Think of the Annual Investment Allowance (AIA) as one of the most generous tax breaks available to businesses in the UK. Instead of spreading tax relief for essential equipment over several years, the AIA lets you deduct the entire cost from your profits in the year you bought it, all the way up to the current £1 million limit.

How the Annual Investment Allowance Fuels Business Growth

Let's use an analogy. Imagine HMRC gives your business a "tax-free spending allowance" of £1 million each year. You can spend this on qualifying purchases like new machinery, computer equipment, or even a 'van'. The full cost of these items is then knocked straight off your taxable profit for that year, which means a smaller tax bill. Simple as that.

This isn't just some obscure accounting rule; it's a deliberate government incentive designed to encourage businesses to invest in themselves and grow. By offering immediate relief, it makes upgrading your assets a much more attractive proposition. The impact on your business can be significant:

- Boosts Your Cash Flow: A lower tax bill means more cash stays in your business right when you need it most. You can use that money to fund other projects, cover running costs, or just build up a healthier bank balance.

- Speeds Up Your Return on Investment: You get the financial benefit of a major purchase in the same year, not drip-fed over a decade. This makes investing in bigger, better equipment feel far less daunting and much more affordable.

- Makes Tax Simpler: For the vast majority of small and medium-sized businesses, the £1 million allowance is more than enough to cover all their equipment purchases for the year. This simplifies the whole process of calculating capital allowances.

At its heart, the Annual Investment Allowance is a 100% upfront tax deduction on qualifying asset purchases. It's a key government tool that makes big investments more financially viable by delivering immediate tax savings.

Basically, the AIA is a catalyst for action. It turns what could be a hefty capital outlay into a manageable expense with an immediate upside. For businesses across the UK, from here in Stirling to our neighbours in Falkirk, this powerful allowance makes it easier to modernise, improve efficiency, and plan for a more profitable future. Getting to grips with how it works is the first step.

The Journey of the AIA Limit and What It Means for You

The Annual Investment Allowance (AIA) limit hasn't always been the generous £1 million we see today. To really grasp why the current, stable threshold is such a big deal for UK businesses, it helps to look back at its journey. Think of it as a story of economic ebb and flow, with the government using the AIA to spur on investment when the country needed it most.

When it first launched back in 2008, the AIA kicked off with a much more modest limit of just £50,000. Over the years, this number has bounced around quite a bit, almost like a government-controlled tap to either encourage or cool down business spending depending on the economic weather. This constant shifting often created a headache for business owners, making it tough to plan major, long-term investments with any real certainty.

From Fluctuation to Stability

For years, businesses had to keep a close eye on temporary increases and scheduled cuts to the AIA. For example, the 2015 Summer Budget set what was meant to be a permanent level of £200,000 starting in January 2016. But to give the economy a shot in the arm, this was temporarily bumped up to £1 million from January 2019, a 'temporary' measure that kept getting extended. Every change meant businesses had to rethink their spending plans, sometimes rushing purchases to get in before a deadline.

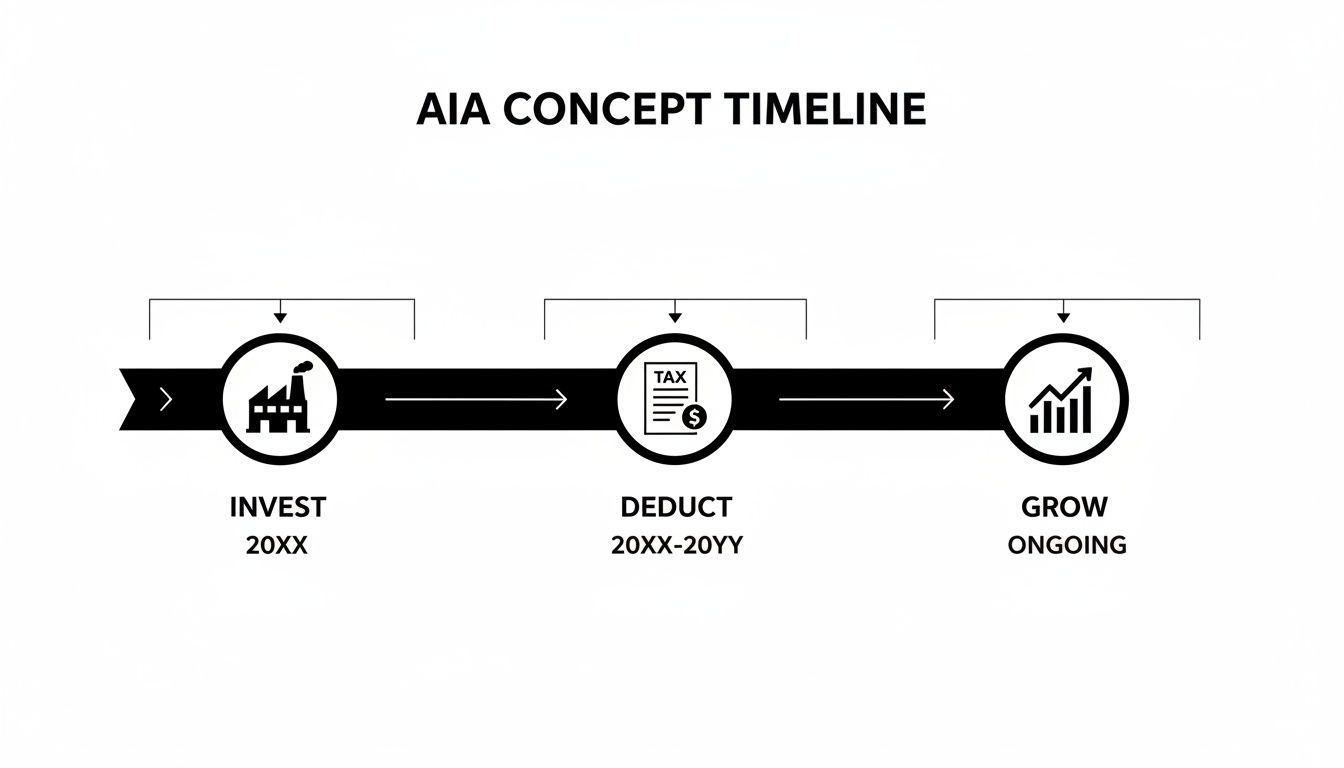

This cycle is what the AIA is all about: invest in your business, write off the cost, and use the tax savings to fuel more growth.

Finally having a stable £1 million limit provides a reliable foundation for proper strategic planning, taking much of the guesswork out of the equation.

The Significance of a Permanent £1 Million Limit

The decision to lock in the £1 million threshold permanently was a genuine game-changer. Let’s say your limited company in Stirling is gearing up for a major expansion. The AIA allows you to claim 100% tax relief on up to a million pounds of qualifying plant and machinery, all in a single tax year. This policy has been so effective at driving investment that its various extensions have come at a significant cost to the government—projected to hit £1,360 million by 2027-28.

The permanent £1 million AIA limit provides crucial certainty. It allows you to plan significant, multi-year investment projects with the confidence that this substantial tax relief will be available when you need it.

This stability transforms the AIA from a short-term tactical tool into a reliable cornerstone of your long-term financial strategy. You can now invest in your company’s future with confidence, free from the pressure of a looming deadline. While the AIA is incredibly useful, it’s also smart to be aware of other reliefs, such as the new 40% First-Year Allowance now in force, which can apply to different types of spending.

Identifying Which Assets Qualify for AIA

Getting your head around the Annual Investment Allowance is the first step. The real magic, though, happens when you know exactly which assets you can claim it on. HMRC's official term is ‘plant and machinery’, which can sound a bit old-fashioned and vague.

A much better way to think about it is this: the AIA covers the tools and equipment you buy to do business, not the actual building you do business in.

Almost any tangible asset you buy for your trade is likely to be eligible. The list of qualifying items is surprisingly long, which is why the AIA is such a powerful tax-saving tool for all sorts of UK businesses, from sole traders to limited companies.

A builder in Falkirk, for instance, could claim for a new cement mixer and a commercial van. Over in Stirling, a graphic design studio could claim for new high-performance laptops and ergonomic office chairs. It's all about the apparatus needed for the job.

What You Can Typically Claim For

So, what does this look like in practice? Here are some of the most common things businesses buy where they can deduct the full cost from their taxable profits, right up to the £1 million AIA limit:

- Office Equipment: Think computers, printers, servers, and essential furniture like desks and chairs.

- Commercial Vehicles: Vans, lorries, and trucks used purely for the business are classic examples.

- Tools and Machinery: From heavy-duty factory machinery and farm equipment to a plumber's power tools, if it's for your trade, it usually qualifies.

- Integral Features: Certain fixtures inside a building also count. This includes things like air-conditioning units, electrical systems, and lifts.

This wide scope means that whether you’re kitting out a new office or upgrading the machinery in your workshop, the AIA is there to provide a significant and immediate tax break.

Key Exclusions to Avoid Mistakes

Knowing what doesn't qualify is just as crucial as knowing what does. A simple mistake here could mean an incorrect tax return and an unwelcome chat with HMRC. The rules are pretty clear: certain assets are excluded because they have their own tax treatment or a very long life.

The most common pitfall is trying to claim the AIA on assets that are explicitly excluded. Always remember the golden rule: the allowance is for the tools of your trade, not the place where you trade.

To help you get it right, this handy table gives you a quick side-by-side comparison of what’s generally in and what’s out.

Common Examples of Qualifying vs Excluded Assets

| Assets That Typically Qualify for AIA | Assets Typically Excluded from AIA |

|---|---|

| Computers, printers, and office furniture | Cars (these have separate rules) |

| Vans, lorries, and commercial vehicles | Land and buildings (including walls, roofs, etc.) |

| Demolition and construction equipment | Items used for business entertainment |

| 'Integral features' like air-con & wiring | Assets received as a gift or for free |

| Agricultural machinery | Structures like bridges or docks |

| 'Fixtures & fittings' like kitchen equipment | Shares and other financial assets |

This isn't an exhaustive list, but it covers the main areas. Understanding these distinctions is key to making a correct claim.

For assets that don't qualify for the AIA, don't worry – you can often still claim other capital allowances over a longer period. And if you have a small remaining balance in your capital allowance pool, it's well worth checking if you could you claim the Small Pool Allowance to write off the full amount.

How Different Business Structures Can Claim the AIA

Claiming the Annual Investment Allowance (AIA) isn't a one-size-fits-all job. The right way to do it comes down to how your business is legally set up, and getting the process right is essential for staying compliant and making the most of this fantastic tax relief.

Whether you're a company director, a sole trader, or in a partnership, the goal is the same: to slash your taxable profit. The real difference is where and how you report that spending to HMRC, as each business structure uses a different tax return with its own specific boxes for capital allowances.

For limited companies, the claim goes on the CT600 Corporation Tax return. For sole traders and partnerships, it's all handled through the Self Assessment tax return, using the supplementary pages to detail your capital allowances claim.

Limited Companies and the CT600 Return

If you're running a limited company, claiming the AIA is a key part of your annual corporation tax filing. When we prepare your CT600 form, we’ll calculate all your qualifying expenditure for the accounting period. This figure, up to the £1 million limit, gets entered into the capital allowances section.

The impact is immediate. This deduction directly lowers your company's taxable profit. For instance, a profit of £150,000 could drop to £100,000 after you claim for £50,000 of new equipment, leading to a much smaller Corporation Tax bill.

Sole Traders and Partnerships

For anyone self-employed, the AIA claim is made on your annual Self Assessment tax return. You’ll need to fill out the capital allowances section on the self-employment pages (SA103).

It works similarly for partnerships. The calculations are first declared on the main partnership tax return (SA800). The allowances are then split between the partners, who each claim their share on their individual Self Assessment returns.

No matter your business size, claiming the AIA correctly is a game-changer. It’s a powerful tool for cutting your tax bill and boosting your cash flow, whether you’re paying Corporation Tax as a company or Income Tax as a sole trader.

Think of it this way: if you’re a sole trader in Alloa with a small workshop and you've just bought new machinery, the AIA lets you deduct the entire cost from your profits in one go. First introduced back in April 2008 with a modest £50,000 limit, the AIA has grown significantly to support UK business investment. You can see a full history of the evaluation of the Annual Investment Allowance on GOV.UK.

What About Landlords?

Landlords with a property rental business can also get in on the action, but there’s a crucial catch. The allowance only applies to plant and machinery used for running the business itself, like a van for maintenance work or office equipment.

It does not cover any assets inside a residential rental property, and you certainly can't claim it on the building itself. Figuring out the best setup for your operations is a big decision, and our guide on choosing between a sole trader or limited company can help you weigh the pros and cons.

Seeing the AIA in Action with Real-World Scenarios

Theory is one thing, but seeing how the Annual Investment Allowance actually works with real numbers is what makes it click. Let's move beyond the definitions and walk through two common scenarios to see how the AIA can directly impact a business’s bottom line.

These examples will show you just how powerful a strategic AIA claim can be, helping you slash your tax bill and free up cash. We’ll look at a limited company making a major investment and a sole trader buying essential equipment.

In both cases, the principle is simple: the cost of the new assets is knocked off the company's profits before tax is calculated.

Scenario 1: A Manufacturing Company Invests in New Machinery

Let's imagine a successful manufacturing firm in Falkirk, operating as a limited company. They’ve had a good year, posting a profit of £500,000 before accounting for any big purchases. To increase their output, they decide to invest £200,000 in new, state-of-the-art production machinery.

Here’s how that plays out on their tax return:

- Starting Profit: Before any allowances, their taxable profit stands at £500,000.

- Claiming the AIA: The £200,000 cost of the machinery is well inside the £1 million AIA threshold, so they can claim the full amount.

- Reducing the Profit: This claim directly cuts their taxable profit down to £300,000 (£500,000 – £200,000).

- Calculating the Tax Saving: With a Corporation Tax rate of 25%, their original tax bill would have been £125,000. Now, on the reduced profit, it’s only £75,000.

By using the AIA, the company made an immediate Corporation Tax saving of £50,000. That's cash that can go straight back into the business, perhaps to hire new staff or ramp up their marketing.

This is a perfect illustration of what the AIA is designed to do—it makes significant investment much more manageable by providing immediate and substantial tax relief.

Scenario 2: A Contractor Buys a New Van and Tools

Now, let's switch to a self-employed contractor working as a sole trader around Stirling. After a profitable year, their taxable profit is sitting at £60,000. To upgrade their setup, they buy a new commercial van and a set of professional tools, costing £40,000 in total.

- Initial Taxable Profit: £60,000

- Qualifying AIA Expenditure: £40,000

- New Taxable Profit: £60,000 – £40,000 = £20,000

By claiming the AIA on their Self Assessment tax return, the contractor has massively reduced the profit they’ll pay Income Tax on. This leads to a huge saving, leaving far more money in their bank account. That extra cash could be crucial for building a safety net or funding the next stage of their business growth.

Navigating the Rules with Expert Tax Guidance

While the Annual Investment Allowance is a fantastic way to slash your tax bill, the rules aren't always straightforward. Even simple questions, like the exact timing of a purchase or how to treat the sale of an old asset, can make a huge difference to your claim. It’s in these details that professional guidance really pays off.

An expert can help you see the bigger picture, moving beyond a single purchase to build a long-term plan. They make sure you’re getting the most out of your claim not just this year, but for years to come, making sure your investment and tax strategies are perfectly aligned.

Trying to navigate the fine print of the AIA can feel like walking through a minefield, especially when your business circumstances are a little more complex.

When Expert Advice Is Crucial

Some situations are just trickier than others and demand a careful approach to stay compliant and get the best result. It's a really good idea to seek professional support if:

- You have associated companies: The £1 million AIA limit has to be shared between any connected businesses, and the rules for dividing it up are very specific.

- Your accounting period changes: Shifting your business's year-end date can trigger some complicated transitional rules for how your AIA claim is calculated.

- You are buying or selling assets: The timing of when you buy new assets and sell old ones can dramatically change the total allowance you’re able to claim.

Getting these details right isn't just about ticking boxes and avoiding errors; it's about actively strengthening your company’s financial position.

A solid tax strategy, created with professional guidance, turns the AIA from a simple tax deduction into a powerful tool for business growth. It means more cash stays in your business and you get greater peace of mind.

At Stewart Accounting Services, we specialise in helping businesses across Stirling, Falkirk, and Alloa build these kinds of smart, effective strategies. We make sure every claim is fully optimised and HMRC-compliant, leaving you free to do what you do best: run your business.

Contact us today to see how we can help.

Common Questions We Hear About the AIA

Even when you've got the basics down, it’s the practical, "what if" scenarios that often pop up. Let's tackle some of the most common questions we get from business owners about putting the Annual Investment Allowance into practice.

What Happens if I Spend More Than the AIA Limit?

Firstly, congratulations! Investing more than £1 million in your business in a single year is a significant milestone. The good news is that you don't lose the tax relief on the amount spent over the limit.

Anything above your AIA threshold simply gets added to your capital allowances pool. You can then claim tax relief on this remaining balance through Writing Down Allowances (WDAs) in future years. For most equipment, this is typically at a rate of 18% per year, so you still get the relief, just spread out over a longer timeframe.

Can I Carry Forward Unused AIA?

This is probably the most frequent question we're asked, and the answer is a firm no. The Annual Investment Allowance is strictly a "use it or lose it" deal. Your £1 million allowance resets at the start of each accounting period, and any unused portion simply disappears. You can't roll it over.

This is exactly why timing your big purchases is so crucial. If a major investment is on the horizon and you're approaching your year-end, you might want to bring the purchase forward to make sure you use up this year’s allowance before it’s gone for good.

Do I Have to Claim the Full Amount?

Absolutely not. You have complete control over how much AIA you claim. You can claim the full amount, a partial amount, or none at all.

Why would you do that? Well, you might choose to claim less if your profits are already low for the year, or if you expect to be much more profitable next year when the tax relief would be more valuable. Any qualifying cost you don't cover with the AIA can be claimed through the slower Writing Down Allowances instead. It’s all about tailoring the claim to your business's financial picture.

Think of the AIA as a flexible tool in your tax planning kit. While you can’t carry it forward, you can decide how much to use each year to get the best result for your business.

How Does Selling an Asset Affect My AIA Claim?

When you sell an asset you've previously claimed AIA on, you need to account for it. The cash you get from the sale (the 'disposal proceeds') is factored back into your main capital allowances pool.

Essentially, this amount is deducted from the pool's balance. If this deduction pushes the pool into a negative balance, it creates what's known as a 'balancing charge', which gets added to your taxable profits for that year.

Getting these details right is key to making your capital investments as tax-efficient as possible. For advice tailored to your unique situation, the team at Stewart Accounting Services can help you build a solid tax strategy. You can find out more by visiting https://stewartaccounting.co.uk.