If you're running a business in the UK, one of the biggest financial questions you'll face is about VAT. The main trigger for having to register is your turnover. Cross the £90,000 threshold in any 12-month rolling period, and you're legally required to register.

Your Guide to UK VAT Registration

So, the big question is, "Do I need to register for VAT?" Let's get straight to it. For most businesses, the answer boils down to one magic number: £90,000.

Think of it this way: your turnover isn't measured just within your financial year. It's a continuous, rolling 12-month total. At the end of every month, you need to look back over the last 12 months. If your total sales in that period have topped £90,000, it’s time to get registered with HM Revenue & Customs (HMRC).

It's crucial to understand what "taxable turnover" actually means. This isn't just your profit; it's the total value of everything you sell that isn't exempt from VAT. That includes items at the standard rate (20%), reduced rate (5%), and even the zero rate (0%). A lot of people get caught out thinking zero-rated sales don't count towards the threshold, but they absolutely do.

What to Include in Your Turnover Calculation

To make sure you're getting your numbers right, your calculation needs to include more than just standard sales. You should be counting:

- Goods you’ve hired or loaned out to customers.

- Any business goods you’ve used for personal reasons.

- Items you’ve bartered, part-exchanged, or given away as gifts.

- Services from overseas businesses where you had to apply the 'reverse charge' mechanism.

On the other hand, things that are genuinely VAT-exempt—like postage stamps, insurance, or certain financial services—don't count towards that £90,000 total. For a deeper dive into how this figure has changed over time, check out our guide on the VAT threshold for 2023-24.

To help you see where your business fits, here’s a quick summary of the main registration scenarios.

VAT Registration At a Glance

| Registration Scenario | When It Applies | Key Consideration |

|---|---|---|

| Mandatory Registration | Your VAT taxable turnover hits £90,000 in any rolling 12-month period. | This is a legal requirement. Miss the deadline and you could face penalties. |

| Voluntary Registration | Your turnover is below the £90,000 threshold. | A good move if you want to reclaim VAT on your expenses, but you'll have to charge it on your sales. |

| Exempt from Registration | You only sell goods or services that are exempt from VAT. | You can't register for VAT, which means you can't reclaim VAT on any of your business costs. |

Getting this right is fundamental to staying compliant and managing your business finances effectively. Whether you're nearing the threshold or just starting out, keeping a close eye on your rolling turnover is one of the smartest things you can do.

What Exactly Is VAT and Why Does It Matter?

Before we get into the nitty-gritty of thresholds and registration forms, let's break down what Value Added Tax (VAT) actually is. I like to think of it as a financial relay race. As a product or service moves along the supply chain, each business adds a bit of tax before passing the baton to the next.

This continues all the way until the final customer makes the purchase, paying the total tax that's been added at each stage. This is why you'll often hear VAT called a 'consumption tax' – it's the end user who ultimately foots the bill, not the businesses. Companies are essentially acting as tax collectors on behalf of the government.

A Pillar of the UK Economy

Understanding its purpose can change your perspective on VAT from a box-ticking exercise to a meaningful part of the UK's economic engine. It’s not just red tape; it's a critical source of revenue that funds the public services we all depend on.

In the 2023/24 financial year alone, VAT brought in around £169.25 billion. That's a massive slice of the government's income, paying for essential services like healthcare, education, and social protection. If you're curious to see the numbers yourself, you can dig into the data on UK tax revenue and public spending on Statista.com.

Seeing it this way makes it obvious why HMRC is so strict about compliance. When you handle your VAT correctly, you're doing more than just filing paperwork – you're directly contributing to the running of the country, from your local school to the NHS.

This is precisely why getting your VAT status right is so crucial. Whether you're a new business owner asking, "do I need to register for VAT?" or you're already in the system, proper compliance is a fundamental responsibility. It's a cornerstone of your company's financial integrity and its contribution to the broader economy.

How to Calculate Your VAT Taxable Turnover

Getting your head around whether you need to register for VAT all comes down to one crucial task: calculating your turnover correctly. The trick is to stop thinking about your financial year or the calendar year. Instead, you need to get used to the idea of a rolling 12-month period.

This means that at the end of every single month, you need to look back over the last 12 months and add up your sales. It’s a continuous process, but it’s the only way to avoid nasty surprises from HMRC. For most business owners, this rolling calculation is the most confusing part of the puzzle.

It's also worth noting that the goalposts have moved recently. The government has raised the VAT registration threshold from £85,000 to £90,000, a move designed to give smaller businesses a bit more breathing room before they have to jump into the world of VAT. You can read a bit more about the recent changes in this overview of VAT changes on vatcalc.com.

What Counts Towards Your Turnover

So, what exactly do you need to add up? A common mistake is thinking only your standard-rated sales count towards the threshold. The reality is you need to include everything you sell unless it’s specifically exempt from VAT.

Your calculation must include the total value of all your sales for:

- Standard-rated goods and services (the ones at 20%)

- Reduced-rated goods and services (those at 5%)

- Zero-rated goods and services (things like most food or children's clothes at 0%)

That last one—zero-rated items—is what often catches people out. Even though you don't actually charge your customer any VAT on these sales, the value of those sales absolutely counts towards hitting that £90,000 threshold.

The Bottom Line: Your VAT taxable turnover is the total of everything you sell that isn't VAT-exempt. Think of it this way: if it has a VAT rate, even a 0% one, it goes into the pot. The only things you leave out are genuinely exempt sales, like insurance or postage stamps.

Let’s run through a quick example. Say you run an e-commerce store. It’s the end of January, so you look back at all your sales from the 1st of February last year right up to today. If the total value of your standard, reduced, and zero-rated sales comes to £91,000, you’ve officially crossed the threshold. You now have 30 days from the end of January to get registered with HMRC.

Is It Worth Registering for VAT Voluntarily?

You don't have to wait until your turnover hits the £90,000 threshold to enter the world of VAT. For many businesses, choosing to register early is a smart strategic move, but it's a decision that needs careful thought. It really is a classic case of weighing the benefits against the burdens.

The Upsides of Going Voluntary

On the one hand, registering for VAT means you can reclaim the VAT you spend on your business expenses. This can be a real game-changer, especially if you have high start-up costs or regularly buy a lot of goods and services. Think about all the VAT you pay on stock, new equipment, or software subscriptions – you can now claim that back from HMRC, giving your cash flow a direct boost.

Beyond the financial perks, having a VAT registration number can significantly enhance your business's credibility. It often makes a company look bigger and more established, which is a definite advantage when you're dealing with other businesses that expect to see a VAT number on an invoice.

Potential Downsides to Consider

However, it's not all plain sailing. The most immediate change is the extra administrative work. Once you're registered, you're legally on the hook for keeping digital records and filing regular VAT returns through the Making Tax Digital (MTD) system. This adds a whole new layer of financial admin to your plate.

The biggest strategic hurdle, though, is your pricing. You'll have to start adding 20% VAT to your sales. For your business-to-business (B2B) customers who are also VAT-registered, this is no big deal – they just reclaim it. But for your customers who aren't VAT registered, like the general public, this is a hefty price hike.

This sudden price jump can put you at a serious competitive disadvantage against smaller, non-registered rivals. Your service or product is now 20% more expensive for the end consumer, a critical factor in any price-sensitive market.

To help you decide if it's the right path for your business, here’s a breakdown of the key points.

Voluntary VAT Registration Pros vs Cons

| Advantages of Registering Voluntarily | Disadvantages of Registering Voluntarily |

|---|---|

| Reclaim VAT on Purchases: Get money back on VAT paid for business expenses, improving cash flow. | Increased Admin: You must comply with Making Tax Digital (MTD) rules, which means more bookkeeping. |

| Enhanced Credibility: A VAT number can make your business appear larger and more professional to clients and suppliers. | Price Increase for B2C: Your products or services become 20% more expensive for non-VAT registered customers. |

| Avoids "Threshold Anxiety": No need to constantly monitor turnover as you approach the £90,000 limit. | Competitive Disadvantage: You may lose out to non-registered competitors who can offer lower prices. |

| Fairer Price Comparison: B2B customers can see your net price, making it easier to compare you with other VAT-registered suppliers. | Potential for Errors: Filing VAT returns can be complex, and mistakes can lead to penalties from HMRC. |

Ultimately, deciding whether to register for VAT voluntarily isn't just about the numbers. It’s a crucial strategic choice about your cash flow, your administrative capacity, and your position in the market. You can explore the benefits and drawbacks of VAT registration on our blog for a deeper dive to help you make the right call.

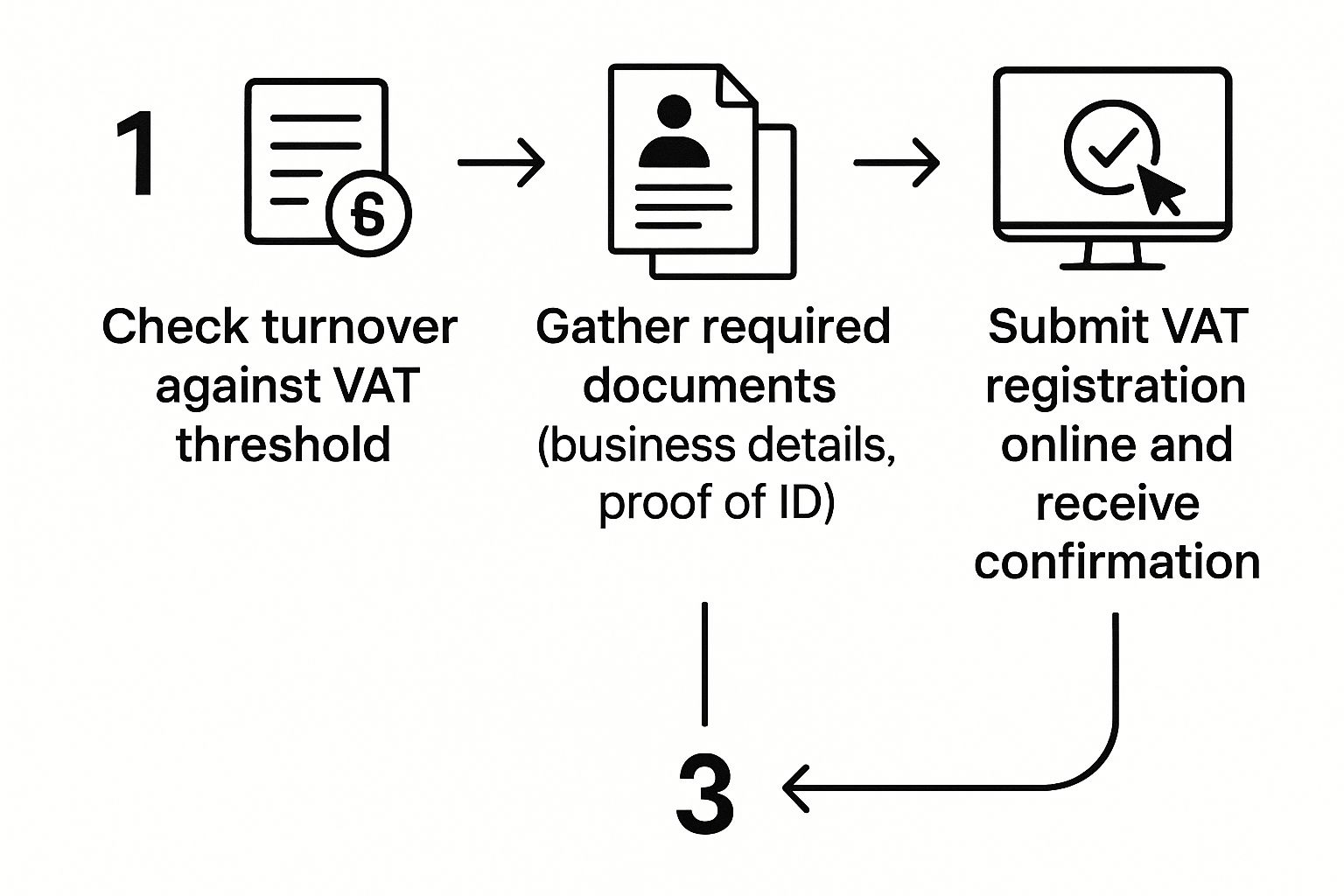

Your Step-by-Step Guide to the VAT Registration Process

So, you’ve realised you need to register for VAT. Whether you’ve decided to do it voluntarily or have just tipped over the £90,000 turnover threshold, it's time to get official. The process might sound a bit intimidating, but it’s actually quite manageable once you know what’s involved.

The most important thing to remember is the deadline. HMRC gives you 30 days from the end of the month you went over the threshold to get your registration sorted. Miss that window, and you could be looking at penalties, so it pays to be prompt.

Getting Your Ducks in a Row: What You'll Need

Before you dive into the online forms, a little preparation goes a long way. Having all your details to hand will make the actual application a breeze.

Here’s a quick checklist of what to gather:

- Your Unique Taxpayer Reference (UTR) – this will be for either Self Assessment or Corporation Tax.

- Basic business details, like your official registered address and contact info.

- Your National Insurance number if you’re operating as a sole trader.

- Your company registration number and incorporation date if you run a limited company.

- Your turnover figures that show you've crossed the threshold.

- The business bank account details you'll be using for VAT payments and reclaims.

Tackling the Online Application

With all your information ready, it’s time to head online. The vast majority of businesses register through the HMRC portal – it’s the standard, and simplest, way to do it.

Once you submit everything, HMRC will process your application. You should receive your VAT registration certificate in the post within about 30 working days, though often it arrives much sooner. This certificate is the golden ticket; it contains your unique VAT number, which you'll need for all your invoices and VAT returns from that point on.

It’s worth noting that registration isn't the final word on VAT. There are some specific scenarios to be aware of, so it's a good idea to understand when you cannot charge VAT.

Common VAT Questions Answered

Even when you've got a handle on the basics, real-world situations can still trip you up. Let's tackle some of the most common questions we hear from business owners about VAT registration.

What Happens If I Register for VAT Late?

Missing your registration deadline isn't something HMRC takes lightly. If you register late, you'll likely face a penalty.

The size of that penalty hinges on two things: how much VAT you owe from the period you should have been registered, and how many months late you are. More importantly, HMRC will hit you with a backdated bill for all the VAT you should have been charging your customers from the date you were legally required to register.

Can I Deregister from VAT?

Absolutely. If your business turnover is heading downwards, you're not stuck in the VAT system forever.

You can apply to cancel your VAT registration if you expect your VAT taxable turnover to drop below the deregistration threshold, which is currently £88,000, over the next 12 months. Just remember, deregistering means you stop adding VAT to your sales, but you also lose the ability to reclaim it on your business purchases. We break this down further in our post on the benefits and downfalls of VAT registration.

A crucial point that often causes confusion is the difference between zero-rated and exempt items. Sales of zero-rated goods (think most food or children's clothes) are still taxable—just at a 0% rate. This means they absolutely do count towards your VAT turnover. Exempt services (like insurance or postage stamps) are outside the scope of VAT entirely, so their sales do not count. Getting this right is vital for calculating your turnover accurately.

Getting your head around VAT can feel like a full-time job in itself, but you don't have to navigate it alone. Stewart Accounting Services can handle everything from getting you registered to filing your returns, making sure you're always compliant. Find out how we can help at https://stewartaccounting.co.uk.