When you're running a limited company, getting to grips with your tax dates is non-negotiable. Two dates stand out above all others: the deadline for filing your tax return and the separate, earlier deadline for actually paying your tax bill.

Mixing these two up is one of the easiest and most costly mistakes a business owner can make, but getting it right is the first step to staying on HMRC's good side.

The Two Core Tax Deadlines You Cannot Ignore

For every company director, mastering the financial calendar really comes down to remembering two distinct, non-negotiable dates. It's a common tripwire for new business owners, so let's clear it up.

Think of it like this: you have one deadline to submit your detailed project report, and a completely separate, earlier deadline to pay the invoice for the work. Hitting one doesn't excuse you from the other. Confusing them can lead to instant penalties from HMRC, even if you’ve met one of the deadlines perfectly.

The Filing Deadline

This is the date you need to get your Company Tax Return (the CT600 form) over to HMRC. This return is the full breakdown of your company's income, expenses, and ultimately, how much Corporation Tax you owe for your accounting period.

The rule of thumb is pretty generous here: you have 12 months from the end of your accounting period to file the return. So, if your company’s year-end is 31st March, your filing deadline is 31st March the following year. This gives you and your accountant plenty of time to get the numbers spot on.

The Payment Deadline

Here's the one that catches people out. The deadline to pay your Corporation Tax bill arrives much sooner than the filing deadline. HMRC needs to have your payment cleared no later than 9 months and 1 day after your accounting period ends.

Let's use that 31st March year-end again. Your Corporation Tax payment would be due on 1st January of the next year. That’s a full three months before your CT600 paperwork even needs to be submitted.

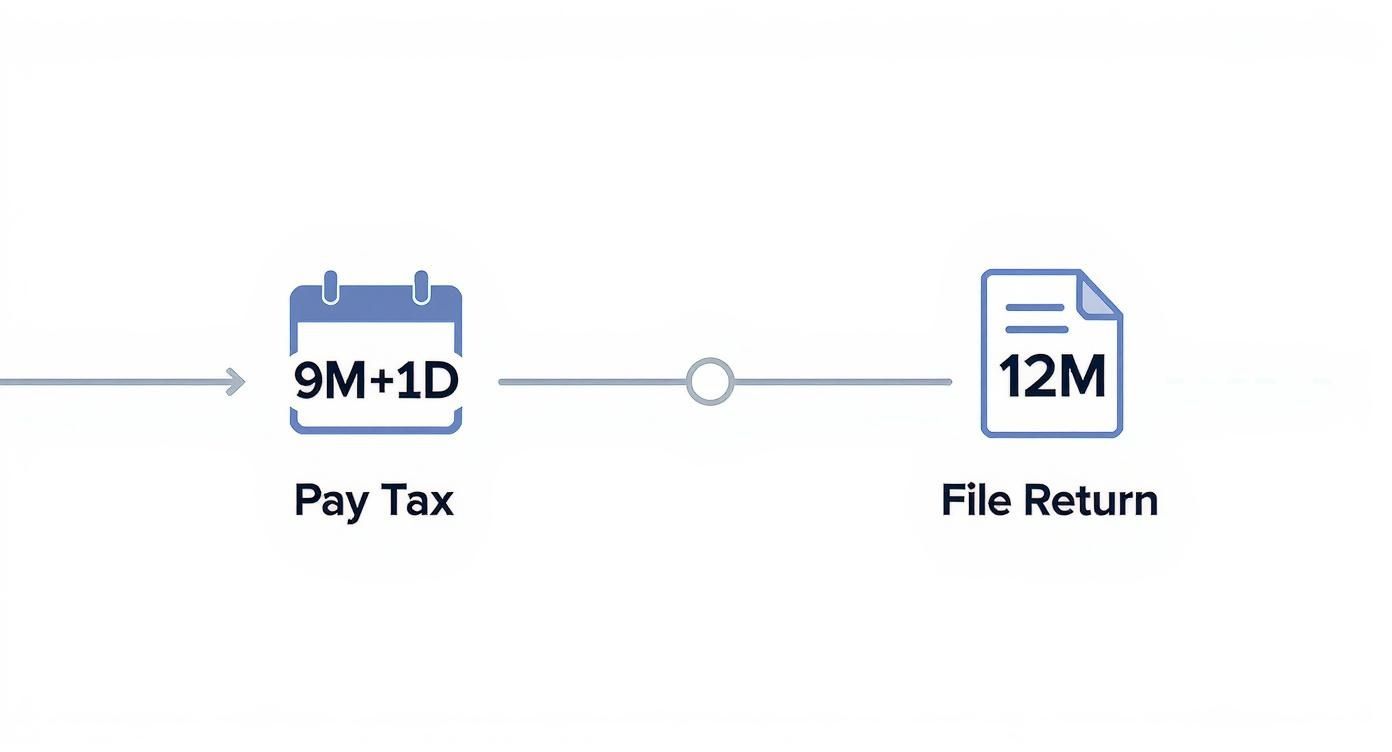

This staggered timeline is crucial to understand. The visual below lays it out clearly.

As you can see, the payment deadline pops up well before the filing deadline, which means you need to be on top of your finances early. You'll have to calculate and pay your tax liability based on your management figures, often long before your final accounts are polished.

For a deeper dive into the process, take a look at our guide on how to file company tax returns.

To make it even clearer, here’s a quick summary of the key dates.

Key HMRC Deadlines at a Glance

| Task | Deadline | What It Involves |

|---|---|---|

| Pay Corporation Tax | 9 months and 1 day after your accounting period ends | Calculating your tax liability and ensuring the funds are received by HMRC. |

| File Company Tax Return | 12 months after your accounting period ends | Submitting the completed CT600 form and supporting accounts to HMRC. |

Keeping these two deadlines separate in your mind and on your calendar is fundamental to good financial management and avoiding unnecessary stress and penalties from HMRC.

Why Your Payment Is Due Before Your Paperwork

It’s one of the most common—and costly—assumptions a company director can make: that your tax payment and filing deadlines are the same day. This simple mix-up catches out countless businesses, often leading to unexpected penalties from HMRC. Let's clear this up right now.

The main reason your payment is due before your paperwork comes down to one thing: government cash flow. HMRC needs your Corporation Tax payment a full three months before your Company Tax Return (CT600) is due because the government relies on that money to fund public services. If they had to wait an entire year after your trading period ends to collect the tax, it would create huge holes in national budgets.

Think of it like pre-paying for a big project. You pay the deposit to get things moving, and the final detailed report comes later. HMRC works on a similar basis, collecting the tax it's owed on your profits well before you've polished and submitted all the detailed calculations in your official return.

A Real-World Deadline Example

Let’s see how this works in practice. Imagine a UK limited company with a financial year-end of 31st March 2024. This is a very popular accounting period, so these dates will probably feel familiar.

Here’s how the key deadlines would stack up for that company:

- Accounting Period Ends: 31st March 2024. This is the final day of their financial year.

- Corporation Tax Payment Deadline: 1st January 2025. The tax owed for the year ending 31st March 2024 must be paid by this date.

- Company Tax Return Filing Deadline: 31st March 2025. The full CT600 tax return has to be with HMRC by this date.

Notice the obvious three-month gap between when the cash is due and when the final forms are sent in. This is exactly why proactive financial planning is non-negotiable.

This staggered system means you cannot wait until your annual accounts are finalised to think about your tax bill. Your business must have a solid estimate of its profits and the resulting tax liability long before the payment deadline arrives.

This structure really hammers home the importance of keeping accurate, up-to-date books throughout the year. If you don't, you’re essentially flying blind as that payment date gets closer and closer.

The Logic Behind the 9 Months and 1 Day Rule

That specific timing isn’t random; it’s a long-established part of the UK tax system. Your deadline for paying Corporation Tax is exactly 9 months and 1 day after your company's accounting period ends. This is a stark contrast to the filing deadline, which gives you a full 12 months.

This shorter payment window is designed to get businesses thinking about their tax obligations much earlier. It also prevents a scenario where companies could use the tax money they owe as extra working capital for another three months. By setting an earlier payment date, HMRC ensures a much more consistent and predictable flow of revenue for the country.

For you as a business owner, this means your cash flow planning has to factor in a major tax payment hitting around nine months after your year-end. If your money is tied up in stock or you’re waiting on a big client invoice, you could face a real cash crunch when HMRC’s payment deadline rolls around. Knowing how to pay Corporation Tax online ahead of time can also help make the process feel less frantic when the day comes.

Your First Year in Business: The Two Tax Return Trap

Getting through your first year of trading is a huge achievement. But when it comes to taxes, there’s a common quirk that often catches new company directors by surprise. It all boils down to a simple difference in how Companies House and HMRC see your first set of accounts.

This isn't just a bit of administrative trivia; it's a detail that means you’ll almost certainly have to prepare and file two separate tax returns for what you think of as your first year. Getting your head around this from the start is the best way to avoid an early, and entirely preventable, penalty.

The "Long" First Year Problem

When you set up a new limited company, Companies House automatically assigns your first year-end. The date is set for the last day of the month, one year after your company was formed. This often creates an accounting period that’s slightly longer than a standard 12 months.

For instance, if you incorporated on 10th June 2024, Companies House would set your first year-end as 30th June 2025. Your first set of statutory accounts would therefore cover 12 months and 21 days.

While Companies House is perfectly happy with this, HMRC has a non-negotiable rule: a Corporation Tax accounting period can never be longer than 12 months. This mismatch is exactly why new businesses often get tripped up.

Because your official company accounts can run for more than 12 months, but your tax period can’t, HMRC forces you to split your first "long" year into two separate periods for tax purposes.

This isn’t a suggestion; it's a hard-and-fast rule. If you try to file a single tax return for a period longer than 12 months, HMRC’s system will simply reject it.

A Real-World Example of the First Year Split

Let's stick with our example to see how this plays out in practice.

- Company Incorporation Date: 10th June 2024

- First Accounts Year-End (for Companies House): 30th June 2025

- Total Period Covered by Company Accounts: 10th June 2024 to 30th June 2025

Since this period is over 12 months, you have to submit two Company Tax Returns (CT600s).

- First Tax Return: This covers the first 12 months of trading, from 10th June 2024 to 9th June 2025.

- Second Tax Return: This covers the leftover bit, from 10th June 2025 to 30th June 2025.

This means your accountant will need to carefully split your income and expenses between these two distinct tax periods. They’ll still prepare one set of annual accounts for the full period, but they’ll use that data to create and file two separate CT600s.

Your First Two Tax Deadlines

Here’s where it gets really important. Each of those two tax returns has its own filing and payment deadline. It’s not as simple as just using the final year-end date.

Let's look at our example again:

For the first tax period (10th June 2024 – 9th June 2025):

- Corporation Tax Payment Deadline: 10th March 2026 (9 months and 1 day after its period end)

- CT600 Filing Deadline: 9th June 2026 (12 months after its period end)

For the second tax period (10th June 2025 – 30th June 2025):

- Corporation Tax Payment Deadline: 1st April 2026 (9 months and 1 day after its period end)

- CT600 Filing Deadline: 30th June 2026 (12 months after its period end)

As you can see, the deadlines are all bunched together. It's incredibly easy to miss one if you're not on top of it, leading to penalties for both late payment and late filing on two separate returns.

What if You Change Your Company's Year-End?

It’s not just the first year of trading that can trigger this rule. You might decide to change your company’s year-end date, perhaps to align with the tax year (ending 31st March) or for reasons specific to your industry.

When you officially change your Accounting Reference Date (ARD), it will either shorten or lengthen your current financial year.

- Making it shorter: If you pull your year-end forward, you'll have a short accounting period. The tax and payment deadlines will also shift forward, giving you less time to prepare.

- Making it longer: If you push your year-end back, you can easily create another "long" period of over 12 months. Just like in your first year, you’d be back to splitting the period and filing two tax returns to keep HMRC happy.

Whether it’s your first year or a change you make down the line, any time your accounting period isn’t a clean 12 months, you need to be extra careful to meet all your tax obligations.

The Real Cost of Missing an HMRC Deadline

Let’s be honest, missing a limited company tax return deadline isn’t just a minor slip-up. It's a costly mistake with a predictable and painful financial fallout. HMRC’s penalty system is automatic and unforgiving, and it's designed to escalate quickly from a manageable fine into a serious financial headache.

The second your Company Tax Return (CT600) is one day late, an instant £100 penalty lands on your doormat. There's no grace period, no warning shot. This is just the starting pistol for a series of escalating fines that grow the longer your return remains unfiled.

How Late Filing Penalties Escalate

Think of HMRC’s penalty system as a series of tripwires. Cross the deadline, and you trigger the first one. The longer you delay, the more tripwires you hit, each adding a heavier financial weight to your initial oversight. It doesn't matter if it's your first time, either – the rules apply to everyone.

Here's how it typically unfolds:

- One Day Late: An immediate and automatic £100 penalty.

- Three Months Late: Another £100 penalty is added, bringing your total to £200.

- Six Months Late: HMRC will estimate what they think your Corporation Tax bill is and add a penalty of 10% of that unpaid amount.

- Twelve Months Late: You guessed it – another 10% penalty of any unpaid tax is tacked on.

It’s easy to see how a simple administrative delay can quickly spiral. If your company has a significant tax liability, those 10% penalties can easily run into thousands of pounds, all because of one missed date in the diary.

The Double Impact of Late Payment

Filing your tax return on time is only half the battle. Missing the deadline to actually pay your Corporation Tax bill carries its own set of consequences that run in parallel with any late filing penalties. From the moment your payment is overdue, HMRC starts charging interest on the outstanding amount until it's paid in full.

This isn't a one-off charge. It’s a daily interest accrual that quietly turns a static tax bill into a growing debt. The longer you wait, the more you owe, compounding the financial pressure on your business.

It’s a classic double-whammy. A business that is six months late with both its filing and payment could be staring down a £200 late filing fine, a 10% late payment penalty, and daily interest on the unpaid tax.

HMRC's two-pronged approach really hammers home how crucial it is to manage both deadlines. Forgetting one can easily lead to penalties for the other.

This table gives a clear breakdown of how the late filing penalties stack up.

HMRC Penalty Structure for Late Company Tax Returns

| Delay | Penalty Amount |

|---|---|

| 1 day late | £100 |

| 3 months late | Another £100 (total £200) |

| 6 months late | HMRC estimates your tax and adds a penalty of 10% of the unpaid tax. |

| 12 months late | Another penalty of 10% of the unpaid tax. |

| Repeated late filings | Penalties can increase to £500 per failure if you file late for three or more consecutive accounting periods. |

As you can see, the costs add up fast, especially for repeat offenders.

The Hidden Costs Beyond the Fines

While the financial penalties are the most obvious consequence, the damage doesn't stop there. Consistently missing deadlines tars your company's compliance record with HMRC, which can have long-term repercussions you might not expect.

A poor compliance history can flag your business for closer scrutiny, making you much more likely to be selected for a full tax investigation or compliance check. An investigation is an incredibly time-consuming and stressful process that pulls you away from what you should be doing – running your business. Staying organised isn't just about avoiding fines; it's about protecting your company’s reputation and your own peace of mind.

Your Action Plan for Stress-Free Tax Filing

Knowing the deadlines is one thing; hitting them without a last-minute panic is another challenge entirely. The key is to shift your mindset. Instead of treating tax filing as a dreaded annual event, build a proactive, year-round approach that makes it a manageable part of your business rhythm. This isn't just about meeting dates; it's about building smart habits.

Success starts with impeccable record-keeping. And I don’t mean frantically hunting for receipts in a shoebox a week before your accountant needs them. It means using simple digital tools to keep your financial data clean, organised, and up-to-date throughout the year.

Adopt a Quarterly Rhythm

Trying to tackle a whole year’s worth of accounts in one go is what causes the stress. Breaking it down into manageable quarterly chunks makes tax planning far less daunting. A regular quarterly review cycle ensures you’re always in control, turning the year-end report into a simple summary rather than a mammoth project.

Here’s what that looks like in practice:

- Financial Health Checks: At the end of each quarter, take a proper look at your profit and loss statements and balance sheet. Are you on track with your forecasts? This constant pulse-check gives you a clear idea of your potential tax liability well in advance.

- Tax Provisioning: This is a crucial habit. Get into the routine of setting aside a portion of your revenue specifically for your future Corporation Tax bill. The easiest way is to open a separate savings account and regularly transfer an estimated percentage of your profits—most small businesses find that putting aside 20-25% is a safe bet.

- Accountant Check-ins: Don't just call your accountant when the deadline is looming. A brief quarterly chat can flag potential issues, make sure you're claiming every expense you're entitled to, and help you optimise your tax position long before the filing deadline rolls around.

This consistent oversight is your best defence against nasty surprises when the payment date finally arrives. For a more detailed framework, our small business accounting checklist for year-end is a great place to start.

Master the Submission Essentials

Understanding the technical side of filing demystifies the whole process. Back in 2011, HMRC made electronic submissions for Corporation Tax mandatory to improve efficiency. This means all filings have to be in a very specific digital format.

HMRC requires every Company Tax Return to be filed electronically using iXBRL (Inline eXtensible Business Reporting Language). Think of it as a special language that tags all your financial data, allowing HMRC's computers to read and analyse it automatically.

Your Government Gateway account is your digital key to this system. It’s the portal your accountant will use to submit your CT600, and it’s where you can log in to check the status of your filings and payments. Keeping those login details safe and accessible is non-negotiable.

An organised approach isn't just about avoiding penalties; it’s about maintaining financial clarity. Knowing your numbers and processes gives you the confidence to make better strategic decisions for your business throughout the year.

Create Your Year-Round Timeline

To truly eliminate the end-of-year rush, you need to map out key actions across the year. This simple timeline ensures you are always well ahead of any limited company tax return deadline.

- Throughout the Year: Maintain pristine digital records. Cloud accounting software makes this easy. Reconcile your bank accounts weekly or, at the very least, monthly.

- Quarterly: Conduct your financial reviews, update profit forecasts, and, most importantly, transfer funds into that tax savings account.

- 6 Months After Year-End: Sit down with your accountant for a detailed meeting to review the draft accounts and get a solid estimate of your tax liability. This gives you three clear months before the payment is due.

- 8 Months After Year-End: Get your accounts and tax computations finalised. Now you have a comfortable one-month buffer before your payment deadline.

- Before 9 Months & 1 Day: Pay your Corporation Tax bill.

- Before 12 Months: Double-check that your accountant has successfully filed your CT600 tax return.

For many business owners, the most effective action plan involves delegating tax matters to a professional. Appointing an accountant to act as your official representative ensures compliance is handled by an expert, freeing you up to focus on what you do best.

Answering Your Top Questions About Company Tax Deadlines

Even the most organised business owners run into questions when it comes to tax. It's completely normal. You might have a solid plan, but unique situations can crop up and leave you feeling unsure about what to do next.

This section is here to clear up the confusion. We're going to tackle some of the most common questions we hear from directors about their limited company tax return deadline. Think of it as a go-to guide for those nagging queries that can keep you up at night, with straightforward answers to help you stay on the right side of HMRC.

Can I Get an Extension on My Tax Return Deadline?

This is probably the number one question we get asked, and the answer is rarely what people want to hear. Unlike personal tax returns, there is no automatic right to an extension for filing your Company Tax Return or paying your Corporation Tax. The deadlines are set in stone.

HMRC will only ever consider an extension under truly exceptional circumstances that are completely out of your control. We're talking about a serious illness of a director right before the deadline, or a fire destroying your financial records.

Things like being too busy, your accountant taking a holiday, or simply forgetting the date won't cut it. These are never considered valid reasons. The best approach is to always assume the deadline is non-negotiable and build your entire year's schedule around meeting it with time to spare.

What Is the Difference Between Companies House and HMRC Deadlines?

It’s incredibly easy to mix up the deadlines for Companies House and HMRC. They both relate to your company's financial year, but they are two separate sets of obligations for two different government bodies. Getting them wrong can land you with penalties from both.

Here’s a simple way to keep them straight:

- Companies House: This is where you file your annual statutory accounts. Its main job is to make your company's financial information a matter of public record. For most private limited companies, the deadline to file is 9 months after your financial year ends.

- HMRC: This is for all things tax. You file your Company Tax Return (CT600) and pay your Corporation Tax bill here. The payment deadline is usually 9 months and 1 day after your accounting period ends, and the deadline to file the return itself is 12 months after the period ends.

Think of it like this: Companies House is focused on corporate transparency for the public, while HMRC is focused purely on collecting the right amount of tax from you. They are two different audiences needing different things on different timelines.

This distinction is a classic tripwire. A company with a 31st March year-end has to file its accounts with Companies House by 31st December, pay its Corporation Tax by 1st January, and then file its tax return by the following 31st March. That’s three critical dates to get right.

What Should I Do If I Cannot Pay My Corporation Tax on Time?

Staring down a tax bill you can't pay is a horrible feeling, but the absolute worst thing you can do is ignore it. The single most important step is to contact HMRC as soon as you know there's a problem—ideally, well before the payment deadline arrives.

Being proactive shows HMRC you're taking your responsibilities seriously. They are often surprisingly willing to help businesses that are upfront about their financial struggles. They might offer you a 'Time to Pay' arrangement, which is a formal agreement allowing you to pay what you owe in manageable instalments.

To have the best chance of securing this, you'll need to clearly explain why you can't pay, show what you've done to try and get the funds, and put forward a realistic repayment plan. Ignoring the problem just leads to mounting interest and penalties, making a bad situation much, much worse.

How Do I Correct a Mistake on a Submitted Tax Return?

Mistakes happen. If you spot an error on a Company Tax Return you’ve already filed, don't panic. There's a formal process for putting it right. You can simply amend your return and resubmit it to HMRC.

As a rule, you have 12 months from the statutory filing deadline to make any changes. So, if your original filing deadline was 31st March 2025, you would have until 31st March 2026 to submit a corrected version.

You can usually do this online using the same Government Gateway account you used for the original submission. If the correction means you owe more tax, you'll need to pay the difference straight away to keep interest charges to a minimum. If it turns out you've overpaid, HMRC will issue a refund once they've processed your amended return. It is always, always better to fix an error yourself than to wait for HMRC to find it.

Feeling overwhelmed by deadlines and compliance? Let the experts take the weight off your shoulders. Stewart Accounting Services offers comprehensive accounting and tax support to ensure you file and pay on time, every time, giving you the peace of mind to focus on growing your business. Discover how we can help you stay compliant and in control.