For anyone self-employed, there's one date that looms larger than any other: 31st January. This is the big one – the deadline for filing your online tax return and paying the tax you owe.

Get this date wrong, and you're looking at instant penalties from HMRC. It's the most important date to have circled, highlighted, and set on repeat in your calendar.

Understanding Your Self Assessment Deadlines

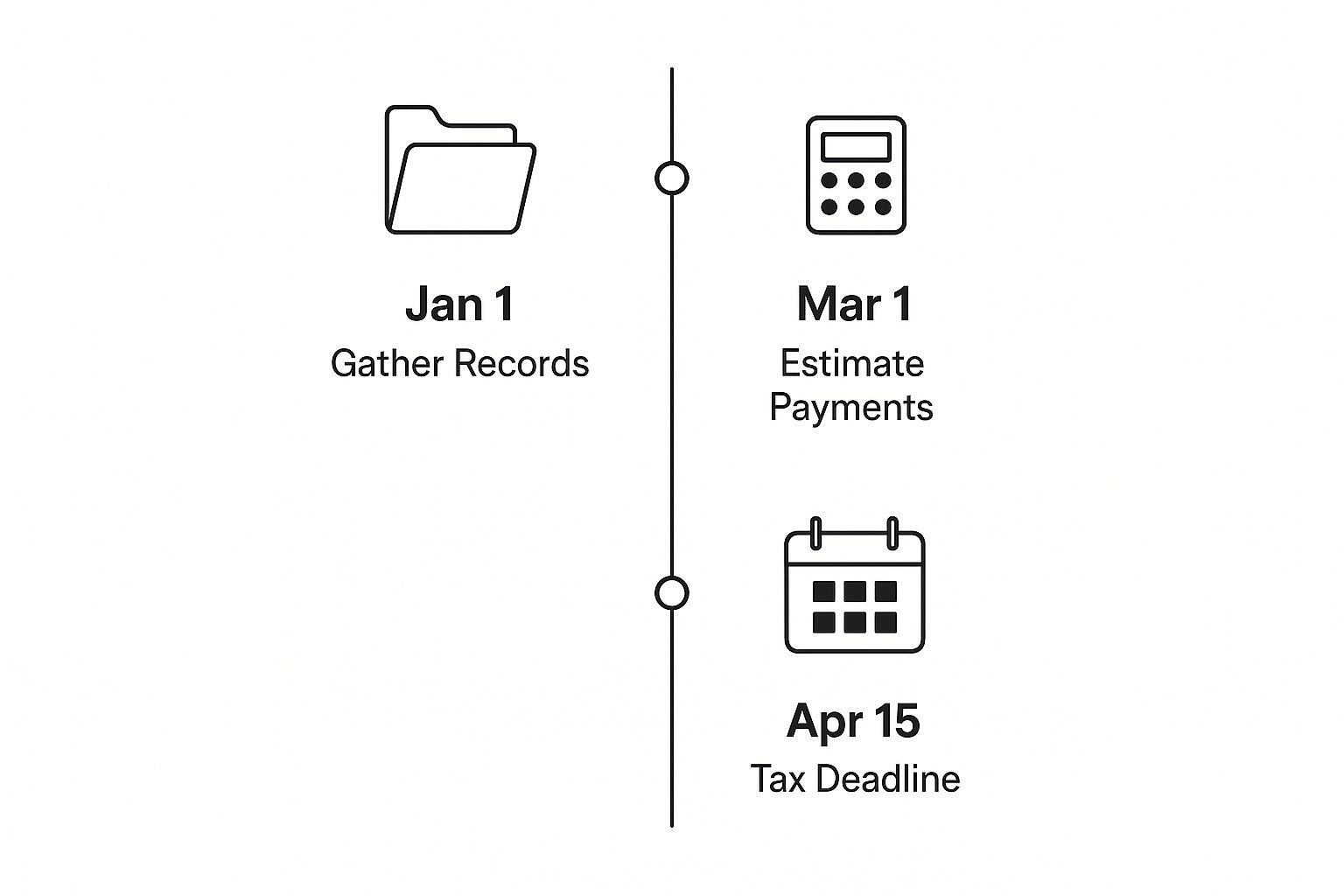

Staring at the tax calendar can feel a bit overwhelming, but it's much less daunting if you see it as a series of smaller, manageable steps throughout the year. The process isn't just about that mad dash in January; it’s a cycle with several key dates designed to keep you on track.

Thinking of the tax year as a timeline helps you plan properly. You can gather what you need when you need it, avoiding that last-minute panic. From registering with HMRC right through to making payments, each deadline has its purpose in keeping your business finances in good order.

The Self Assessment Timeline

A few key dates pop up on the UK's Self Assessment calendar every year. If you've just started your self-employed journey, your first big deadline is to register with HMRC by 5th October following the end of the tax year in which you began trading.

After that, if you're one of the few who still file by post, your paper return needs to be in by 31st October. For everyone else, the main event is the online filing and payment deadline of 31st January.

To help you keep track, here's a quick rundown of the essential dates you need to know.

Key Self Assessment Dates for the Self Employed

| Task | Deadline | Notes |

|---|---|---|

| Register for Self Assessment | 5th October | This is for the tax year after you started your business. |

| Paper Tax Return Filing | 31st October | For those submitting a physical, paper-based tax return. |

| Online Tax Return Filing | 31st January | The main deadline for the vast majority of people. |

| Pay the Tax You Owe | 31st January | Your tax bill must be paid by this date to avoid interest. |

This table lays out the core deadlines, but seeing it visually can really help it sink in.

As you can see, tax prep isn't a one-off task. It's a continuous process. Spreading out the work – gathering receipts, estimating your profits, and setting money aside – is the secret to avoiding that January scramble.

Key Takeaway: The best way to handle your tax return is to treat it like a year-round project, not a single, stressful event. This simple shift in mindset turns a dreaded chore into a standard part of running your business, keeping you organised and in control.

Getting to grips with the full cycle is the first step to mastering your tax obligations. For a more detailed breakdown, our guide on the HMRC tax return deadline has all the extra information you might need.

The Real Cost of Missing the Filing Deadline

So, what actually happens if the self employed tax return deadline zips past and you haven't filed? Let’s be clear: this isn't a minor slip-up. HMRC doesn’t offer a grace period. The moment you miss the deadline, an immediate £100 penalty lands on your doorstep.

That initial fine is just the beginning, though. Think of it as a small snowball at the top of a very steep hill. If you don't act fast, it quickly gathers speed and size, turning into a much bigger financial headache for your business.

How the Penalties Pile Up

After the first three months of being late, the fines really start to escalate. This is where the pressure properly mounts, as daily charges get added to what you already owe.

- After 3 months: HMRC can start charging you £10 per day, every day, for up to 90 days. That’s a potential £900 on top of the first fine.

- After 6 months: An additional penalty of 5% of the tax you owe or £300 (whichever amount is greater) is tacked on.

- After 12 months: You’ll face another penalty of 5% or £300 (again, whichever is greater), added to all the previous fines.

On top of all these late filing penalties, HMRC also charges interest on any tax you haven't paid. This means the total bill just keeps climbing until you've settled everything – the original tax, all the penalties, and the interest.

This penalty structure shows just how critical it is to file on time. For the 2022 to 2023 tax year, a record 11.5 million people managed to file before the deadline, with a huge number submitting on the final day. You can read more about these filing statistics on the official government website.

Understanding these costs is probably the best motivation there is to get your tax return sorted before that deadline arrives.

How to Confidently File Your Tax Return

Let’s turn tax season from something you dread into a manageable, even straightforward, task. It all starts with having a clear plan.

While you can still file a paper tax return, most people now file online, and for good reason. It gives you a much longer deadline and, crucially, you get instant confirmation that HMRC has received your return safely. No more nail-biting waits.

The real secret to a stress-free filing experience is getting your house in order before you even think about logging into the HMRC portal. Rushing to gather your documents at the last minute is a surefire way to make mistakes and, worse, miss out on deductions you’re entitled to.

Your Document Checklist

Think of this as your mise en place for tax—getting all the ingredients ready before you start cooking. Having everything to hand makes the process quicker, easier, and a lot more accurate.

- Proof of Income: This means all your issued invoices, bank statements showing customer payments, and any other proof of money coming in.

- Records of Expenses: Dig out all those receipts! This includes everything from software subscriptions and office supplies to travel costs and a portion of your home utility bills.

- P60s or Other Employment Income: If you're also employed, you'll need your P60 to declare that PAYE income correctly.

- Details of Other Income: Don't forget any extra income streams, like interest from savings, dividends from shares, or rent from a property.

A solid, year-round system for organising your paperwork is the single best thing you can do to simplify Self Assessment. It’s the foundation for confident tax filing, ensuring you claim every allowable expense and report your income accurately.

Once you have all your documents organised, the process of actually filling out the return becomes a simple matter of data entry. While tax systems differ globally—for instance, US freelancers need to get to grips with reporting non-employee compensation with Form 1099-MISC—the principle of good preparation is universal.

For a detailed walkthrough of the UK process, check out our step-by-step guide on how to prepare a Self Assessment tax return. Getting this prep work done early is the key to meeting the self-employed tax return deadline without breaking a sweat.

Online vs Paper Tax Return Filing

Deciding how to file is your first big choice. Most people find filing online far more convenient, but it's helpful to see the differences side-by-side.

| Feature | Online Filing (HMRC Website) | Paper Filing (SA100 Form) |

|---|---|---|

| Filing Deadline | 31st January | 31st October (3 months earlier) |

| Confirmation | Instant, on-screen receipt | None. You post it and hope! |

| Tax Calculation | Automatic and instant | You must calculate it yourself |

| Payment Deadline | Same day as filing (31st Jan) | Same day as filing (31st Jan) |

| Corrections | Easy to amend online within 12 months | Must send a new paper form |

| Accessibility | Available 24/7 from any device | Requires posting during business hours |

Ultimately, filing online is quicker, safer, and comes with a later deadline. Unless you have a specific reason for filing on paper, the digital route is almost always the better option.

Making Sense of Payments on Account

Just when you think you've got your head around the main self-employed tax return deadline, another concept pops up: 'Payments on Account'. It often catches newly self-employed people off guard, but it's actually quite straightforward.

Think of it as paying your next year's tax bill in two manageable instalments. It's HMRC's way of helping you spread the cost, so you don't get hit with one giant bill every January.

You'll usually be asked to make these advance payments if your last Self Assessment tax bill was more than £1,000. The other condition is that less than 80% of your income was taxed at source (like through an employer's PAYE system). If you meet both criteria, HMRC basically estimates your upcoming bill based on last year's and asks you to pay half of it upfront.

The Key Payment on Account Dates

This system introduces two extra deadlines you absolutely need to have in your calendar. Getting these dates locked in is a game-changer for managing your cash flow throughout the year.

- First Payment: Due by midnight on 31st January. This is the first chunk for the current tax year, and you pay it at the same time as you settle any remaining tax for the previous year.

- Second Payment: Due by midnight on 31st July. This is your second and final advance payment towards the current year's bill.

When you eventually file your tax return for that year, HMRC subtracts the two advance payments you’ve already made. If you earned less and overpaid, you’ll get a tax refund. If you earned more and still owe a bit, you simply clear the difference with a ‘balancing payment’ by the following January.

Getting comfortable with this cycle is key. The July payment, in particular, can be a real challenge for many business owners as it falls right in the middle of the year, long after the January rush.

If you're worried about having the funds ready, it's a good idea to read up on some strategies for funding your July tax payment. A little bit of planning goes a long way in avoiding any financial stress.

Stay Ahead with Proactive Tax Planning

Let's be honest, the self employed tax return deadline can feel like a dark cloud looming on the horizon. But what if you could turn it from a source of annual dread into just another routine business task? It’s completely possible. The most organised sole traders I know don't see tax prep as a mad January dash; they see it as a series of small, manageable habits they stick to all year.

Adopting this mindset really pays off. When you file your return early, you find out exactly how much tax you owe months in advance. No nasty surprises. This gives you plenty of breathing room to budget for the payment. And if you happen to be due a refund? Getting your return in sooner means that cash is back in your bank account much faster.

Adopt Year-Round Habits for a Stress-Free Tax Season

The secret to a painless tax season isn't some complex financial wizardry. It's about building simple, consistent habits that make the whole process a breeze when the time comes.

- Get some decent accounting software: Modern cloud-based tools are a game-changer. They automatically pull in your income and help you categorise expenses on the fly, giving you a live look at your finances and a running estimate of your tax bill.

- Snap your receipts as you go: Forget the shoebox stuffed with faded bits of paper. Use your phone to take a quick photo of every receipt the moment you get it. This completely removes the risk of losing them and makes tracking expenses almost effortless.

- Start a "tax pot": Open a separate bank account and get into the habit of moving a slice of every single payment you receive into it—somewhere around 20-30% is a good rule of thumb. When your tax bill finally arrives, the money is already sitting there waiting.

When you treat your tax return as an ongoing task rather than a single, scary event, the last-minute panic just melts away. You're always prepared, you're in control of your cash flow, and the January deadline will never catch you off guard again.

The Growing Trend of Early Filing

This forward-thinking approach is really catching on. More and more self-employed people are discovering the peace of mind that comes with getting their tax return sorted early.

HMRC's own figures show that the number of people filing on the very first day of the tax year has more than doubled in just five years. Back in 2018, around 37,000 people filed on 6th April. Fast forward to 2023, and that number shot up to over 77,500. It’s a clear sign that people are tired of the stress and are taking back control. You can discover more about early filing trends on the HMRC press site. With a few simple habits, the tax deadline can become just another date in your calendar.

Common Questions About Self-Employed Tax

Even with the best of intentions, navigating the world of Self Assessment can throw up some tricky questions. Let's tackle some of the most common queries that trip up self-employed people.

A classic moment of panic is realising you've missed the 5th October deadline to register with HMRC. If this is you, don't worry. The most important thing is to get registered as soon as possible. Acting quickly shows HMRC you're trying to put things right and can help you avoid penalties.

What if you didn't make any money, or even made a loss? Do you still need to file? In almost every case, the answer is yes. If HMRC has sent you a notice to file, you are legally required to complete a Self Assessment, regardless of your profit.

Making Changes and Final Checks

We've all had that sinking feeling after clicking 'submit'. What happens if you find a mistake on your tax return after you've filed it?

Thankfully, HMRC gives you a window to make corrections. You can amend your tax return online for up to 12 months after the original filing deadline. This is a lifesaver if you later find a misplaced expense receipt or discover you've entered an income figure incorrectly. Just log back into your Government Gateway account and submit the right information.

It’s vital to remember that even with zero profit, the duty to file doesn't disappear if you're registered for Self Assessment. Filing the return officially confirms your financial position to HMRC and keeps you compliant, which is far better than facing automatic penalties for not submitting anything at all.

Here are a few final pointers to keep in mind:

- Keep Your Records: You must hold onto all your financial records for at least five years after the tax year they're for.

- De-register if You Stop: If you cease trading or are no longer self-employed, you have to tell HMRC so they can take you out of the Self Assessment system.

- Ask for Help Early: Feeling out of your depth? Don't leave it until the last minute. Getting professional advice can save a world of stress and often money, too.

Juggling all your tax responsibilities on your own is a huge demand. At Stewart Accounting Services, we take the guesswork out of the process, ensuring you meet every self-employed tax return deadline with confidence. Find out how we can give you more time, money, and peace of mind by visiting stewartaccounting.co.uk.