watertight compliance and better efficiency.

Ultimately, knowing that your sensitive employee data is secure and that a specialist is making sure you're compliant is perhaps the single greatest benefit. It’s the kind of peace of mind you can’t put a price on.

How to Choose the Right Payroll Service Provider

Picking the right partner to handle your payroll is one of the biggest decisions you'll make for your small business. Get it right, and you’ll gain efficiency and peace of mind. Get it wrong, and you’re looking at a world of administrative headaches. It’s a bit like hiring a key member of your team; you need someone with the right skills, a transparent way of working, and the ability to just fit with how your business operates.

Thankfully, making this choice doesn't have to be overwhelming. If you focus on a few key areas, you can confidently find a provider that truly matches your company's needs, culture, and budget. This isn't just about finding someone to process payments—it's about building a partnership that supports your growth.

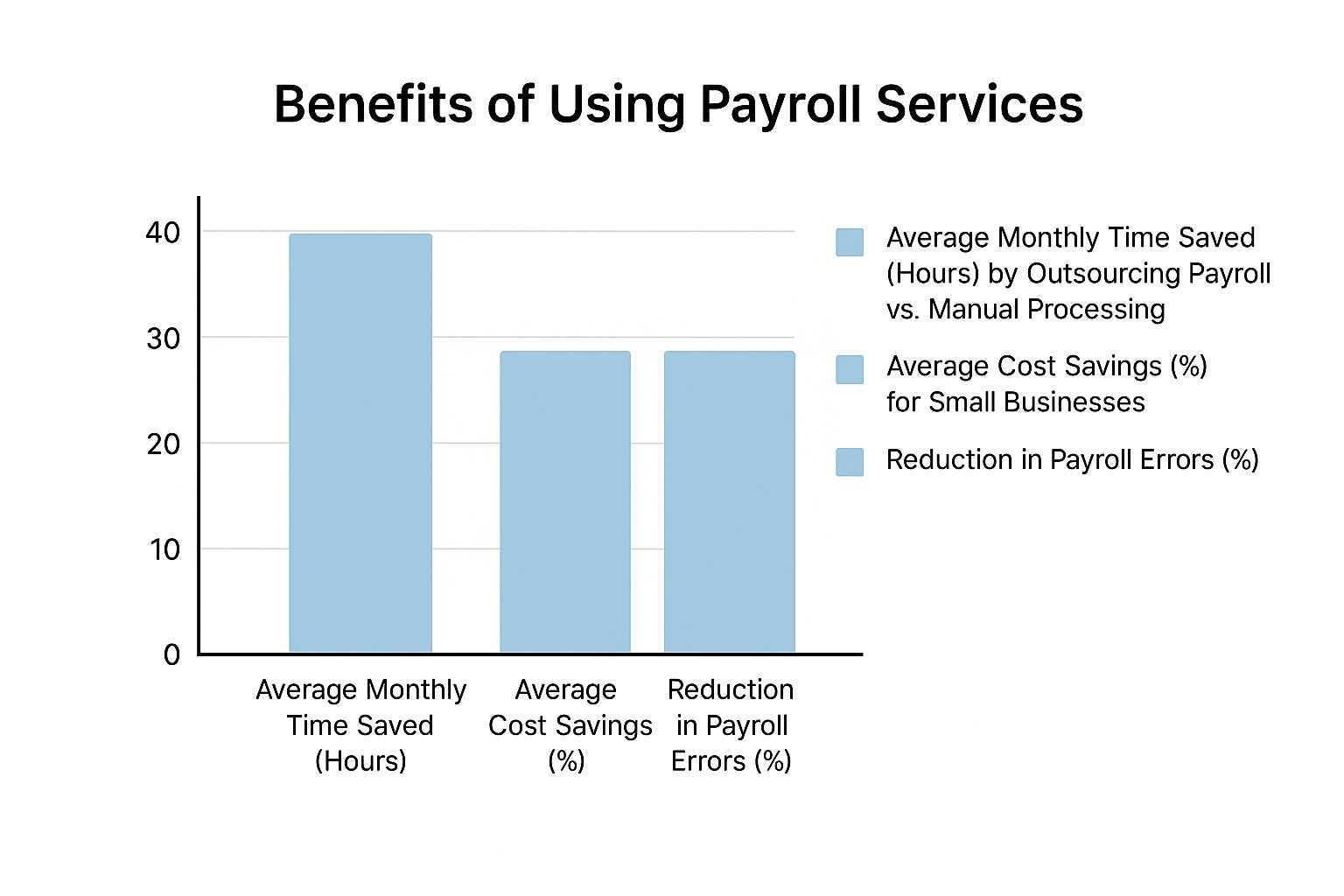

The infographic below really highlights the benefits businesses see when they move from doing payroll themselves to using a professional service. The time savings, cost reductions, and drop in errors are significant.

As you can see, outsourcing is a smart, strategic move. It dramatically cuts down on mistakes while saving you both time and money.

Evaluate Their Expertise with UK Small Businesses

The very first filter you should apply is experience. A provider might have a big, recognisable name, but do they actually get the unique pressures and challenges of a UK small business? Look for a solid track record of working with companies that are a similar size and in the same industry as yours.

This specialisation really matters. The needs of a five-person creative agency are completely different from a multinational corporation's. A provider that specialises in small businesses will be on intimate terms with HMRC’s expectations for SMEs, including all the fiddly details around auto-enrolment, statutory pay, and RTI submissions for smaller teams. Their advice will be practical and directly relevant to you.

Insist on Transparent and Predictable Pricing

Nobody likes a surprise bill. When you're looking at payroll services for small business UK providers, clear and predictable pricing is absolutely non-negotiable. Vague fee structures or promises that sound too good to be true are massive red flags. You need to know exactly what you’re paying for each month, with zero hidden extras.

Most providers use a straightforward per-employee, per-month model, which is easy to budget for. But the devil is in the detail, so you have to clarify what’s actually included in that price. You need to ask some direct questions to uncover any potential extra costs.

"A common pitfall is overlooking additional charges for tasks like processing new starters or leavers, generating end-of-year P60 forms, or providing extra reports. Always ask for a complete breakdown of what is and isn't included in the monthly price."

By getting this sorted upfront, you avoid nasty shocks down the line and can be sure the service will stay affordable as your business grows.

Comparing Payroll Service Provider Models

To help you navigate the options, it's useful to understand the main types of payroll services available to UK small businesses. Each has its own strengths and is suited to different business needs.

| Provider Type | Best For | Potential Drawback |

|---|---|---|

| Accountancy Firms | Businesses wanting a holistic service combining payroll, bookkeeping, and tax advice. | Can be more expensive than standalone payroll software. |

| Dedicated Payroll Bureaus | Companies focused purely on getting payroll done accurately and efficiently. | May not offer wider financial or HR advisory services. |

| DIY Payroll Software (e.g., Xero, QuickBooks) | Very small businesses with simple payrolls and the time/confidence to manage it in-house. | The business owner is fully responsible for accuracy and compliance. |

This table gives you a starting point for thinking about which model aligns best with your resources, expertise, and long-term goals.

Check for Seamless Software Integration

These days, your business systems have to talk to each other. It’s essential that your payroll service integrates smoothly with the accounting software you already use, whether that's Xero, QuickBooks, or something else. Without that link, you’re just creating a new administrative bottleneck for yourself, manually keying in data from one system to another.

Manual data entry is not only a drag on your time, but it’s also a perfect breeding ground for errors. A provider that offers seamless integration automates all of this, making sure your financial records are always accurate and up to date. It creates a single source of truth for your business finances, which makes reporting and financial planning far more reliable.

Key Questions to Ask Potential Providers

To cut through the marketing fluff and get to what really matters, you need to ask the right questions. Before you start having conversations, get a checklist ready. This will help you compare different services fairly, like for like.

Here are some essential questions to have on your list:

- HMRC Communications: How do you handle all communications with HMRC for us?

- Support System: If I have an urgent payroll question, what’s your support process and how quickly can I expect a response?

- Onboarding Process: What does the setup process involve, and how much of my time will it take?

- Hidden Fees: Are there extra charges for year-end reporting, adding new employees, or fixing errors?

- Data Security: What specific measures do you use to keep my employee data secure and compliant with GDPR?

The quality of their answers—and the confidence with which they give them—will tell you a huge amount about their expertise and how much they value their clients. A structured approach like this is the best way to choose a partner that truly gets what you need.

Let Us Handle Your Payroll, So You Can Handle Your Business

Trying to manage UK payroll on your own can feel like you’re spinning plates. Just when you think you’ve got one thing sorted, another one starts to wobble. Keeping up with HMRC regulations, wrestling with pension auto-enrolment – it’s a constant drain on your time and energy, pulling you away from what you’re actually in business to do.

This is precisely why we created our payroll services for small business UK owners. We’re here to take that entire administrative burden off your plate for good.

At Stewart Accounting Services, we don’t just crunch the numbers. We become part of your team. You won't find any faceless call centres here; instead, you get a dedicated, friendly expert who knows you and your business. We understand the real-world pressures you're under because we work with business owners like you every single day. We're always just at the other end of the phone.

Solving Your Payroll Headaches

We've designed our service to cut through the confusion and give you what you really need: clarity, guaranteed compliance, and total peace of mind. Our goal is to get you out of the back office and back to leading your business.

Here’s a snapshot of how we make that happen:

- Guaranteed HMRC Compliance: We take full responsibility for your Real Time Information (RTI) submissions. Your data gets to HMRC accurately and on schedule, every single time. Forget about deadline-day stress.

- Hassle-Free Auto-Enrolment: We manage the A to Z of your workplace pension duties. From figuring out who’s eligible and calculating contributions to dealing with the pension provider, we’ve got it covered.

- Clear, Simple Reporting: You’ll get easy-to-read reports that break down your payroll costs – wages, tax, National Insurance, and pension payments. This clarity makes budgeting and financial planning so much easier.

When you work with us, you’re not just ticking a box. You’re gaining a partner who is genuinely invested in your business's financial wellbeing. We make sure every 'i' is dotted and every 't' is crossed, giving you the security to focus on growth.

Choosing Stewart Accounting Services means you’re getting seasoned expertise with a personal touch. We get stuck into the complexities so you can step back, confident that your team is being paid correctly and your business is playing by the rules.

If you’re ready to stop juggling payroll and get back to what you love, let's talk. Get in touch for a friendly, no-obligation chat about what you need and how we can help.

Got Questions About Small Business Payroll? We've Got Answers

Stepping into the world of payroll services can feel a bit daunting, and it's natural to have a few questions. Making the right choice for your business is crucial, so let's clear up some of the most common queries we hear from founders and small business owners.

What’s the Going Rate for Payroll Services?

In the UK, the cost of outsourcing your payroll is almost always tied to the size of your team. Most providers keep it simple with a set fee per employee, per month. This model is great because it’s easy to understand and scales up or down as your business evolves.

For a small business with just a few people on the books, you’re likely looking at somewhere between £5 to £10 per employee each month. Of course, this can shift depending on what’s included. It's always smart to ask for a full breakdown—are things like year-end P60s or processing new starters and leavers part of the package, or are they extras?

Is Switching Payroll Providers a Headache?

You'd be surprised how straightforward it is. Moving your payroll to a new provider, even mid-way through a tax year, is a well-trodden path. A good payroll service will take the lead on the entire transition, making sure the handover is seamless and your staff get paid on time, without a single hitch.

The process is simple. Your new provider just needs the year-to-date payroll figures for each employee, which you can easily get from your old provider or software. With that data, they can pick up exactly where things left off, ensuring all tax and National Insurance calculations continue accurately for the rest of the year.

It all comes down to clear communication. A great provider will give you a simple checklist of what they need and then handle all the technical bits themselves, making the switch completely stress-free for you.

What Info Do You Need From Me Each Month?

To get your payroll right every time, your provider will need a few key details from you before each pay run. Your main job is simply to keep this information organised and send it over.

Typically, they'll need to know about:

- Hours Worked: Timesheets for any staff who are paid hourly.

- Pay Adjustments: Any bonuses, commission payments, or overtime that needs to be added.

- Starters and Leavers: Details for any new hires or employees who have recently left.

- Absences: A record of any sick days or holidays that could affect someone's pay.

How Do You Keep My Team's Data Safe?

Data security is paramount, and it's not something to be taken lightly. Any credible payroll provider is legally bound by the UK General Data Protection Regulation (GDPR) to protect your sensitive employee information with the highest level of care.

When you're choosing a provider, look for one that uses robust security measures like data encryption and secure online portals for sharing files. They should have a transparent privacy policy and be able to tell you exactly how they keep your data locked down. Ultimately, choosing a provider that prioritises security is fundamental to protecting both your business and your people.

Ready to take payroll off your to-do list for good and get back to growing your business? The team at Stewart Accounting Services offers expert, reliable payroll management built for UK small businesses just like yours. Let us give you the confidence that comes from knowing your payroll is sorted.