It's a frustrating truth every business owner learns, often the hard way: profit on paper doesn't pay the bills. The real measure of your company's financial health isn't just what you've earned, but the actual cash you have in the bank to keep the lights on. This is where small business cash flow problems sneak in – when more money is flowing out than coming in, even if your business is technically profitable.

Why Cash Flow Is Your Business's Oxygen

So many business owners get tripped up by confusing profit with cash flow, but they are worlds apart.

Profit is what’s left after you subtract your expenses from your revenue. It's a great indicator, but it's a bit like a report card—it tells you how you did over a period. Cash flow, on the other hand, is the lifeblood of your operation. It’s the real-time movement of money into and out of your business, day in and day out. A business can look fantastic on the profit and loss statement but still go under if it runs out of cash.

Think of a thriving creative agency that just landed its biggest-ever client. The books look amazing, showing a healthy profit on the project. The problem? The client’s payment terms are 90 days out. In the meantime, the agency has bills that won't wait:

- Designer salaries are due at the end of the month.

- The office rent is due on the 1st.

- Software subscriptions are auto-renewing next week.

- Countless other operational costs need covering now.

Despite being profitable, the business is suddenly facing a serious cash crunch. Without enough liquid cash to cover these immediate expenses, they risk missing payroll, damaging their reputation with suppliers, and spiralling into debt. This isn't some rare horror story; it's a daily reality for countless small businesses.

To really nail this down, let’s look at the two concepts side-by-side.

Profit vs Cash Flow A Quick Comparison

This quick table breaks down the core differences, helping to clarify why a 'profitable' business can still be short on cash.

| Concept | What It Measures | Real-World Example |

|---|---|---|

| Profit | Your business's financial performance over a specific period (e.g., a quarter). | A bakery sells £10,000 worth of cakes in a month with costs of £6,000. The profit for that month is £4,000, regardless of whether all the customers have paid their invoices yet. |

| Cash Flow | The actual movement of money into and out of your bank account. | The same bakery collects £7,000 in cash payments but has to pay £6,000 in immediate supplier and staff costs. Its net cash flow is only £1,000, even though its profit was £4,000. |

This distinction is absolutely critical. Understanding it is the first step toward getting your finances under control.

The Real Impact of Cash Flow Gaps

This isn't just a theoretical headache—it's a major operational hurdle for businesses across the UK. Recent data shows that nearly half of UK small businesses (47%) struggled with cash flow challenges as of mid-2025, and a staggering 57% expect their operating costs to climb even higher. It’s a clear sign that if you're feeling this pinch, you are far from alone.

The disconnect between a profitable income statement and an empty bank account is where most small business cash flow problems begin. Your ability to pay suppliers, staff, and yourself depends entirely on the cash available, not the profit you've theoretically made.

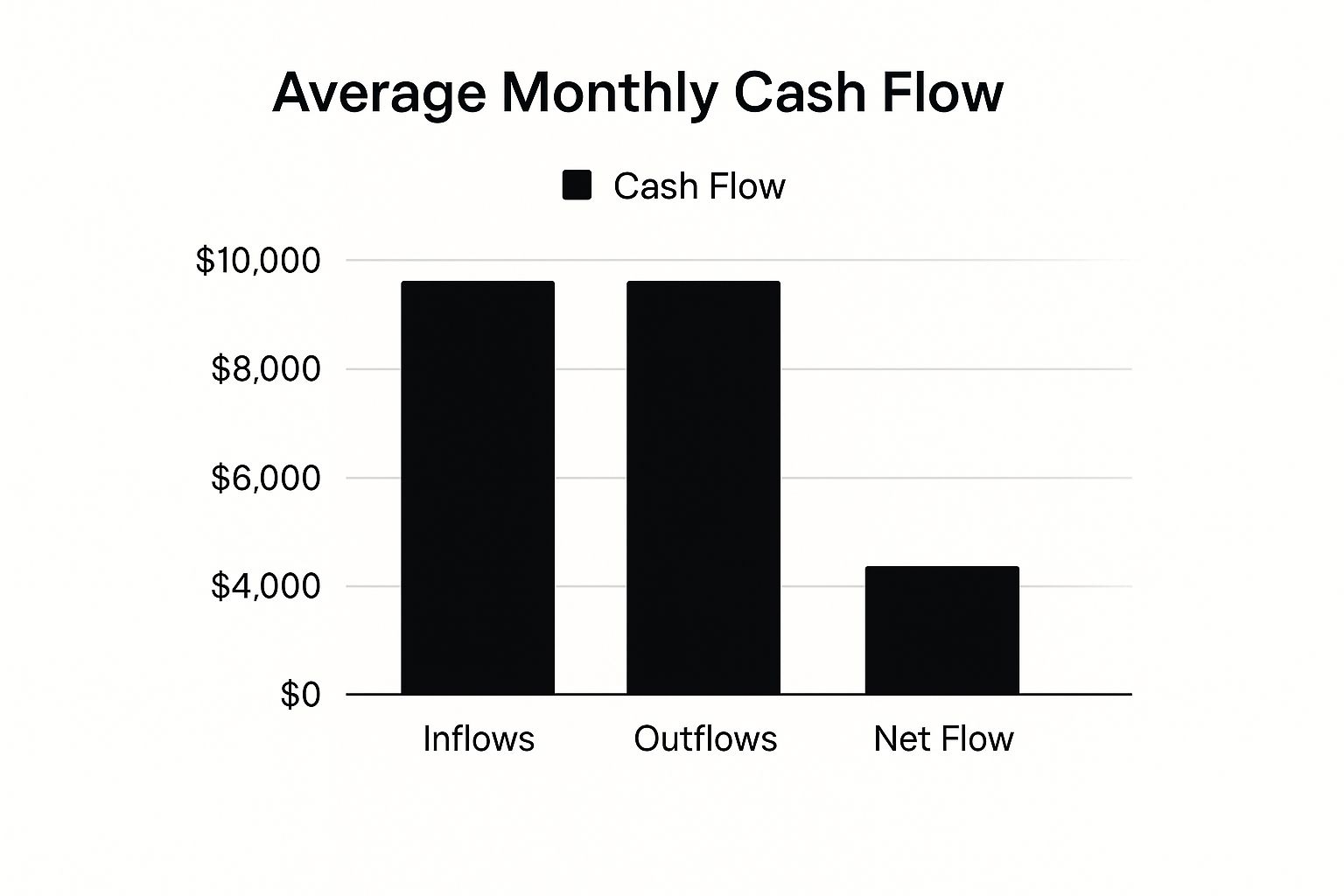

This chart paints a perfect picture of how inflows, outflows, and net cash flow tell the real story of a business's health.

As you can see, even with a solid stream of income, high expenses can quickly create a negative net cash flow, putting the entire operation at risk. For a deeper dive into building financial stability, I'd highly recommend reading this guide on mastering small business cash flow management. Getting a firm grip on this principle is your first real step toward building a more resilient and secure business.

How to Pinpoint Your Cash Flow Gaps

Before you can fix your cash flow, you have to play detective. The first, most crucial step is to figure out exactly where and when your money is getting tight. I see so many business owners put this off, worried about what they might uncover, but it's a financial deep-dive that’s simpler than you think and absolutely essential for solving small business cash flow problems.

Don't worry, you don't need a degree in finance for this. All the clues you need are sitting right there in your bank records and accounting software like Xero or QuickBooks. The goal is to map out a simple cash flow statement—a document that tracks all the money coming in and all the money going out over a set period, like a month or a quarter.

This simple exercise will immediately shine a light on your cash position. You’ll see, clear as day, if you have more money leaving the business than coming in. That, right there, is a cash flow gap.

Spotting the Common Cash Traps

Once you have a clear picture of your cash movements, you can start hunting for the culprits. These are the usual suspects where cash gets unexpectedly tied up, often hiding in plain sight.

As you comb through your numbers, ask yourself these questions:

- Are late payments a recurring nightmare? Take a hard look at your accounts receivable. Is there a big client who consistently pays their invoices 60 or 90 days late? That’s a massive cash trap.

- Is my inventory gathering dust? If you sell products, check your inventory turnover rate. Stock that just sits on a shelf is cash that isn't working for you.

- Do I have predictable seasonal dips? For many businesses—from landscapers to retail shops—demand isn’t a flat line all year round. Identifying these slow periods is vital for proper planning.

- Am I paying my suppliers too quickly? Check the payment terms with your vendors. If you have 30 days to pay a bill but you’re paying it on day one, you’re putting needless strain on your cash reserves.

For many owners, the idea of creating a formal statement feels a bit overwhelming. But it doesn't have to be. You can find out more about how to build a clear and effective cash flow forecast for your small business to make this whole process much smoother.

Get to Grips with Your Cash Conversion Cycle

Beyond just looking at money in versus money out, you need to understand the timing of it all. This is where the cash conversion cycle (CCC) comes into play. It might sound technical, but the concept is really simple: it’s the time it takes for a pound you spend on your business (like materials or staff time) to make its way back into your bank account from a customer sale.

A shorter cash conversion cycle means you get your money back faster, which massively improves your liquidity. A long cycle means your cash is tied up for ages, creating a constant financial strain.

Think about it this way: a freelance web developer might spend 40 hours working on a project in May but not actually get paid for it until July. Their cash conversion cycle is over 60 days. By simply asking for a 50% deposit upfront, they could slash that cycle in half and instantly boost their cash position. Understanding this timing reveals the true source of the pressure.

Getting Paid Faster with Smarter Invoicing

There's nothing more draining for a business owner than chasing late payments. It’s stressful, time-consuming, and a massive culprit behind many small business cash flow problems. The good news? You can sidestep a lot of that pain by getting smarter and more proactive with your invoicing right from the start.

This isn't about being pushy. It's about clarity. Your clients aren't mind-readers, so spell out your payment terms on every single quote, contract, and invoice you send out. Make it impossible to miss, whether it's "Payment due within 14 days" or "Due upon receipt".

The scale of late payments in the UK is genuinely staggering. By 2025, a whopping 62% of UK SMEs were owed an average of £21,400 in overdue invoices. To make matters worse, 54% of those invoices were over a month late. This isn't just an inconvenience; it's a primary reason why 67% of these businesses struggle with cash flow.

Establish Clear and Proactive Policies

If your payment terms are vague, you're just inviting delays. What you need is a system that not only encourages people to pay on time but actually makes it incredibly easy for them to do so.

A great place to start is offering multiple ways to pay. Think online card payments, bank transfers, or even setting up direct debits. The less friction there is, the faster the money hits your account. For businesses with recurring revenue, looking into automatic payment collection can be an absolute game-changer.

Here are a few proactive tactics you can put into practice right away:

- Offer an Early Bird Discount: A small incentive, like a 2% discount for paying within 10 days, often works wonders. It gives clients a real reason to prioritise your invoice.

- Require Upfront Deposits: For any significant project, asking for a deposit is non-negotiable. A 25-50% upfront payment covers your initial costs and confirms the client is serious.

- Introduce Late Payment Fees: Don't be shy about this. Clearly state in your terms that overdue invoices will incur interest or a late fee. It's a powerful deterrent against tardy payers.

Your invoicing process shouldn't be an afterthought. It's a critical part of your financial strategy. A clear, firm, and consistent approach is your best defence against cash flow gaps.

Systemise Your Follow-Up Process

A polite but persistent follow-up system is your secret weapon. Trying to manually track every invoice is a fast track to missed deadlines and a mountain of stress. Instead, create a set of templates you can use for every stage of the chase.

For example, you could set up a simple automated sequence:

- 7 days before due: A friendly "just a heads-up" email.

- On the due date: A polite nudge that the payment is now due.

- 7 days past due: A slightly firmer email noting the invoice is officially overdue.

- 14 days past due: A more direct message, which you might want to follow up with a phone call.

Having these templates ready to go means you can act quickly and consistently without having to think about it every time. This organised approach not only helps you get paid faster but also keeps your client relationships professional. For more in-depth advice, you can explore our guide on how to https://stewartaccounting.co.uk/improve-cash-flow-with-smarter-invoicing-habits/ for more actionable templates and tips.

Controlling Costs and Managing Outgoings

Chasing invoices is only one half of the cash flow battle. The other, often overlooked, part is getting a firm grip on what’s going out the door. It’s easy to get so focused on making sales that you miss the slow, steady drain of unnecessary expenses. Honestly, reining in your outgoings is one of the quickest ways to fix your small business cash flow problems.

A brilliant first move is to put every single one of your expenses on trial. This isn't about becoming a spreadsheet wizard overnight; it's about making practical, tough decisions. Every cost in your business usually falls into one of three buckets.

This simple audit forces you to ask, "Do we really need this right now?" You might discover that a fancy software subscription could be downgraded or that a monthly service you signed up for months ago is just gathering digital dust. If you want to go deeper, there are plenty of proven strategies for reducing overall business costs you can explore.

Categorise Your Business Spending

To see exactly where your cash is disappearing, try sorting your expenses into these simple groups:

- Essential Costs: These are the absolute must-haves, the things you need to pay just to keep the lights on. Think rent, staff wages, crucial software licences, and insurance.

- Growth-Focused Costs: This is your investment pile. It includes things like marketing campaigns, buying new equipment to improve efficiency, or training courses that upskill your team.

- Nice-to-Have Costs: Be honest here. This bucket is for anything that’s pleasant but not critical for survival. We’re talking about the premium coffee machine, team lunches, or that extra app subscription that someone used once.

When you're in a cash crunch, that 'nice-to-have' list is the first place you should look to make immediate savings. The idea isn't to strip out all the joy from your business, but to be deliberate about where every single pound is going.

Negotiate Better Terms with Suppliers

Your suppliers are business owners too, and your relationship with them is more flexible than you might think. Never assume the terms on an invoice are set in stone, especially if you’ve been a loyal customer for a while.

Let's say a local café is feeling the squeeze. Instead of just paying their coffee bean supplier on the dot, they could try a few things. They could ask for a small discount for placing a slightly larger order, or even just ask to extend their payment terms from 30 to 45 days. That simple change gives them two extra weeks before the cash has to leave their bank account – a crucial bit of breathing room.

Or think about a freelance designer reviewing their monthly software bills. They might realise they’re paying for three different tools that all do similar things, when one consolidated, cheaper platform would work just as well. A few clicks to cancel the unneeded subscriptions could easily save hundreds of pounds a year, which goes straight back into their cash reserve.

Once you’ve trimmed the fat, the final step is to build a realistic budget around your new, leaner operation. This becomes your financial roadmap, holding you accountable and stopping old spending habits from creeping back in. A quick monthly or quarterly check-in on this budget is all it takes to stay on track.

Building Your Financial Safety Net

Think of a healthy cash reserve as your business's ultimate defence against the unexpected. It's the buffer that lets you weather a quiet month, pounce on a sudden opportunity, or simply sleep better at night without worrying about every single invoice. Building this up is a core strategy for long-term resilience and a powerful fix for many small business cash flow problems.

So, how much is enough? A solid rule of thumb I always recommend is to have enough cash on hand to cover three to six months of essential operating expenses.

To get your target number, just add up all your non-negotiable monthly outgoings – things like rent, payroll, key software subscriptions, and loan repayments. Multiply that figure by three (or six, if you want to be extra secure), and that’s the goal you’re aiming for.

Of course, saving is only half the story. You also need a plan for when you need to access funds. Building these strong foundations is crucial, and you can get a deeper look at developing cash flow resilience and access to funding in our detailed guide.

Understanding Your Financing Options

Even with a well-stocked reserve, there will be times when you need to look at external financing. The trick is to see these options as strategic tools for growth, not just emergency plasters for a financial wound. Knowing which tool to use for which job is half the battle.

Here are the most common financing routes for UK small businesses:

- Business Overdraft: This is a flexible agreement with your bank that lets you dip into the red up to an agreed limit. It’s perfect for covering very short-term gaps, like bridging the week between paying your team and a large client payment finally landing.

- Line of Credit: This works a bit like an overdraft but is often a separate facility. You get access to a pre-approved pot of money you can draw from whenever you need it. The best part? You only pay interest on what you actually use. It’s ideal for managing unpredictable costs or seasonal lulls.

- Short-Term Loans: A short-term loan gives you a single lump sum that you repay over a fixed period, usually a year or two. This is best for specific, planned investments like buying a new piece of equipment or funding a big marketing push where you can confidently forecast the return.

Choosing the right financing is all about matching the solution to the problem. An overdraft is for temporary relief, a line of credit is for flexibility, and a loan is for planned investment. Using them incorrectly can create more financial stress, not less.

Preparing to Secure Funding

While lending to UK SMEs is on the rise, getting your hands on those funds still requires some prep work. Gross lending climbed by 14% to £4.6 billion in the first quarter of 2025, but many small business owners are still hesitant to borrow. Overdraft approvals are at their highest since mid-2020, yet utilisation is still under 50% – showing a clear gap between what's available and what's being accessed. You can dig into more data on UK business finance trends on ukfinance.org.uk.

My best advice? Get your house in order before you're desperate for the money. When you approach a lender, they’ll want to see a few key things:

- A Clear Business Plan: This doesn't need to be a novel, just a concise document showing you know your business model, target market, and growth plans.

- Up-to-Date Financials: Have your profit and loss statement, balance sheet, and realistic cash flow forecasts ready to go.

- Recent Bank Statements: Lenders will comb through these to get a feel for your financial discipline and day-to-day operations.

- A Detailed Funding Request: Be specific. Explain exactly how much you need, what you'll use it for, and how you plan to pay it back.

Walking in with this information neatly organised shows you're a serious, low-risk borrower. It makes it much, much easier for a lender to say yes.

Answering Your Most Pressing Cash Flow Questions

When you’re staring down the barrel of cash flow issues, you need clear answers, not vague business theory. Let's cut through the noise and tackle some of the most common questions I hear from business owners struggling to keep their finances in the black.

A big one I always get is, "How much cash should I really have on hand?" It’s a great question, and while there's no magic number for everyone, a solid rule of thumb is to have enough cash tucked away to cover three to six months of your essential operating expenses.

Sit down and work out your bare-bones monthly costs – things like rent, payroll, key subscriptions, and loan repayments. That number is your monthly burn rate. Multiply it by three, and you've got your minimum safety net.

"My Business Is Profitable, So Why Am I Always Broke?"

This is probably the most painful and confusing situation for any business owner. The short answer is yes, you can absolutely be profitable on paper and still have no cash in the bank. It's a classic trap.

Profit is an accounting measure; it's what's left after you subtract your costs from your revenue. Cash flow, on the other hand, is the actual money moving in and out of your business. You could land a huge, profitable contract, but if your client is on a 90-day payment term, that profit won't help you make payroll this Friday.

Your profit and loss statement can look fantastic, but if your customers haven't actually paid you, that money is just a number on a spreadsheet. Cash is what keeps the lights on, not the promise of a future payment.

What’s the Quickest Way to Get Cash Flowing Again?

If you need to make an immediate impact, you need a two-pronged attack: get money in the door faster and keep it from leaving for as long as possible.

First, stop waiting to send your invoices. Bill your clients the moment the work is done. Make your payment terms crystal clear – "Due in 14 days" – and offer as many payment options as you can. Think online payments, direct debit, anything that makes it incredibly easy for them to pay you instantly.

At the same time, look at who you owe money to. Pick up the phone to your suppliers, especially if you have a good relationship with them. You'd be surprised how many are willing to extend your payment terms from 30 days to 45 or 60. That simple change can give you some much-needed breathing room.

Should I Get a Loan to Solve My Cash Flow Problem?

This is a tricky one, and the answer is a firm "it depends." Using a flexible credit facility, like an overdraft or a line of credit, can be a lifesaver for managing predictable, short-term dips. For example, if you need to buy a load of stock for the Christmas rush, it's a perfect tool to bridge the gap until you sell it.

But, and this is a big but, taking out a loan to cover a fundamental flaw in your business model is just kicking the can down the road. It's a plaster on a wound that needs stitches. If your business is consistently short on cash, a loan just adds the stress of debt repayments to an already leaky bucket. You need to fix the leak first.

Here at Stewart Accounting Services, we do more than just crunch the numbers. We specialise in helping businesses all over the UK get a real grip on their finances, building the stability they need to grow. If you're ready to put your cash flow challenges behind you for good, get in touch with our team today.