Ever seen a price tag and wondered if that's actually what you'll pay? When a price is inclusive of VAT, it means exactly what it says on the tin. The price you see is the final price you pay at the till.

Think of it this way: the tax is already baked into the cost, so there are no nasty surprises when it's time to hand over your cash.

Demystifying VAT Inclusive Pricing

When you buy a coffee advertised for £3, you hand over £3. That’s VAT-inclusive pricing in action. It’s a straightforward approach designed for absolute clarity, ensuring the price on the shelf is the same as the price at the checkout. You'll find this is the standard for almost all UK high street retailers and consumer-facing businesses.

The whole point is transparency. As a customer, you shouldn't need a calculator to figure out your final bill. The business has already done the maths, working out and including the Value Added Tax (VAT) within that sticker price.

Understanding Different UK VAT Rates

Of course, not everything is taxed at the same level. While the standard rate is the one we see most often, it's worth knowing the other rates that still follow this inclusive pricing model.

- Standard Rate (20%): This is the big one. It applies to most goods and services, from your new laptop to a meal out at a restaurant.

- Reduced Rate (5%): You'll come across this on specific items, like domestic energy bills and children's car seats.

- Zero Rate (0%): This covers many essential items. Think most food from the supermarket, books, and children's clothing. The price technically includes VAT, but the rate is simply 0%.

This system of showing the total cost upfront is a cornerstone of UK consumer law. VAT first arrived in the UK on 1st April 1973 with a 10% standard rate. It's since become a huge part of our economy, with the current 20% rate being set back in 2011. If you're curious about its evolution, it's worth exploring the history of VAT in the UK.

How to Work Out the VAT Hidden in Any Price

When you look at a price tag that says it’s “inclusive of VAT,” the tax has already been baked into the final figure. Figuring out how much of that price is actually tax is easier than it sounds, but it’s a common trip-up. The one thing you can't do is simply subtract 20% from the total—that will always give you the wrong answer.

The trick is to think about it in reverse. The total price you see is the original price (the net amount) plus 20% VAT. So, that final figure actually represents 120% of the net price. To find the VAT, you just need to work backwards from there.

The Quick Trick for a 20% VAT Rate

For any item charged at the standard 20% VAT rate, there's a brilliantly simple shortcut to find the tax element: just divide the total price by 6.

Why does this work? Because 20% is one-fifth of the net price. When you add that one-fifth on, the VAT amount becomes one-sixth of the new, total price.

The Rule of Thumb: To find the VAT in a price that includes the standard 20% rate, divide the total cost by 6. Simple as that.

Let’s see how this plays out in a couple of everyday business situations.

Example 1: Buying a New Business Laptop

Imagine your company purchases a new laptop for £600. That price is VAT-inclusive.

- Calculation: £600 ÷ 6 = £100

- The Breakdown: The VAT portion of the price is £100. This means the laptop itself cost £500 before the tax was added.

Example 2: A Client Meal

You treat a client to dinner, and the final bill is £72, including VAT.

- Calculation: £72 ÷ 6 = £12

- The Breakdown: You paid £12 in VAT on that meal. The pre-tax cost of the food and service was £60.

This "divide by six" rule is a lifesaver for business owners who need to track their expenses accurately for tax records, or even just for curious shoppers who want to know where their money is going.

For a deeper dive into other rates and more complex calculations, our full guide can help you calculate VAT like a pro.

Why VAT Inclusive Pricing Is a Big Deal for UK Businesses

For any business in the UK, getting to grips with what "inclusive of VAT" means isn't just about sticking a price on something. It's a cornerstone of your legal obligations and sound financial management. Once your taxable turnover crosses a certain line, you're required to register for VAT and start adding it to your sales.

This registration effectively turns your business into an unpaid tax collector for HMRC. You take the VAT from your customers and hold onto it before paying it to the government. This simple fact makes getting your pricing and bookkeeping right absolutely non-negotiable.

The VAT Registration Threshold

The VAT registration threshold is a major milestone for any growing UK business. The threshold for mandatory registration recently increased from £85,000 to £90,000. As your turnover gets closer to this figure, your pricing strategy needs serious attention.

Once you’re registered, you have to account for VAT on your invoices. Stating your prices correctly isn't just good practice—it's essential for staying on the right side of the law and avoiding hefty penalties. Knowing how VAT will affect your profits is also a critical part of solid financial planning for business owners.

Legal Rules for Displaying Prices

If you sell directly to the public (in a B2C model), UK law is completely unambiguous: your prices must be displayed inclusive of VAT. This is a fundamental consumer protection rule designed to prevent nasty surprises at the till.

The price a shopper sees is the final price they should pay. You can’t spring the VAT on them at the checkout. This is all about transparency and building trust with your customers.

Getting this wrong can result in penalties and serious damage to your reputation. For your own books, you still need to work out the VAT component from the total price and separate it from your actual revenue before filing your returns. This keeps your financial operations clean, compliant, and headache-free.

Choosing Between Inclusive and Exclusive VAT Pricing

Deciding whether to show your prices with or without VAT boils down to one simple question: who are you selling to? This isn't just a tiny detail on an invoice; it shapes your entire pricing strategy and how customers perceive your value.

If you're selling directly to the public (B2C), the path is clear. A shopper on the high street or browsing your online store wants to know the final damage. Displaying prices inclusive of VAT is not only good practice but a legal must in the UK. It's about transparency and trust – the price they see is the price they pay. No nasty surprises at the checkout.

When to Use Exclusive VAT Pricing

On the flip side, the business-to-business (B2B) world plays by a different set of rules. When your customers are other VAT-registered companies, showing prices exclusive of VAT is the norm. Why? Because for them, the VAT portion isn't a true cost. They can usually claim it back from HMRC.

Their main focus is the net price – the real hit to their bottom line.

For a VAT-registered business, the tax is essentially a cash flow item that passes through their books, not a final expense. Showing the ex. VAT price makes cost analysis and business-to-business transactions much more straightforward.

Diving deeper into what exclusive of VAT means can clear up a lot of the accounting and invoicing headaches. For any UK business, solid financial planning is non-negotiable, and that means properly accounting for VAT. Understanding how to build financial models that drive business growth gives you a powerful framework for managing these details.

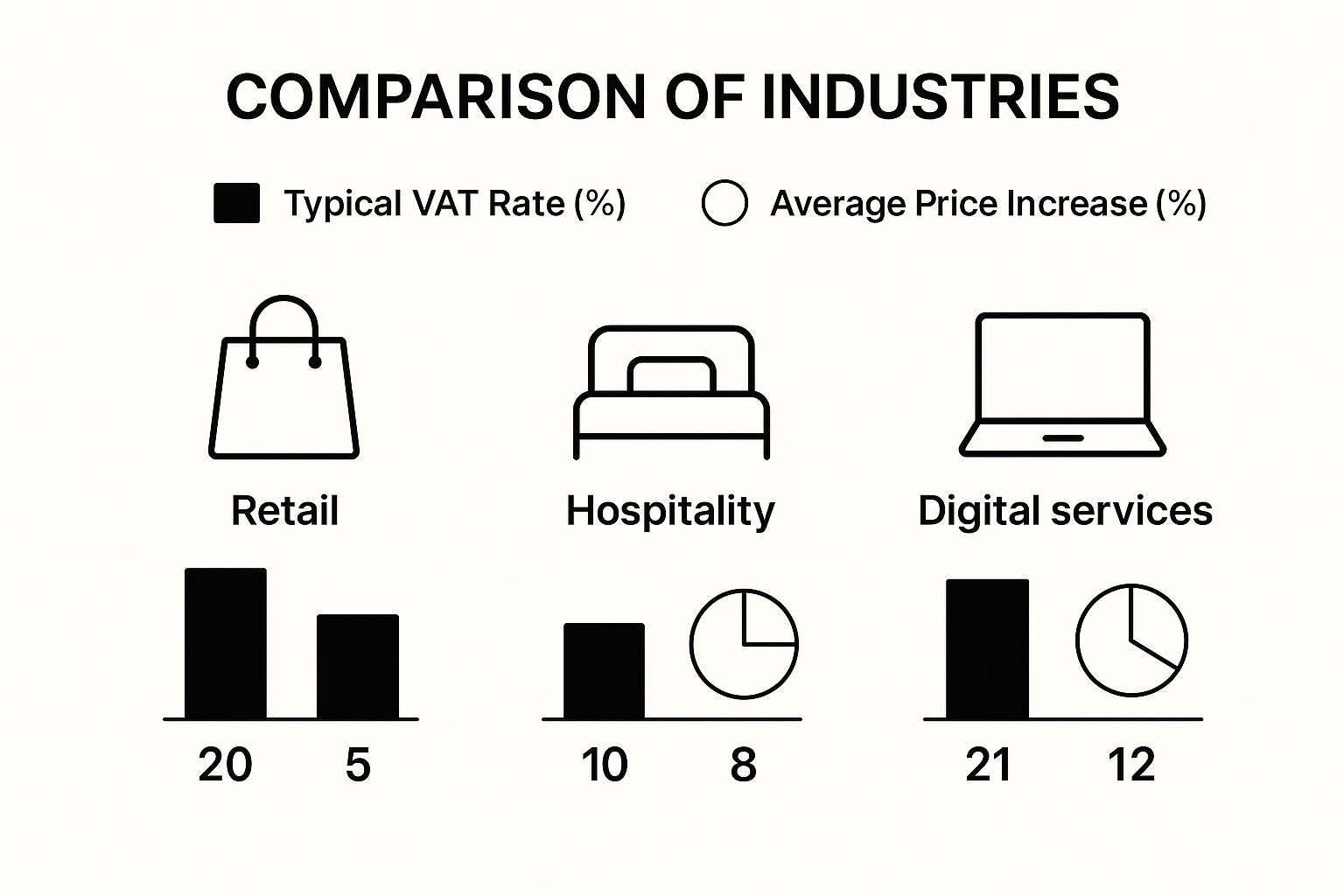

The image below gives a quick snapshot of how VAT rates often apply in different customer-facing sectors.

As you can see, areas like retail and hospitality—which deal directly with the public—almost always have the standard 20% VAT baked into their prices. It just makes things clearer for the end consumer.

VAT Inclusive vs Exclusive Pricing in Different Scenarios

To really nail down the difference, let’s look at how a £1,000 base price is treated in both B2C and B2B settings. This table breaks it down.

| Feature | VAT Inclusive (Typical B2C) | VAT Exclusive (Typical B2B) |

|---|---|---|

| Advertised Price | £1,200 (The final price the customer pays) | £1,000 (+ VAT) (The net cost is highlighted) |

| Invoice Breakdown | Item: £1,200 (includes £200 VAT) | Item: £1,000 VAT @ 20%: £200 Total: £1,200 |

| Customer Focus | The total cost. They want to know the final figure without doing any maths. | The net cost. They can reclaim the £200 VAT, so their real cost is £1,000. |

| Best For | Retail, hospitality, e-commerce, and any business selling directly to the general public. | Wholesalers, manufacturers, consultants, and any business selling to other VAT-registered firms. |

Ultimately, choosing the right approach isn't just about compliance; it's about clear communication. Aligning your pricing display with your customer's expectations makes for a smoother, more professional transaction every time.

The Bigger Picture: How VAT Fuels the UK Economy

When you see a price is inclusive of VAT, it’s easy to dismiss it as just another tax. But that small percentage on your receipt is doing some seriously heavy lifting for the nation's financial health. Value Added Tax is actually one of the UK government's biggest earners, acting as a powerful engine for the economy.

The money collected doesn't just vanish into a black hole. It’s ploughed directly back into the essential public services we all depend on, day in and day out. Think about the NHS, the schools our kids attend, and the motorways we drive on—VAT receipts are woven into the very fabric of our society.

A Powerful Tool for Economic Policy

Beyond just funding services, the government also uses the VAT rate as a strategic lever to influence economic behaviour. You might remember during the COVID-19 pandemic, they introduced a temporary rate cut for the hospitality sector. This wasn't just a random act of kindness; it was a targeted move to encourage spending and prop up struggling businesses when they needed it most.

VAT is far more than a simple sales tax; it's a dynamic tool that helps steer the national economy, funding vital services and responding to economic challenges.

The numbers really drive this home. In the 2023/24 financial year alone, VAT brought in a staggering £169.25 billion for the UK treasury. That makes it one of the top three sources of government income, right up there with income tax and National Insurance. It consistently accounts for about a fifth of the UK's total tax receipts. For a deeper dive into the data, the Office for Budget Responsibility has some fascinating insights.

So, the next time you see "inclusive of VAT" on a price tag, you’ll know that a little slice of your purchase is doing its part to keep the country running.

Your Common VAT Questions Answered

Even when you’ve got a handle on what 'inclusive of VAT' means, certain situations can still leave you scratching your head. Let's run through some of the most common questions we hear, giving you clear, straightforward answers so you can feel confident you’re getting it right.

Do All UK Goods and Services Include VAT?

Not at all. While the price you see on the tag is always the final price you pay, not everything has the standard 20% VAT added to it. The UK actually has a tiered system to keep essential items more affordable.

Many staples are ‘zero-rated’, which means they have a 0% VAT rate. This applies to most food from a supermarket, books, and children’s clothing. Then there's a ‘reduced rate’ of 5% for things like home energy bills and children’s car seats. On top of that, some services, such as postage stamps and insurance, are ‘exempt’ from VAT altogether.

How Should a VAT-Inclusive Price Look on a Receipt?

What's required on a receipt really depends on who it's for. A simple till receipt from your local shop, intended for a personal purchase, might just show the total amount you paid. Simple.

But for a business that needs to reclaim VAT, it's a different story. A formal VAT receipt isn't just a proof of purchase; it's a legal document that needs to show a full breakdown. By law, it must include:

- The total price including VAT.

- The net price (the cost before tax).

- The exact amount of VAT charged for each rate that applies.

- The seller's VAT registration number.

This transparency is non-negotiable for business-to-business transactions. It's what allows for accurate bookkeeping and, crucially, for the buyer to reclaim the tax they've paid.

Key Takeaway: A proper VAT invoice is the key that unlocks a VAT-registered business's ability to recover the tax it has paid on expenses. Without it, you can't make a claim.

Understanding these rules is vital, especially if you’re wondering whether your own business needs to get on board. Our guide can help you figure out if you need to register for VAT and what your responsibilities will be.

What Happens If a UK Business Advertises a Price and Forgets to Mention VAT?

Consumer protection laws in the UK are crystal clear on this. If a price is advertised to the general public, it is legally assumed to be inclusive of VAT. Full stop.

A business can’t show you one price on the shelf and then spring the VAT on you at the till. That’s illegal. This rule exists to stamp out misleading advertising and ensure shoppers know exactly what they're going to pay from the outset. While it's perfectly normal for business-to-business suppliers to quote prices exclusive of VAT, they have to state this explicitly and clearly.

Navigating the world of VAT can feel like a minefield, but you don't have to walk it alone. The expert team at Stewart Accounting Services is here to handle all your VAT, bookkeeping, and payroll needs. We'll give you more time, more money, and a clearer mind to focus on what you do best—growing your business. Get in touch with us today to see how we can help.