So, you’ve missed the filing deadline for your limited company accounts. What happens next?

Unfortunately, the consequences are both immediate and automatic. Companies House doesn’t offer a grace period or a gentle reminder; its system is built to issue a late filing penalty the very next day. Think of it less as a fine that someone decides to issue and more as an unavoidable legal consequence that’s automatically triggered.

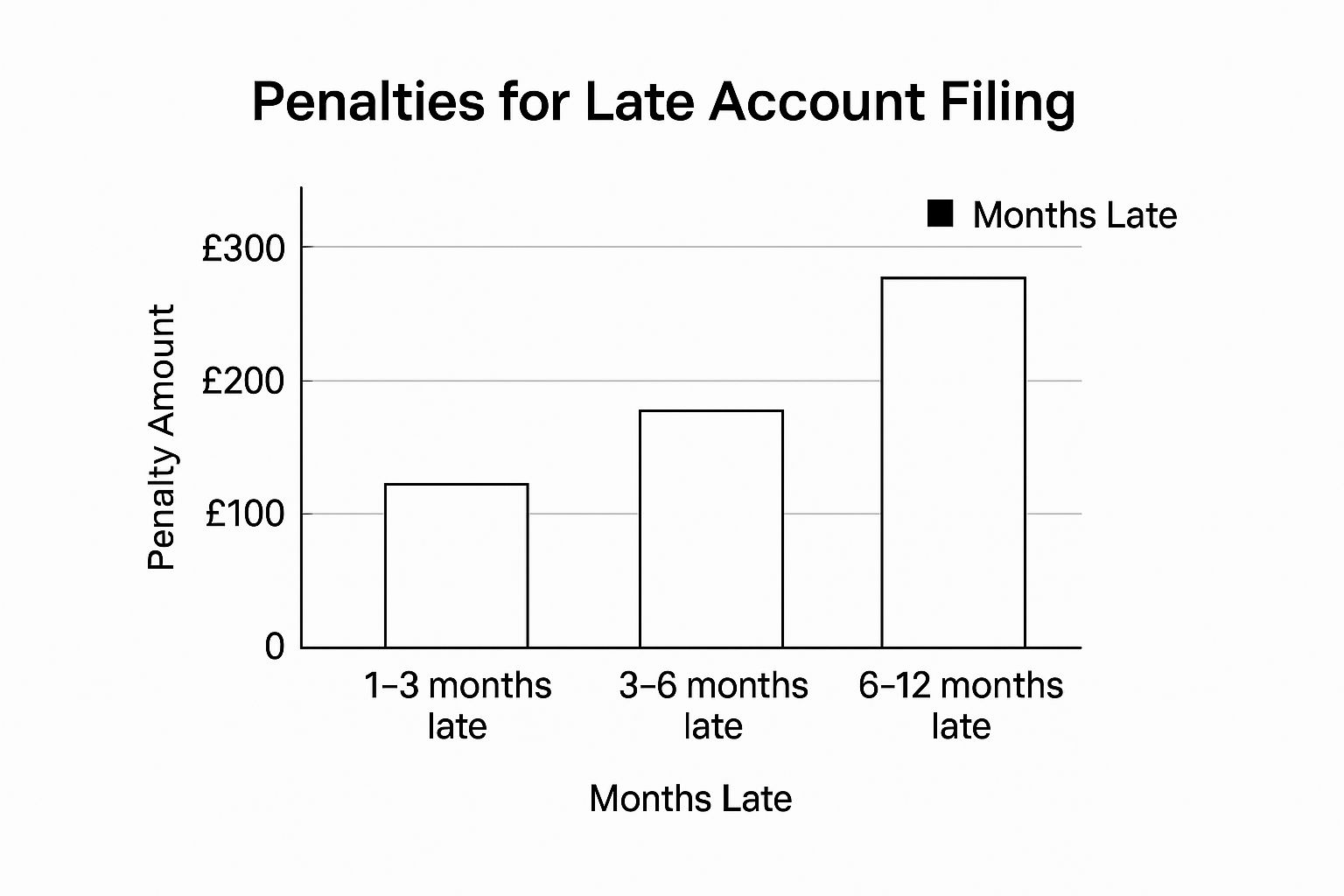

This isn’t a one-off penalty, either. The system is designed to ramp up the pressure the longer your accounts are overdue. The amount you owe grows over time, creating a real sense of urgency for company directors to get things sorted.

How the Penalties Escalate

For a private limited company, the financial hit starts at £150 if you’re up to one month late. It doesn’t sound like much, but it’s just the beginning.

Wait a little longer, and the cost quickly climbs. Between one and three months late, the penalty jumps to £375. If you let it slide to between three and six months, you’re looking at £750. Beyond six months? A hefty £1,500.

To see how these penalties rack up over the first few months, take a look at the chart below.

As you can see, procrastination comes at a steep price. The key takeaway here is that taking immediate action is crucial to minimise the financial damage. For a complete breakdown, you can read more about the Companies House late filing penalties.

Companies House Late Filing Penalties for Private Limited Companies

To make it crystal clear, here’s a table showing exactly what you’ll face depending on how late you file your company accounts.

| How Late the Accounts Are | Penalty for a Private Company | Penalty if Late in Two Consecutive Years |

|---|---|---|

| Up to 1 month | £150 | £300 |

| More than 1 month but not more than 3 months | £375 | £750 |

| More than 3 months but not more than 6 months | £750 | £1,500 |

| More than 6 months | £1,500 | £3,000 |

This table lays out the stark reality of the penalties. But pay close attention to that last column—it’s where things get really serious for repeat offenders.

Crucial Point: If your company files its accounts late for two years in a row, the penalties are doubled. That standard £1,500 penalty for being over six months late suddenly becomes a £3,000 bill. For any small business, that’s a significant financial blow that could have been easily avoided.

Why Are So Many Companies Filing Their Accounts Late?

If you’ve just missed your filing deadline, it's easy to feel like you're the only one who's let things slip. But the truth is, you're in very common company. Thousands of other company directors find themselves in exactly the same boat every single year.

Missing a statutory deadline rarely happens because of deliberate carelessness. It's usually the final straw after a long battle with economic headwinds, confusing regulations, and the simple day-to-day chaos of keeping a business afloat. Once you understand the common reasons why this happens, you’ll see it’s a shared struggle for many modern businesses.

The Real-World Pressures on Directors

Let's be honest, running a limited company means you're constantly spinning plates. Directors often have to be the lead salesperson, the operations manager, and the head of HR all rolled into one. When you’re laser-focused on winning the next contract, managing your team, and keeping clients happy, it’s all too easy for a compliance deadline to get lost in the noise. It’s not a sign of a bad business; it’s a sign of having too much to do with too little time.

And this isn't just a feeling; the numbers back it up. In the 2023-24 financial year, Companies House handed out a colossal £34.4 million in fines for late filings. To put that in perspective, it’s more than triple the £10.2 million from 2019-20. The number of companies fined for being more than six months late also exploded from 3,418 to 11,463 in that same timeframe. You can read more about this sharp rise in late filing penalties and the forces behind it.

This isn't some random statistical blip. The surge is largely down to the lingering economic scars left by the pandemic, which have made financial reporting a nightmare for many. When you’re in survival mode, compliance paperwork inevitably slides down the priority list.

Common Reasons for Missing the Deadline

So, what are the specific tripwires that cause so many businesses to stumble? Understanding these can help you sidestep them next time around.

- Cash Flow Problems: A tight budget can mean you can't afford to pay your accountant on time, which creates a domino effect and stalls the entire accounts preparation process.

- Lack of Internal Resources: Most small businesses simply don't have the luxury of an in-house finance department. This leaves the director, who's already stretched thin, to grapple with complex accounting rules.

- Personal Circumstances: Life happens. An unexpected illness, a family crisis, or other personal emergencies can completely derail even the most meticulously planned schedule.

- Poor Record-Keeping: If your books are a mess of disorganised receipts and incomplete spreadsheets, pulling together a set of compliant accounts becomes a mammoth task, especially as the deadline closes in.

At the end of the day, these factors highlight that filing late is often a symptom of being overwhelmed, not a sign of not caring.

The Hidden Dangers Beyond Financial Penalties

The automatic late filing penalty is certainly the most immediate sting, but honestly, it’s often just the start of your problems. The real damage from missing your filing deadline happens more quietly, chipping away at your business's health in ways that are far trickier to fix than just paying a fine.

Think of it like a small crack appearing in your company’s foundation. It might not look like much at first, but over time it can compromise the whole structure. The real risks go way beyond a one-off financial hit and can leave a lasting, negative mark on your company’s future.

Damage to Your Company Credit Score

One of the first casualties of a late filing is your company's credit score. It’s an easy one to overlook, but it has serious knock-on effects. Credit reference agencies—think Experian, Equifax, and the like—keep a close eye on the public register at Companies House. As soon as your accounts are flagged as overdue, it’s a major red flag for them.

A late filing screams poor financial management and potential instability, which will almost certainly cause your credit rating to plummet. This isn't just a number on a report; it has immediate, real-world consequences:

- Trouble Getting Loans: Banks and lenders view you as a higher risk, making it much harder to get that business loan, overdraft, or other finance you might need to grow.

- Worse Supplier Terms: Many suppliers run credit checks before they’ll offer you trade credit. A lower score could mean they start demanding payment upfront, which can be a massive blow to your cash flow.

- Higher Insurance Premiums: Insurers also use this data to calculate risk. A dodgy filing history can easily lead to more expensive business insurance premiums.

Reputational Harm and Loss of Trust

Your company's filing history is completely public. Anyone—a potential customer, a keen investor, a future business partner, or even a nosy competitor—can look it up with a few clicks.

A late filing on your public record sends a clear, and unflattering, message of disorganisation. It can make potential clients second-guess your reliability and professionalism, possibly costing you valuable contracts.

On top of that, your company's official status on the Companies House register will change from 'Active' to 'Active – accounts overdue'. This is a very public badge of non-compliance that can seriously erode the trust you’ve worked so hard to build. Beyond the direct penalties, missing deadlines opens your business up to significant operational and reputational threats. A solid understanding of effective SaaS risk management is crucial for protecting against these kinds of dangers.

The Ultimate Risks: Prosecution and Strike-Off

If late filings become a habit, the consequences ramp up from financial and reputational damage to something far more serious: a direct threat to your company's existence. Companies House has the authority to take strong action against directors who repeatedly fail to meet their legal duties.

Failing to file your accounts is actually a criminal offence. While a prosecution is unlikely for a first-time slip-up, it’s important to know that company directors can be personally prosecuted and hit with an unlimited fine.

The most severe risk, however, is compulsory strike-off. If Companies House has reason to believe a company is no longer in business—and persistently failing to file accounts is a huge indicator—it can start the process to remove it from the register. If your company is struck off, it legally ceases to exist. At that point, all its assets, including every penny in the company bank account, become the property of the Crown. That is the ultimate penalty.

Your Action Plan to Get Back on Track

Realising you’ve missed the filing deadline for your company accounts is a horrible feeling. It’s easy to panic, but what you do right now is what truly matters. The key is to act decisively and quickly to get things sorted. This situation is fixable, but you need to move fast to stop the penalties from getting any worse.

Think of this as your straightforward roadmap to getting your company back in good standing with Companies House. Follow these steps, and you’ll be able to put this behind you.

Step 1: Prepare and Submit Your Accounts Immediately

Your absolute number one priority is to get those overdue accounts filed. Simple as that. The penalty clock is ticking, and the fines get bigger the longer you wait. Stopping that clock is your main goal.

If your books are already up to date, this might be a relatively quick job. But if your bookkeeping has fallen behind, you need to make it your sole focus. Start by gathering all your financial paperwork – that means bank statements, invoices, receipts, and any records of expenses.

Don't let it slide: If you're feeling out of your depth or just don't know where to start, get an accountant involved right away. The cost of their help will almost certainly be less than the mounting penalties and the stress of trying to untangle it all yourself.

Step 2: Pay the Late Filing Penalty

After your accounts have been filed, a penalty notice from Companies House will arrive at your company's registered office. It’s crucial that you don’t ignore this letter.

The notice will state exactly how much you owe and how to pay it. You can usually pay the penalty online, which is the quickest way to settle it. Make sure you pay the fine promptly to draw a line under the whole affair. An unpaid penalty can escalate into debt recovery action, which is a headache you definitely don't need.

Step 3: Check Your Company’s Public Status

Once you've filed the accounts and paid the fine, it’s a good idea to check your company’s public record on the Companies House register. You want to see for yourself that everything is back to normal.

Here’s what to look for:

- Filing History: Your recently filed accounts should now be listed on the public record.

- Company Status: The status should have changed from ‘Active – accounts overdue’ back to simply ‘Active’.

- Next Deadline: While you're there, find your next accounts due date and put it in your calendar with multiple reminders!

Seeing that your record is clean provides the final bit of peace of mind that the issue is officially resolved.

Step 4: Confirm Your Filing Was Successful

Don't just hit 'submit' and assume the job is done. You should get an email confirmation from Companies House once they’ve accepted your accounts. If you don't see that email within a day or two, it's worth logging back in to double-check the submission status.

It’s not uncommon for accounts to be rejected because of small errors – a missing director's signature or an incorrect figure. A rejection means your accounts are still considered un-filed, and the penalty clock effectively keeps running. A quick check allows you to catch and fix any problems straight away, ensuring you’ve truly met your legal obligations as a director.

What Are Your Chances of Appealing a Penalty?

It’s the first question every director asks when that dreaded penalty notice lands on their desk: “Can I get out of paying this?”

Let’s be honest—your chances are slim. Companies House is notoriously strict, and they only consider appeals in truly exceptional circumstances that were genuinely beyond your control.

Don't fall into the trap of thinking your accountant being swamped or you misplacing some paperwork will cut it. The law is crystal clear: the responsibility for filing on time rests squarely on the shoulders of the company directors. An appeal isn’t a negotiation tactic; it’s a plea for leniency based on a catastrophic, unforeseen event.

What Is a Valid Reason for an Appeal?

To have any hope of a successful appeal, you need to prove that something happened which made it physically impossible for you to file the accounts on time. Companies House works on a simple principle: if an issue was foreseeable, you should have planned for it.

So, what counts as a valid reason? Here are a few examples of what might be accepted:

- A fire or flood that destroyed all your company records right before the filing deadline.

- The unexpected death or a sudden, life-threatening illness of the one director who handles the accounts.

- A prolonged and unforeseen postal strike that stopped paper accounts from being delivered (though, thankfully, most filing is digital these days).

See the pattern here? These are sudden, unavoidable disasters. Forgetting the date, being on holiday, or having a disagreement with your accountant simply won't be accepted.

The key takeaway is that the event must be both exceptional and have happened very close to the filing deadline. If your office flooded six months before the accounts were due, Companies House would argue you had plenty of time to recover and still get them filed.

Reasons That Will Almost Certainly Be Rejected

It’s just as crucial to understand what won't work. Chasing a doomed appeal will only add to your stress. You can be almost certain that Companies House will reject appeals based on these common reasons:

- You didn’t know the deadline: As a director, ignorance of your legal duties is no defence.

- Your accountant messed up: You hired them, but the legal responsibility is still yours.

- The company is dormant: Dormant companies still have to file accounts (or a confirmation statement) on time.

- You couldn't afford to pay your accountant: This is considered a business management issue, not an exceptional circumstance.

- The penalty notice went to the wrong address: It’s your legal duty to keep your registered office address up to date with Companies House.

Filing an appeal is a formal process. You’ll need to back up your claim with hard evidence, like a fire incident report or a doctor's letter. Without verifiable proof, your appeal has virtually no chance.

Before you even start, take a realistic look at your situation. The most reliable way to deal with a penalty is to pay it promptly and put measures in place to make sure it never happens again.

How to Never Miss a Filing Deadline Again

Let's be honest—dealing with the fallout of a missed filing deadline is a painful, stressful, and expensive lesson. But here's the good news: you can use this experience as the push you need to build a system that ensures it never happens again.

From this point on, the goal isn't just about dodging penalties. It's about creating solid financial habits that underpin the long-term health of your business. Think of it as moving from reactive panic to proactive control. Adopting proven strategies to meet project deadlines can be the key to consistently getting your company accounts submitted on time.

Build Your Proactive Filing System

The first and easiest step is to use the official tools available to you. Companies House offers a free email reminder service that pings you when your accounts are due. Signing up is straightforward and acts as an essential safety net.

Next, get serious about your calendar. As soon as you know your filing deadline, put it in your digital calendar—but don't stop there. Set multiple reminders to go off at key intervals:

- Three months before the deadline

- One month before

- Two weeks before

- One week before

This simple habit costs you nothing, but it could easily save you hundreds, if not thousands, of pounds.

Treat your filing deadline with the same seriousness as a major client project. It's a non-negotiable commitment that directly impacts your company's financial stability and reputation. For any healthy business, ignoring it is simply not an option.

Use Technology and Professional Support

Modern accounting software is your best friend when it comes to staying organised. Tools like Xero keep your financial records tidy and accessible all year round, which makes preparing your accounts a much less intimidating task. When your books are always up to date, the year-end process becomes a straightforward review, not a frantic scramble to find receipts.

Finally, perhaps the most effective strategy of all is to get an accountant on board early. Don't wait until the deadline is just around the corner before seeking professional help. A good accountant does far more than just file your documents; they provide ongoing advice, manage your deadlines for you, and help you plan. This frees you up to focus on what you do best—running your business with confidence.

Frequently Asked Questions About Late Filing

To wrap things up, let's go over a few common questions we hear from directors who find themselves in this tricky situation. Hopefully, these quick, clear answers will help clear up any lingering confusion.

Companies House vs HMRC: What’s the Difference?

This is a big one, and it catches a lot of people out. It’s crucial to understand that Companies House and HMRC are separate government bodies, each with its own set of rules and deadlines.

When you miss your deadline to file your company accounts, the immediate problem is with Companies House. They’re the ones who issue the automatic penalties we’ve been talking about.

HMRC, on the other hand, deals with your Company Tax Return (Form CT600). Yes, you need your statutory accounts to fill out your tax return, but the deadline for that is different. If you miss HMRC’s deadline, you’ll face a separate set of penalties and interest charges specifically related to your Corporation Tax bill.

How Is My Filing Deadline Determined?

Your company’s filing deadline all comes down to its Accounting Reference Date (ARD). Think of the ARD as your company's financial year-end. For most businesses, this is simply the last day of the month they were originally set up. So, if you incorporated your company on 10th May, your ARD would be 31st May every year.

Here’s how the deadlines work based on that date:

- For your very first set of accounts: You get 21 months from the date of incorporation to file them.

- For every year after that: You have 9 months from your ARD to get your accounts over to Companies House.

Remember, your ARD sets the financial period your accounts must cover. The filing deadline is the date by which those accounts must be submitted. Understanding this distinction is fundamental to staying compliant.

What If My Dormant Company Misses Its Deadline?

Even if your company has never made a sale or had any transactions, it isn't off the hook. A dormant company still has a legal duty to file dormant company accounts with Companies House before its deadline.

If you fail to do this, you’ll be hit with the exact same late filing penalties as a fully active, trading company. There’s no special treatment for being dormant—the rules and the financial consequences are the same for every limited company on the register.

Navigating Companies House deadlines and financial compliance can be a significant source of stress for business owners. At Stewart Accounting Services, we take that burden off your shoulders. Our expert team ensures your accounts are accurate, compliant, and always filed on time, giving you the freedom to focus on growing your business. Contact us today to see how we can help.