When you first step into the world of self-employment, the freedom is brilliant. But with that freedom comes a whole new set of responsibilities – namely, sorting out your own taxes. The single most important part of this is getting to grips with the key dates set by HMRC. Miss one, and you could face an automatic penalty, even if you don't actually owe any tax.

Your Essential Map to Self-Employed Tax Dates

Think of the tax year as a timeline with a few critical checkpoints. For anyone self-employed, these dates are non-negotiable and need to be circled in your calendar right now. Forgetting about them isn't just a minor oversight; it's a surefire way to land yourself with financial stress and penalties that can quickly escalate. Getting this calendar clear in your head from the very beginning is the best way to stay in control.

This guide will be your command centre, laying out the entire schedule for the tax year. We'll walk through everything from registering with HMRC for the first time to filing your return and, finally, paying what you owe.

As a rule of thumb, the three most important self-employed tax return dates are the 5th of October to register for Self Assessment, the 31st of October for paper tax returns, and the 31st of January for online returns and paying your tax bill.

To give you a clear picture of the whole journey, let's break down the key milestones in the self-assessment tax year. Each date represents a specific action you need to take to keep things above board and avoid any unnecessary fines. This is your at-a-glance cheat sheet for staying on HMRC's good side.

Key HMRC Deadlines for the Self Employed at a Glance

Here’s a quick summary of the most critical dates in the self-assessment tax year, from getting registered to making your final payment.

| Milestone | Deadline | What It Means for You |

|---|---|---|

| Register for Self Assessment | 5th October | If you're newly self-employed, you must tell HMRC by this date following the end of the tax year you started your business. |

| Paper Tax Return | Midnight 31st October | This is the final date to submit a paper Self Assessment tax return. Most people now file online. |

| Online Tax Return | Midnight 31st January | The absolute deadline for submitting your online Self Assessment tax return. |

| Pay Your Tax Bill | Midnight 31st January | This is also the deadline to pay any tax you owe from the previous tax year, plus your first 'payment on account' for the current tax year. |

| Second Payment on Account | Midnight 31st July | The deadline for making your second 'payment on account' towards your tax bill for the current tax year. |

Think of this table as your essential timeline. Keep these dates handy, and you'll find the whole process of managing your tax obligations far less daunting.

The First Step: Registering for Self Assessment

Before you can even think about filing a tax return, you have to let HMRC know you exist as a business. This isn't just a bit of admin; it's a legal requirement with a deadline that catches a surprising number of new sole traders out. Think of it as the starting pistol for your tax journey – you can't join the race if you haven't signed up first.

This registration process is what gets you your Unique Taxpayer Reference (UTR). It’s a 10-digit number that essentially becomes your ID for anything related to Self Assessment. Without it, you can't file your return or sort out your tax bill.

The Critical 5th October Deadline

If there's one early date to circle in your calendar, it's 5th October. This is your deadline to register for Self Assessment for the tax year after you started your business.

Let’s break that down. If you started trading anytime between 6 April 2023 and 5 April 2024, you absolutely must register with HMRC by 5 October 2024.

Getting this done on time is crucial. If you're late, it can delay HMRC sending out your UTR number, which in turn can make it impossible to file your tax return on time – landing you with a penalty before you’ve even begun. For a full walkthrough, take a look at our guide on how to register as a sole trader.

Missing this first hurdle creates a domino effect. A late registration can make it impossible to meet the January filing deadline, automatically triggering late filing penalties even if you had the best intentions.

Failing this initial test sets you on the back foot from day one. Pop this date in your diary as soon as you start trading to ensure your tax journey is as smooth and penalty-free as possible.

Choosing Your Path: Paper vs. Online Filing

Once HMRC has you on their books, the next big hurdle is actually filing your Self Assessment tax return. You’ve got two ways to do this, and honestly, your choice here dictates one of the most important deadlines you’ll face. Getting this wrong can land you in hot water from the get-go.

Think of it like booking a holiday. You could go the old-school route with a travel agent and paper tickets, which takes a bit more planning and time. Or, you can hop online and book it yourself right up to the last minute. HMRC offers a similar choice between a traditional paper return and a modern online one.

The Traditional Paper Return

If you're someone who prefers a physical, pen-and-paper approach, you can absolutely file a paper tax return. But, and this is a big but, you’re working with a much tighter deadline. Your completed paper return needs to be physically on HMRC’s desk by midnight on 31st October.

There's no wiggle room here. This early cutoff is in place simply to give HMRC the time it needs to manually process all that paperwork. If you miss this date, you’ve missed your filing deadline for the year—even though the online one is still a few months away.

The Modern Online Return

Let's be clear: the vast majority of people file online these days, and for good reason. It’s more flexible, the system calculates your tax bill for you as you go, and you get an instant digital receipt the moment you hit 'submit'. Crucially, it buys you more time.

The deadline for online submissions is midnight on 31st January. That's a full three months later than the paper deadline, which can be a lifesaver when you're trying to get your records in order. As you get ready, it’s worth exploring the new Self Assessment services announced by HMRC to see what tools are available to help you out.

Whichever route you take, missing the final deadline has immediate consequences. An automatic £100 penalty is issued the very next day. This applies even if you don't owe any tax or are actually due a refund.

This penalty is non-negotiable and serves as a sharp reminder of how seriously HMRC takes its deadlines. Many new business owners are shocked to learn that this fine is triggered automatically, so it pays to be prepared.

Getting to Grips with Payments on Account

Filing your return is one thing, but settling the bill is what really matters. While everyone knows about the big 31st January deadline, many self-employed people get caught out by something called Payments on Account. It can seem a bit confusing at first, but it's crucial for keeping your cash flow in good health.

Think of it like paying for your holiday in instalments. You wouldn't pay for the whole trip in one go; you pay a deposit and then the balance later. HMRC’s system is a bit like that – it asks you to pay a portion of your next year's tax bill in advance, split into two chunks.

The whole point is to help you spread the cost so you’re not scrambling to find a huge lump sum every January. It's designed to make your tax bill more manageable and prevent a cash flow nightmare.

How Do Payments on Account Actually Work?

HMRC will automatically put you onto this system if your Self Assessment tax bill is more than £1,000 and less than 80% of your income is taxed at source (like through a PAYE job). It's all based on what you earned in the previous tax year.

The two key dates you absolutely need in your diary are:

- 31st January: This is when your first payment is due. It’s paid at the same time as any tax you still owe from the previous year (this is called a 'balancing payment').

- 31st July: Your second payment is due six months later.

Each of these payments is usually 50% of your previous year's tax bill. So, if your bill last year was £3,000, you'd pay £1,500 in January and another £1,500 in July towards the current year's tax.

The January payment can feel like a double whammy. You're often paying off last year's tax bill and making the first advance payment for this year, all at once.

This is exactly why the July deadline catches so many people off guard – it can feel like it comes out of nowhere. If you're worried about finding the cash, our article on struggling to fund your July tax payment has some practical advice.

Ultimately, planning for both dates is the key to keeping your business finances healthy and predictable all year round.

The True Cost of Missing HMRC Deadlines

Let's be clear: HMRC penalties aren't just a slap on the wrist. They're a structured system designed to escalate, and a simple missed deadline can quickly snowball into a serious financial problem. The penalties kick in the very day you miss a self employed tax return date and only get worse from there.

It all starts with an immediate, automatic £100 fine for missing the 31 January online filing deadline. This applies even if you have no tax to pay or are actually due a refund. Think of it as the starting pistol for a race you don't want to be in.

The Escalating Penalty Timeline

If you're three months late, things get significantly more expensive. HMRC starts adding a daily penalty of £10 per day, which can run for up to 90 days. That's a potential £900 on top of the initial fine, pushing your total penalty to £1,000 before they even think about adding interest.

The penalties are designed to get you to act. They don't just punish the initial oversight; they punish the failure to sort it out quickly. The longer you leave it, the worse it gets.

Hit the six-month mark, and another penalty is slapped on. This time, it's either £300 or 5% of the tax you owe—whichever figure is higher. If your return is a full twelve months late, they hit you with the same penalty again, adding it to all the previous fines.

Here’s a breakdown of how quickly those late filing penalties can stack up.

HMRC Late Filing Penalty Timeline

| Delay | Penalty Applied | Cumulative Potential Cost |

|---|---|---|

| 1 day late | £100 fixed penalty | £100 |

| 3 months late | £10 per day (up to 90 days) | Up to £1,000 |

| 6 months late | £300 or 5% of tax due (whichever is higher) | £1,300+ |

| 12 months late | £300 or 5% of tax due (whichever is higher) | £1,600+ |

As you can see, the costs accumulate alarmingly fast. This doesn't even include the interest charged on the unpaid tax and on the penalties themselves.

Interest Charges Make Everything Worse

On top of all these fixed penalties, HMRC also charges interest. This isn't just on the tax you haven't paid; interest also piles up on the penalties themselves. It’s a vicious cycle that can become very difficult to break once it starts.

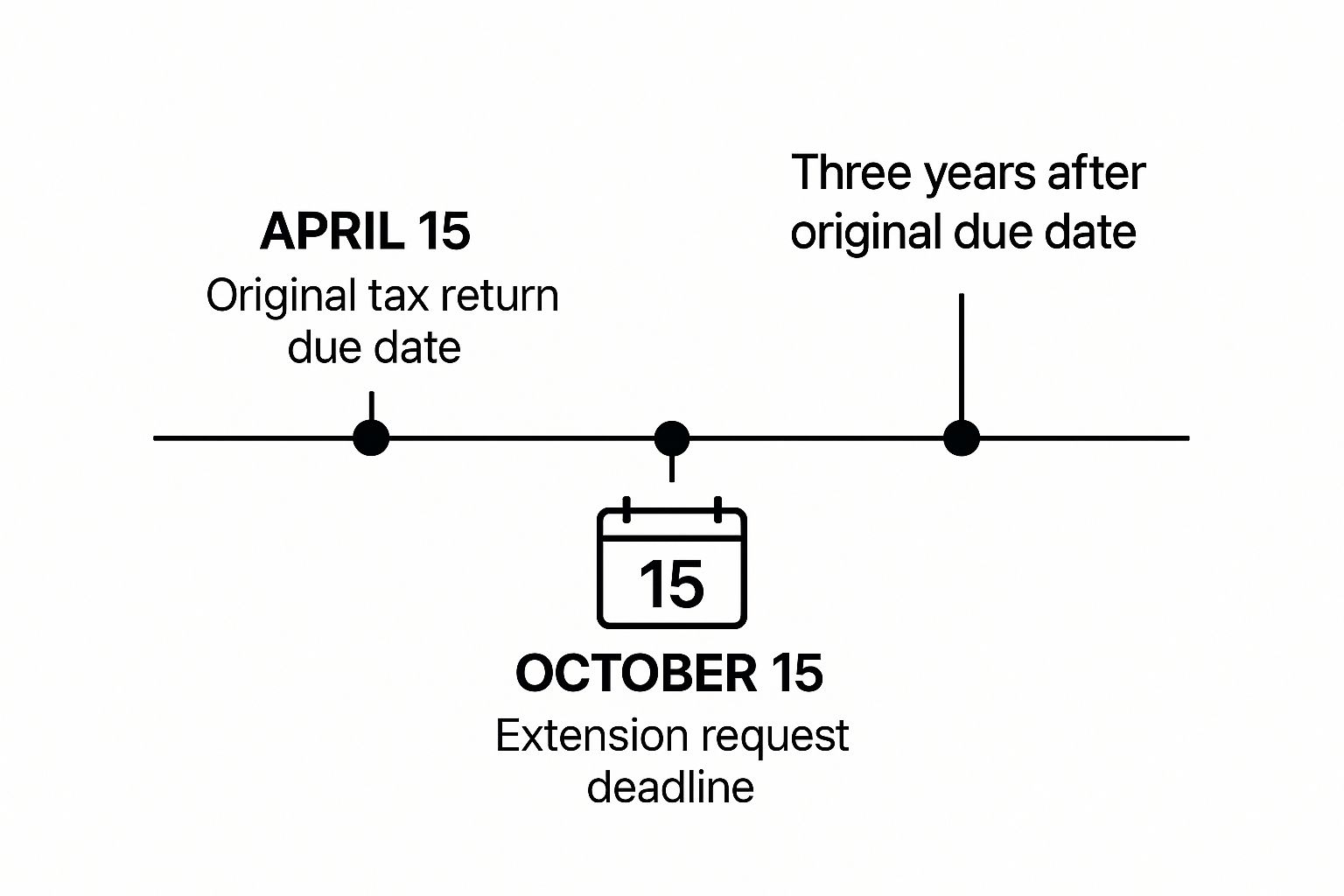

This visual guide gives you a clearer picture of the other key dates you need to know, including when you can amend your return.

As the infographic shows, your tax journey has several important milestones beyond just the filing date. Getting a handle on this timeline is the best way to stay out of trouble. As HM Revenue & Customs themselves will tell you, filing on time is your best defence against this penalty system. You can read more about how HMRC stresses the importance of meeting deadlines on their official site.

A Proactive Plan to Meet Every Tax Deadline

Knowing the self-employed tax return dates is one thing; actually meeting them without a last-minute panic is another entirely. The secret isn't a mad dash in January. It's about building small, consistent habits throughout the year that turn tax season into a calm, manageable task.

The single most effective strategy is to keep on top of your bookkeeping all year round. Forget shoving receipts into a shoebox to be dealt with later. Get into the habit of logging your income and expenses as they happen, using simple accounting software or even just a dedicated spreadsheet. This one change transforms a monumental annual chore into a small, weekly check-in.

Build a Tax-Ready Routine

Here’s a simple but game-changing habit: open a separate bank account just for your tax.

Every single time a client pays you, immediately transfer a set percentage—a good rule of thumb is 20-30%—into this tax pot. Doing this consistently means the money is already ringfenced and ready to go when the bill arrives. It completely removes that dreaded cash-flow panic so many self-employed people face.

Of course, the biggest hurdle is often just getting started. If you find yourself putting things off, learning some practical tips for overcoming procrastination can make a huge difference in staying ahead of the game.

The best advantage you can give yourself is filing early. Don't wait for January. Aim to get your tax return sorted out months ahead of the deadline. You’ll know exactly what you owe well in advance, giving you time to plan and enjoy some well-deserved peace of mind.

By taking these proactive steps, you can swap tax anxiety for financial confidence and stay firmly in control of your deadlines.

Common Questions About Self-Employed Tax Dates

https://www.youtube.com/embed/71vwVX67KNM

Getting your head around the different tax return dates can feel a bit overwhelming, especially when you're new to being self-employed. Let's run through some of the most common questions we get from sole traders and freelancers.

What Happens If I Register Late?

Missing the 5th October registration deadline can quickly snowball into bigger problems. HMRC can hit you with a penalty for late registration, but the more immediate headache is the delay in getting your Unique Taxpayer Reference (UTR) number.

Without a UTR, you simply can't file your tax return. This often means you'll miss the January filing deadline as well, triggering even more automatic penalties. It’s a chain reaction you really want to avoid.

Can I Get an Extension on My Deadline?

In a word, probably not. HMRC is notoriously strict about granting extensions for Self Assessment. You need what they call a 'reasonable excuse', which is reserved for serious, unexpected life events like a sudden illness or a bereavement in your immediate family.

Unfortunately, things like forgetting the date, being too busy, or not having your paperwork sorted just won't cut it.

It’s always safest to treat the deadline as set in stone. The bar for a 'reasonable excuse' is incredibly high, so planning ahead is the only surefire way to dodge late-filing penalties and a lot of unnecessary stress.

At Stewart Accounting Services, we take the guesswork out of your tax obligations. Let us manage your self assessment deadlines so you can focus on running your business.