At its heart, simple bookkeeping for small businesses boils down to one thing: creating a clear and consistent system to track your money. It's the habit that keeps financial chaos at bay and gives you the insights you need to grow. You'll know exactly what’s coming in, what’s going out, and what’s left over.

Building Your Bookkeeping Foundation

Getting started with bookkeeping can feel overwhelming, but it’s more straightforward than you might think. It’s really about choosing the right tools and methods for your business's size and complexity right now. For many UK businesses just starting, the first big decision is whether to stick with a simple spreadsheet or jump straight into dedicated accounting software.

Spreadsheet or Software?

A spreadsheet is a perfectly fine starting point if you're a freelancer or a sole trader with only a handful of transactions each month. It’s cheap (or free) and gives you a basic way to log your income and expenses.

But as your business grows, that manual data entry quickly becomes a real chore, and it’s surprisingly easy to make mistakes. This is where dedicated software really shines. It can automate data entry by linking to your bank account, generate professional reports in a click, and help you stay compliant with UK regulations like Making Tax Digital (MTD) for VAT.

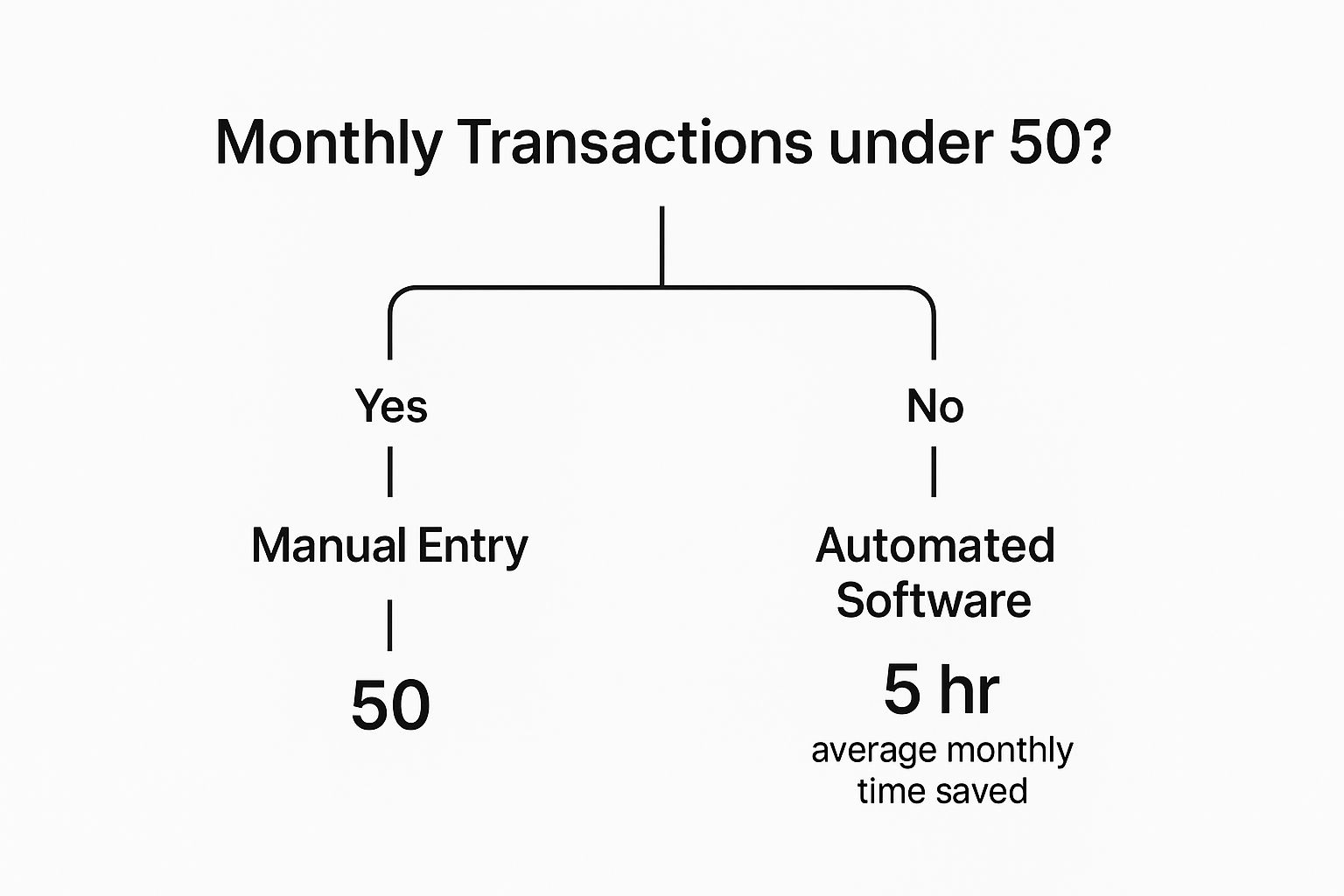

This image really helps visualise that decision point between manual entry and automation.

From my experience, once you're dealing with more than 50 transactions a month, the time you save with software makes the investment well worth it.

To help you decide, here’s a quick breakdown of what you get with each option.

Choosing Your Bookkeeping System: Spreadsheet vs Software

| Feature | Spreadsheet | Accounting Software |

|---|---|---|

| Cost | Free or low-cost (e.g., Microsoft Excel, Google Sheets). | Monthly subscription fee, typically from £10-£30+. |

| Ease of Use | Simple for basic lists, but requires manual formula setup. High risk of errors. | Designed for non-accountants. Guided setup and intuitive interface. |

| Automation | None. All data entry is manual and time-consuming. | Automatically imports bank transactions, sends invoice reminders. |

| Reporting | Manual creation of charts and reports. Can be complex. | Instantly generates key reports like Profit & Loss and Balance Sheets. |

| MTD Compliance | Not compliant on its own. Requires bridging software for VAT submissions. | Built-in MTD for VAT functionality, making submissions simple. |

| Scalability | Becomes difficult to manage as transaction volume grows. | Easily scales with your business, handling thousands of transactions. |

Ultimately, while a spreadsheet can work in the very beginning, most businesses will quickly find that accounting software pays for itself in time saved and accuracy gained.

Single-Entry vs Double-Entry Bookkeeping

Once you've picked your tool, you need to decide on a method. The two main approaches are single-entry and double-entry bookkeeping.

- Single-Entry Bookkeeping: Think of this like your personal bank account register. You record money in and money out, and that's it. It’s fine for very small, simple businesses with no stock to manage.

- Double-Entry Bookkeeping: This is the standard for almost every business for a good reason. Every transaction is recorded in two places. For example, if you buy £100 of office supplies, your 'Cash' account goes down by £100, and your 'Office Supplies' expense account goes up by £100. This built-in checking system makes everything far more accurate.

For any business planning to grow, get a loan, or bring on investors, double-entry bookkeeping isn't just a good idea—it's essential. It’s the language of finance and the foundation of all proper financial statements.

Getting this structure right is crucial, especially when you consider that around 60% of small business owners feel they're not confident with their financial knowledge. A solid system helps bridge that gap right from the start.

Building a good foundation isn’t just about ticking boxes for HMRC. It’s about creating clarity. And beyond just the numbers, it also helps with optimizing business processes. A well-organised system turns your financial data from a headache into a powerful tool for making smart decisions.

Creating a Practical Chart of Accounts

Let's talk about your Chart of Accounts. Think of it as the index for your business's financial story. It's essentially a customised list of all the categories you'll use to sort every single transaction, and it's the absolute backbone of an organised bookkeeping system. Without one, you're just throwing numbers into a void.

A well-structured Chart of Accounts gives you a crystal-clear view of where your money is coming from and exactly where it’s going. This clarity is what allows you to make smart business decisions on the fly and makes tax season feel less like a looming dread. You're not just logging numbers; you're building a narrative about your business's financial health.

For any UK business, keeping accurate financial records isn't just good practice—it's the law. In fact, the current economic climate has made sharp financial oversight more crucial than ever. Many small businesses are now seeking professional help just to stay afloat and compliant. You can get a better sense of how UK businesses are tackling this in the latest bookkeeping industry statistics from llcbuddy.com.

The Core Account Categories

Every Chart of Accounts is built on five fundamental pillars. Most accounting software, like Xero or QuickBooks, will give you a default list to start with, but the real power comes from tailoring it to your unique operations.

Here are the big five:

- Assets: This is everything your business owns. Think cash in your business bank account, your work laptop, office furniture, and even unpaid client invoices (also known as Accounts Receivable).

- Liabilities: This is what your business owes to others. It includes things like business loans, outstanding credit card balances, and any bills you need to pay to your suppliers (Accounts Payable).

- Equity: This represents the net worth of your business. It’s the owner's stake, covering your initial investment and any profits you’ve reinvested back into the company (Retained Earnings).

- Income (or Revenue): All the money your business earns. It’s a smart move to break this down. For instance, you could have separate categories for 'Client Project Revenue', 'Product Sales', and 'Monthly Retainer Fees'.

- Expenses: Every penny your business spends to keep the lights on. This is where you'll want the most detail.

My two cents: Aim for clarity, not complexity. You need enough detail to see what’s happening, but not so much that you’re scrolling through hundreds of accounts. A great rule of thumb I’ve seen work is to create a new expense category only if it accounts for more than 2% of your total spending.

Let me give you a practical example. Instead of one vague 'Software' category, you could create 'Accounting Software Subscriptions' and 'Design Software Licences'. This small change instantly shows you where costs might be creeping up, helping you make better decisions about your overheads.

Similarly, separating 'Office Rent' from 'Utilities' gives you a much clearer picture of your fixed versus variable costs. This kind of simple bookkeeping practice is an absolute game-changer for financial planning.

Mastering Daily Financial Transactions

This is where the real work of bookkeeping begins—the daily habit of recording every transaction. Get this right, and you'll separate your organised business from the ones that are constantly playing catch-up. Now that your Chart of Accounts is set up, you have the framework to log every penny that moves.

The goal isn't to spend hours bogged down in spreadsheets. It's about creating a simple, repeatable routine that takes just a few minutes each day. Think of it as the engine of your financial system. You’ll be logging sales invoices, supplier bills, petty cash top-ups, and bank transfers as they happen, creating a rhythm so nothing falls through the cracks.

At its core, you’re just tracking money in and money out. Every sales invoice you send is money in. Every bill from a supplier or any other business expense is money out.

Handling Different Transaction Types

Of course, not every transaction is a simple sale or purchase. Business finance has its quirks, and knowing how to handle them is what keeps your books truly accurate. A common sticking point for many small businesses is dealing with deposits or payments made in stages.

Let’s walk through a real-world scenario.

Imagine you're invoicing a client for a £1,000 project. They agree to pay a 50% deposit of £500 upfront. Here’s how you’d handle it properly:

-

Customer Deposit: That first £500 isn't technically revenue yet because you haven't completed the work. Instead, you'd record it as a liability in an account like 'Customer Deposits' or 'Deferred Revenue'. This accurately reflects that you owe your client the finished project (or their money back).

-

Final Payment: Once the job is done, you send the final invoice for the remaining £500. When that payment lands in your account, you can finally recognise the full £1,000 as 'Sales Revenue'. You'll also clear the £500 liability, as the debt is now settled.

This method, which is key to accrual accounting, gives you a much clearer picture of your actual earnings and financial health, rather than just watching cash come and go.

The Importance of Organised Receipts

For every single expense you record, you need proof. HMRC is very clear on this, requiring UK businesses to keep detailed records. The good news? Digital copies are completely fine. We can officially say goodbye to the overflowing shoebox of crumpled, faded receipts.

My best piece of advice is to go digital from the get-go. The second a receipt is in your hand, snap a photo with your phone and upload it straight to your accounting software or a designated cloud folder. It’s a tiny habit that prevents a massive headache down the line, especially when tax season looms.

Keeping these digital files organised is simple. You could create folders for each month ('October 2024 Receipts') or sort them by expense category, like 'Travel' and 'Office Supplies'. A neat system doesn't just make it easy to find what you need; it makes your business practically audit-proof. This daily discipline is what builds the foundation for robust financial control.

Why Bank Reconciliation Is Non-Negotiable

If there's one monthly habit that truly underpins the accuracy of your books, it's reconciling your bank accounts. Think of it as your financial health check—a critical process you simply can't afford to skip. This is the moment you prove that your business records perfectly match the reality of your bank account.

This isn’t just about being tidy. Bank reconciliation is your first line of defence against costly errors, unexpected cash flow issues, and even potential fraud. It’s how you ensure every penny is accounted for, giving you genuine confidence in your financial reports.

The process might sound formal, but the concept is straightforward. You take your bank statement and compare it, line by line, against the transactions you've logged in your bookkeeping system. The goal? To make sure the closing balances on both documents are identical.

Uncovering and Fixing Discrepancies

The real value of reconciliation shines through when the numbers don't match. This is where you get to play detective, uncovering issues that would otherwise fly completely under the radar. Thankfully, most discrepancies are innocent and easy to fix once you know what you’re looking for.

Common culprits I see all the time include:

- Bank Charges: Monthly account fees or sneaky transaction charges the bank deducts that you forgot to record.

- Uncashed Cheques: You’ve recorded a payment to a supplier, but they haven't gotten around to depositing the cheque yet.

- Timing Differences: A customer payment you logged on the 31st of the month might not actually clear in your bank account until the 1st of the next month.

- Simple Errors: An accidental duplicate entry or a classic typo (like entering £54 instead of £45) can throw everything off.

The core principle is simple: your books must reflect reality. Reconciliation forces you to find and fix any differences, ensuring your financial data isn't just a guess—it's a fact. This precision is what turns basic record-keeping into a powerful tool for making smart business decisions.

It's no surprise that many UK businesses seek support here. With approximately 5.5 million private sector businesses in the UK—the vast majority being SMEs—the administrative burden is significant. In fact, studies show that around 37% of small businesses outsource accounting tasks because they find them too confusing or time-consuming. You can learn more about how UK businesses handle their finances on anna.money.

A Practical Reconciliation Example

Let's walk through a common scenario. Imagine you're reconciling your March accounts. Your bookkeeping software shows a closing balance of £4,500, but your bank statement says it's £4,485. Where did that £15 go?

You start by comparing the two documents. After a quick scan, you spot a £15 "Monthly Account Fee" on your bank statement that isn't in your books. The fix is easy: you simply add this as a new expense transaction in your software, categorise it under 'Bank Fees', and voilà—the balances now match perfectly.

Mastering this simple bookkeeping task doesn’t just keep your numbers accurate. It empowers you to spot trends and manage your money with far greater control. It really is a non-negotiable step toward achieving true financial clarity.

Using Financial Reports to Steer Your Business

This is where all that hard work in your books pays off. Financial reports are where simple bookkeeping stops being a chore and becomes your single most powerful tool for making smart decisions. These aren't just stuffy documents for your accountant; they're the pulse of your business, telling you a story about its health, performance, and future.

When you get comfortable with these reports, you can stop running your business on guesswork. Instead, you'll be making moves based on cold, hard data. You'll spot trends before they become problems, get a real handle on your cash flow, and see exactly which parts of your business are actually making you money.

Let's walk through the three key reports you absolutely need to understand.

The Profit and Loss Statement

You'll often hear this called the P&L or an Income Statement. Think of it as the highlight reel of your business's financial performance over a set period—be it a month, a quarter, or a full year. The number at the very bottom tells a simple, critical story: did you make a profit or a loss?

For instance, a freelance consultant’s P&L might show £5,000 in ‘Project Revenue’ for March. Underneath, it would list out all the costs for that month, like £50 for ‘Software Subscriptions’, £200 for a ‘Co-working Space’ desk, and a £30 ‘Professional Indemnity Insurance’ payment. The report instantly calculates a net profit of £4,720, giving a clear picture of that month's success. By keeping an eye on this every month, you can quickly see which services bring in the most cash or where your costs are starting to creep up.

The Balance Sheet Snapshot

While the P&L tells a story over time, the Balance Sheet gives you a snapshot of your company's financial health on one specific day. It paints a picture of what your business owns versus what it owes, all built around one core formula:

Assets = Liabilities + Equity

As the name suggests, this equation must always balance out.

- Assets: This is everything your business owns that has value. Think cash in the bank, your work computer, and any invoices your clients still owe you (that’s your accounts receivable).

- Liabilities: This is everything your business owes to someone else. It includes bank loans, credit card debt, and any bills you need to pay to your suppliers (your accounts payable).

- Equity: This is what's left for you, the owner, after you pay off all your liabilities with your assets. It’s the true net worth of your business.

A strong balance sheet shows that your assets are more than enough to cover your liabilities. That's a huge sign of financial stability—and something any bank or investor will look at first.

Reading a Balance Sheet is like checking your business's vital signs. It tells you if you have enough cash to cover short-term debts and provides a real measure of your company's overall value at a specific moment in time.

The All-Important Cash Flow Statement

It's a classic saying for a reason: cash is king. A business can look profitable on paper but still go under if cash isn't coming in fast enough to pay the bills. The Cash Flow Statement is designed to stop that from happening by tracking the real, physical movement of money into and out of your bank account.

It breaks down your cash activity into three main categories:

- Operating Activities: Cash from your day-to-day business, like customer payments.

- Investing Activities: Cash spent on or gained from long-term assets, like buying a new van or selling old equipment.

- Financing Activities: Cash from outside sources, like taking out a loan, the owner putting money in, or repaying debt.

This report is your early-warning system. It’ll help you see a cash crunch coming weeks or months away, giving you time to chase that big overdue invoice or hold off on a purchase that isn't urgent.

To really drive it home, here’s a quick-glance table to help you remember what each report is for.

Understanding Key Financial Reports

| Financial Report | What It Shows | Key Question It Answers |

|---|---|---|

| Profit & Loss (P&L) | Your revenues, costs, and expenses over a specific period (e.g., a month or quarter). | "Is my business making money?" |

| Balance Sheet | A snapshot of your assets, liabilities, and equity on a single day. | "What is my business worth right now?" |

| Cash Flow Statement | The actual movement of cash into and out of your business over a period. | "Do I have enough cash to pay my bills?" |

Mastering these three reports is how you turn bookkeeping from a backward-glancing task into a forward-looking strategy. It's how you build a business that doesn't just survive, but truly thrives.

Common Bookkeeping Questions Answered

Even with a great system, you'll always have questions pop up as you get into the nitty-gritty of managing your own books. Simple bookkeeping often means figuring out these day-to-day uncertainties. Here are some straightforward answers to the questions we hear most often from UK small business owners.

How Often Should I Do My Bookkeeping?

Consistency is your best friend here. For most small businesses, setting aside a little time weekly strikes the right balance. It stops the paperwork from piling up into a weekend-destroying mountain and gives you a much clearer, more immediate picture of your cash flow. A weekly check-in means you can spot an overdue invoice and give it a nudge before it becomes a real problem.

If you’re running something with a lot of daily transactions, like a café or an online shop, a quick daily tally is even better.

No matter what, you absolutely must get everything reconciled at the end of each month. This isn't just a "nice-to-do"; it's essential for creating financial reports that you can actually trust to make smart business decisions.

When Should I Upgrade From Spreadsheets to Software?

Look, spreadsheets are perfectly fine when you're just starting out and only have a few transactions each month. But there are some very clear signals that it's time to move on.

The second that manual data entry starts to feel like a major chore, that's your cue. It's also time to switch if you find yourself needing to:

- Send professional-looking invoices and track when they're paid automatically.

- Link your business bank account so transactions flow in on their own.

- Handle VAT, especially with HMRC's Making Tax Digital (MTD) rules.

- Create proper financial reports without battling complex spreadsheet formulas.

As you grow, the time you save and the accuracy you gain from proper software far outweigh the cost. Spreadsheets just can't keep up. If you're new to the idea of digital finance tools, a resource like a simple guide to cloud accounting for business owners can be a brilliant place to start.

Do I Still Need an Accountant for Simple Bookkeeping?

Yes, absolutely. Even if you become a bookkeeping wizard, an accountant is still a crucial part of your team. It helps to think of your roles as different but working together. You're on the ground, handling the daily recording and organising of financial information. Your accountant uses that information for bigger-picture strategy.

An accountant can spot tax-saving opportunities you'd never know existed, advise on the best business structure as you grow, and make sure your year-end accounts are filed perfectly with Companies House and HMRC. Their expertise is an investment that pays for itself many times over in saved money and stress.

What Are the Biggest Bookkeeping Mistakes to Avoid?

Thankfully, the most common and costly mistakes are also the easiest to sidestep with a bit of discipline. Just knowing what they are is half the battle.

First up, mixing personal and business finances. This is the cardinal sin of bookkeeping. Open a dedicated business bank account from day one and use it for everything business-related. It draws a clean line in the sand and makes life so much simpler.

Next is forgetting to record small cash purchases. Every receipt for a legitimate business expense, no matter how small, helps reduce your taxable profit. Throwing them away is like volunteering to pay more tax.

Finally, letting your records fall behind is a sure-fire recipe for chaos and costly errors. Making bank reconciliation a regular, non-negotiable habit is your best defence. It keeps your books clean, current, and accurate.

Feeling buried under a pile of receipts, or just ready to focus on growing your business instead of wrestling with spreadsheets? The team at Stewart Accounting Services can give you back your time and peace of mind. We provide expert bookkeeping, accounting, and payroll support tailored to UK small businesses. Find out how we can help at https://stewartaccounting.co.uk.