Break-even analysis is a simple but incredibly useful tool for any business owner. It pinpoints the exact sales volume you need to hit to cover all your outgoings. Think of it as your business's 'ground zero'—that sweet spot where you're not making any money, but you're not losing any either. For any business in the UK, from a high-street shop to a software startup, this is a number you absolutely have to know.

What Break-Even Analysis Really Means for Your Business

At its heart, break-even analysis answers one crucial question: "How many units do I need to sell, or how much revenue must I bring in, just to keep the lights on?" It's the baseline for survival and the starting line for profit. Once you know this figure, you’re no longer guessing; you have a concrete, calculated target to aim for every month, quarter, and year.

Let’s say you’re opening a new coffee shop in Stirling. Before you’ve poured a single latte, you've got costs adding up. There's the rent for the premises, your barista's wages, and the lease on that fancy espresso machine. These are your fixed costs – they stay the same whether you sell one coffee or a thousand. Then, for every cup you actually sell, you have the cost of the beans, the milk, and the paper cup. These are your variable costs.

Your break-even point is the moment you've sold just enough coffee to cover both your fixed and your variable costs. Every single coffee sold after that is pure profit.

This calculation is so much more than just a number on a spreadsheet; it's a fundamental piece of your financial planning. It helps you:

- Set smart prices: You can immediately see how a price change, up or down, will affect how long it takes to become profitable.

- Manage costs effectively: The analysis shines a spotlight on how your fixed and variable expenses impact your bottom line.

- Make informed decisions: Got a new product idea? Want to launch a big marketing campaign? Break-even analysis gives you the data to see if it’s financially viable.

- Secure funding: Lenders and investors need to see you've done your homework. Showing them you understand your break-even point proves you have a clear plan for making money.

In short, it shifts your mindset from simply hoping for success to actively planning for it. It gives you the clarity you need to make sound decisions backed by real data.

The Core Components of Your Calculation

To get your break-even analysis right, you first need to get a solid grip on its three key ingredients. Think of them like the components of a recipe – if you get one wrong, the entire result will be off. These crucial pieces are your fixed costs, variable costs, and the contribution margin.

Let's walk through each one so you can confidently spot them within your own business.

Unpacking Your Fixed Costs

First up, fixed costs. These are the consistent, predictable bills your business has to pay every month, no matter how many products you sell or services you deliver. They're the financial baseline of your operation; they don't budge whether you have a record-breaking month or a quiet one.

Imagine you run a creative agency from an office in central Falkirk. Your monthly rent is a perfect example of a fixed cost. Whether you sign ten new clients or none at all, the landlord still expects that payment on the first of the month. Simple as that.

Common examples of fixed costs include:

- Rent for your office, workshop, or retail space.

- Salaries for your permanent administrative staff.

- Insurance premiums for your business liability cover.

- Annual software subscriptions, like your accounting package or project management tools.

- Loan repayments with a fixed interest rate.

These costs provide a degree of stability, but they also create constant pressure. You have to generate enough revenue to clear these hurdles before you can even begin to think about making a profit.

Identifying Your Variable Costs

Next, we have variable costs, which are the complete opposite of their fixed counterparts. These expenses are tied directly to your level of production or sales activity. The more you sell, the higher your variable costs climb. If you sell nothing, these costs could, in theory, drop to zero.

A Sheffield-based manufacturing firm, for instance, will see its raw material costs rise with every new widget it produces. In the same way, an e-commerce store's shipping fees increase with every single order that goes out the door. These costs are a direct consequence of making a sale.

Variable costs are the costs of doing business on a per-unit basis. They scale up and down in direct proportion to your business activity.

Understanding the Contribution Margin

The final piece of the puzzle, the contribution margin, might sound a bit technical, but it's a surprisingly simple and powerful concept. It’s the amount of money left over from a single sale after you've covered the variable costs associated with that specific sale. This leftover cash is what "contributes" towards paying off all your fixed costs.

The calculation is straightforward: Selling Price per Unit – Variable Cost per Unit = Contribution Margin per Unit.

Every time you make a sale, the contribution margin is the slice of revenue that helps chip away at your mountain of fixed costs. Once those fixed costs are fully covered for the month or year, the contribution margin from every sale after that point is pure profit. This is a critical idea for UK businesses, where managing tight cash flow is often a daily reality.

A key part of any break-even analysis is getting a handle on your expenses. For a closer look at effective strategies to reduce operational costs, which will directly improve your break-even point, you might find this article useful.

How to Calculate Your Break-Even Point

Once you've got a solid handle on your fixed and variable costs, you're ready for the main event: the calculation. The break-even formula is a beautifully simple tool that pinpoints the exact volume of sales you need to cover every single one of your expenses. It's that magic number where you're not making a loss, but you're not yet in profit either.

Think of it as the financial baseline for your business. The formula tells you precisely how many units of your product or service you have to sell to hit this critical milestone.

Break-Even Point in Units = Fixed Costs / (Selling Price Per Unit – Variable Cost Per Unit)

That bottom part of the formula, (Selling Price Per Unit – Variable Cost Per Unit), is your contribution margin. This is the slice of revenue from each sale that chips away at your fixed costs.

A Practical Example: A UK Craft Brewery

Let's make this real. Imagine you're running a small craft brewery somewhere in the UK, and your flagship product is a signature India Pale Ale (IPA). Your big question is: how many bottles do I need to sell each month just to keep the lights on?

First things first, we need to round up the numbers.

-

Identify Total Fixed Costs: These are the bills that land on your desk every month, no matter how much beer you brew.

- Brewery rent: £2,000

- Staff salaries: £4,500

- Insurance: £300

- Marketing budget: £500

- Utilities (non-production): £200

- Total Fixed Costs = £7,500 per month

-

Determine Variable Costs Per Unit: These are the costs directly tied to producing a single bottle of your IPA.

- Malt, hops, and yeast: £0.45

- Bottle and cap: £0.20

- Label: £0.10

- Excise duty (tax): £0.25

- Total Variable Cost Per Unit = £1.00

-

Set Your Selling Price: After doing your market research, you decide to sell each bottle of your signature IPA to distributors for £2.50.

Right, we've got all the pieces of the puzzle. Now we just need to put them together.

Putting the Numbers Together

With your figures neatly organised, you can plug them straight into the formula to find your target.

- Fixed Costs: £7,500

- Selling Price Per Unit: £2.50

- Variable Cost Per Unit: £1.00

First, let's work out the contribution margin for each bottle sold:

£2.50 (Selling Price) – £1.00 (Variable Cost) = £1.50 (Contribution Margin)

So, for every bottle of IPA you sell, you have £1.50 left over to put towards covering that hefty £7,500 in fixed monthly costs.

Now for the final step:

£7,500 (Fixed Costs) / £1.50 (Contribution Margin) = 5,000 units

There it is. Your break-even point is 5,000 bottles. You must sell 5,000 bottles of your IPA each month just to cover everything. The moment you sell that 5,001st bottle, you start making a profit. For a little help with these kinds of sums, you can always turn to handy tools like online business finance calculators.

Break-Even Calculation for a Hypothetical Coffee Shop

To give you another angle, let's look at a different type of UK business: a local coffee shop. This table shows how a café owner would break down their own numbers to find their break-even point in cups of coffee.

| Component | Description | Example Value |

|---|---|---|

| Fixed Costs (Monthly) | Costs that remain the same, like rent, salaries, and insurance. | £4,000 |

| Selling Price Per Unit | The retail price for one cup of coffee. | £3.00 |

| Variable Cost Per Unit | The cost of coffee beans, milk, cup, and lid for one serving. | £0.75 |

| Contribution Margin | Selling Price (£3.00) – Variable Cost (£0.75). | £2.25 |

| Break-Even Point (Units) | Fixed Costs (£4,000) / Contribution Margin (£2.25). | 1,778 cups |

As you can see, the coffee shop needs to sell 1,778 cups of coffee a month to cover its costs. Anything beyond that is pure profit, which is exactly the kind of clarity this calculation provides.

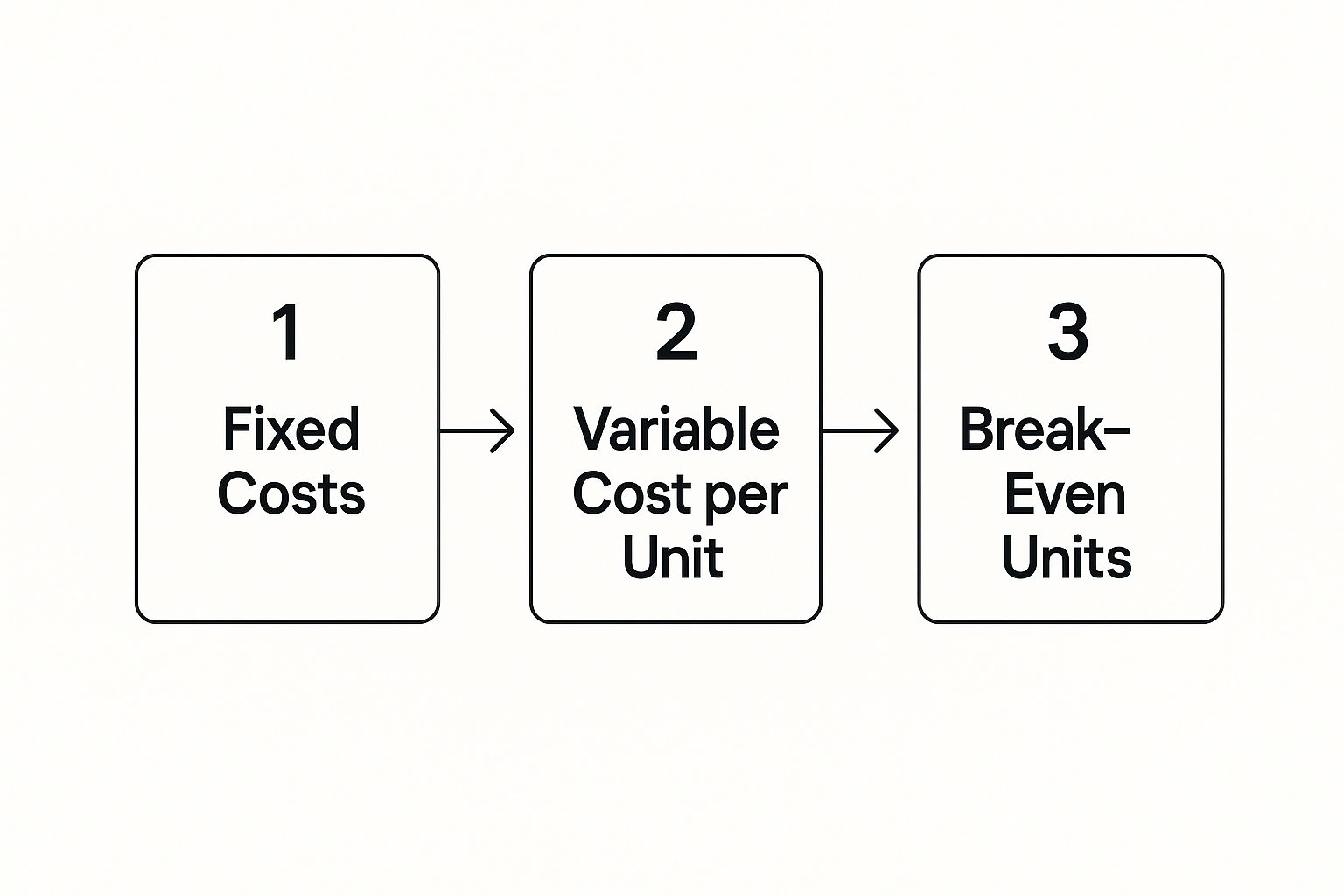

This infographic neatly summarises how your different costs feed into the final break-even calculation.

The visual flow makes it crystal clear that getting a firm grip on your fixed and variable costs is the essential first step to finding your break-even target.

Making Sense of Your Break-Even Results

So, you've crunched the numbers and found your break-even point. That's a massive step, but the number itself is only half the story. The real magic happens when you start to understand what that figure truly means for your business strategy and your day-to-day decisions.

Think of it less as a simple pass-or-fail grade and more as a diagnostic tool. It’s your financial compass, pointing you towards what’s working and what isn’t. If your break-even point feels terrifyingly high, it’s a red flag that something in your cost structure or pricing model isn't sustainable. But if you're consistently sailing past that target, you know you’ve built a healthy buffer against the unexpected.

Introducing Your Margin of Safety

That buffer has a proper name: the margin of safety. It’s the gap between your actual sales and your break-even point. In simple terms, it tells you exactly how much your sales can drop before your business starts losing money. A wider margin means you’ve built a more resilient, lower-risk operation.

It’s a bit like the reserve fuel in a car. The more you have in the tank, the less you worry about hitting an unexpected traffic jam or finding the next petrol station closed. A business with a healthy margin of safety can handle a slow month or an unforeseen expense without hitting the panic button.

Your margin of safety is a crucial indicator of your business's financial resilience. It’s not just about surviving; it’s about having the stability to thrive and invest in growth.

Let’s imagine a UK retail business with fixed costs of £8,000 a month. They calculate their break-even point at 324 units. If they are currently selling 450 units each month, their margin of safety is 126 units. That's a comfortable cushion against market wobbles. This dynamic is a cornerstone of smart business planning, and you can see more UK-specific examples in these case studies from Save My Exams.

What to Do If Your Break-Even Point Is Too High

If your calculation delivers a stark dose of reality and the target seems miles away, don't despair. This is where the analysis becomes truly powerful. It shows you exactly which levers you can pull to get things on track.

You essentially have three core strategies to lower your break-even point:

-

Reduce Your Fixed Costs: Look at your overheads with a critical eye. Could you find a cheaper office? Are you paying for software subscriptions you barely use? Every pound you shave off your fixed costs directly lowers the number of sales you need to make.

-

Lower Your Variable Costs: It might be time to have a chat with your suppliers. Can you negotiate a better price for raw materials? Could you find a more cost-effective shipping partner? Improving these per-unit costs means every sale contributes more towards covering your overheads.

-

Adjust Your Pricing Strategy: This is often the most direct route. Increasing your prices instantly boosts your contribution margin per sale. But this lever needs to be pulled with care—you have to be sure the market will bear the new price without sales volumes taking a nosedive.

By focusing on these three areas, your break-even analysis stops being just a number on a page. It becomes your practical roadmap for building a more profitable and sustainable business.

Using Break-Even Analysis in Business Decisions

Knowing your break-even point isn't just a stuffy accounting exercise. Think of it as a powerful, real-world tool that shifts your strategic planning from pure guesswork to a confident, data-backed process. Once you have that magic number, it becomes your guide for making smarter, more profitable decisions right across the business.

Instead of just crossing your fingers, break-even analysis lets you model the future. It gives you a safe space to test out different 'what if' scenarios and see the financial fallout before you commit a single pound. This transforms the calculation from a static figure into a dynamic, proactive aid for your day-to-day choices.

Let's walk through four common situations where this kind of analysis really proves its worth.

Setting Achievable Sales Targets

Launching a new product always feels like a bit of a leap of faith, but break-even analysis acts as your financial safety net. As soon as you calculate the break-even point for that new item, you have a crystal-clear, non-negotiable sales target. This number tells your sales team exactly what they need to aim for to make the launch a success.

For instance, if your numbers show you need to sell 800 units to cover the initial marketing spend and production costs, you can break that down into monthly or weekly targets that are both ambitious and firmly grounded in reality.

Assessing a New Marketing Campaign

Thinking about a big marketing push? A quick break-even calculation will tell you if it’s a smart move. Let's say you plan to spend £5,000 on a new digital advertising campaign. For that period, this sum gets added straight to your fixed costs.

You can then re-run your break-even calculation to answer the most important question: "How many extra sales do we need to generate just to pay for this campaign?" If the required sales lift seems wildly optimistic, you can adjust the budget or rethink your strategy before a penny is wasted.

Break-even analysis acts as a financial stress test for your strategic ideas, revealing whether they are likely to generate a return or simply increase your costs.

This is especially vital for UK businesses trying to navigate today's volatile markets. We know from past economic downturns that break-even points tend to creep up as fixed costs become harder to cover. Back in 2021, for example, around 13% of UK small businesses pointed to fixed costs as a major barrier to profitability, which really highlights why you need to model new expenses carefully.

Evaluating Equipment Investments

Deciding whether to buy a new piece of machinery is a classic business crossroads. The purchase price, plus any ongoing maintenance, bumps up your fixed costs. Naturally, this will raise your break-even point.

By running the numbers beforehand, you can see the exact increase in sales needed to justify the investment. It helps you answer whether the potential boost in efficiency from the new kit will translate into enough extra profit to make the purchase worthwhile.

Optimising Your Pricing Strategy

Finally, break-even analysis is your best friend when it comes to pricing. It allows you to model the impact of price changes with incredible precision.

- Raising your price? You can work out how many fewer units you could sell and still come out ahead.

- Lowering your price? The analysis shows you exactly how many more units you must sell to justify the smaller margin.

This gives you the hard data to find that pricing sweet spot that truly maximises your profitability. For anyone serious about getting their finances in order, understanding this concept is key to nailing financials in a business plan and winning over potential investors.

Got Questions About Break-Even Analysis?

Even when you’ve got the formula down, some of the finer points of break-even analysis can still be a bit tricky. Getting these details right is the key to using this tool properly and avoiding any misunderstandings that could lead to dodgy business decisions.

Let's dig into some of the most common questions that pop up.

One of the big ones is how this model works for businesses that don't sell physical things. How on earth can a consultant or a software company find their break-even point when there's no "unit" to physically count?

How Does This Work for a Service Business?

For a service business, you just need to think about your "unit" a little differently. Instead of a tangible product, your unit might be an hour of your time, a single project, or a monthly retainer for a client. The principle is exactly the same; you're just measuring a different kind of output.

Take a marketing consultant in Falkirk, for instance. For them, a single billable hour is the "unit."

- Fixed Costs: This would be their office rent, professional insurance, and any software subscriptions they pay for every month.

- Variable Costs: These could be project-specific expenses, like travel costs to meet that client or a one-off software licence needed for that particular job.

- Selling Price: This is simply their standard hourly rate.

By working out how many billable hours they need to sell each month, they can find their break-even point. It’s the same logic a manufacturer uses, but it helps the consultant set realistic income targets and understand just how much work they need to bring in.

The core idea behind break-even analysis works for any business. The trick is to correctly identify what a single, sellable 'unit' of value looks like in your world, whether it's a physical product or a block of your time.

What Are the Biggest Limitations?

Break-even analysis is incredibly handy, but it's not a crystal ball. It's built on a few key assumptions, and you absolutely need to be aware of its limitations to make smart decisions.

For starters, it assumes that your costs and prices are static, which almost never happens in the real world. The price of your raw materials might go up, or you might offer a discount for a bulk order, which changes your revenue per unit. It also completely ignores market demand. Knowing you need to sell 5,000 units is one thing, but that doesn’t mean 5,000 people actually want to buy them.

Because of this, you should think of the analysis as a snapshot in time. It’s a brilliant starting point for your financial planning, but it's definitely not the whole story.

How Often Should I Recalculate?

Given that things are always changing, your break-even analysis should be a living document, not a "do it once and forget about it" exercise. It's a good habit to revisit the numbers whenever there's a significant shift in your business.

You should definitely run a new analysis if you:

- Face a rent increase or another big change to your fixed costs.

- Negotiate a new deal with a supplier that changes your variable costs.

- Are planning to change the price of your products or services.

- Introduce a new product line with a completely different cost structure.

Updating your break-even point regularly—maybe every quarter as part of your financial review—makes sure your targets and strategies are based on what's actually happening in your business right now. It keeps your financial planning sharp and relevant.

Navigating your business finances can be complex, but you don't have to do it alone. Stewart Accounting Services offers expert guidance on everything from bookkeeping and VAT returns to strategic business planning. Let us help you gain clarity and control over your numbers so you can focus on growth. Find out how we can support your business today.