The thought of tackling your Self Assessment can be overwhelming, but honestly, breaking it down into manageable chunks is the secret to getting it done without the stress. This guide will give you the practical self assessment tax return help you're looking for, starting with the basics: figuring out if you even need to file and the key dates you absolutely cannot miss.

Let's get you started on the path to a confident and penalty-free tax season.

Getting Started Without the Stress

The very first question to answer is whether you actually need to file a tax return. It's a common misconception that it's only for the self-employed. In reality, a whole host of situations require you to declare your income to HMRC.

If you're unsure where you stand, our detailed article explains exactly who must send in a tax return. It covers the nuances, but as a general rule, you'll probably need to get registered.

Who Needs to File a Tax Return

You'll almost certainly need to send a return if, during the last tax year (which runs from 6 April to 5 April), any of the following applied to you:

- You were self-employed as a ‘sole trader’ and earned more than £1,000.

- You were a partner in a business partnership.

- You were a company director (with some exceptions for non-profits where you received no pay or benefits).

- Your total taxable income was over £100,000.

Other common triggers include having untaxed income over £2,500 (from things like tips or freelance work), earning money from renting out a property, or if you or your partner earned over £50,000 and claimed Child Benefit.

Registering with HMRC

Before you can even think about filing, you need to be registered for Self Assessment. Once you've done this, HMRC will post you a Unique Taxpayer Reference (UTR). This ten-digit number is vital—it's your identifier for everything tax-related, so treat it like gold.

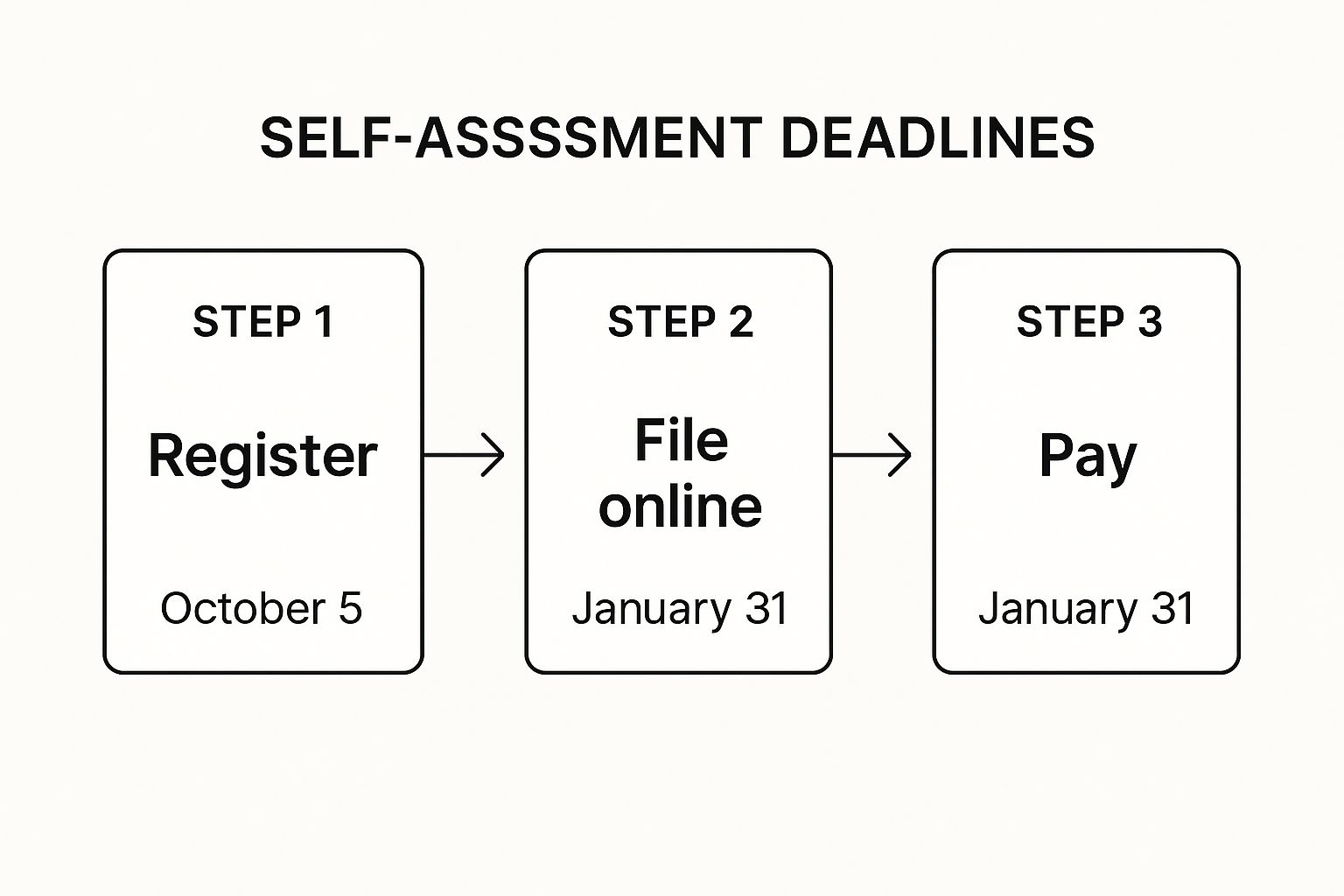

Crucially, the deadline to register is 5 October following the end of the tax year you need to file for.

My Advice: Don't leave registration until the last minute. It can take a couple of weeks for the UTR to arrive in the post, and you literally cannot file your return without it. Missing that 5 October deadline just adds unnecessary pressure to the process.

Understanding Key Deadlines

Getting your dates straight is the single most important thing you can do to avoid automatic penalties. The UK tax year is fixed from 6 April to 5 April, and the deadlines for filing and payment are just as rigid.

To keep things clear, here's a quick-reference table outlining the most important dates in the Self Assessment calendar. Knowing these will help you stay compliant and avoid any nasty surprises from HMRC.

Key UK Self Assessment Deadlines to Remember

| Milestone | Paper Return Deadline | Online Return Deadline | Tax Payment Deadline |

|---|---|---|---|

| For the tax year ending 5 April 2024 | 31 October 2024 | 31 January 2025 | 31 January 2025 |

As you can see, filing online gives you a lot more breathing room. It's the method most people use, not just for the later deadline but also because you get instant confirmation that HMRC has received your return.

Be warned: missing the 31 January deadline triggers an instant £100 penalty, and that fine only gets bigger the longer you delay. A bit of forward planning means you'll have plenty of time to gather your documents, double-check your figures, and submit everything without that last-minute panic.

Gathering Your Financial Information Like a Pro

An accurate tax return starts with organised records. Honestly, this is the most important part of the whole process. Think of it like preparing your ingredients before you start cooking – having everything ready makes the actual task a whole lot smoother. Rushing into the forms without a complete financial picture is just asking for errors, missed deductions, and, eventually, a headache from HMRC.

Before you even think about logging into the government portal, get your financial toolkit in order. A bit of prep work here can turn what feels like a monumental task into a much more straightforward process.

Your Core Information Checklist

First things first, let's get the absolute essentials sorted. You won't get far without these key details, so have them handy before you begin.

- Your 10-digit Unique Taxpayer Reference (UTR). This is the number HMRC gave you when you first registered for Self Assessment.

- Your National Insurance number. You can find this on old payslips, your P60, or on letters about tax and benefits.

With those basics covered, it's time to dig into the numbers for the tax year.

From my experience, the single biggest time-saver is keeping on top of your records throughout the year. Trust me, trying to piece together 12 months of transactions from a shoebox of faded receipts in the middle of January is a nightmare. A simple spreadsheet or some basic accounting software will make a world of difference.

Documenting Your Income Sources

Right, now for the money coming in. You need to build a complete picture of every penny you earned during the tax year, which runs from 6 April to 5 April. This isn't just about your main freelance or business income; HMRC needs to know about everything.

For instance, a freelance graphic designer will obviously have to account for every client invoice. But what if she also rents out a spare room on Airbnb and sold some shares? Yep, that income needs to be declared too.

Your income documentation will likely include a mix of the following:

- Self-Employment: All sales invoices, business bank statements, and any records of cash payments.

- Rental Properties: A log of all rent received, statements from your letting agent, and details of any other income related to the property.

- Employment (if you also have a job): Your P60 and P11D forms. These detail your salary and any taxable benefits from an employer.

- Other Income: Details of interest from savings accounts, dividends from investments, or cash from a side hustle.

Uncovering Allowable Expenses

This is where good record-keeping really starts to pay off. Allowable expenses are the costs you incurred "wholly and exclusively" for your business. When you claim them, they're deducted from your total income, which reduces your taxable profit and, ultimately, your final tax bill.

Imagine you're a self-employed consultant who drives 50 miles to a client meeting. The fuel for that trip is an allowable expense. The new laptop you bought specifically for work? That's an expense. The monthly subscription for your industry-specific software? That's an expense, too. Getting this right is crucial, and our guide on self-employed record keeping goes into much more detail on what you can and can't claim.

If you’re looking to get a really firm grip on this, exploring some comprehensive accounting, bookkeeping, and finance courses can build a solid foundation and give you more confidence in managing your own finances.

Common expense categories you'll want to track include:

- Office Costs: Things like stationery, phone bills, and software subscriptions.

- Travel Costs: Fuel, parking, train tickets, and hotel stays for business trips.

- Marketing and Advertising: Website hosting, social media ads, or printing business cards.

- Legal and Financial Costs: Any fees you've paid to an accountant or solicitor for business matters.

By meticulously pulling all this information together upfront, you're not just ensuring your tax return is accurate—you're making sure you're as tax-efficient as possible.

A Practical Walkthrough of the Online Return

Right, with all your financial records neatly organised, it's time to get stuck into the online return itself. The vast majority of people file online these days, and for good reason. It’s faster, more secure, and HMRC's system does some of the heavy lifting with calculations, which really helps cut down on simple mistakes.

Think of the online portal as a structured conversation. It asks you questions to figure out exactly which parts of the tax form you actually need to fill in.

The first port of call is logging into your Government Gateway account. This is the secure hub for all your dealings with HMRC, so it goes without saying you should keep those login details safe.

This is the login screen you'll see – the starting gate for your online Self Assessment journey.

Here's where you'll pop in your User ID and password to get things moving.

Tailoring Your Return

Once you’re in, the first stage is called "Tailor your return," and this is where the online system truly proves its worth. Instead of dumping a massive, intimidating form on you that covers every financial situation under the sun, it simply asks you a series of questions about your income and circumstances for the year.

Based on how you answer, it cleverly adds the sections you need and hides the ones you don't.

- Were you self-employed? It'll add the self-employment pages (SA103).

- Did you sell some shares? In goes the Capital Gains section (SA108).

- Did you earn income from a property? You'll get the UK property pages (SA105).

This customisation is a game-changer. It stops you from getting bogged down in irrelevant fields and is one of the biggest reasons why filing online is so much more straightforward than the old paper method.

A Word of Warning: Don't rush this initial part. A very common slip-up is accidentally ticking or unticking a box. This small error could mean you forget to declare a source of income or, just as importantly, fail to claim a tax relief you’re entitled to. Always double-check your answers here before you move on.

Entering Your Figures

Now for the main event: transferring the numbers from your organised records into the relevant boxes on the form. Each section will directly correspond to the information you've already pulled together, like your total business turnover or the gross interest earned from savings accounts.

A huge benefit of the online form is the ability to save your progress at any point and come back later. This feature is incredibly handy. It means you don’t have to complete the entire return in one marathon session, which significantly reduces the chance of making mistakes when you’re tired.

Reviewing and Submitting

After you’ve filled in all your information, the system calculates your tax liability in real-time. This is your chance to take a breath and review everything. Go through each section one last time to make sure the figures are correct and you haven't made any typos. It’s much easier to fix a mistake now than after you’ve submitted.

Once you’re happy that everything is spot on, you can submit the return directly to HMRC. You’ll get an instant on-screen confirmation and a submission receipt. Make sure you save a copy of this for your records—it’s invaluable proof that you filed on time.

More and more people are getting ahead of the game. For the tax year beginning 6 April 2025, an incredible 300,000 taxpayers filed their returns in the very first week. This shift shows that people are realising the benefits of getting their tax sorted early, allowing them to plan their finances properly without the mad dash to the January deadline.

Even with a user-friendly system, navigating the forms and understanding all the nuances can still be a challenge. To help with this, you might be interested in the new self assessment services announced by HMRC which are designed to offer more support. Taking your time and using the system’s features is the key to filing with confidence.

Understanding Your Tax Bill and Making Payments

After you’ve double-checked everything and hit 'submit' on your tax return, HMRC instantly calculates your final tax and National Insurance liability for the year. This figure is what you owe based on the profits you've declared. But for many, especially if you're new to self-assessment, the story doesn't quite end there.

That final figure can often include a bit of a shock: Payments on Account. These are essentially advance payments towards next year's tax bill. If you aren't expecting them, they can put a real dent in your cash flow.

What Exactly Are Payments on Account?

Think of Payments on Account as HMRC's way of spreading out your tax bill, similar to how employees pay tax through PAYE throughout the year. It stops you from being hit with one enormous bill annually.

You'll usually have to make these advance payments if two conditions are met:

- Your last Self Assessment tax bill was over £1,000.

- Less than 80% of your income was taxed at source (like through a PAYE job).

Each payment is exactly 50% of your previous year's tax bill. The deadlines are non-negotiable:

- 31 January: Your first payment is due. This is on top of any final balancing payment you owe for the tax year you've just reported on.

- 31 July: Your second payment is due.

Let's use an example. Say your tax bill for the 2023/24 tax year comes to £3,000. By midnight on 31 January 2025, you'd owe that £3,000. On that very same day, you would also have to pay your first Payment on Account for the next tax year, which would be £1,500 (50% of £3,000). The second £1,500 would then be due on 31 July 2025. This is why that first January payment can feel so hefty.

Managing and Reducing Your Payments

What if you’ve had a great year, but you know the next one will be quieter? You're not locked into making high advance payments based on historical earnings. If you're confident your income will be lower, you can apply directly to HMRC to reduce your Payments on Account.

Be careful here. It’s tempting to lower the payments as much as possible, but you need to be realistic. If you reduce them too much and then end up earning more than you predicted, HMRC will charge you interest on the shortfall. It pays to be honest and make a sensible forecast.

Once you get a handle on your tax liability, you might want to look into expert strategies to pay less income tax to make sure you're being as efficient as possible.

How to Pay What You Owe

When it's time to settle up, HMRC makes it fairly straightforward. You’ve got a few options for paying your bill:

- Online bank transfer (Bacs/CHAPS): This is often the easiest way. Just make sure you use your 11-character payment reference so the money goes to the right place.

- Debit card: You can pay with your personal or corporate debit card directly through your HMRC online account.

- Direct Debit: A good option to 'set it and forget it'. You can authorise HMRC to take a single payment or set up a regular budget payment plan.

Keeping a close eye on these deadlines is absolutely crucial. Missing the filing date triggers an immediate £100 penalty, even if you don't owe any tax. These fines can escalate quickly, so it's vital to understand the system, manage your payments, and avoid any nasty surprises from HMRC.

Preparing for the Future of UK Tax

The way we all handle our taxes in the UK is changing, and it’s happening faster than you might think. HMRC is pushing hard to bring everything into the digital age, which means we’re all moving away from the old-school annual tax return scramble towards a more real-time system. Getting your head around these shifts now will save you a world of headaches later on.

The biggest change on the horizon is Making Tax Digital (MTD) for Income Tax. This isn't just a minor tweak; it's a complete overhaul of how self-employed people and landlords report their earnings to the taxman.

What Is Making Tax Digital All About?

At its heart, MTD is about ditching paper records and yearly summaries for digital bookkeeping and regular updates. The idea is to give both you and HMRC a much clearer, more up-to-date picture of your tax position throughout the year, rather than having a nasty surprise after it’s all over.

After a few delays, MTD for Income Tax is now set to kick in from April 2026. If you're self-employed or a landlord with an annual income over £50,000, you’ll be first in line. You'll need to keep all your records digitally and send quarterly summaries to HMRC using approved software. To get a handle on what this means for you, it’s worth reading up on the latest changes to the UK tax system.

How to Get Ready for MTD

Don't make the mistake of putting this on the back burner until 2026. The smartest move is to start getting into good digital habits right now. It will make the final switch feel like a small step, not a giant leap.

- Go Digital with Your Bookkeeping: Still clinging to that trusty spreadsheet or, dare I say, a paper ledger? Now is the perfect time to move over to MTD-ready accounting software. Tools like Xero or FreeAgent are built for this.

- Get into a Quarterly Rhythm: Start checking in on your income and expenses every three months. If you build this into your routine now, sending the official updates to HMRC will feel like second nature when the time comes.

- Talk to an Expert: A good accountant can be invaluable here. They can help you pick the right software for your business and make sure you’re set up correctly from day one.

It’s not just MTD you need to be aware of. From January 2025, online platforms like Airbnb, Amazon, and Uber have to report how much their users are earning directly to HMRC.

What does this mean? It means HMRC has more visibility than ever. There’s simply nowhere to hide undeclared income. This makes it absolutely crucial that you report everything accurately on your Self Assessment, because you can bet HMRC will be cross-referencing their data with what you submit.

Keeping on top of these changes isn’t just about ticking boxes. It's about protecting your business, staying compliant, and making sure your finances are ready for what’s coming next.

Got a Question About Self Assessment? Let's Get It Answered

Even with the best preparation, you’re bound to run into a few head-scratchers when doing your taxes. It happens to everyone.

This is where we tackle some of those common queries head-on, giving you clear, practical answers for those tricky spots that can stop you in your tracks.

What Happens If I Miss the Self Assessment Deadline?

Let’s be blunt: missing the 31 January online filing deadline isn’t a good idea. HMRC issues an immediate £100 penalty the very next day. This penalty applies even if you have no tax to pay or you’ve already paid what you owe.

And it doesn't stop there. The penalties are designed to escalate the longer the delay.

If you’re three months late, you could be hit with daily penalties of £10. At six months, another penalty of £300 (or 5% of the tax due, whichever is higher) is added. This is repeated again at the twelve-month mark. On top of all that, interest will be racking up on any unpaid tax.

Key Takeaway: Always file on time, even if you can’t afford to pay the bill straight away. Submitting the return stops the late-filing penalties from snowballing. You can then address the payment separately.

How Do I Claim Expenses for Working from Home?

If you’re self-employed and working from home, you can absolutely claim tax relief on your household costs. HMRC gives you a choice between two methods.

- Calculate your actual costs: This is the more detailed approach. You’ll need to work out the business proportion of genuine household bills like electricity, heating, and council tax. This means figuring out a fair percentage based on how much of your home is used for work and for how long.

- Use HMRC's simplified expenses: This is a much quicker flat-rate system. HMRC allows you to claim a set monthly amount based on the number of hours you work from home. It saves you from digging through utility bills and doing complex sums.

The simplified method is certainly easier, but if you have significant home-running costs, taking the time to calculate the actual figures could lead to a much bigger tax deduction. It’s often worth the effort.

Can I Correct a Mistake on a Submitted Tax Return?

Yes, you can. People make mistakes, and HMRC has a process for this. If you’ve spotted an error on a return you’ve already filed, it’s always best to correct it as soon as you can.

You have a window of 12 months from the original filing deadline to amend your return online. It's a straightforward process: just log back into your HMRC online account, navigate to the relevant tax year, and choose the option to "amend your return".

Once you've made the changes, you simply resubmit it.

If you realise there's a mistake more than a year after the deadline, you can’t amend it online. Instead, you'll need to write to HMRC directly, clearly explaining the error and providing the correct information.

Navigating the finer points of tax can be a challenge, but you don't have to do it alone. For expert Stewart Accounting Services support with your tax return and financial planning, visit our website at https://stewartaccounting.co.uk and let us help you find clarity and peace of mind.